Market Overview - Page 64

October 17, 2023

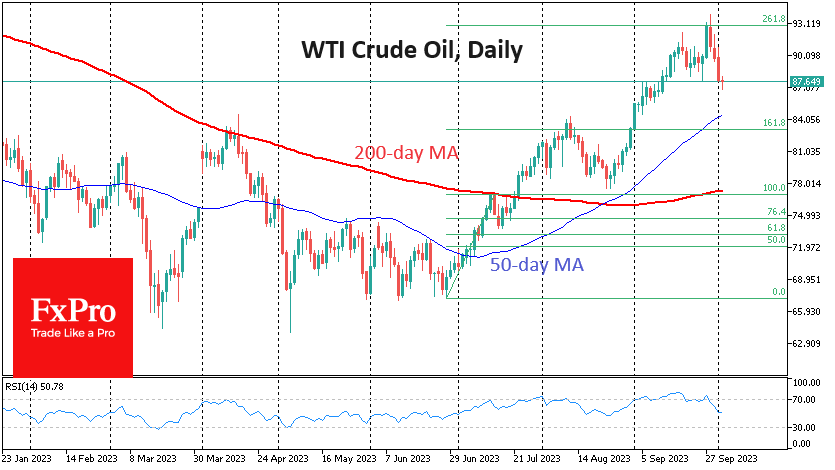

Oil made curious movements last week. After opening last week with a gap of 2.3% and quickly rising to 5.2%, the price stabilised and turned downwards. On Thursday, the gap at the week’s opening was closed entirely. Given the current.

October 11, 2023

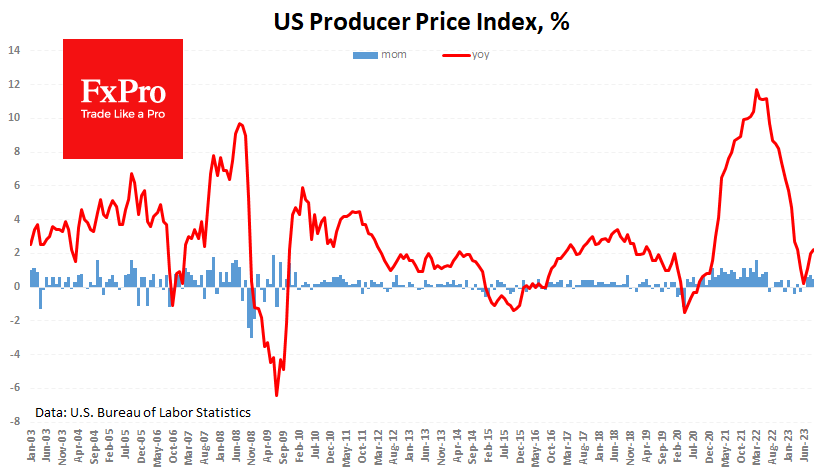

Headline PPI rose 0.5% m/m instead of the expected 0.3%. In the same month a year earlier, the index was higher by 2.2% instead of the expected 1.6% y/y. This divergence in the estimates of annual rates is due to.

October 11, 2023

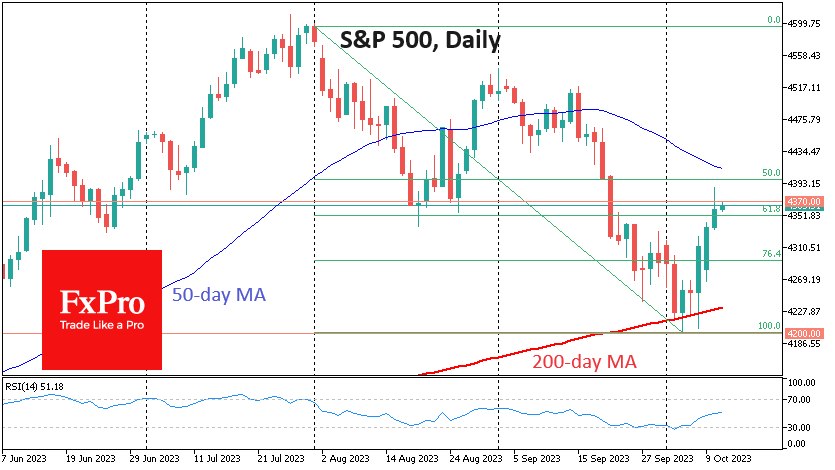

The major US indices staged an impressive intraday reversal on Friday and have been rallying impressively ever since. The fundamental driver was the change in tone of the Fed’s comments. Since last week, one FOMC member after another has indicated that further.

October 10, 2023

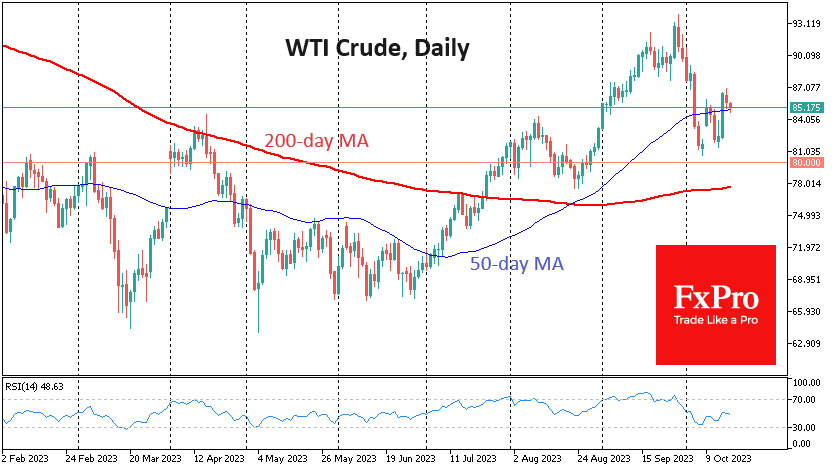

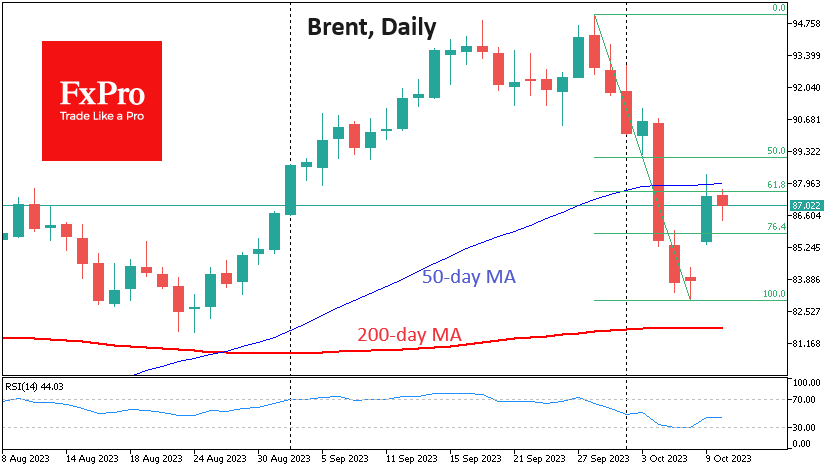

Oil’s bounce at the start of the week’s trading was an essential step in correcting the short-term oversold condition, but it may only fuel the interest of new sellers. The oil price is down 12.8% in the six trading sessions.

October 10, 2023

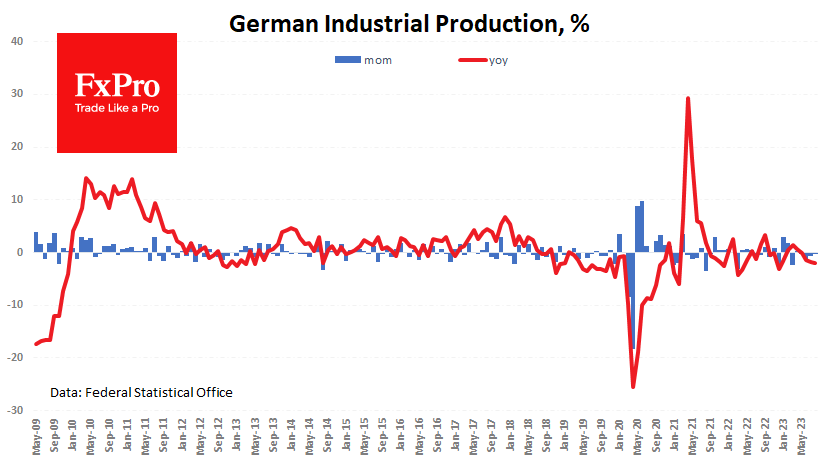

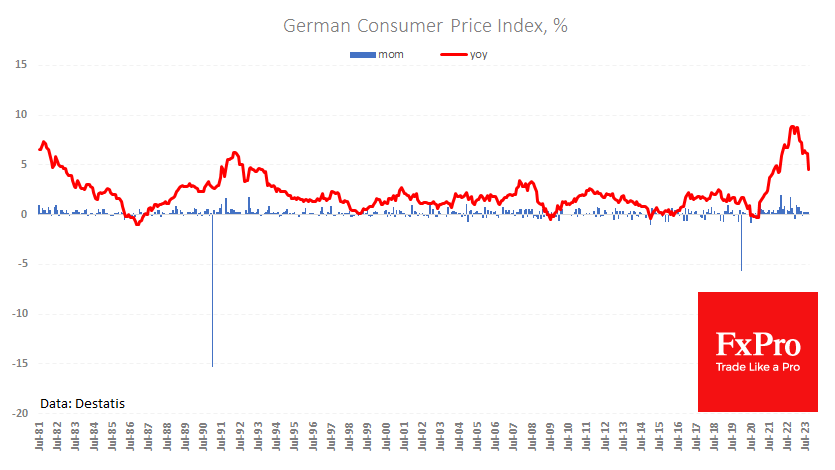

German industrial production contracted for the fourth consecutive month in August, missing expectations. Last month’s loss was 0.2%, bringing the year-on-year decline to 2.0%. Germany’s industrial production index started on a downward path at the beginning of 2018, which is.

October 9, 2023

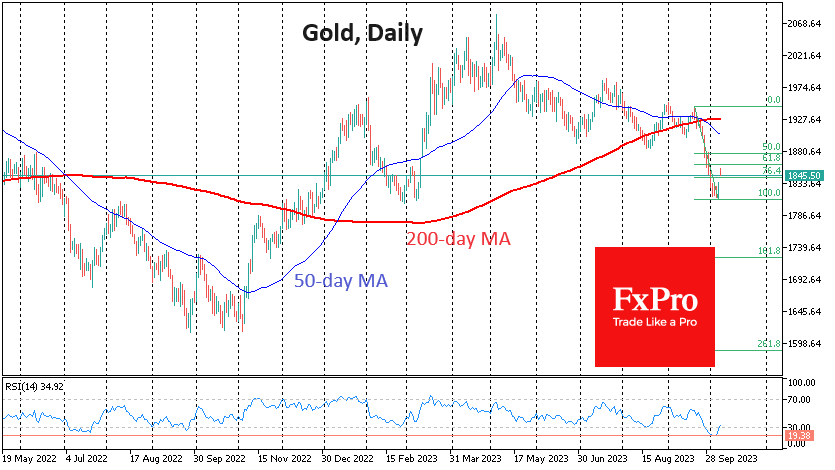

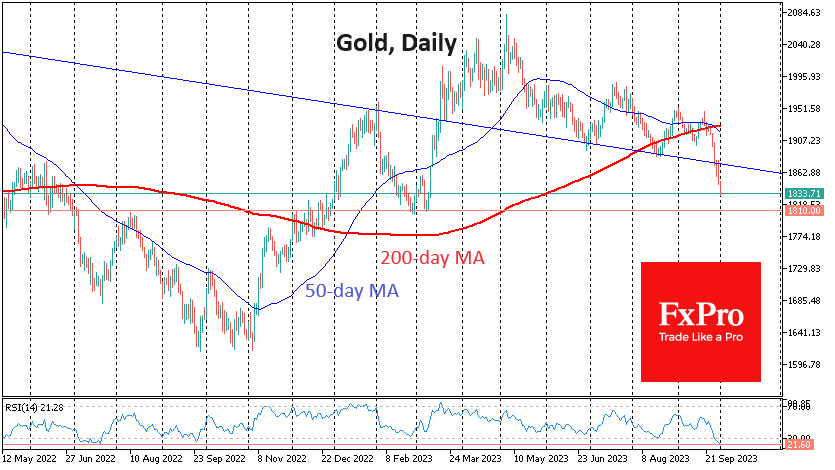

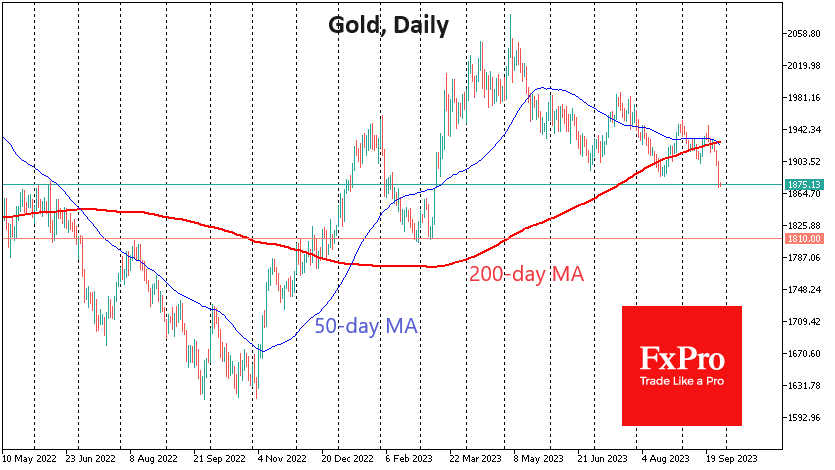

Gold climbed close to $1855 per troy ounce in early trading on Monday and stabilised in a relatively narrow range of $1845-1853 during the European session. The rise from Friday’s lows of $1810 resulted from a combination of three factors..

October 3, 2023

Oil prices fell for the fourth session after hitting 13-month highs. The spot price of a barrel of WTI approached $94 in what looked like a desperate last-ditch attempt by the bulls to assert their superiority. However, this appeared to.

October 2, 2023

Gold lost almost 4% last week, the biggest drop in over two years. The price of a troy ounce fell below $1835, its lowest level since March. Gold’s sell-off last week looked like a capitulation of the bulls, with a.

September 29, 2023

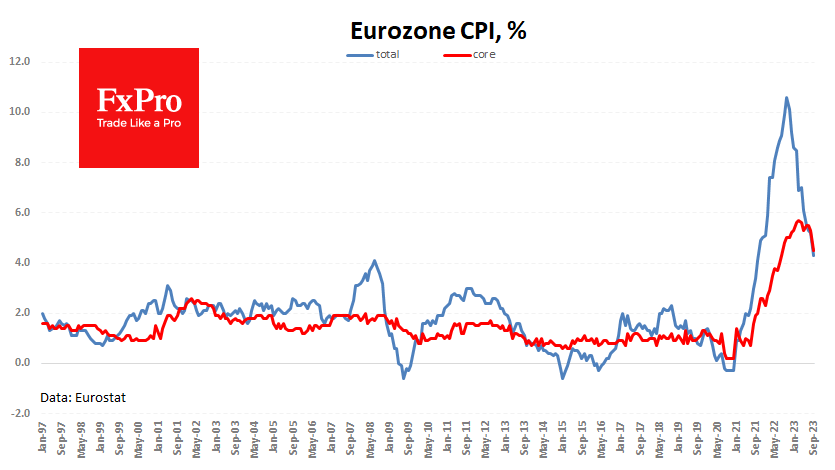

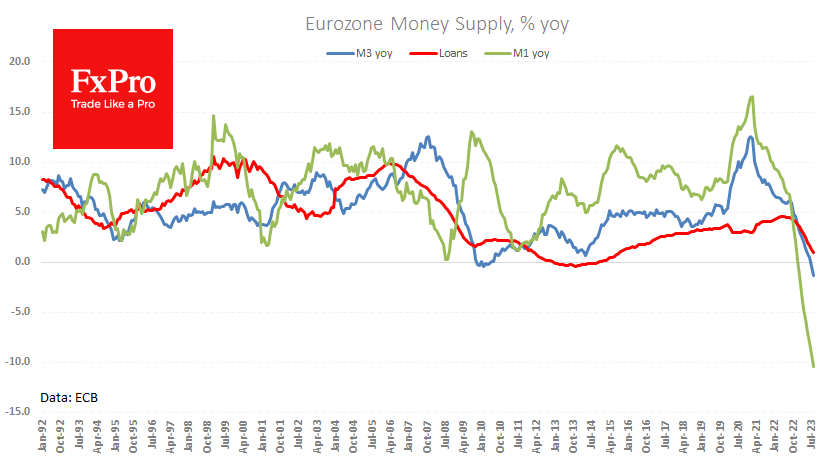

Recent reports from Europe and the US have highlighted a slowdown in inflation. The slowdown in price growth triggered a wave of purchases of risk assets in the hope that central banks would not have to keep rates at restrictive.

September 28, 2023

German consumer inflation slowed more than expected in September, according to Destatis’ preliminary estimate. The price growth rate slowed to 4.5% y/y from 6.1% y/y vs. 4.6% y/y expected. However, the monthly rate growth remains elevated, with the last four.

September 28, 2023

The price of a troy ounce of gold fell 1.4% on Wednesday to $1875, its most significant drop since early June, building this week’s loss to 2.7%. Gold has not been so cheap in Dollars since the first half of.