Market Overview - Page 488

July 2, 2019

The U.S.-China trade war and a spike in oil prices from geopolitical tensions have the potential to push the world into recession next year, according to renowned doomsayer Nouriel Roubini. “It’s a scary time for the global economy,” the head.

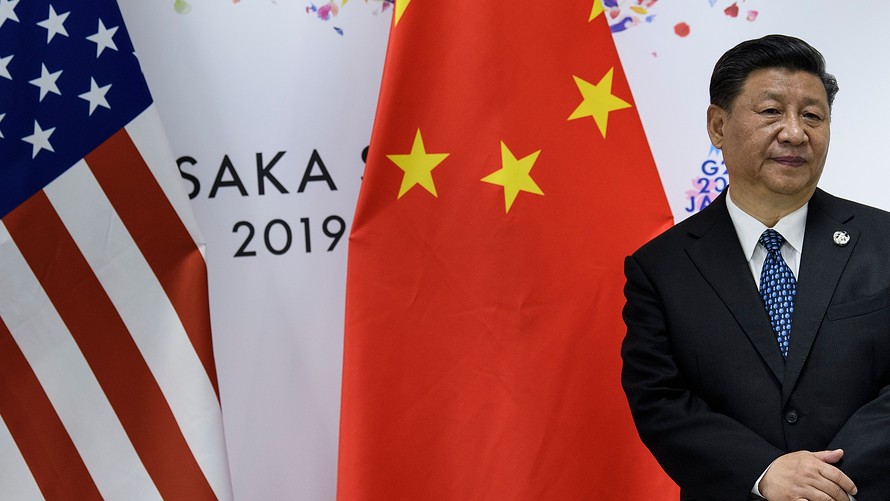

July 2, 2019

The great U.S.-China trade war is all over but the shouting. In a meeting on the sidelines of the G-20 summit in Osaka, Japan, President Donald Trump and Chinese President Xi Jinping agreed to resume trade talks that had broken.

July 2, 2019

The success, or failure, of trade talks between the U.S. and China will be a decisive factor in the oil price outlook this year, despite OPEC’s decision to extend production cuts, oil market expert Amrita Sen told CNBC on Tuesday..

July 2, 2019

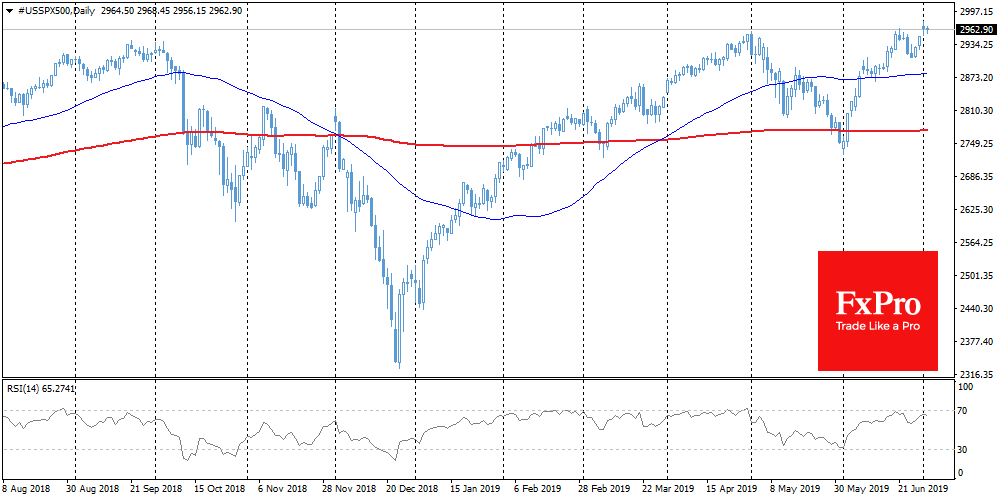

The euphoria around the trade truce gave way to a more restrained mood on the market. Trump said that the deal with China should be in favour of the States. In addition, the US government has returned to the threat.

July 2, 2019

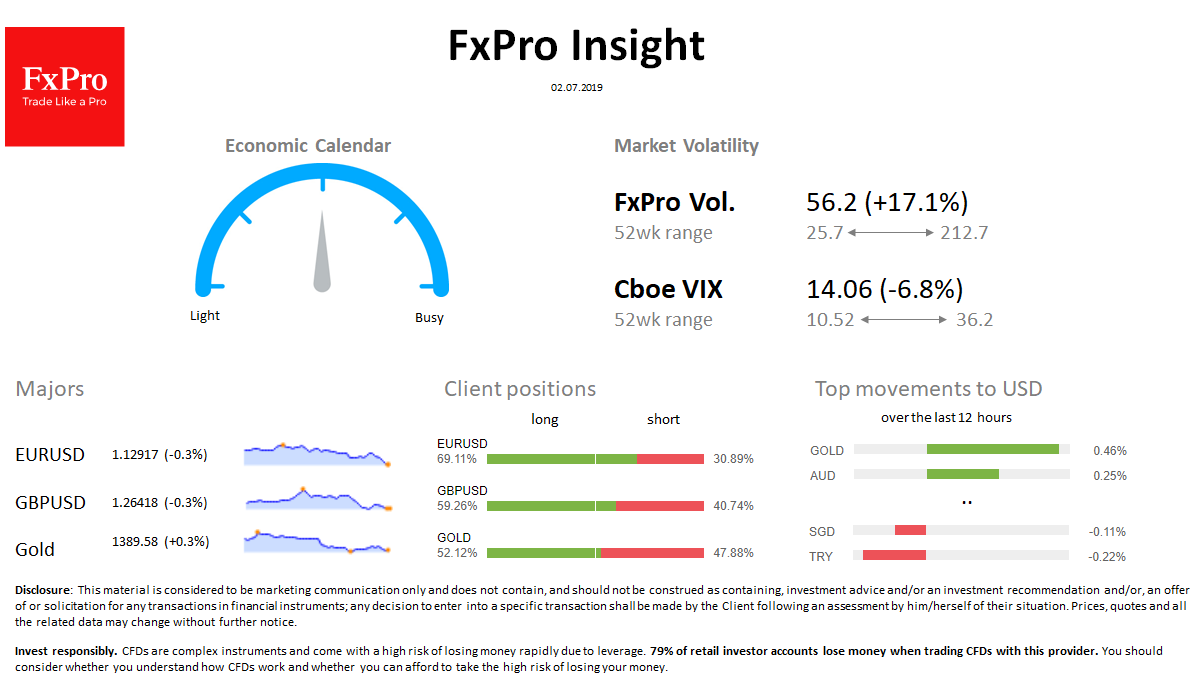

Market overview FX: USD adds after strong data reduces the chances of Fed rate cuts. Stocks: SPX and Asian indices moved away from Monday’s highs, but cautious purchases remain in the morning. Commodities: Brent has been growing since morning, returning.

July 1, 2019

OPEC and its allies looked all but certain to extend oil supply cuts by nine months, after several members of the Middle East-dominated producer group endorsed a policy designed to support oil prices amid a weakening global economy. Saudi Arabia’s.

July 1, 2019

On June 30, according to a cryptocurrency trader, a single investor on Bitfinex placed a 20,000 BTC short order, betting more than $200 million that the bitcoin price would go down in the near term. Overnight, the bitcoin price fell.

July 1, 2019

Tech titan Mark Cuban listens to entrepreneurs’ countless business ideas thanks to his starring role as a judge on ABC’s “Shark Tank.” But Cuban recently revealed what areas of technology he’d focus on if he were to launch a business.

July 1, 2019

Asia Pacific markets mostly rose on Monday after U.S. President Donald Trump and Chinese President Xi Jinping agreed to hold off on slapping additional tariffs in an effort to resume trade talks. Mainland Chinese shares soared on the day. The.

July 1, 2019

On Friday, the markets were waiting for the G20 summit to end, and therefore were in no hurry to grow. So, by the end of the session, the Dow Jones lost 0.45%, the S&P500 sank by 0.30%, and the Nasdaq.

June 28, 2019

Believe it or not, China was once the de-facto capital of Bitcoin (BTC). The nation, after all, spawned Bitmain and many early crypto asset investors, presumably due to the culture of risk, speculation, and technological development. According to a recent.