Market Overview - Page 48

June 12, 2024

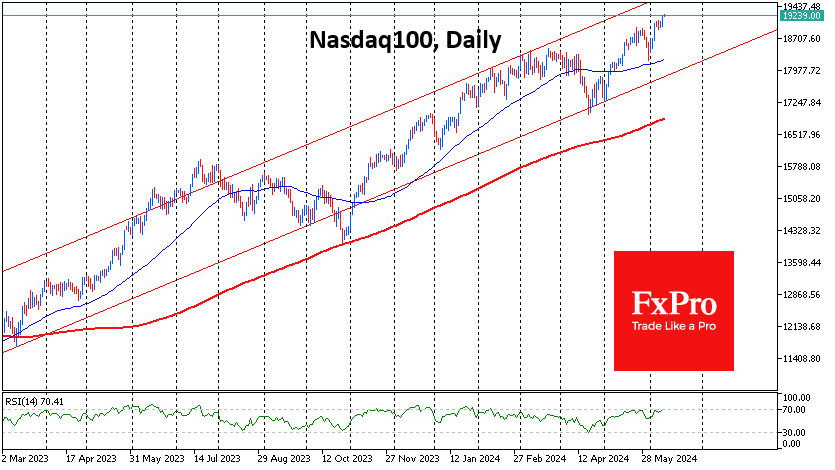

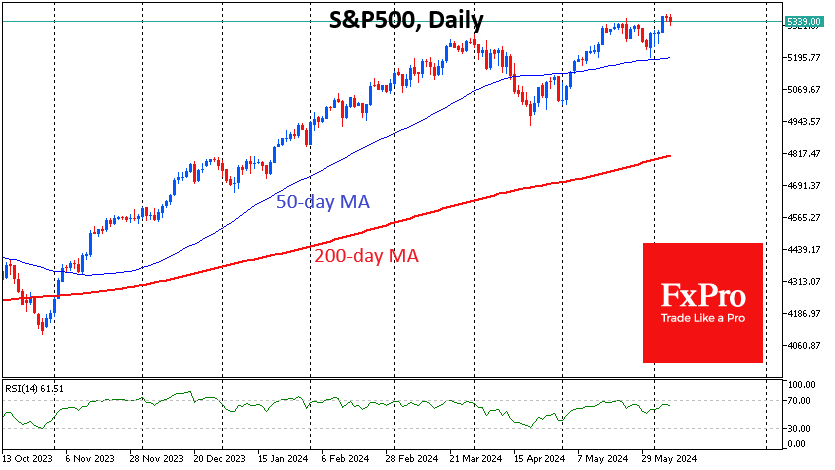

The US indices, S&P500 and Nasdaq100, closed at new all-time highs, largely due to Apple’s positive performance. However, other markets and indices are far from similarly positive. This both leaves room for growth and indicates investor wariness. The Nasdaq100 index.

June 12, 2024

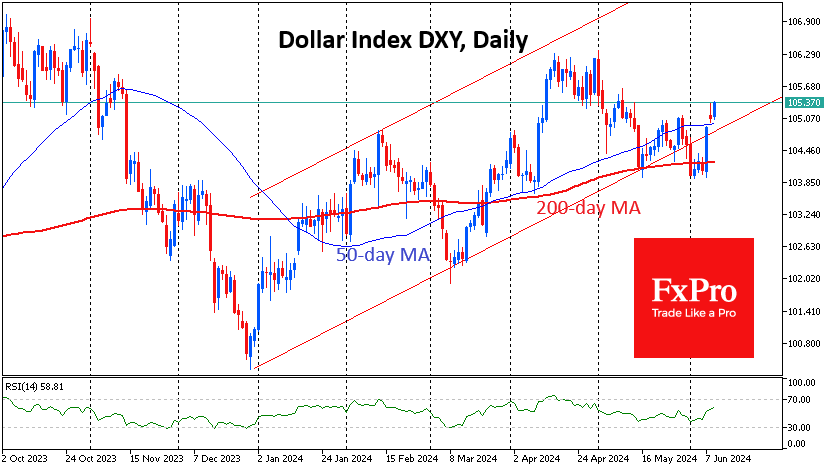

Friday’s labour market data provided the dollar with a strong upward momentum. This bullish signal needs confirmation or refutation, and we are likely to get one or the other by the end of Wednesday. The dollar index started June with.

June 11, 2024

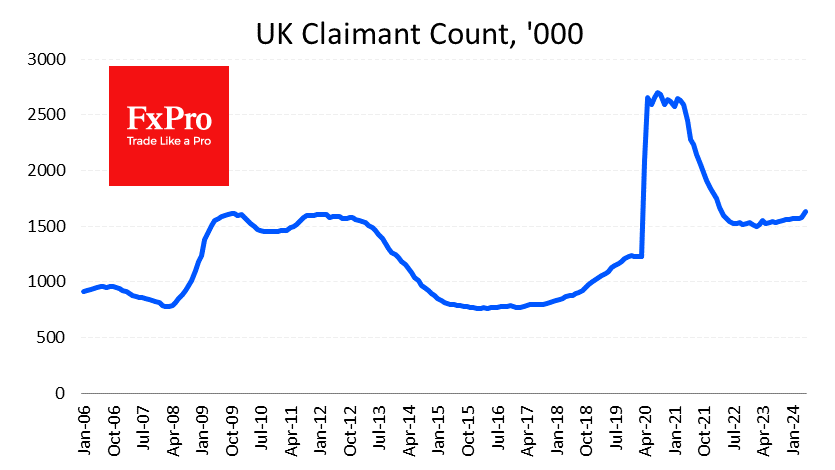

Unexpected weakness in the UK labour market could signal an important turnaround in the economy and raise the urgency of monetary easing. The short-term impact on the Pound has been relatively limited, but the currency market has now adopted a.

June 10, 2024

The US indices, S&P500 and Nasdaq100, closed Wednesday at record highs, taking a decisive step up, adding over 1.1% and 2%, respectively. The Dow Jones index lagged, adding just 0.25% for the day and is 3% off all-time highs. The.

June 10, 2024

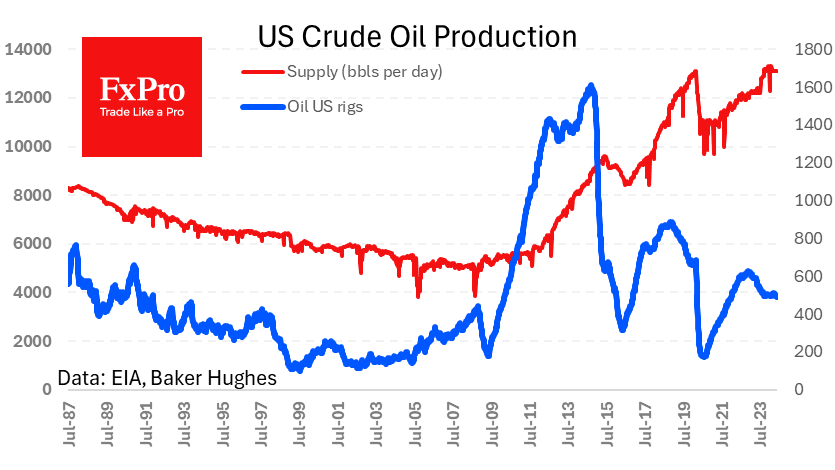

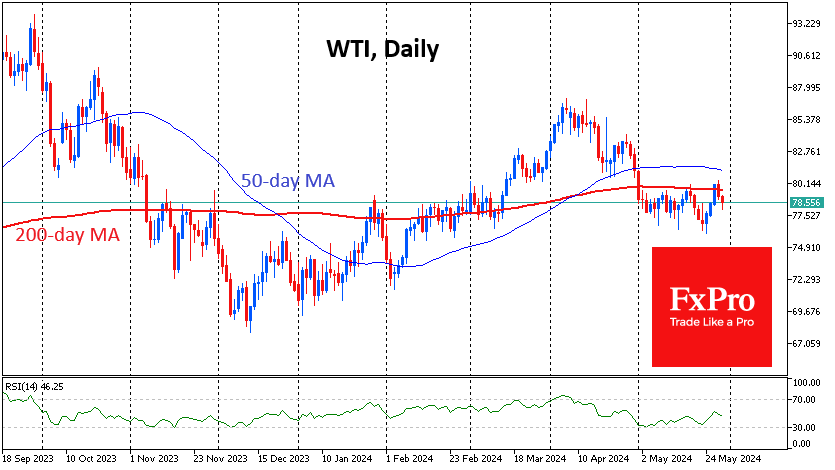

Low oil prices are not attractive to producers in the US, where the number of active drillers has fallen to its lowest level since early 2022. Drilling activity in the US has been falling since early May after a relatively.

June 6, 2024

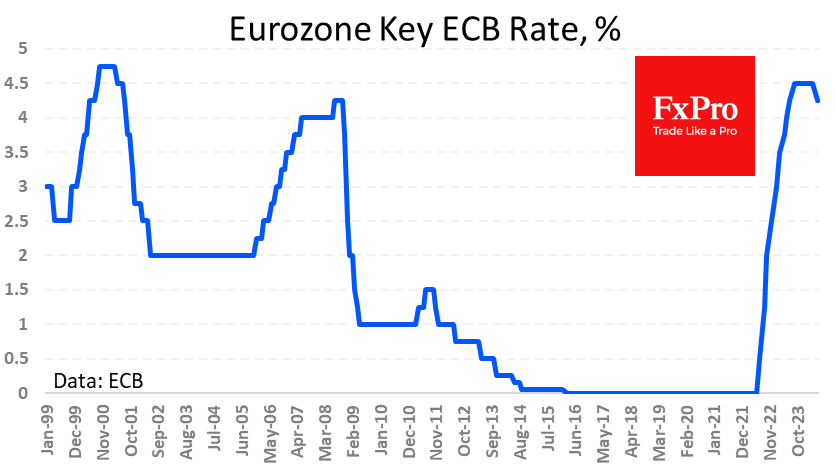

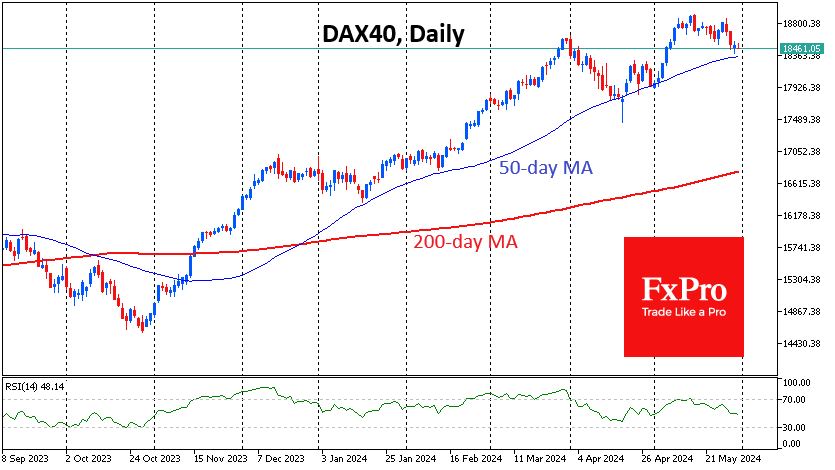

The European Central Bank cut all three of its key interest rates by 25 points, which is in line with market expectations. The ECB has kept rates unchanged for the past nine months and tightened policy from July 2022 to.

June 5, 2024

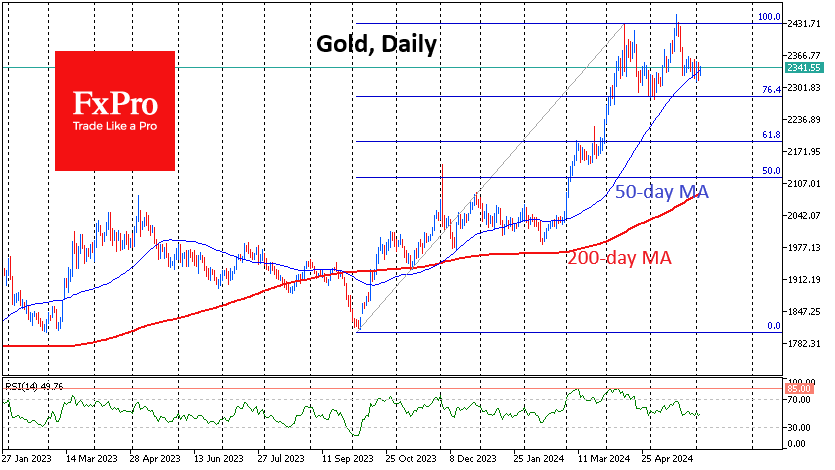

Gold volatility has fallen markedly in recent days as gold traders consider their next move, while many commodities are in a corrective decline. In May, the gold price climbed towards $2450, above the peaks of April, but failed to consolidate.

June 4, 2024

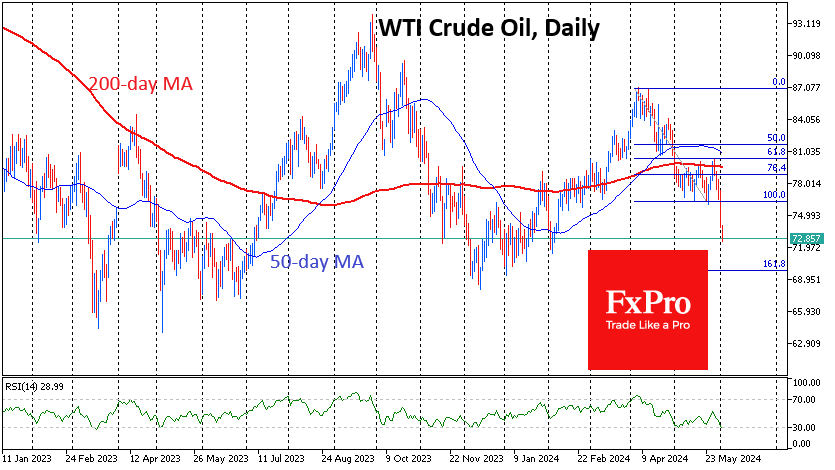

Oil has lost 1.7% since the start of the day on Tuesday, in addition to a more than 3% drop the day before, clearly showing the market’s reaction to the OPEC+ meeting over the weekend. The technical picture in oil has turned.

May 31, 2024

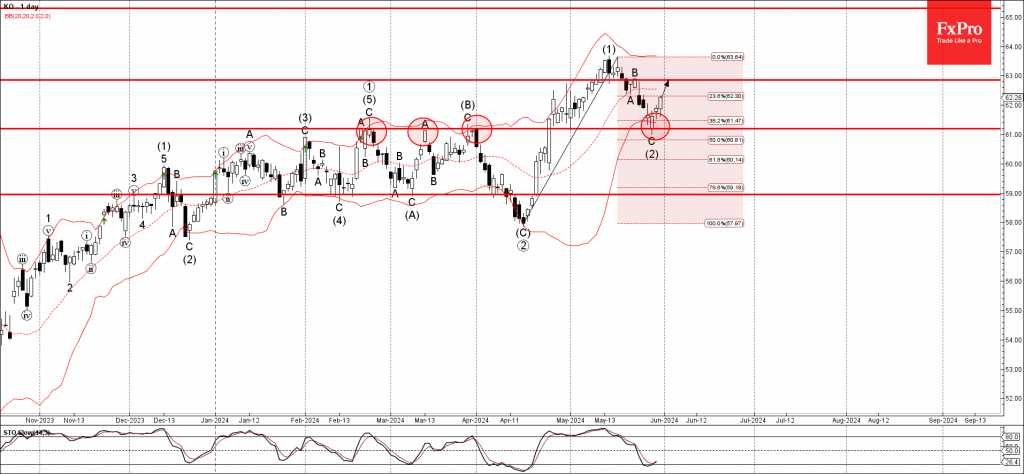

– Coca-Cola reversed from support level 61.00 – Likely to rise to resistance level 63.00 Coca-Cola recently reversed up from the key support level 61.00, former resistance from February, March and April. The support level 61.00 was strengthened by the.

May 31, 2024

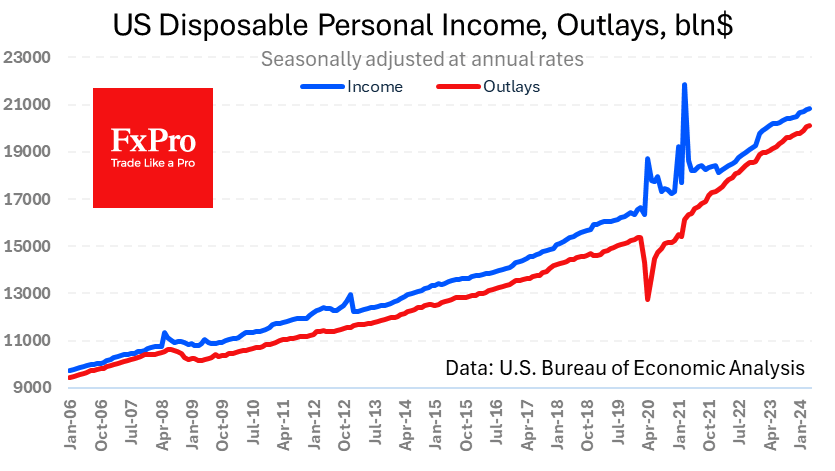

A fresh batch of important monthly data on income, outlays, and personal consumption expenditure prices in the US has been published. Personal outlays grew by 0.2% in April after a 0.7% jump a month earlier. Incomes rose 0.3% following a.

May 31, 2024

The US S&P500 and Nasdaq100 have declined for the past three consecutive days, with futures pointing to a negative opening on Friday. Meanwhile, Dow Jones has almost erased the gains of the first half of the month, losing for the.