Market Overview - Page 54

March 19, 2024

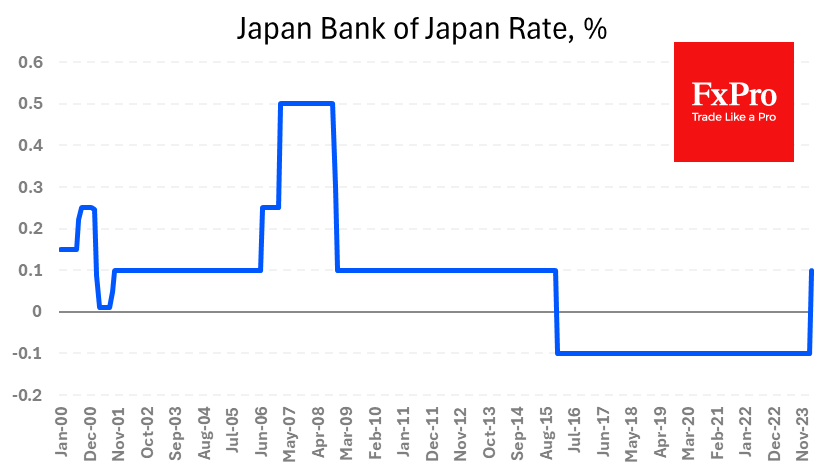

The Bank of Japan raised its key interest rate, becoming the last of the world’s central banks to abandon its negative interest rate policy. The BoJ raised the rate from -0.1% to a range of 0.0% to 0.1%. The central.

March 15, 2024

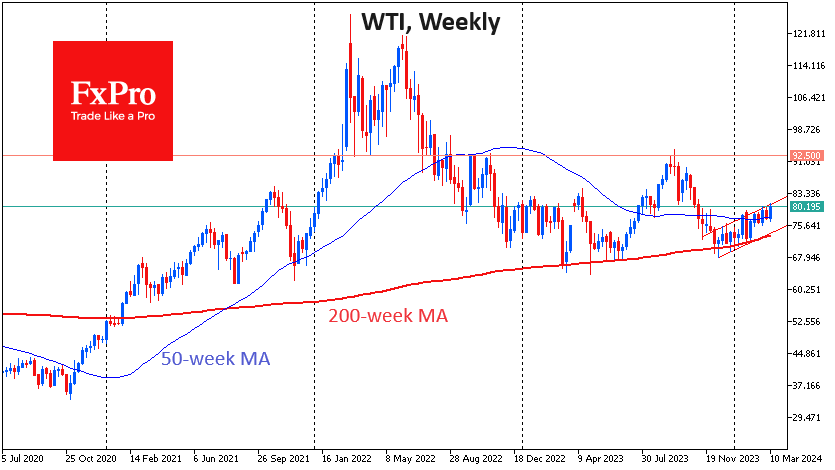

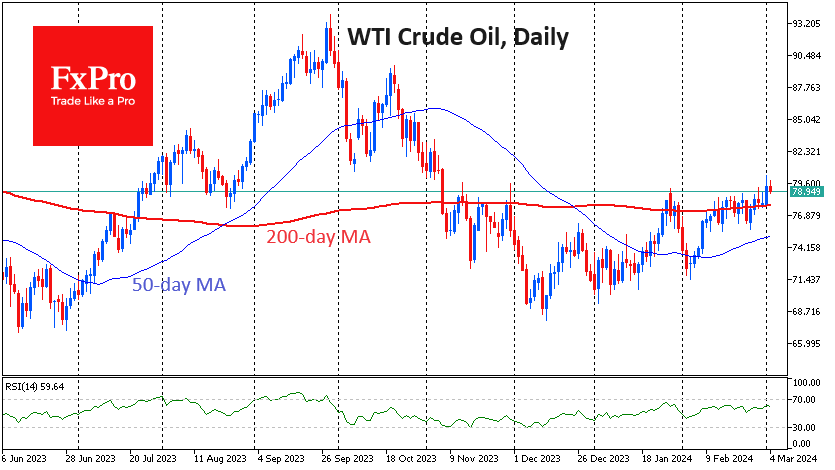

Oil hit 4-month highs on Thursday, closing the day above $80 per barrel WTI. The indicative smooth uptrend suggests that the wildest part of the rally is yet to come. The medium-term uptrend in oil began at the December lows..

March 13, 2024

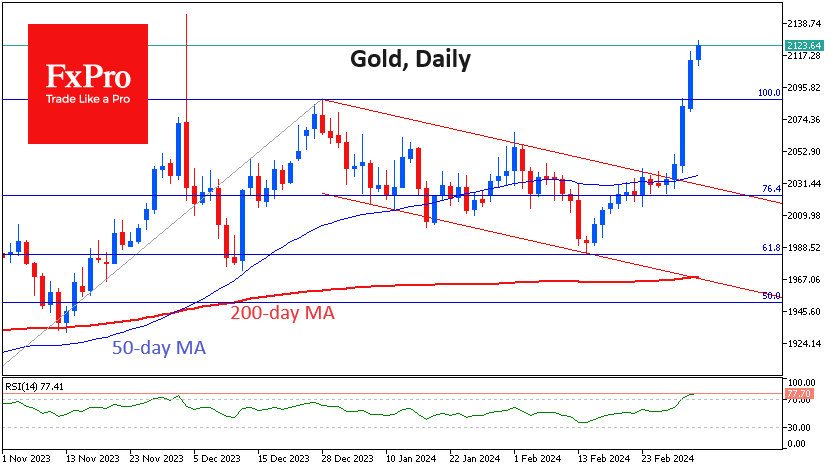

Gold lost over 1% on Tuesday, its first daily decline after nine days of gains, six of which were all-time highs. Signs of consolidation were already evident on Monday and Tuesday, which began with a moderate decline, accelerated by the.

March 12, 2024

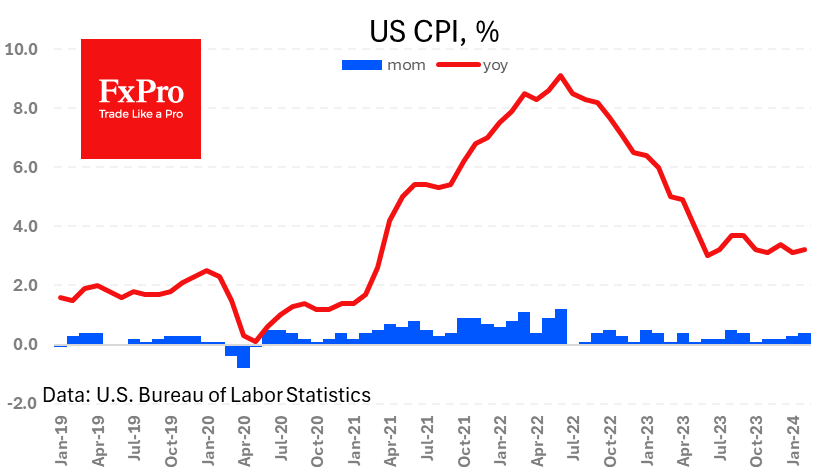

US consumer inflation beat expectations for the fourth month in a row. The CPI rose 0.4% m/m. The monthly growth rate has been rising since October. The year-over-year rate climbed to 3.2%, a bit above forecasted 3.1%. Core CPI rose.

March 12, 2024

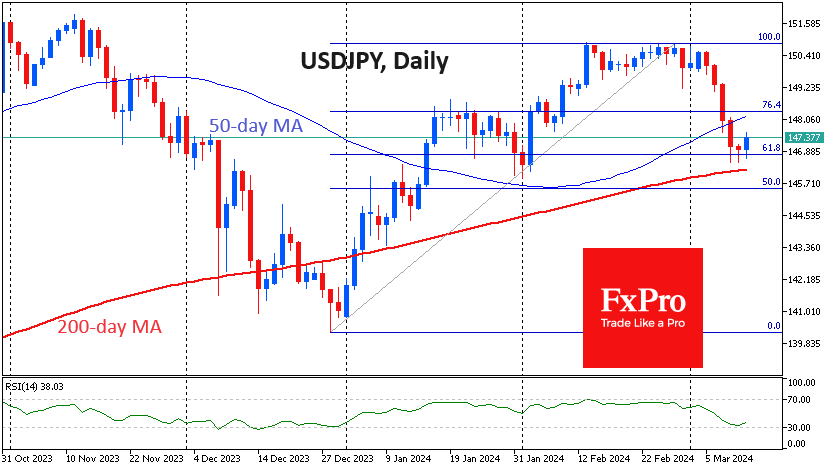

USDJPY is bouncing back after five trading sessions where it fell by a cumulative 2.5%. On daily timeframes, the pair’s subsequent move after the pause allows us to determine further medium-term trends. The weakening of the dollar accompanied the pair’s.

March 12, 2024

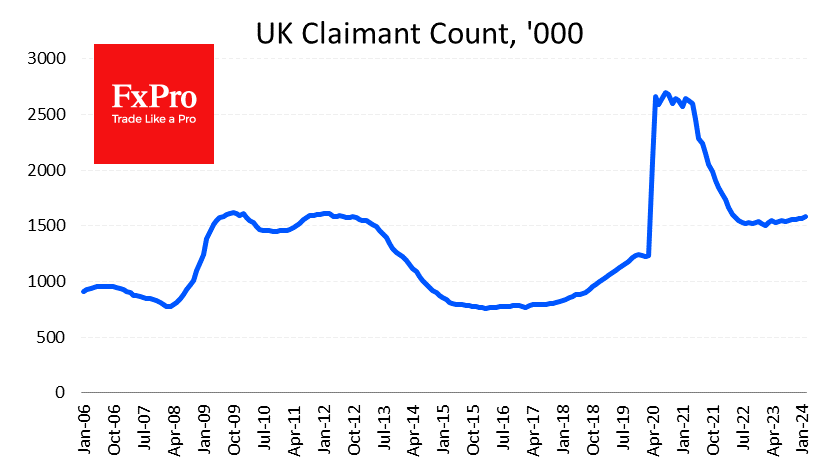

The British Pound is losing ground against the US Dollar for the second day in a row as pressure mounts on fresh UK employment data. Data for February showed a rise in Claimant Count by 16.8K – the biggest since.

March 12, 2024

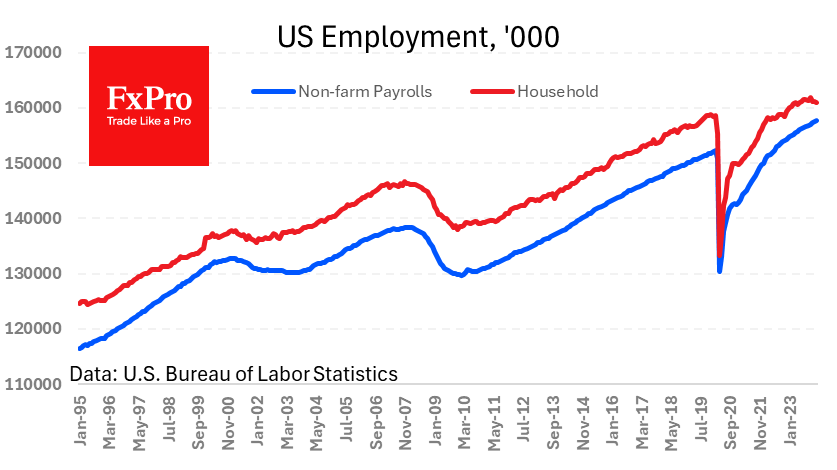

Friday’s employment report caused a mixed reaction in the markets, with an initial surge of optimism followed by a deterioration in sentiment as we delved into the details of the release. The headline number in the report beat forecasts, something.

March 8, 2024

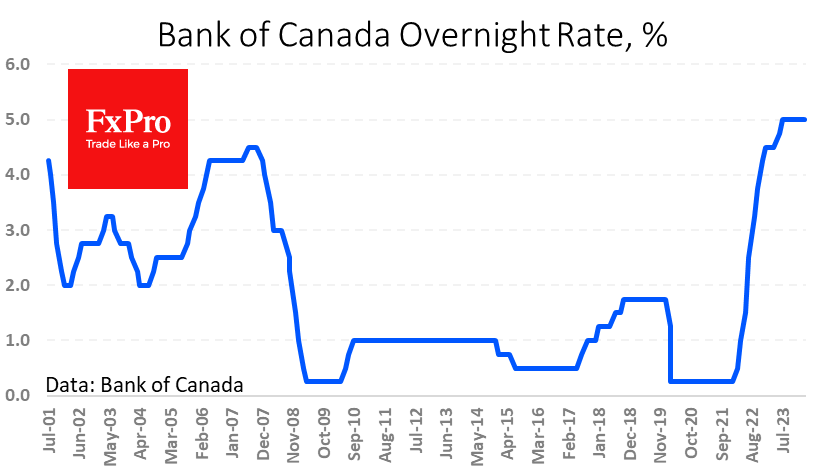

The Canadian dollar gained 0.5% following comments from the Bank of Canada on Wednesday night. The central bank kept its benchmark interest rate at 5% at its regular meeting and continued its quantitative tightening policy. The Bank of Canada remains.

March 7, 2024

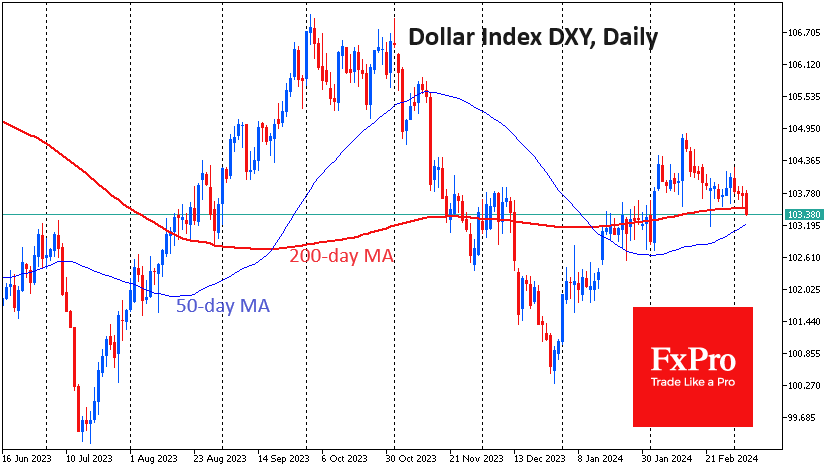

The Dollar Index lost a third of a per cent on Wednesday and is once again attempting to break below its 200-day moving average (MA). Perhaps the formula “if it doesn’t rise, it falls” can be applied to the dollar..

March 5, 2024

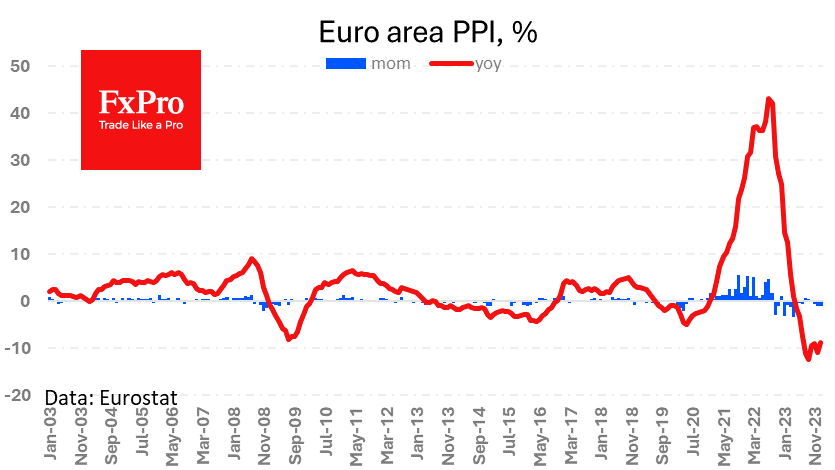

Price falls in Europe are faster than expected, bringing the date of ECB monetary easing closer. It is looking more and more realistic that Europe will move to easing sooner than America. Eurozone producer prices fell by 0.9% in January,.

March 5, 2024

Gold is primed for a substantial move, second only to cryptocurrencies in amplitude but lacking their enduring strength. At the end of last week, we saw a swift technical completion of a bullish pattern. Sometimes, gold avoids volatility for weeks,.