Market Overview - Page 69

August 3, 2023

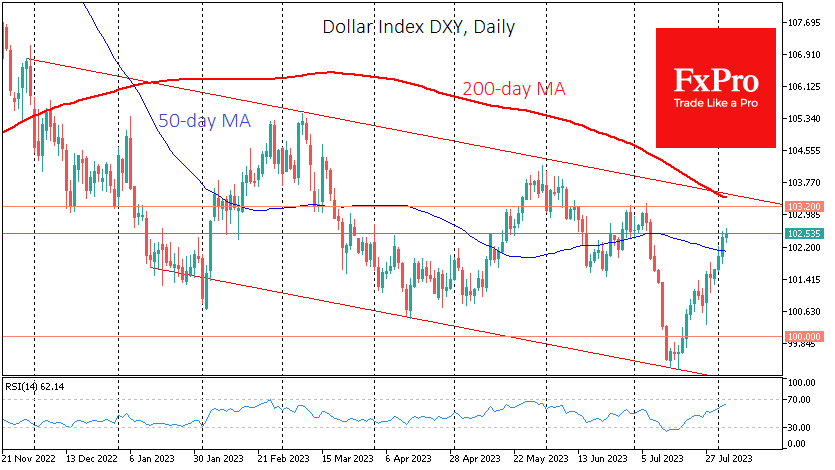

The US dollar is continuing the rally that began in the middle of last month, benefiting from the caution in financial markets in recent days. Although the current rally has not yet brought the Dollar Index back to the levels.

August 2, 2023

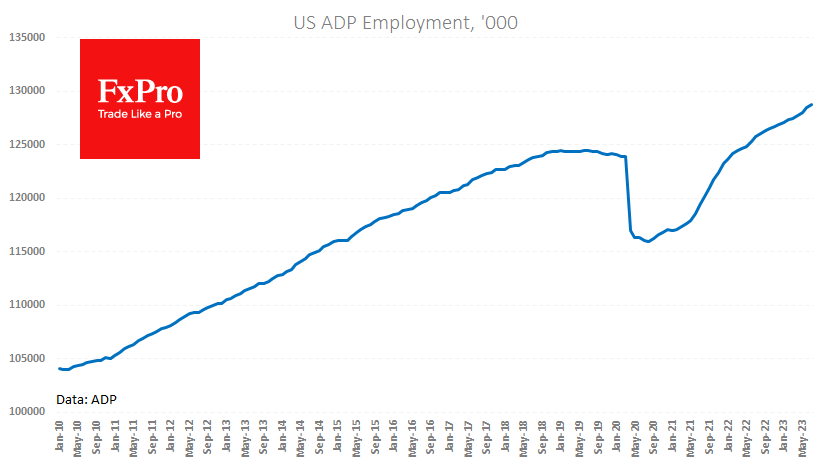

Ahead of Friday’s official employment report, ADP provided another robust estimate for July. It is said that the private sector added 324K jobs last month, down from 455K the previous month. The pace of hiring rose rather than fell in.

August 2, 2023

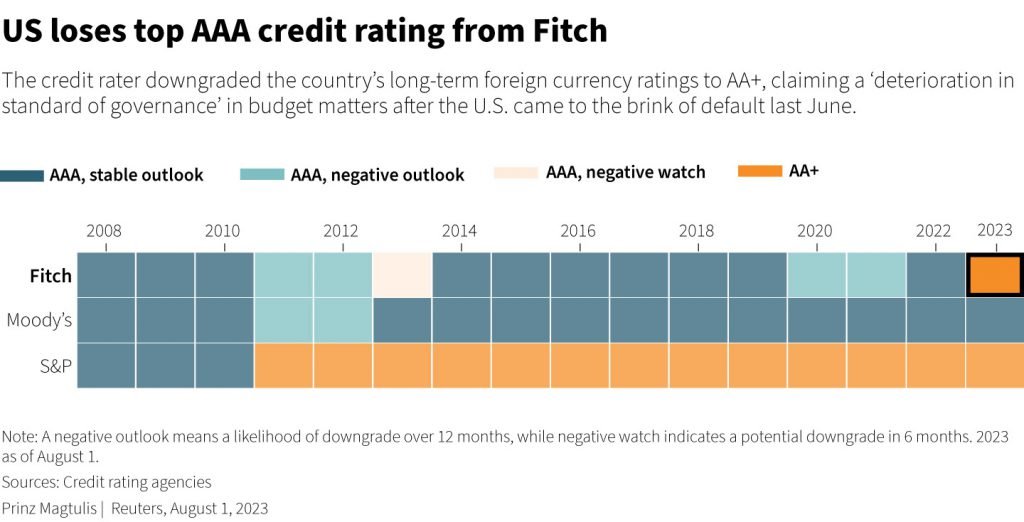

Fitch Ratings unexpectedly cut the US long-term credit rating by one notch to AA+. In response, markets have begun a gradual but broader risk repricing. The suddenness of Fitch’s move is disconcerting, given that the rating was not under review.

August 1, 2023

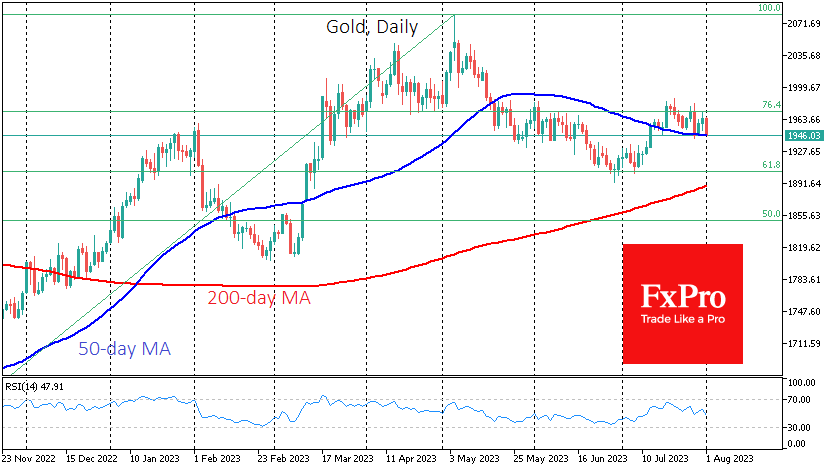

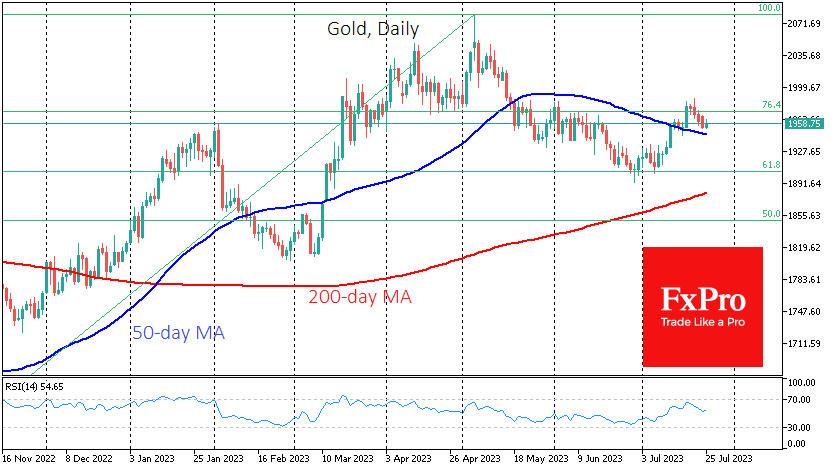

Gold has been sticking to support at the 50-day moving average since July 13th but has not found enough strength to break away from it. The markets tested the uptrend again last Thursday amid a wave of dollar strength. On.

July 31, 2023

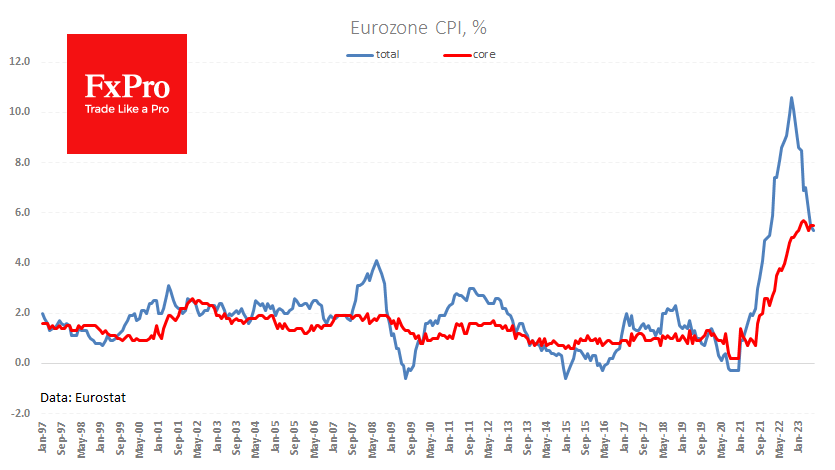

According to Eurostat’s preliminary estimate, eurozone inflation slowed to 5.3% year-on-year in July. This is the lowest rate since January 2022 and aligns with analysts’ expectations. The core index stood at 5.5%, above the headline rate for the first time.

July 31, 2023

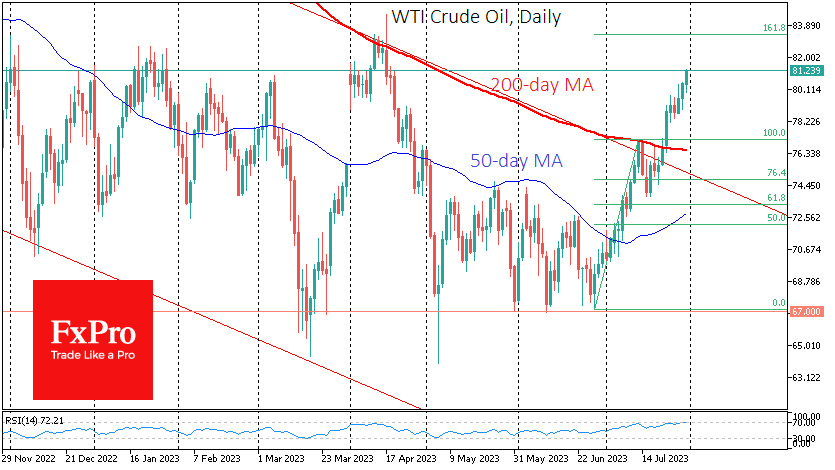

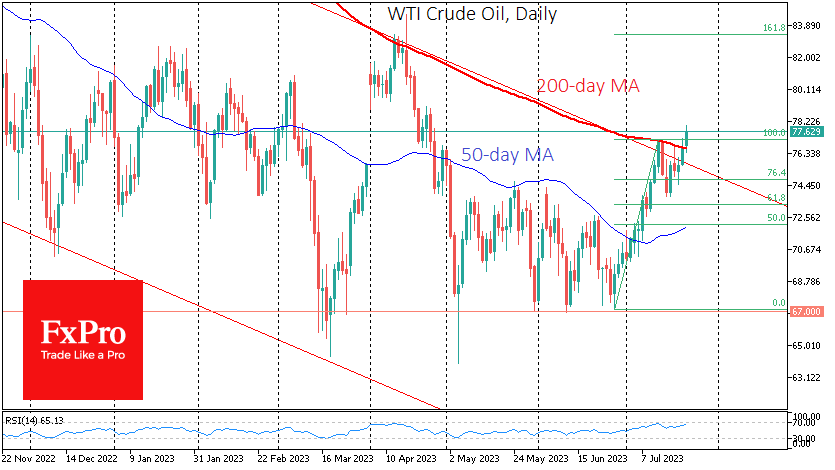

Oil has accelerated its gains over the past week, adding more than 20% to the lows of 28 June, when the latest rally began. Technical factors coming into play and excitement in the markets from robust macro data are adding.

July 27, 2023

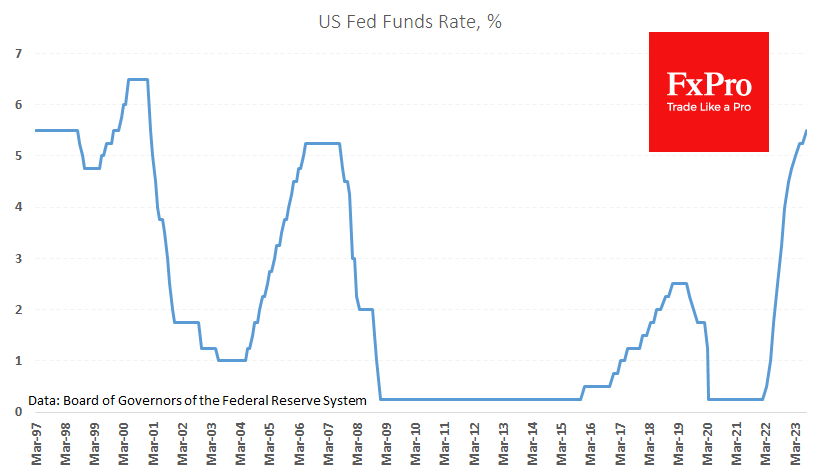

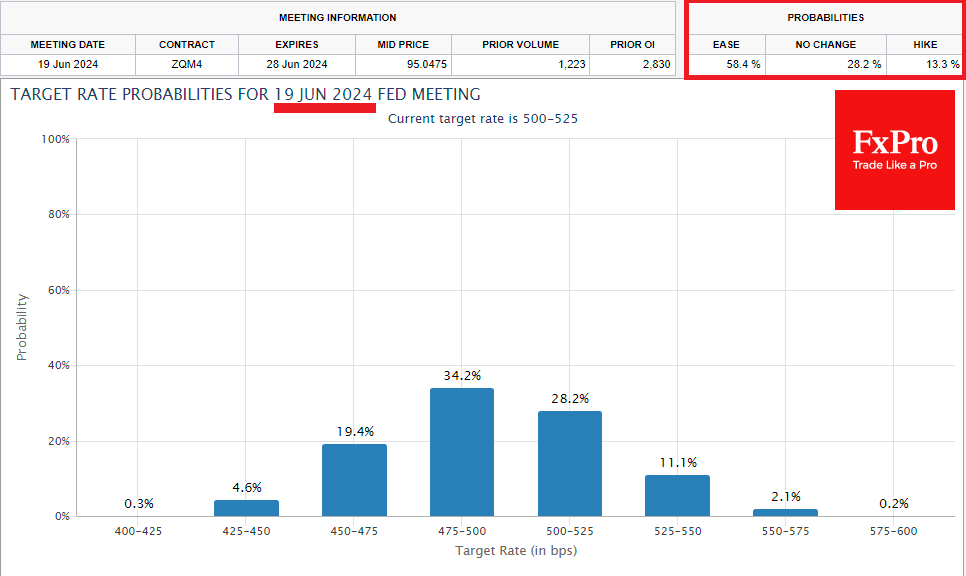

The Fed raised its key rate by 25 bps to 5.25-5.50%. The upper boundary of this range is the highest in 22 years. The lower boundary corresponds to the plateau level at which the Fed held rates from July 2006.

July 26, 2023

After pausing at the last meeting, the Fed will announce its rate decision today with a widely expected 25-point hike to a range of 5.25%-5.50%. This event is 97% priced into interest rate futures, according to the FedWatch tool, and.

July 25, 2023

The US dollar has risen for the 6th consecutive session, weighing on gold. However, this corrective pullback now highlights gold’s internal strength. Over the last week, gold fell 1.2% to $1953, erasing the rally of the 18th. However, longer declines.

July 24, 2023

Crude oil rebounded on Monday after four weeks of gains. Today’s rise of 1.2% to $77.7 per barrel of WTI is not remarkable in terms of momentum, but it is noteworthy for its potential impact on the technical picture. At.

July 24, 2023

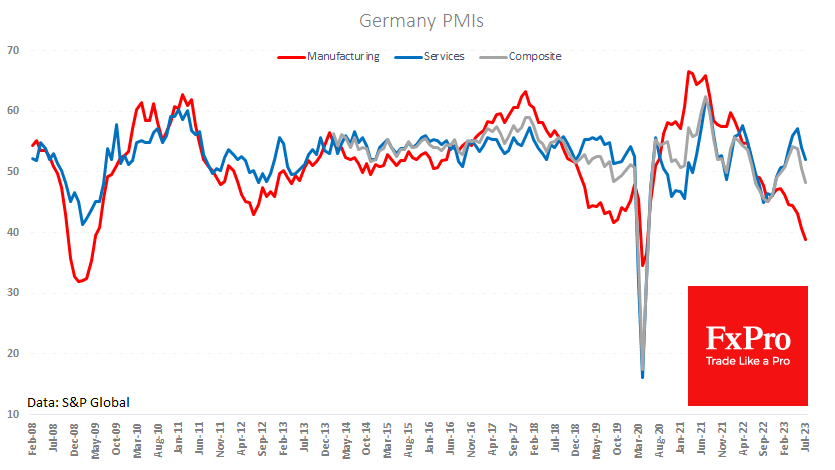

The single currency fell against the Dollar on Monday, dropping to 1.1070 following the release of weak economic data. After losing for five consecutive sessions, the EURUSD has given back almost half of its gains from the 6th to the.