Market Overview - Page 59

December 22, 2023

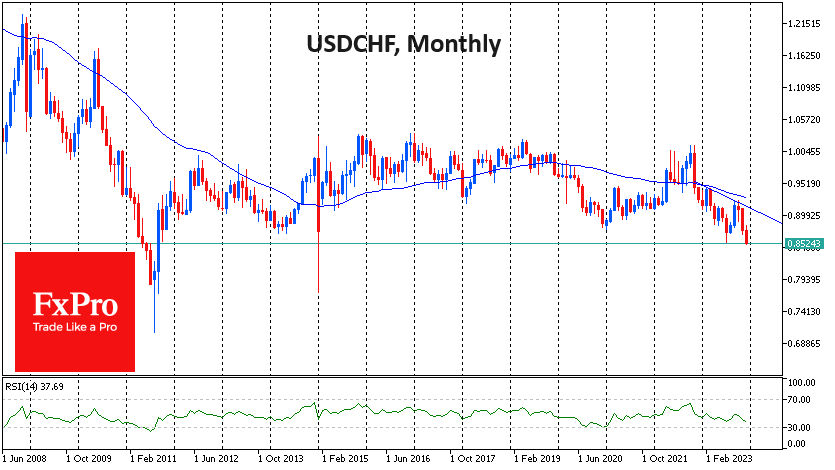

The Swiss franc hit nearly nine-year highs against the dollar on Friday, adding over 6.2% YTD and 8% YTD. If we exclude the period of abnormal volatility on 15 January 2015, EURCHF rewrote historic lows, falling just a couple of.

December 22, 2023

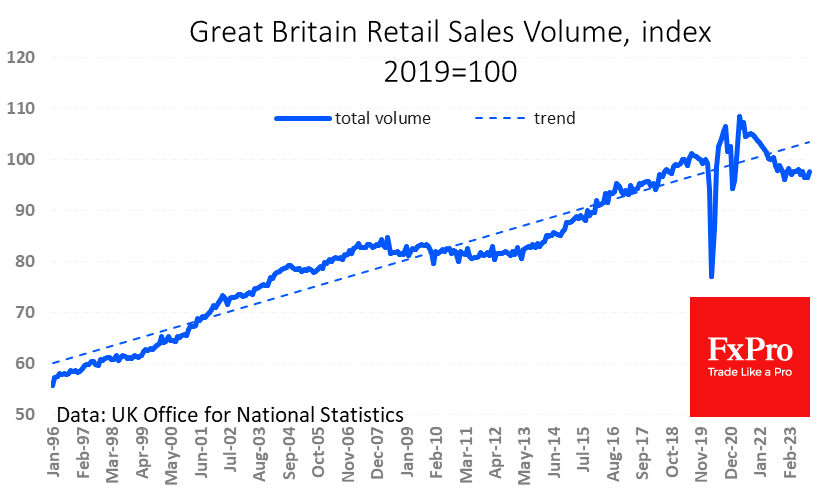

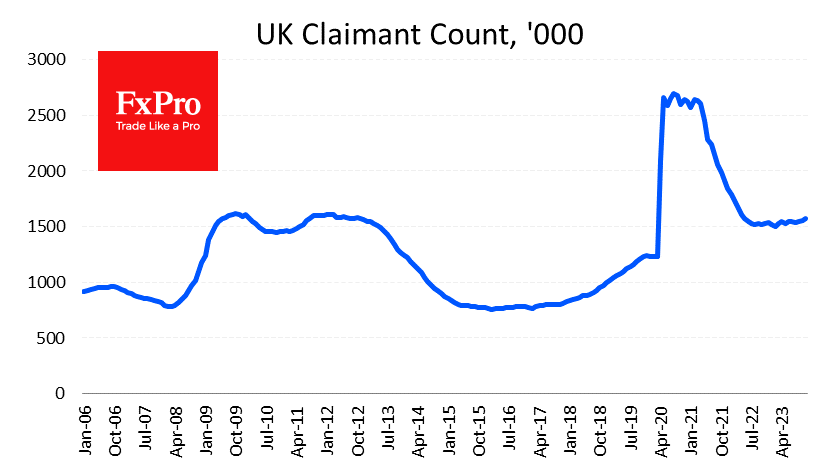

Fresh data from the UK painted a mixed economic picture, but the market, in line with the trends of recent days, paid attention only to the positive data. The bright side was a 1.3% increase in retail sales for November.

December 20, 2023

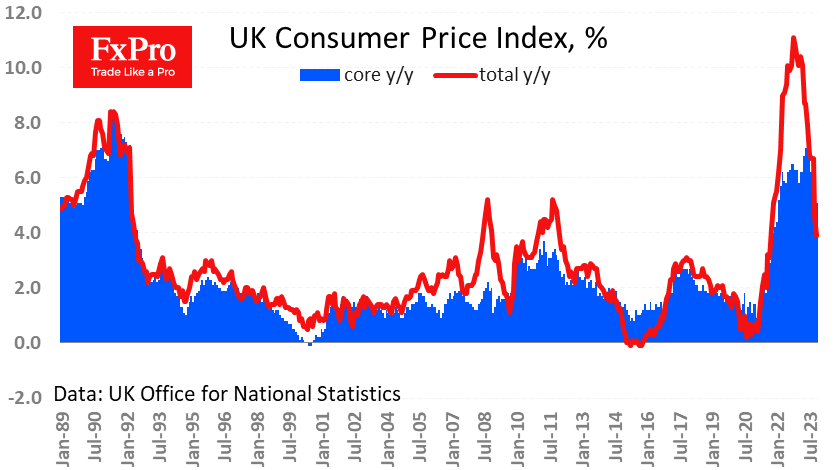

Britain’s impressive slowdown in inflation has increased speculation around a rate cut next year. The headline consumer price index lost 0.2% in November, and the annual rate slowed from 4.6% to 3.9% – impressively below the expected 4.3%. Inflation excluding.

December 19, 2023

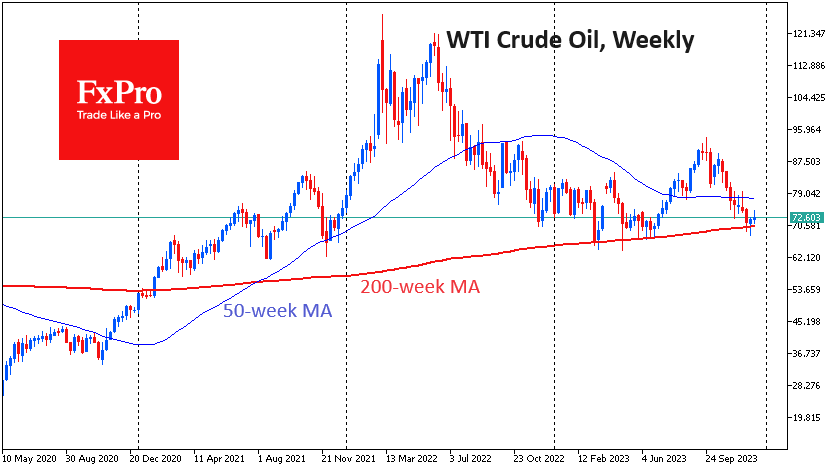

Oil has been gaining for the past week after briefly dipping into the area of the lows of the year. Oil was up amid Red Sea tankers’ attacks, a crucial trade route that accounts for about 30% of trade turnover..

December 19, 2023

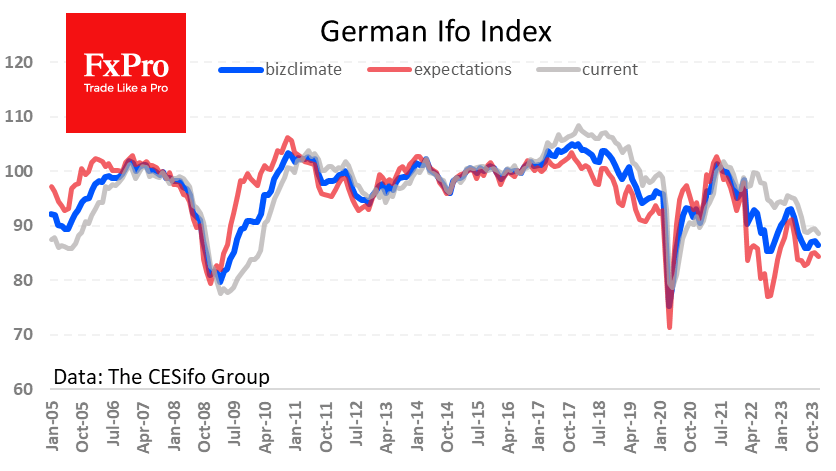

Germany’s business climate, according to the Ifo Institute, deteriorated in December instead of the expected improvement, providing further evidence that the manufacturing sector is struggling. The business climate indicator fell from 87.2 to 86.4 instead of the expected increase to.

December 19, 2023

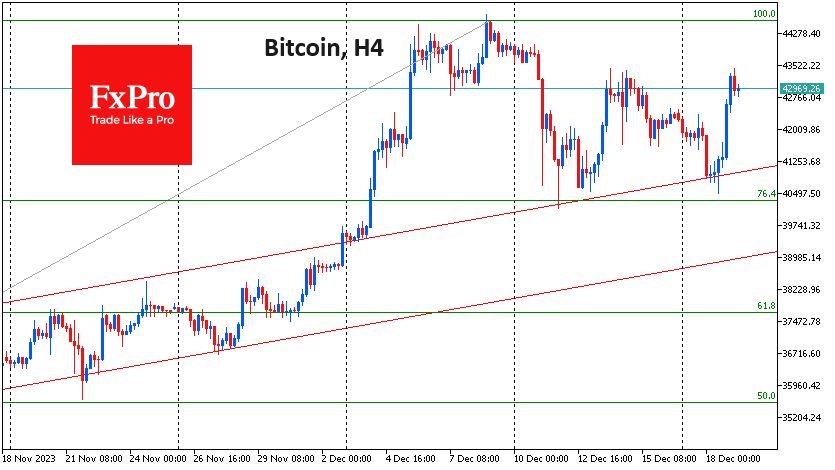

Market Picture The second half of Monday proved to be for the bulls in cryptocurrencies, triggering a 3.5% rise in capitalisation over the last 24 hours to $1.61 trillion. Daily updates of all-time highs in US stock indices support the.

December 18, 2023

The Dollar made a crucial technical breakdown the previous week following a public admission from the Fed of a policy reversal. The Fed’s comments and subsequent press conference pressed the Dollar index under its 200-day moving average. The decline continued.

December 14, 2023

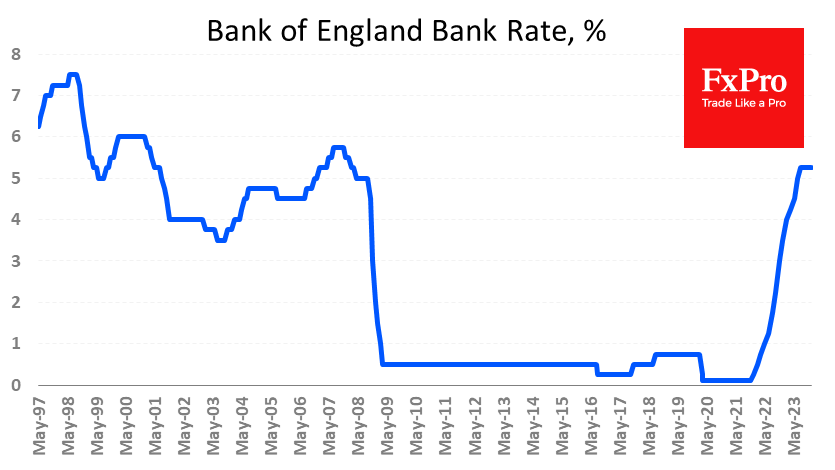

The Fed’s dovish attitude, for now, hasn’t extended too far into Europe. The Bank of England kept its key rate unchanged at 5.25%, with three of the nine members voting in favour of a quarter-point hike. In a commentary on.

December 14, 2023

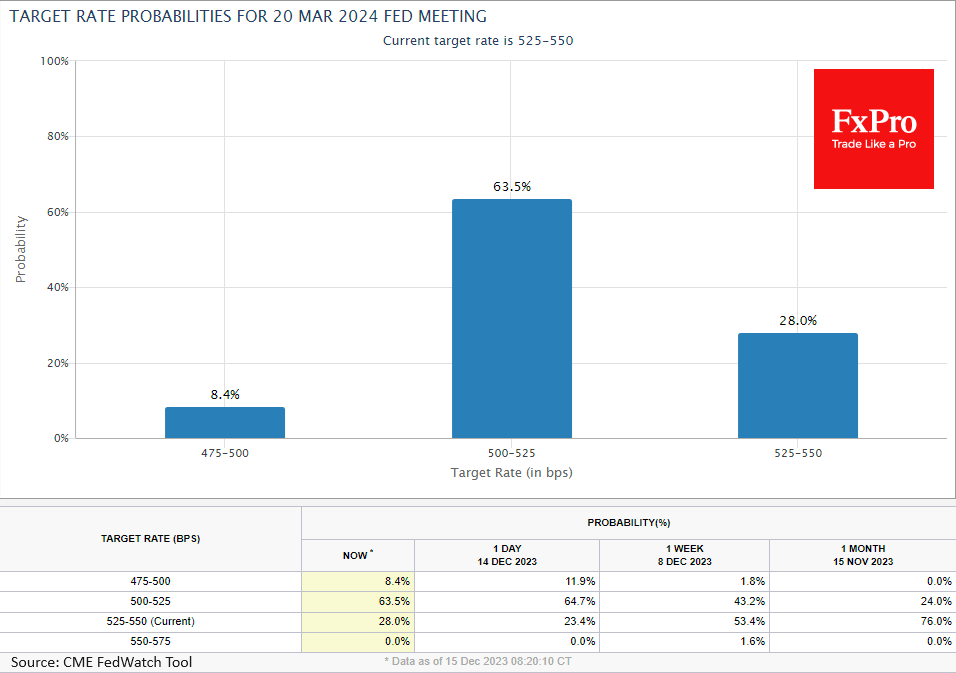

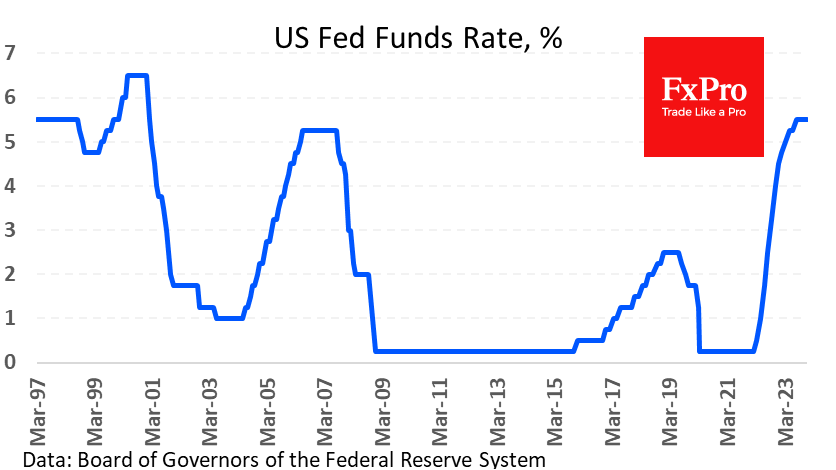

The Fed expectedly kept the key rate at the highest level in 22 years in the 5.25%-5.50% range but kicked off a powerful rally in equities and dollar sell-off with a dramatic change in rhetoric. Despite the tight monetary conditions,.

December 13, 2023

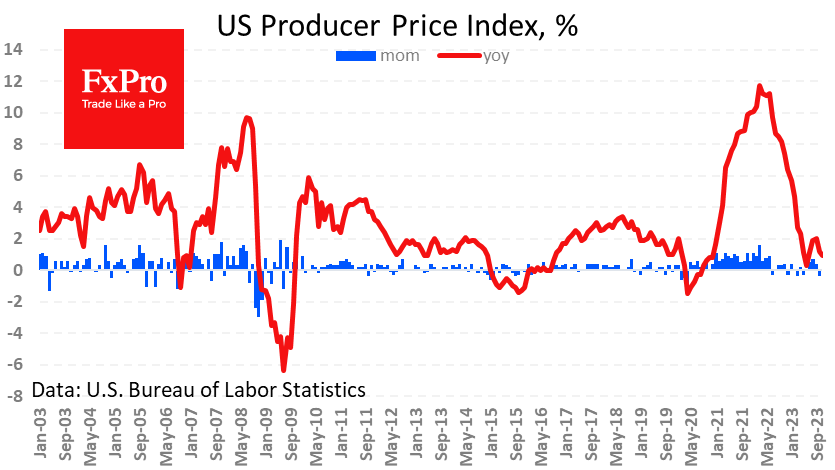

US producer prices came out weaker than expected, increasing speculation that the Fed may soon turn to policy easing, causing pressure on the dollar. The overall and core producer price indices showed zero change for November and slowed from 1.2%.

December 12, 2023

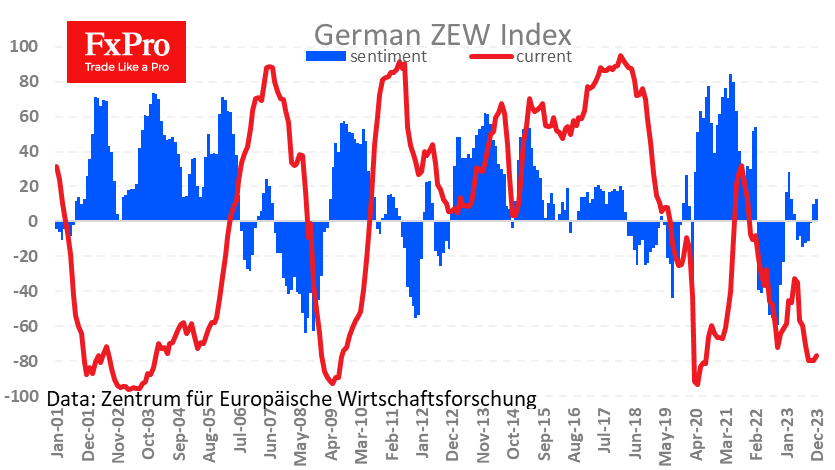

Fresh business sentiment assessments from ZEW saw the sentiment index rise from 9.8 to 12.8, a positive surprise for analysts who had anticipated a slight decline to 9.6. The current optimism level is the highest since March this year but.