Market Overview - Page 536

February 4, 2019

Two internets could emerge in the next five years — one led by China and one led by the United States — a top venture capitalist has predicted, adding to a growing chorus of voices suggesting such a development could.

February 4, 2019

Crypto fever has truly broken. That was a big takeaway this week from the Paris Fintech Forum, one of the biggest annual gatherings of its kind in Europe. On Tuesday and Wednesday, about 3,000 entrepreneurs, investors, bankers, and regulators descended.

February 4, 2019

Important upcoming events and publications for February 4 (GMT): 10:00 Eurozone Producer price index rarely causes a big surge of EUR volatility. Nevertheless, PPI is a reliable inflationary indicator. The index is expected to fall by 0.7%, developing a marked.

February 1, 2019

U.S. hiring in January topped all forecasts while wage gains cooled and the government shutdown pushed up the unemployment rate, signaling job gains remain robust without major inflation pressures that would worry Federal Reserve officials. Nonfarm payrolls increased by 304,000,.

February 1, 2019

In the last 24 hours, the crypto market has slightly declined by $2 billion in valuation as the Bitcoin price fell by one percent. The decline in the value of major crypto assets in the likes of Ripple (XRP) and.

February 1, 2019

Much excitement has been building since the large American financial services firm Fidelity Investments first announced back in October that they were building a cryptocurrency trading and custody platform. They are now almost ready to launch their Fidelity Digital Assets.

February 1, 2019

While the world’s attention is occupied by Brexit, Venezuela, and a hundred other concerns, an almost forgotten monster is raising its head: the threat of nuclear war. Nuclear war gets surprisingly little attention considering there are enough nukes to end.

January 31, 2019

US stock exchange operator CBOE has resubmitted its application to list a bitcoin ETF on one of its trading platforms, just days after the firm withdrew its previous bid. That bitcoin ETF, the VanEck SolidX Bitcoin Trust, would allow wealthy.

January 31, 2019

The American dollar came under pressure because of the willingness of the Fed to be patient in assessing the situation. This was regarded as a signal of readiness not only to take a pause in rate increases but also to.

January 31, 2019

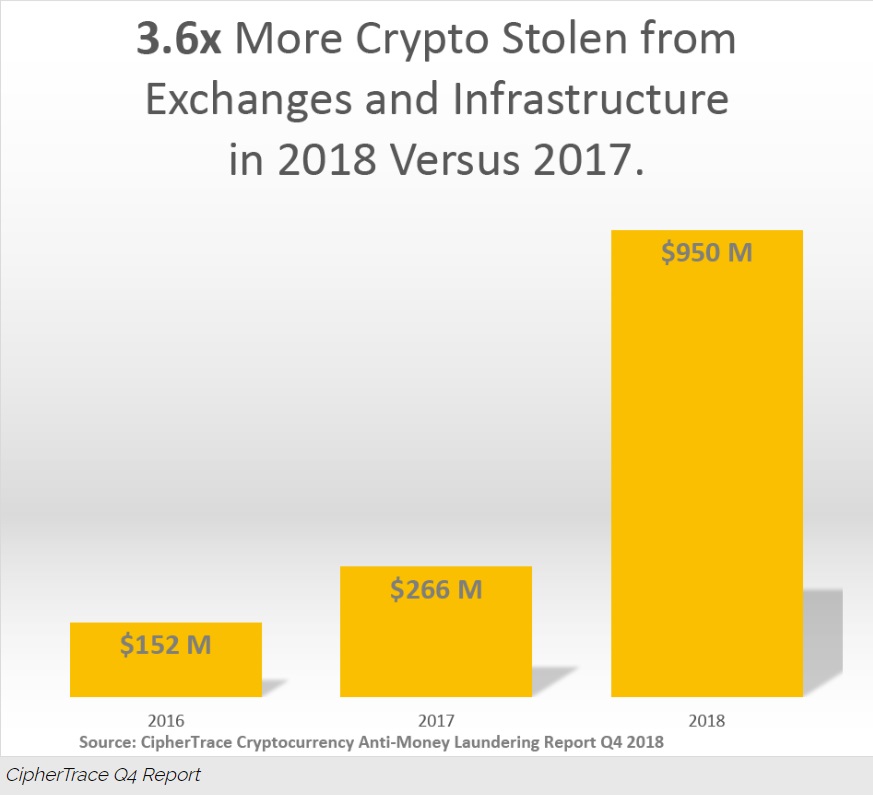

$1.7 billion was stolen from cryptocurrency exchanges, custodial services, and in ICO exit scams in 2018. That’s a dramatic rise from the year before, despite the shrinking market. And according to the Q4 CipherTrace Cryptocurrency Anti-Money Laundering Report, that money.

January 31, 2019

E-commerce giant Alibaba Group’s quarterly revenue grew at its weakest pace since 2016, as the impact of a slowing Chinese economy and a crippling Sino-U.S. trade war kept buyers away during its top-sale season. The result is likely to add.