Market Overview - Page 62

November 15, 2023

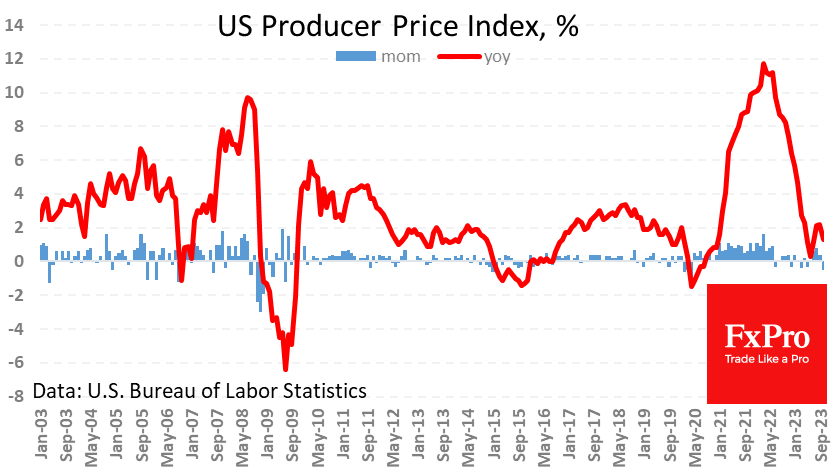

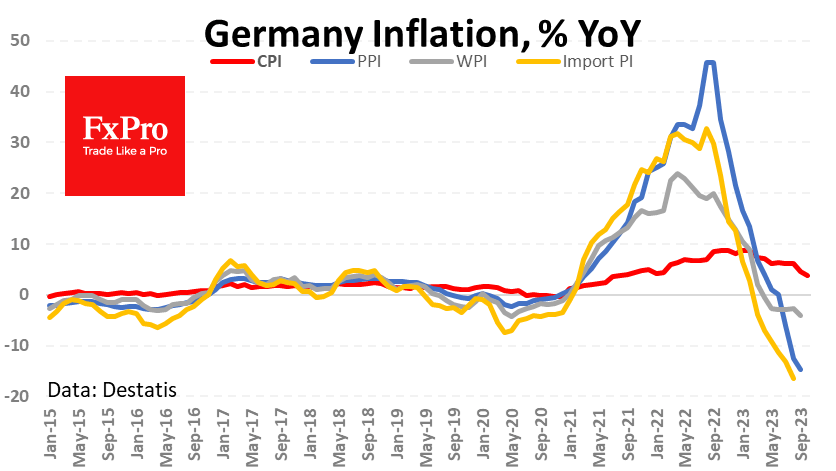

A new batch of statistics from the US once again reminds us of the Goldilocks story, when one can have fun and not pay the price for it. Producer prices fell 0.5%, against expectations for a 0.1% rise. And that’s.

November 15, 2023

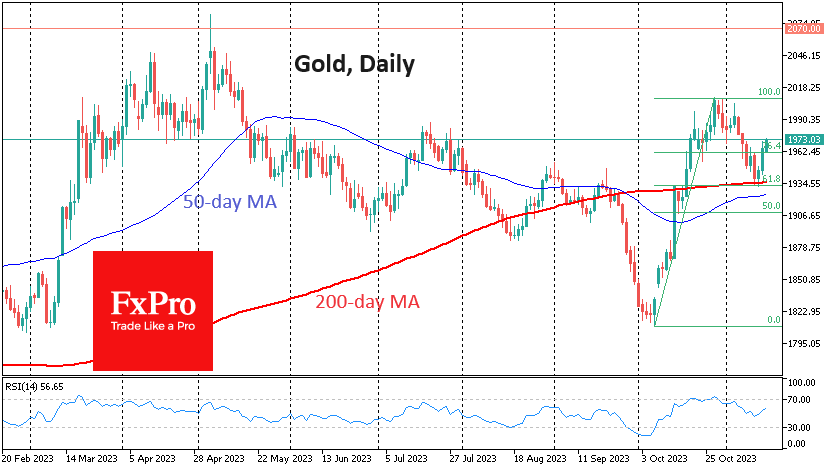

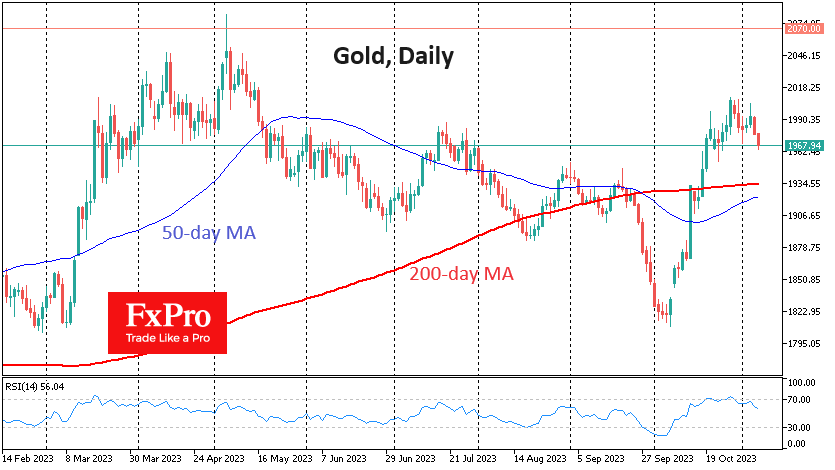

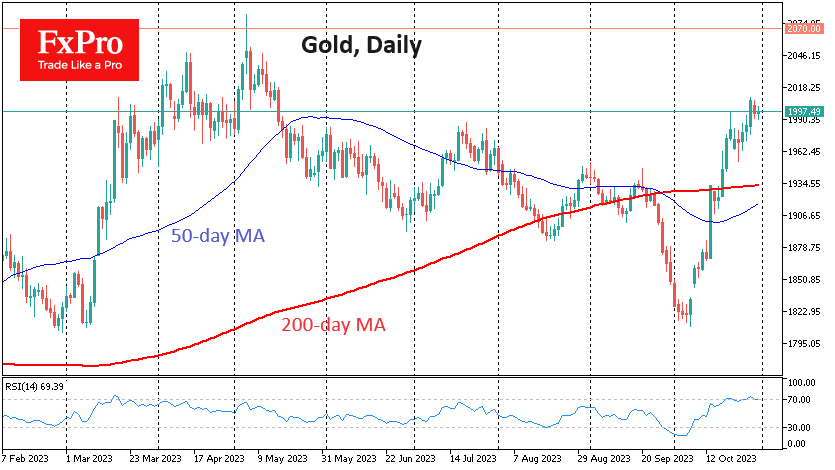

Gold has made a decisive reversal to the upside this week. We are likely to see the start of a new bullish momentum with the potential to renew all-time highs above $2100. Gold rallied by $200 in October and peaked.

November 14, 2023

💵 The Dollar Index rose 1% and has been performing well against other currencies, but can it make up for the drop earlier this month? 💰 Gold retreated from $2000 in a corrective phase, but will it stay above the.

November 9, 2023

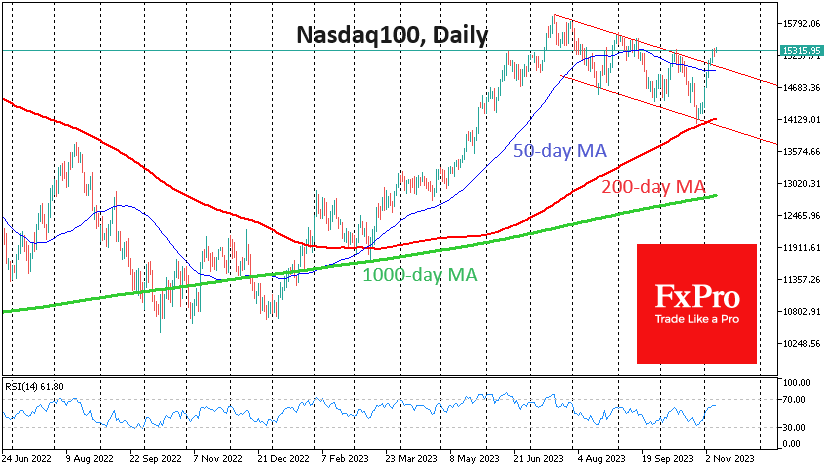

US indices turned sharply higher at the start of last week and are still on the offensive, with the Nasdaq100 leading the rally. The pace of growth has slowed considerably, but it would be foolhardy to bet on a corrective.

November 7, 2023

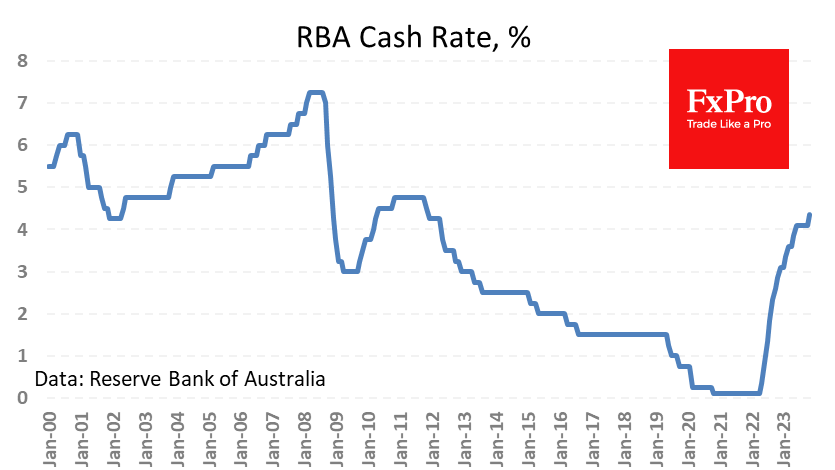

The Australian dollar has lost over 1% since the start of the day on Tuesday as traders appeared unimpressed with the monetary authorities’ actions. The selling momentum hit AUDUSD following the decision to raise the key rate by 25 basis.

November 7, 2023

Gold came under pressure this week, losing around 1.4% and retreating to $1966. This drops below previous local lows, forming a short-term downtrend and fitting into a pattern of declines following local overbought conditions. Gold has been in strong demand.

November 6, 2023

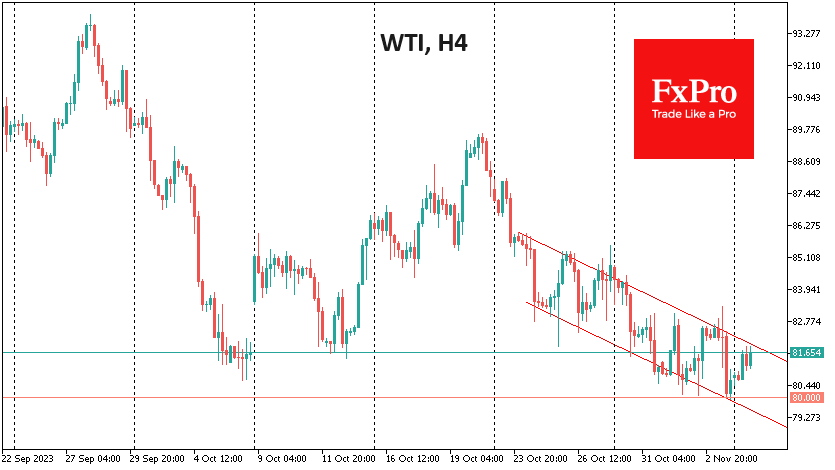

Oil is trying to find a bottom. At the same time, political commentary and market sentiment are moving in the same direction, increasing the chances of a rebound. The price of a barrel of WTI has been falling in a.

November 6, 2023

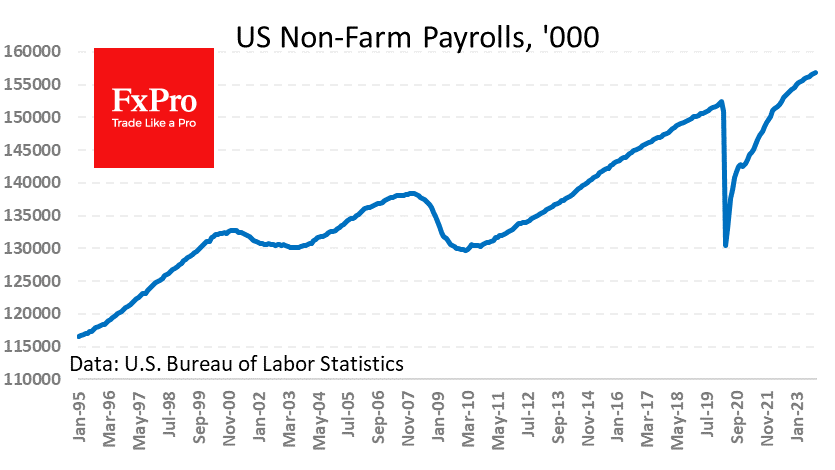

Finally, US data came out so weak that the market could celebrate. The US labour market added 150k jobs in October after 297k (revised from 336k) and expected 180k. The unemployment rate unexpectedly rose from 3.8% to 3.9% despite the.

November 1, 2023

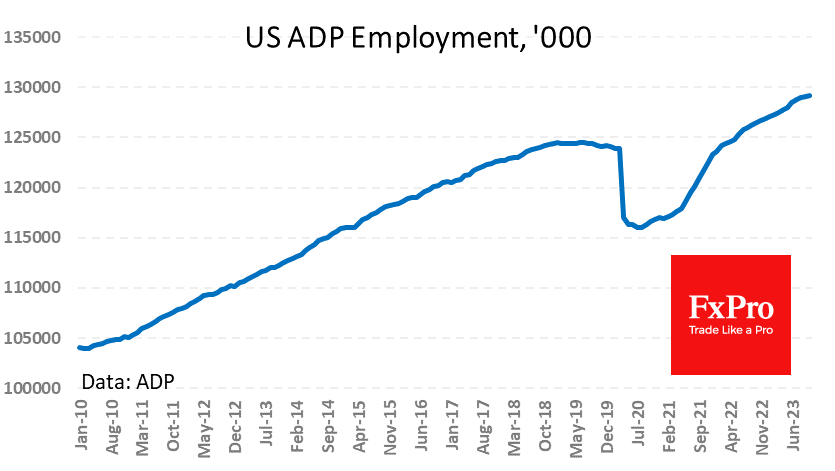

ADP estimates of the US labour market two days before the official release painted a relatively bleak picture. The private sector reportedly created 113K new jobs in October after 89K a month earlier. Analysts, on average, had forecast growth of.

November 1, 2023

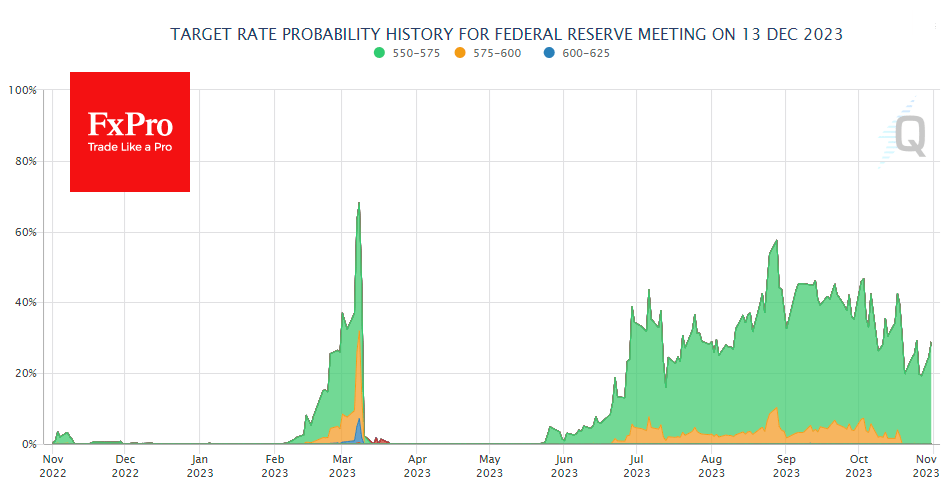

The rate decision and the Fed’s comments promise to be the highlight in a week full of releases. The market is in no doubt that the pause in policy tightening is here to stay, with interest rate futures pricing in.

October 31, 2023

Gold broke through the $2000 mark in a decisive move at the end of last week. Corrective sentiment has intensified near this psychologically important level as some speculators rush to take profits from the roughly $200 rally from the $1810.