Market Overview - Page 70

July 18, 2023

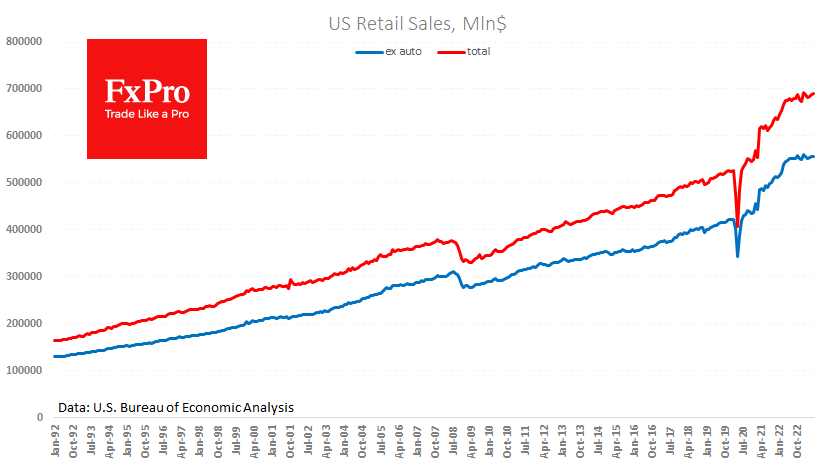

US retail sales rose 0.2% in June, weaker than the +0.5% expected. Year-to-date sales are up 1.5% versus 3% inflation over the same period, so it makes sense that consumer activity is slowing. Sales excluding cars also rose by 0.2%.

July 18, 2023

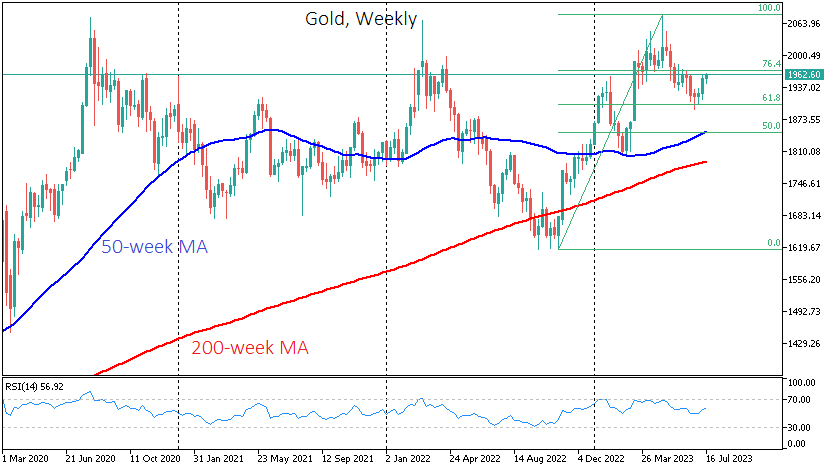

Gold returned to monthly highs near $1962 on Tuesday morning after consolidating around the 50-day moving average. All eyes are now on gold’s ability to break away from this line, a medium-term trend indicator. The upward move is well within.

July 17, 2023

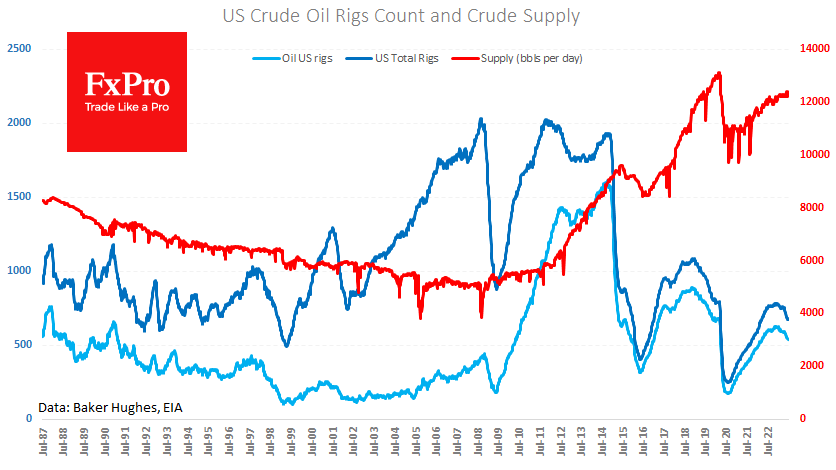

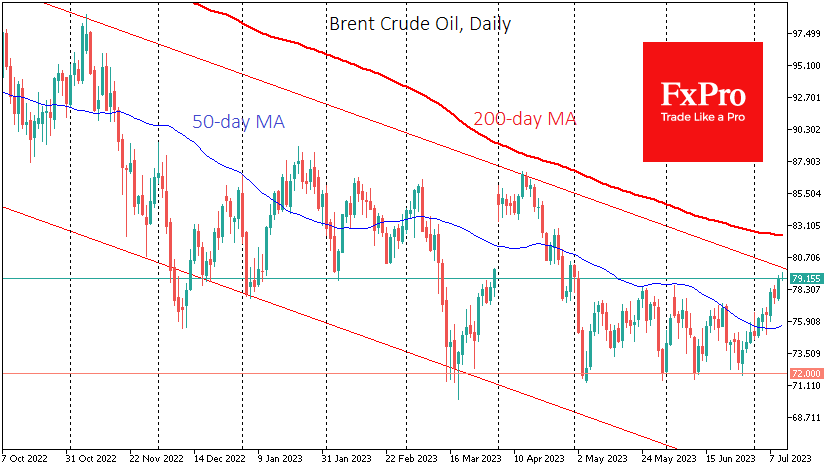

Crude oil reversed sharply last Friday after rallying almost 15% from the lows at the end of last month. The short-term decline so far fits into a technical correction after the rally. However, looking at the broader trend, this reversal.

July 14, 2023

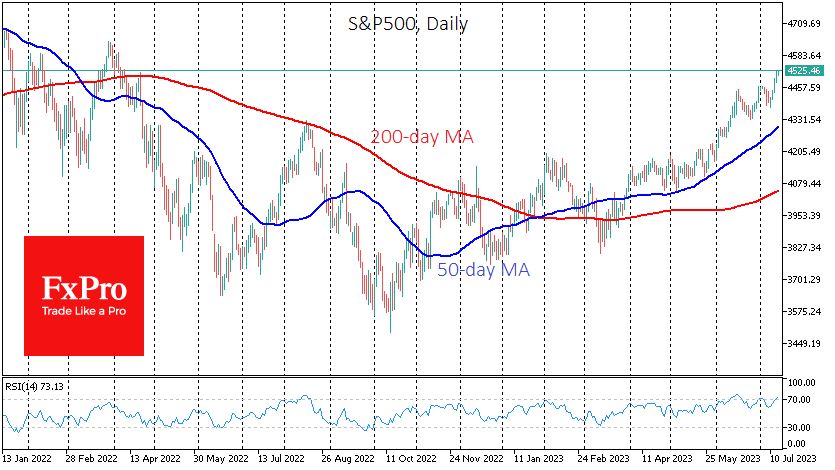

After the impressive rally in equity indices in the first half of the year, it was logical to expect a correction or a summer lull. But we only got a brief pause, and the rally resumed this week with renewed.

July 12, 2023

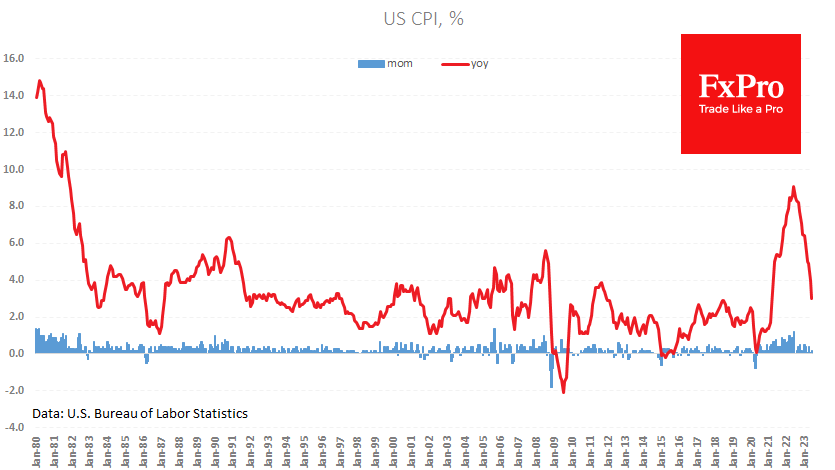

The US consumer price index slowed to an annual rate of 3.0% in June from 4.0% the previous month. This was slightly below the expected 3.1%. Core inflation slowed to 4.8% from 5.3%, and 5.0% expected. This is the ninth.

July 12, 2023

Crude oil has rallied more than 10% from the lows two weeks ago. The price of a barrel of Brent rose above $79.50 on Wednesday, its highest level since early May. But the easy part of the journey for the.

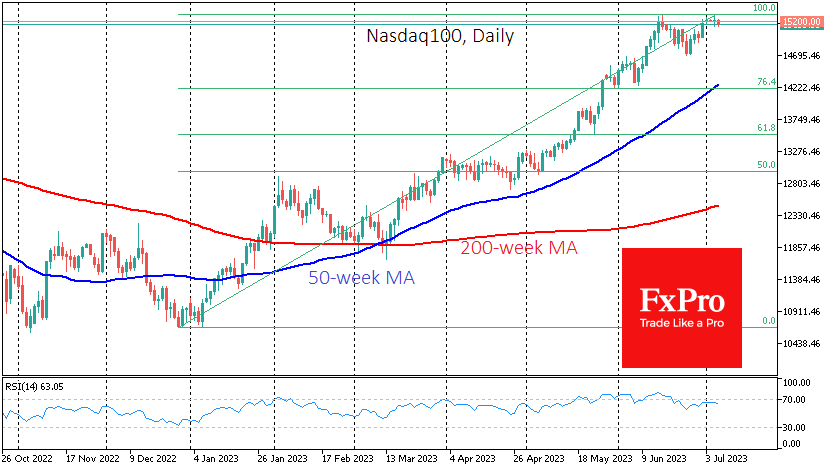

July 11, 2023

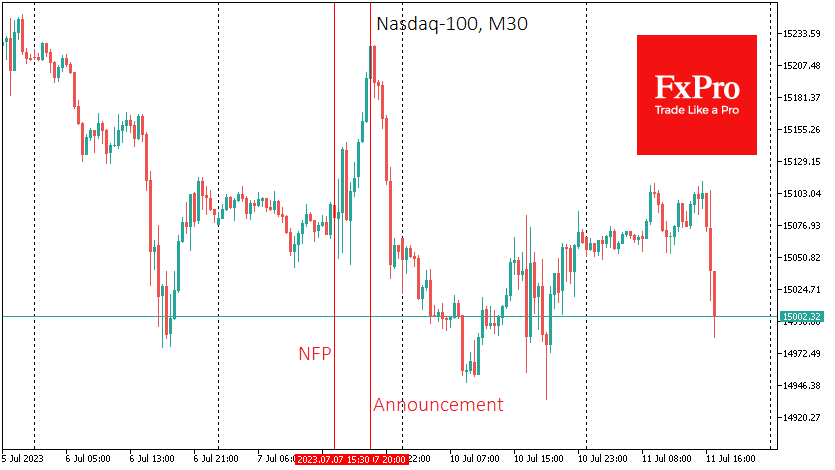

Big-tech stocks like Apple, Amazon, Microsoft, Tesla, Netflix, Nvidia, and others have been under increased pressure since last Friday. This is directly related to Nasdaq’s press release to do a rebalancing of the Nasdaq-100 index to reduce the concentration of.

July 11, 2023

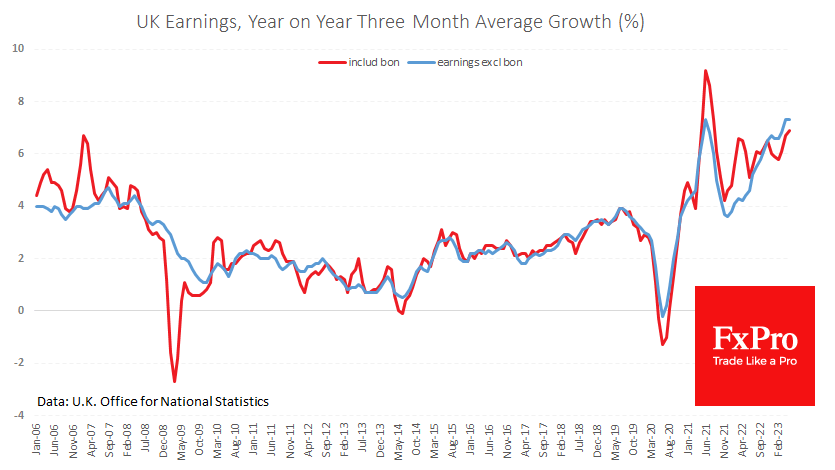

UK labour market data is making the Bank of England’s task of fighting inflation complex, with markets increasing expectations of a 50bp rate hike in early August. But we focus on falling employment, which could be the first sign of.

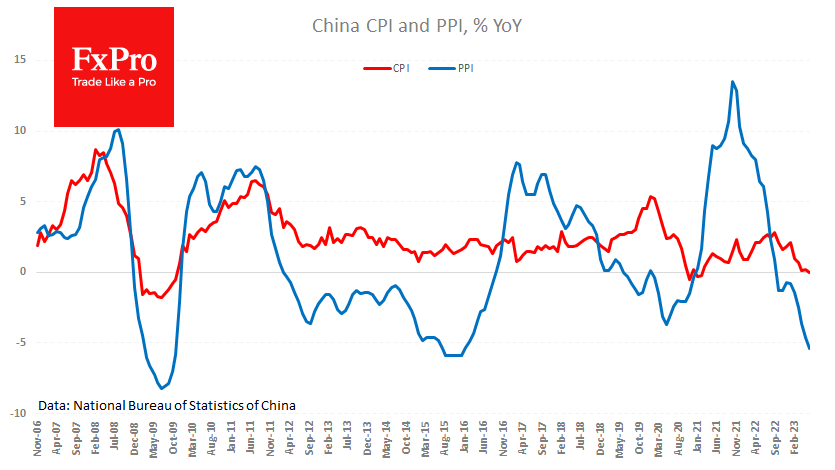

July 10, 2023

A further slowdown in China’s inflation is increasingly raising concerns about the Celestial Empire’s economic growth, which could be bad for the rest of the world. June data showed that CPI fell from 0.2% y/y to 0.2% y/y and PPI.

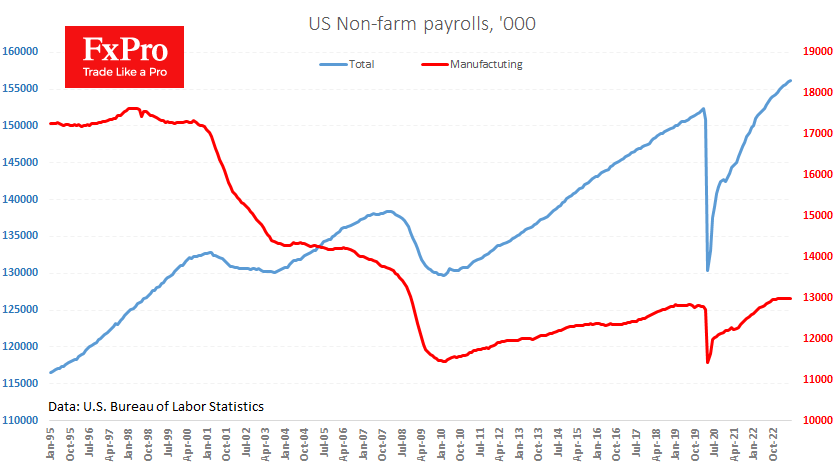

July 10, 2023

Friday’s US employment report sparked a sell-off in both the dollar and stock indices, as the pace of job creation missed forecasts, but hourly earnings growth beat expectations. The economy added 209k jobs in June, compared to 306K the previous.

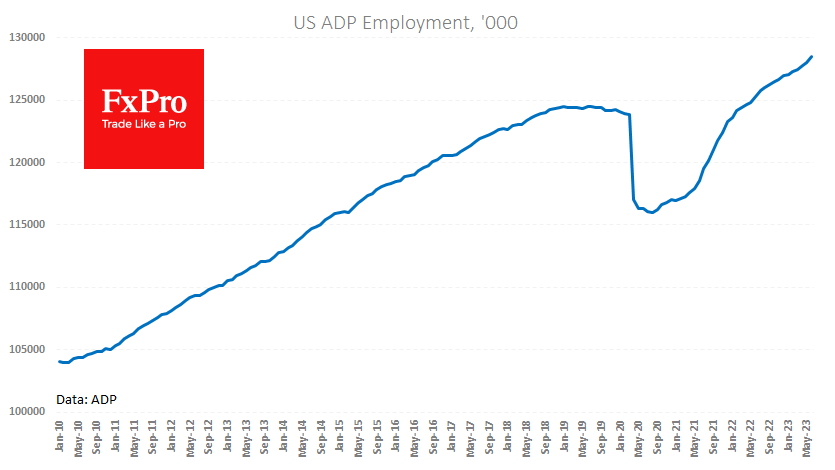

July 6, 2023

ADP released another super strong job report for the US, noting private sector employment growth of 497k in June. This is more than double the expected 226k growth and completely contradicts the idea that the world’s largest economy has entered.