Market Overview - Page 68

August 14, 2023

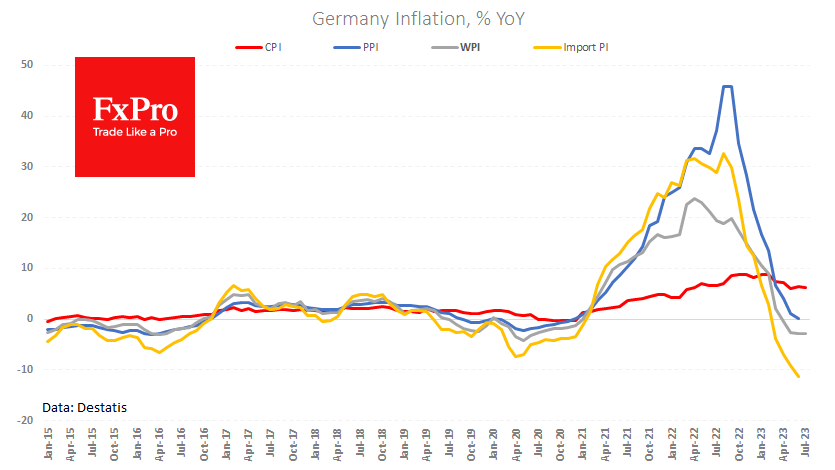

Wholesale prices in Germany dropped by 0.2% in July and decreased by 2.8% compared to last year. These figures were lower than economists’ average forecasts, with 0.1% and 2.6% declines, respectively. This indicates a weaker inflationary pressure than expected. The.

August 14, 2023

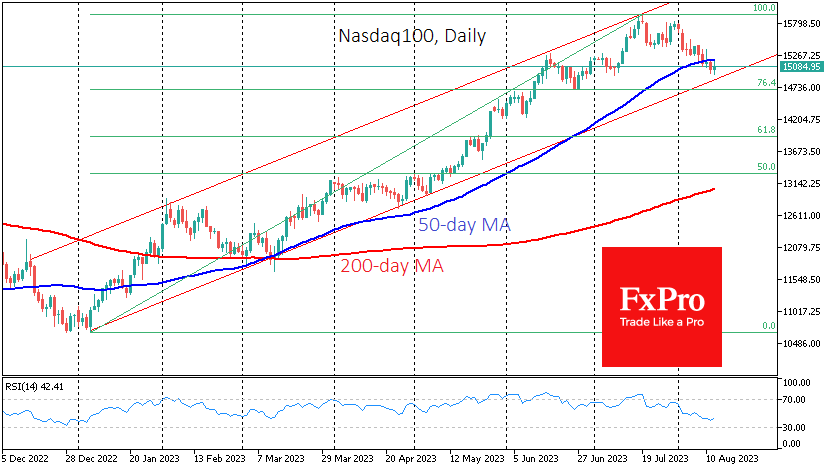

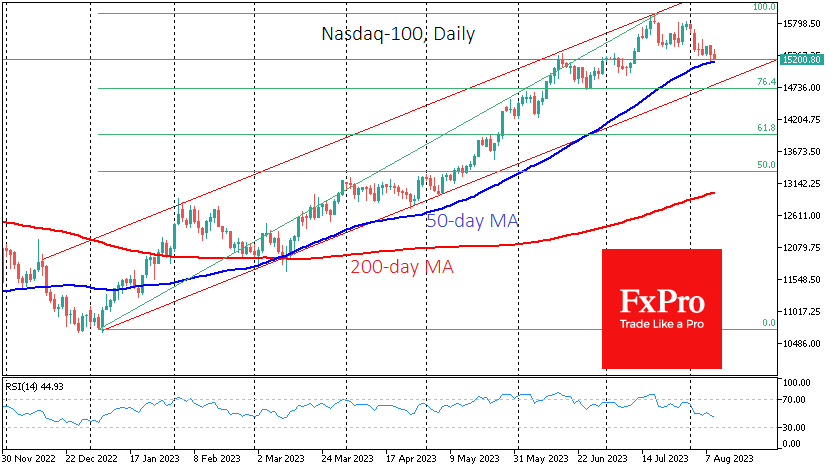

The Nasdaq 100 and S&P 500 indices, most closely followed by retail investors and traders, have faced some downward pressure since early August, but the latter still has a chance of maintaining an uptrend. The Nasdaq ended last week with.

August 11, 2023

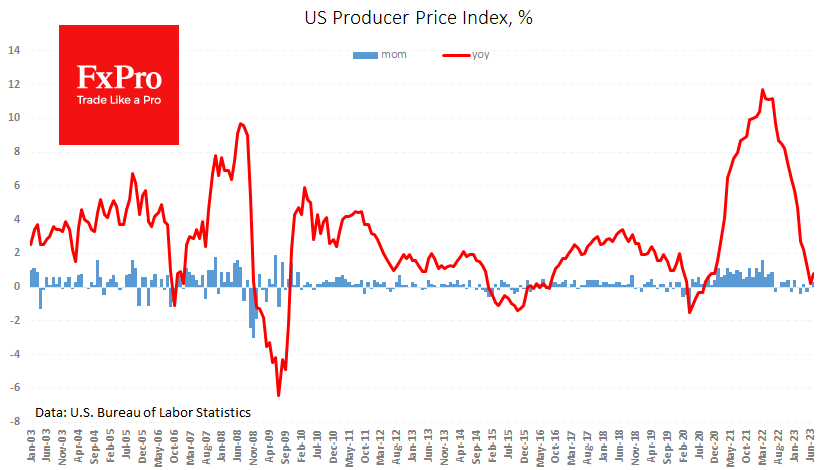

US producer prices, both including and excluding food and energy, rose 0.3% m/m in July. This is the first positive surprise for the indicator in six months – before this, prices had regularly missed average forecasts, supporting expectations of a.

August 11, 2023

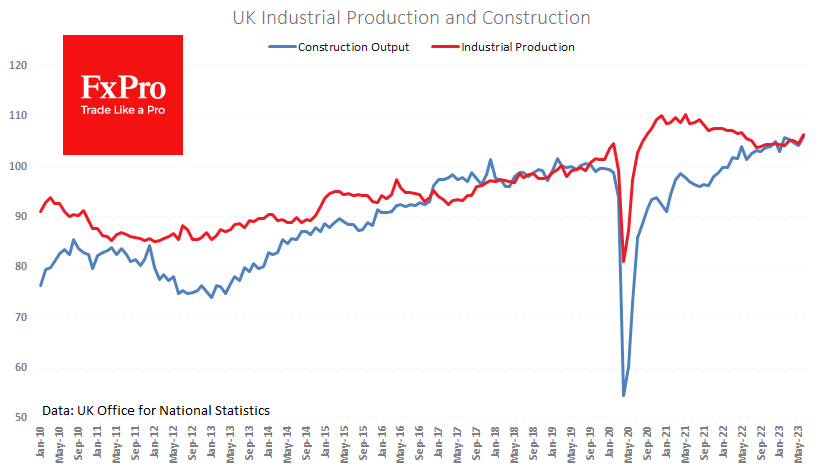

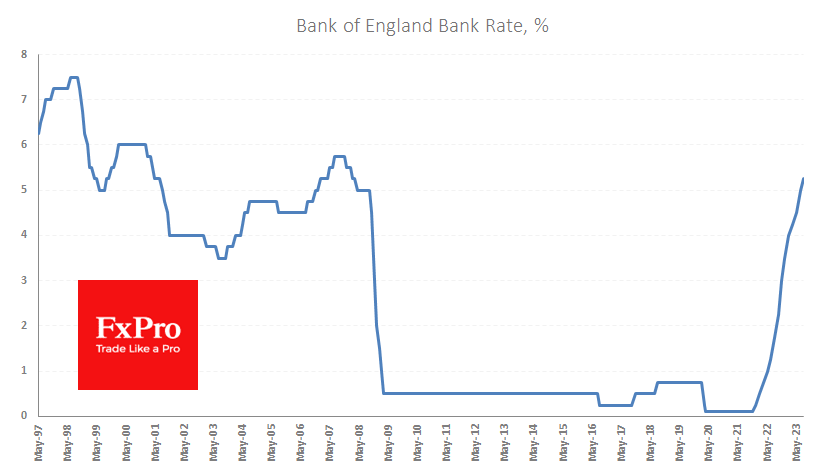

According to a data set released on Friday, the UK economy performed better than expected across a wide range of indicators in June. GDP rose by 0.2% in the second quarter and 0.4% in the same quarter a year earlier..

August 10, 2023

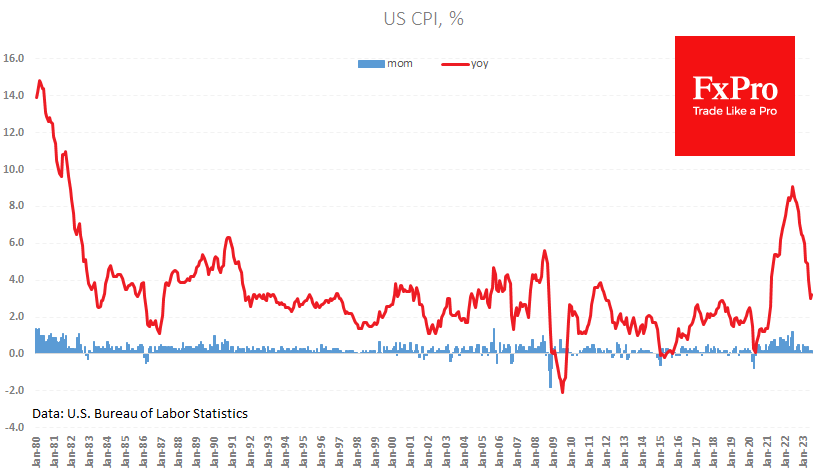

US CPI rose 3.2% y/y, slightly weaker than the 3.3% y/y expected. Core inflation slowed to 4.7% y/y, although analysts, on average, were looking for it to maintain its 4.8% y/y pace. This is negative news for the USD and.

August 10, 2023

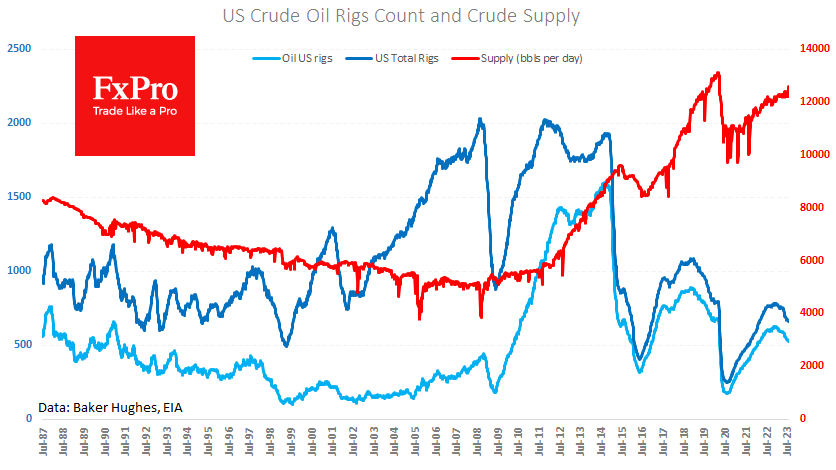

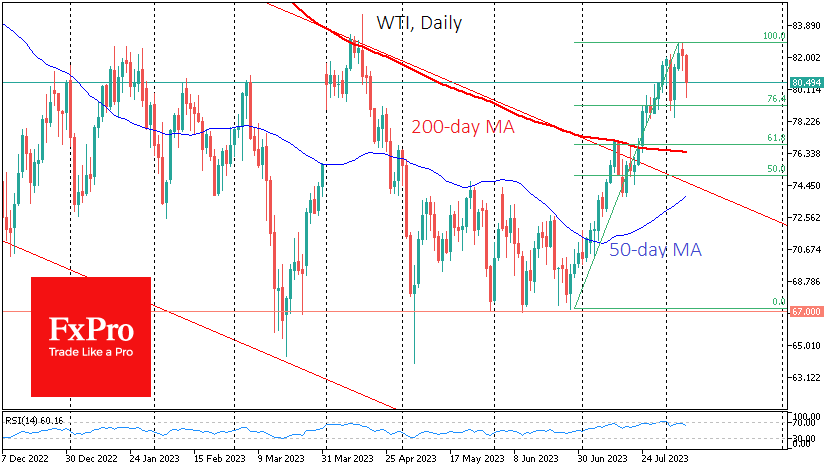

Oil is storming to new multi-month highs, rising for the seventh week. Prices have grown high enough to be of interest to US oil producers and, locally, a threat to markets. Data released by the Department of Energy on Wednesday.

August 9, 2023

The US Nasdaq-100 lost 1.75% at one point on Tuesday but managed to trim its losses to 0.9% thanks to buying at the end of the session. The index bounced off its 50-day moving average, which is an essential medium-term.

August 9, 2023

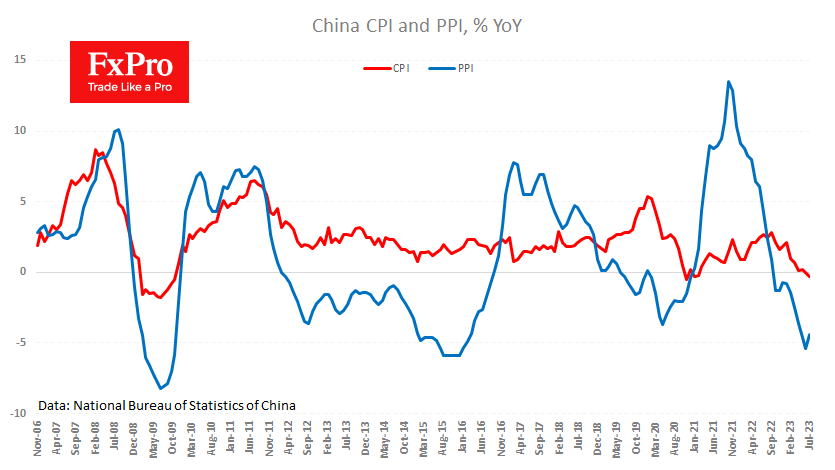

China’s CPI was 0.3% lower year-on-year in July, which the media has rushed to call deflation, while by definition, it is a sustained price fall. It is more accurate to discuss disinflationary pressures caused by one-off factors, including last year’s.

August 8, 2023

Oil is down around 2.5% since the start of the day on Tuesday to $80.1 per barrel WTI, as a loss of traction in risk assets coincided with a fresh wave of concerns over China’s growth rate. Foreign trade data.

August 4, 2023

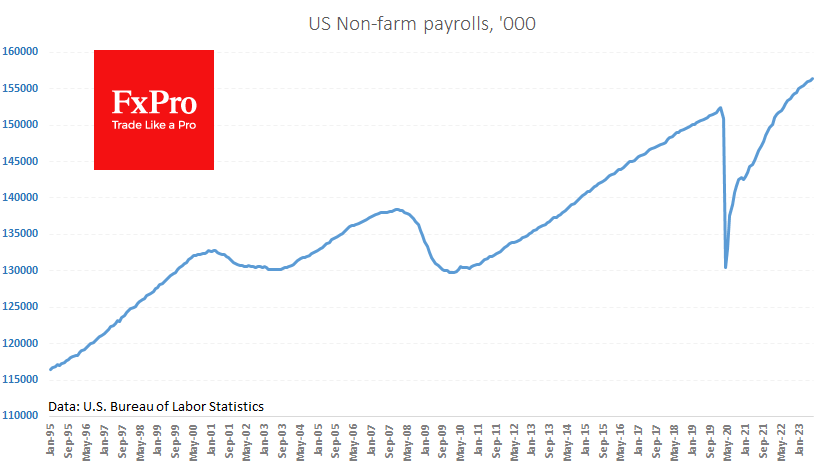

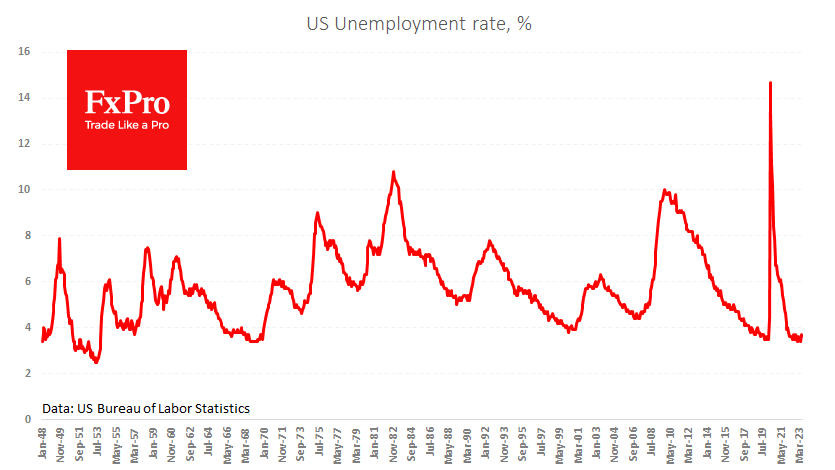

Employment growth is somewhat weaker than expected, but wage growth and the falling unemployment rate could be a reason for another Fed rate hike. The US labour market created 187k new jobs after 185k previously (revised from 209k). Formally, the.

August 4, 2023

Later on Friday, an important US employment report will be released. On average, analysts expect employment growth of just over 200K, which is in line with the trend rate of hiring during periods of trend GDP growth. Hourly payrolls are.