Market Overview - Page 60

December 11, 2023

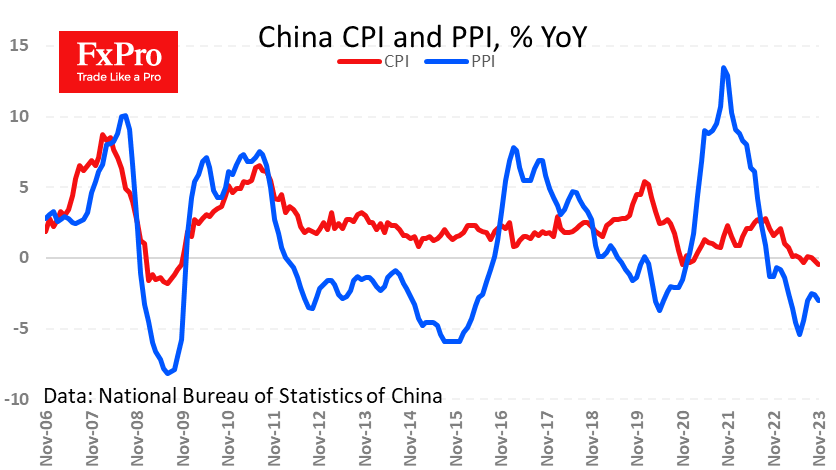

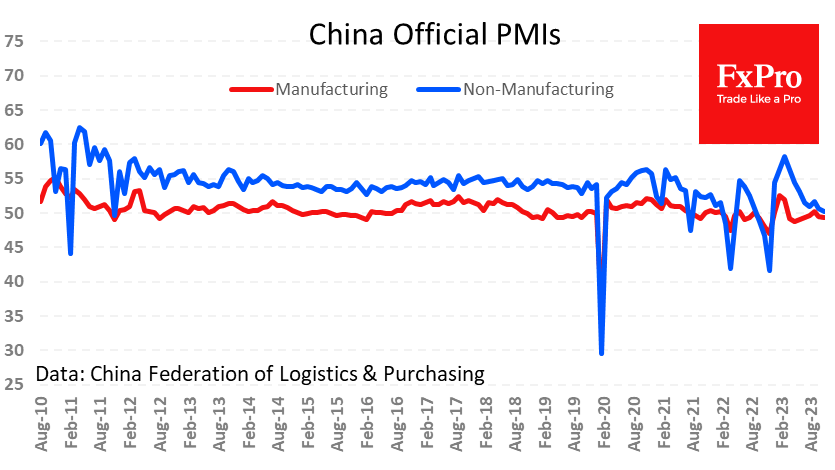

Consumer prices in China accelerated their decline in November, losing 0.5% yoy vs. 0.2% yoy expected and the same amount a month earlier. Producer prices also intensified their decline, losing 3.0% y/y vs -2.6% previously and a softer-than-expected -2.8%. PPI.

December 7, 2023

The Japanese yen was the hero of the day on Thursday, adding over 1.7% against the dollar and 1.6% against the euro since the start of the day. The yen has been sided by Japan’s regional banks, which are rumoured.

December 6, 2023

ADP reported a 103k increase in new private sector jobs in the US, against expectations of 130k and 106k (revised from 113k) a month earlier. This indicator was designed as the last insight on the jobs market before the official.

December 6, 2023

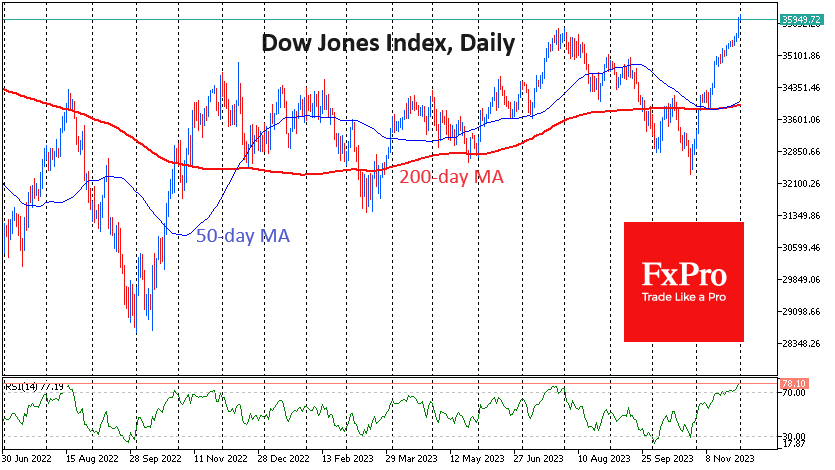

The Dow Jones index has switched into consolidation mode, joining the S&P500 and Nasdaq100, which did so almost two and three weeks ago, respectively. This could be consolidation before a spurt to new highs, but it’s more likely that we’re.

December 5, 2023

There were more signs of a cooling US labour market ahead of Friday’s employment report. The number of open job vacancies in October fell to 8.733 million from 9.35 million a month earlier and 9.31 million expected. With occasional bounces, the.

December 5, 2023

Oil remains under pressure, reflecting fears of demand cuts, despite verbal interventions by OPEC+ and US government officials over the past week to shift the balance in favour of a deficit. Last week, the expanded OPEC+ agreed a production cut.

December 5, 2023

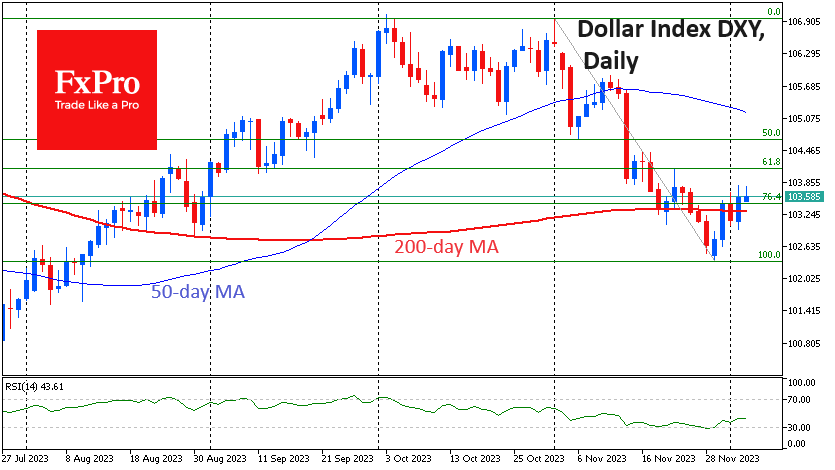

The American dollar is fighting hard for the trend. For the last three trading sessions, the dollar index has been crossing up and down the 200-day moving average every day. All in all, the flirting with this level has been.

December 5, 2023

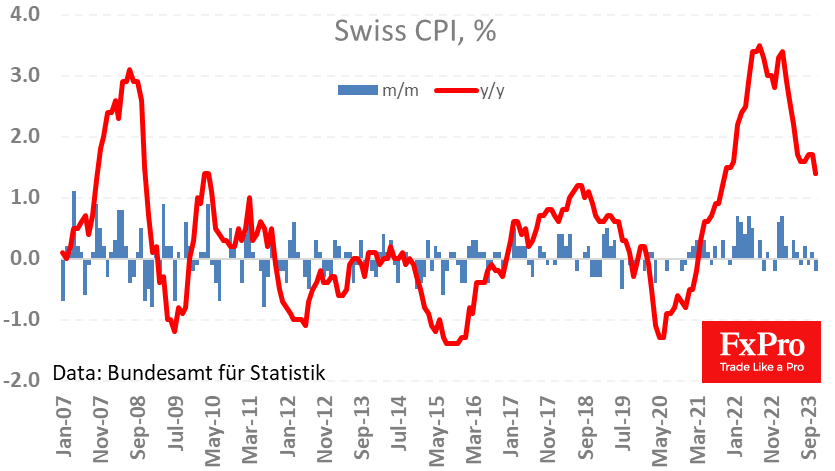

Swiss inflation is falling below expectations, and this may be a reason for the SNB to change its rhetoric next week. Consumer prices fell 0.2% in November, slowing the annual pace from 1.7% to 1.4%, while no changes were expected..

December 4, 2023

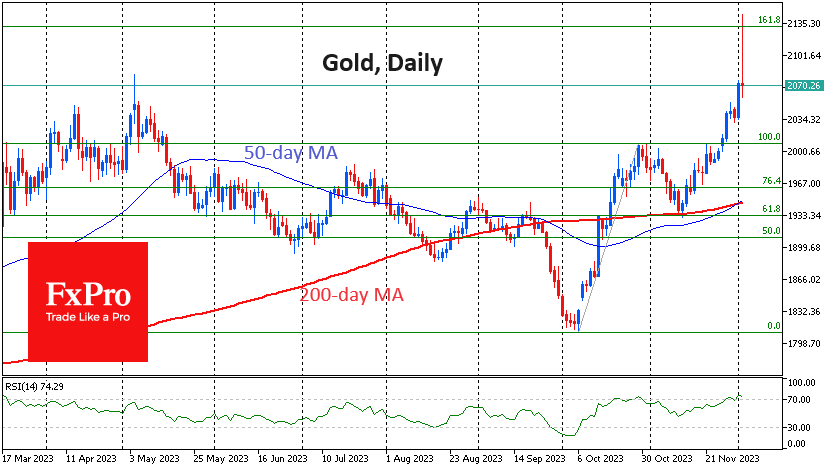

On Friday and Monday, we saw legendary moves in gold. On Friday evening, the price rose to $2075 on the background of risk appetite with reduced liquidity in the instrument. On Monday, the price of gold reached $2145, a new.

December 1, 2023

The Dow Jones has taken a high of 36,000, which is only 2.5% below its historical peak of January 2022. Above that round level, the index traded above it for a few days in November 2021 and briefly in December.

December 1, 2023

The euro was down 0.5%, close to 1.09, on a continuing wave of weak data from Germany and the eurozone, reinforcing expectations of a policy reversal. Wednesday saw weak inflation reports from Germany and Spain. On Thursday, equally weak French.