Market Overview - Page 66

September 14, 2023

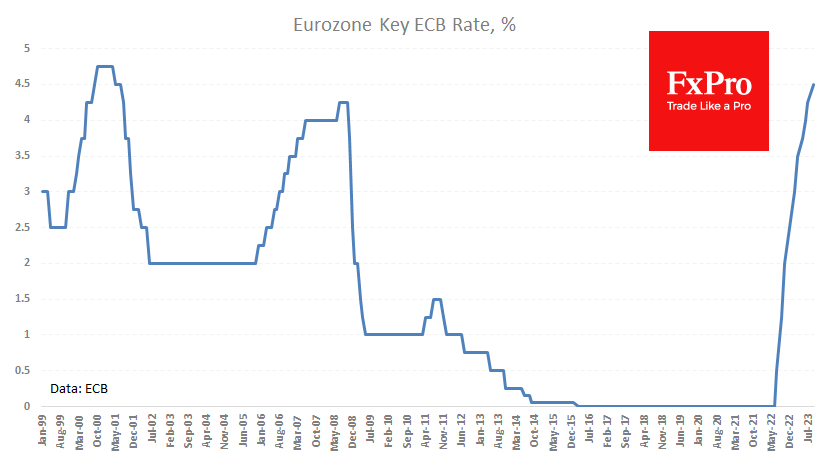

Though analysts anticipated no changes, the ECB raised the rate by 25 points to 4.5%. However, the ECB’s comments had a more significant effect on the markets. They stated that current rates are effective enough to normalise inflation eventually. This.

September 14, 2023

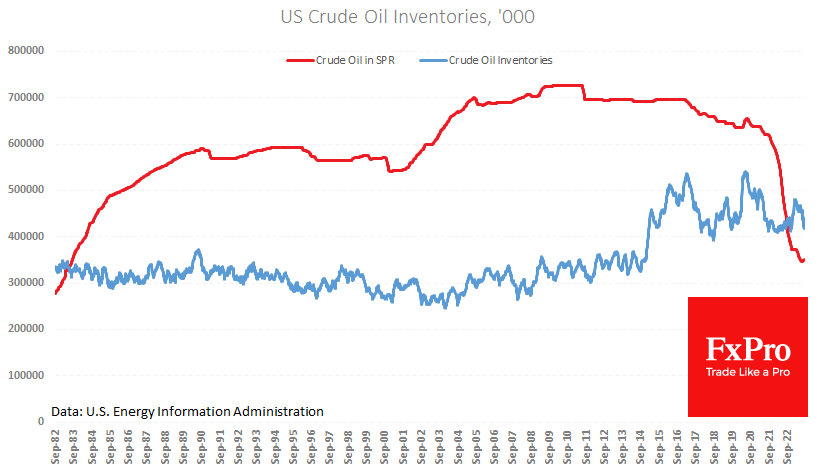

Oil prices are going up because the largest members of the OPEC+ cartel are facing a shortage. The US has increased its production since August without increasing the number of drilling rigs, only boosting output from existing ones. These conditions.

September 13, 2023

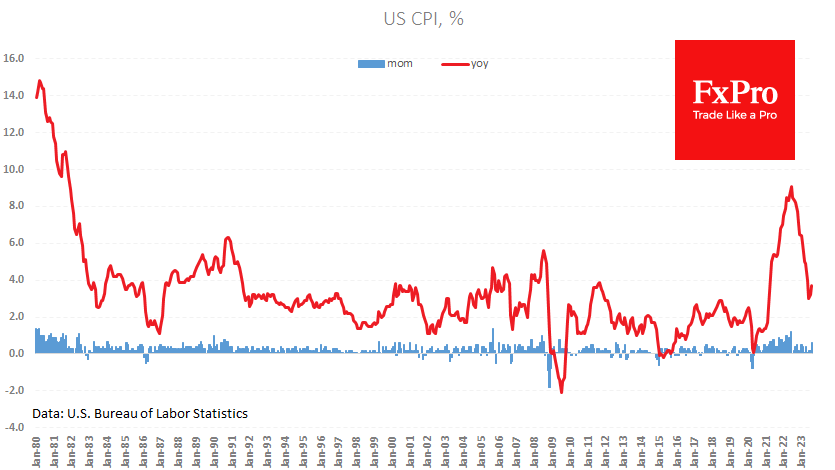

The latest US report was a reminder that the fight against inflation will not be easy. We would guess that the most challenging period for the authorities has just begun. In August, the US CPI rose by 0.6% m/m, taking.

September 8, 2023

Better-than-expected Canadian jobs data made the Loonie seem stronger than the Greenback for a while, and it made another attempt to get back below 1.36 for USDCAD. Payrolls rose by 39.9k, double the expected 19K. On a more positive note,.

September 5, 2023

Business activity in the UK is losing ground, as is the case in Europe and China, although the final reading for August saw the services PMI rise to 49.5 from the first estimate of 48.7. According to today’s PMI, the.

September 5, 2023

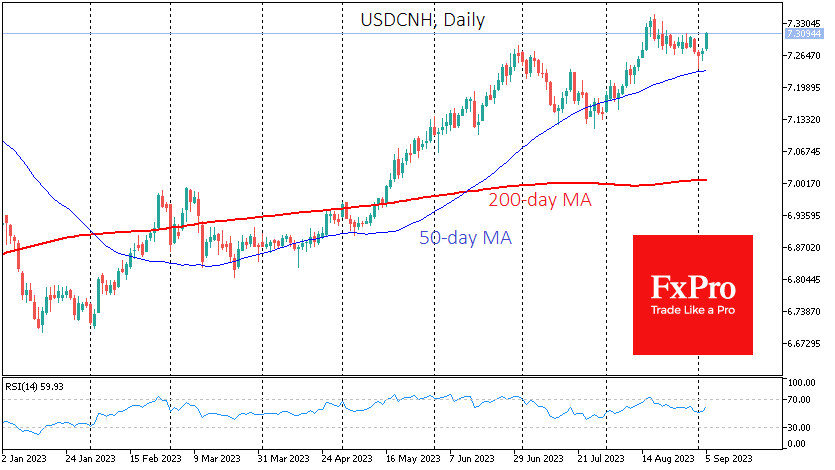

Economic data from China and the eurozone sent markets back into sell-off mode. China’s services PMI fell from 54.1 to 51.8, the smallest growth rate since last December. That’s a sharper slowdown than the 53.6 expected. The momentum of the.

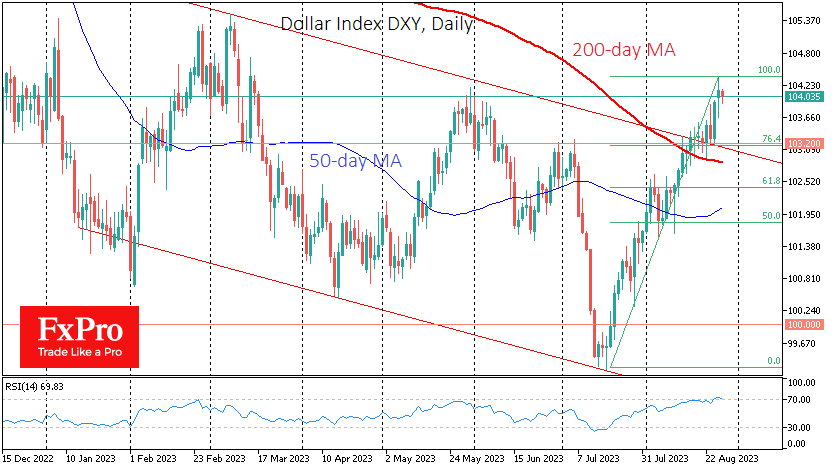

September 4, 2023

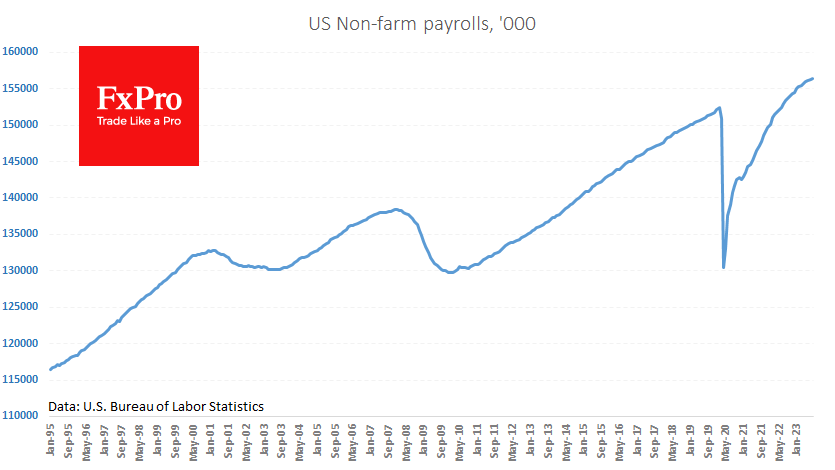

Friday’s batch of US statistics boosted the Dollar, while the US stock market was mixed as a sell-off replaced an initial rally. The data showed that the US economy created 187K jobs in August, but data for the previous two.

August 31, 2023

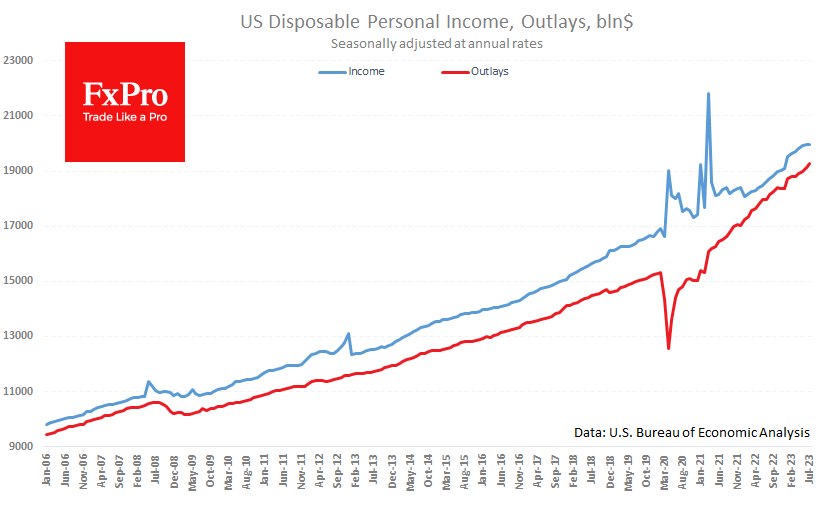

Personal spending by Americans in July points to increased risks of a return to inflation. Consumer spending rose 0.8% in July, following a 0.7% increase a month earlier. Meanwhile, incomes rose 0.2% in July and 0.3% in June. Disposable personal.

August 31, 2023

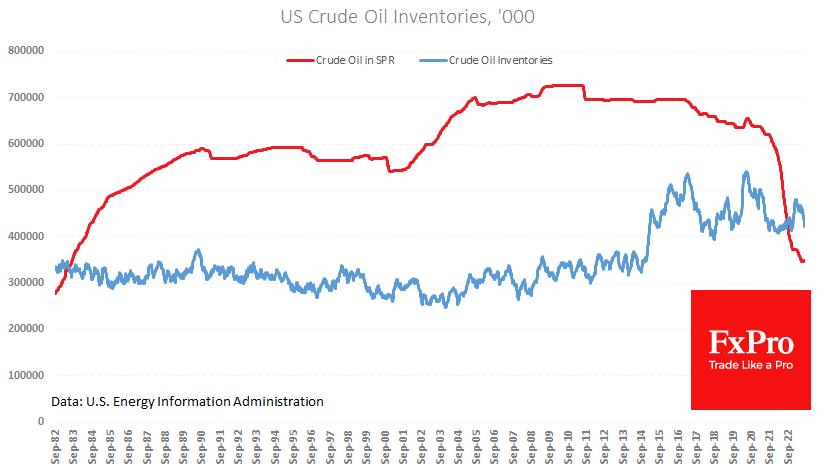

Oil has risen in five of the last six trading sessions, gaining almost 4%. With a lower volatility, Crude may be preparing for a big move higher. US commercial oil inventories plunged by 10.6M barrels last week and have fallen.

August 30, 2023

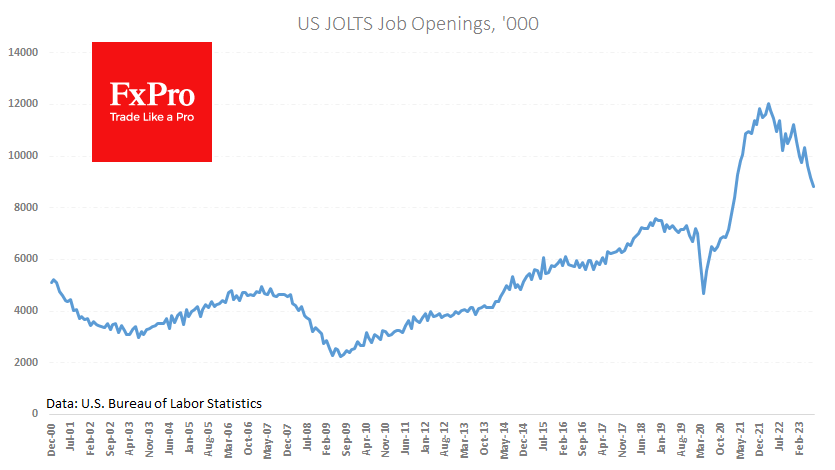

Financial markets have staged an impressive rally across a broad range of instruments. This is an essential signal that risk appetite improves after about a month of correction. But based on the idea that “the worse, the better”, such a.

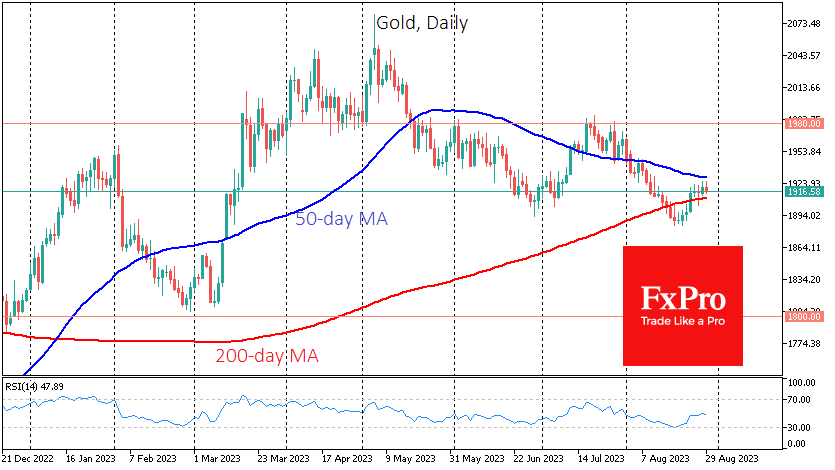

August 29, 2023

Gold’s rally appears to be running out of steam after a 2% rally since the beginning of last week. Gold has been at the mercy of sellers for a month since the 20th, losing over 5.2% from peak to trough..