Market Overview - Page 65

September 27, 2023

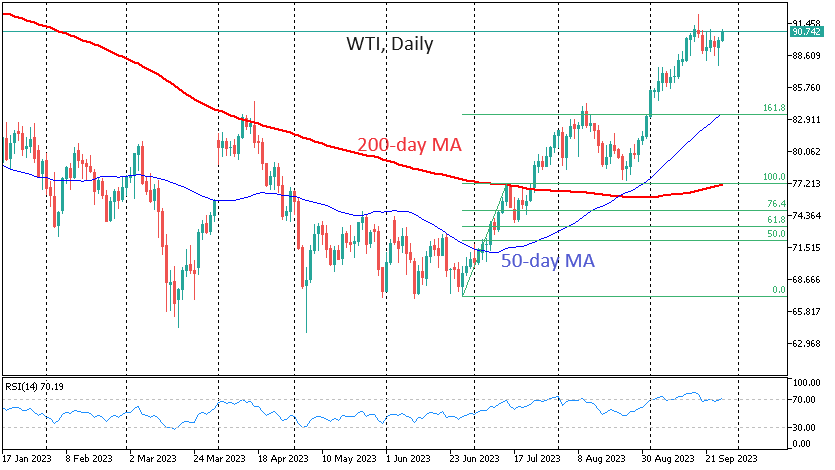

Global markets are in sell-off mode, but oil has quickly recovered and is rising for the second day after a shallow correction. The dollar index added for the 11th week in a row – one of the most persistent rallies.

September 26, 2023

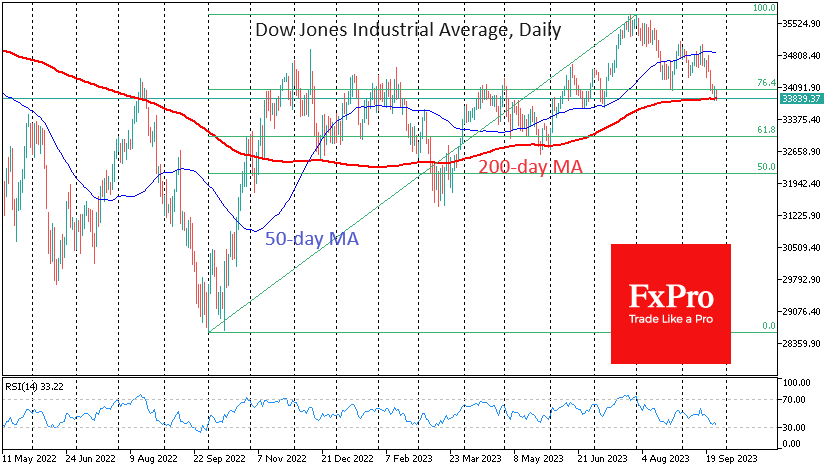

The Dow Jones Index is testing the long-term trend’s strength in the form of the 200-day moving average. The touching of this curve at the end of May and a brief dip below in March was characterised by increased buying..

September 26, 2023

The British Pound lost ground against the Dollar for the fifth consecutive session, falling below the 1.2200 level. GBPUSD is down 4% since the beginning of the month, when pressure on the Pound intensified, and 7.3% from July’s peak. Fundamentally,.

September 25, 2023

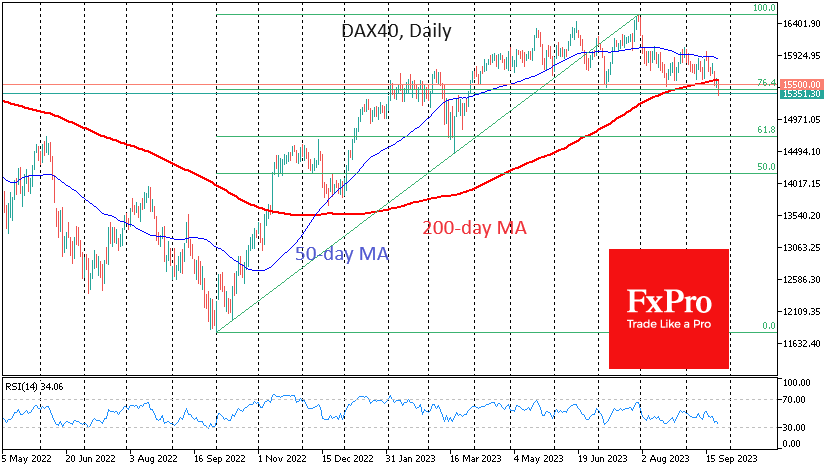

There is growing evidence that equity markets are amid a deep correction from the run-up that began almost 12 months ago. The reaction of Europe’s significant indices in recent days has been telling. The German DAX40 fell below its 200-day.

September 25, 2023

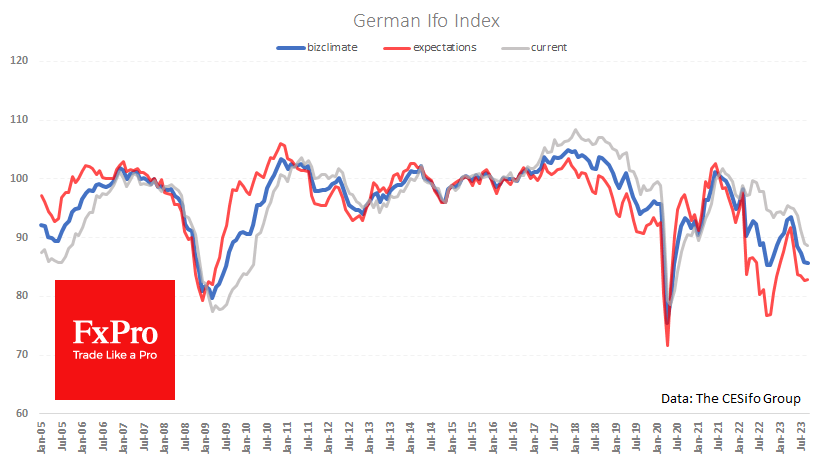

Germany’s Ifo business climate index held steady in September at the previous month’s level despite expectations of further deterioration. The business climate indicator fell from 85.8 to 85.7, better than the expected 85.1 but still the lowest since mid-2020. Excluding.

September 22, 2023

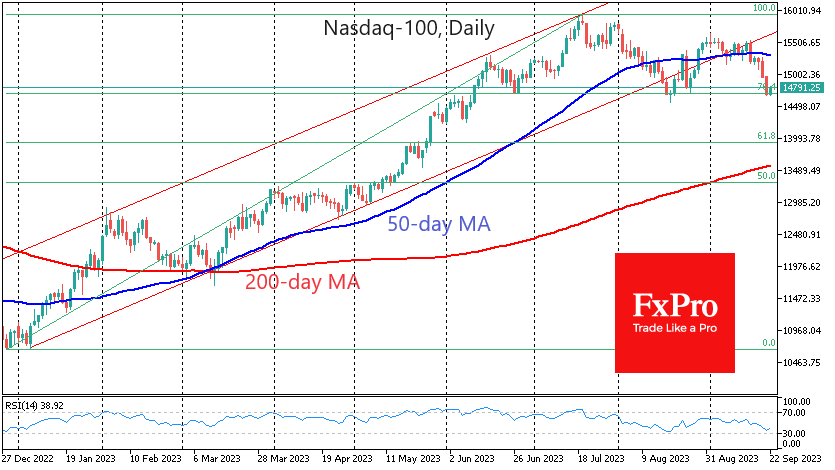

The US stock market is attempting to bounce back on Friday after the heavy sell-off on Wednesday and Thursday. The Nasdaq-100 index was close to key levels where it reversed gains made in June and August. The S&P 500 has.

September 21, 2023

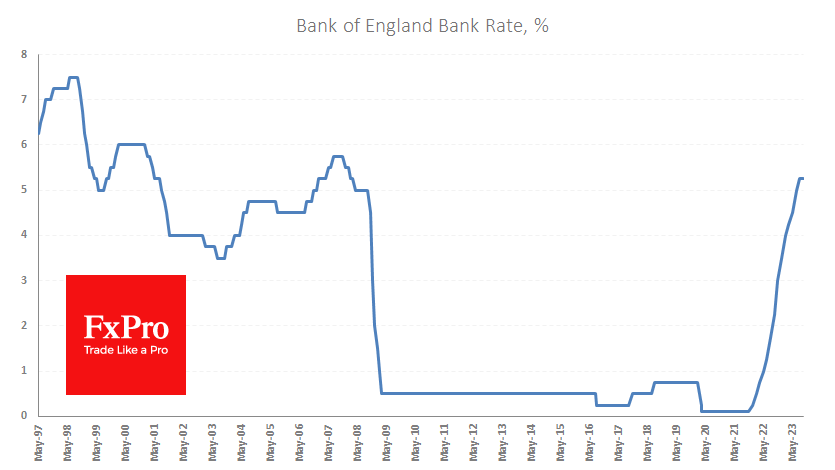

The Bank of England has left its key interest rate unchanged at 5.25%. The likelihood of such an outcome was actively priced into Pound quotes following yesterday’s UK inflation report. The accompanying commentary noted the Bank of England’s worsening outlook.

September 21, 2023

The Swiss National Bank left its key interest rate unchanged at 1.75%. On average, markets had been predicting a 25-basis point hike, contrary to our expectations. Most likely, market participants’ forecasts were influenced by the ECB rate hike a week.

September 20, 2023

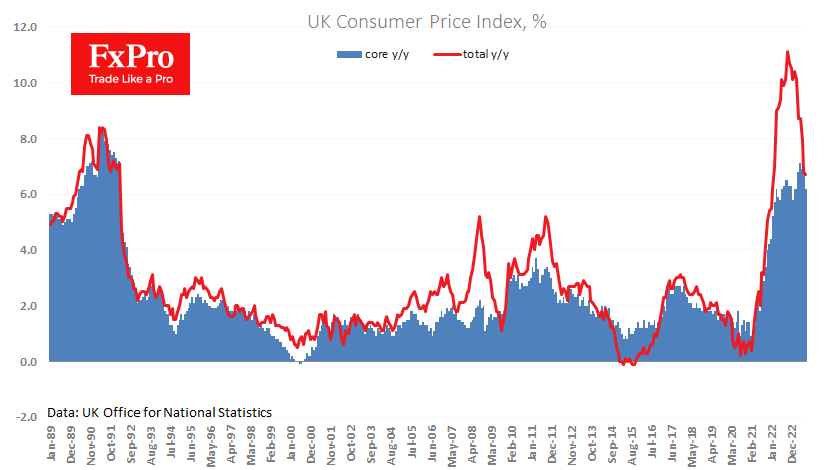

UK consumer inflation slowed from 6.8% to 6.7% y/y, contrary to the expected acceleration to 7.0%. Core inflation, excluding food and energy, saw an even more significant slowdown of 6.2% from 6.9% y/y, well below the average forecast of 6.8%..

September 19, 2023

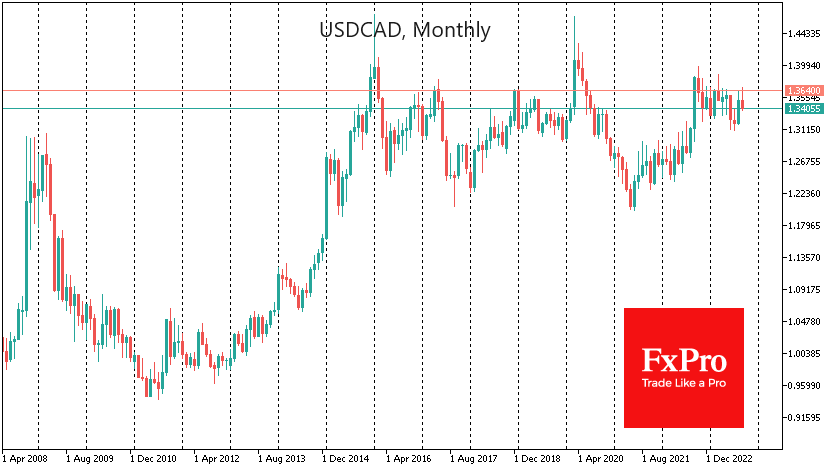

The Canadian dollar reversed course to the upside a week and a half ago, and its strength is gaining momentum on the back of both a fresh wave of demand for commodities and robust economic data. USDCAD is down 1.9%.

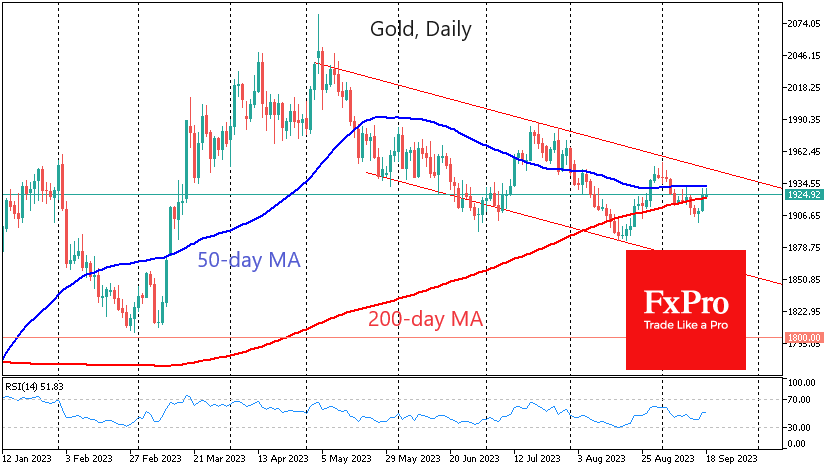

September 18, 2023

Gold added almost 1% on Friday, having managed to defend against a fall below $1900 the day before. The price tests the long-term and medium-term trends for the second month, leaving the Fed to make a decisive argument in favour.