Market Overview - Page 47

June 24, 2024

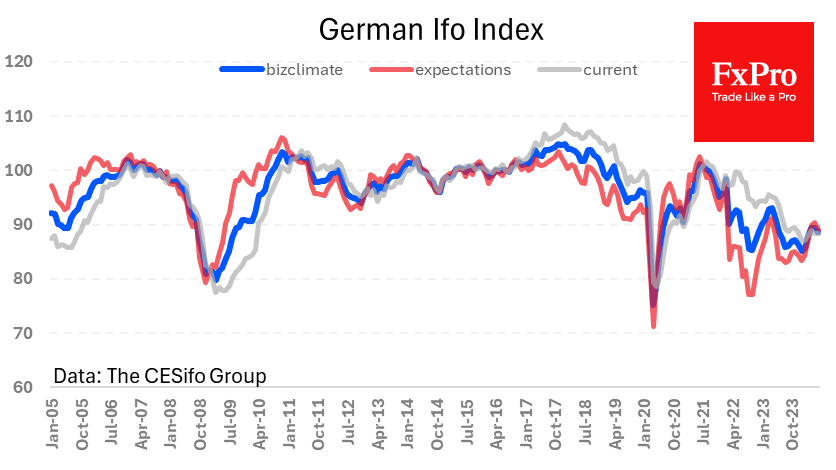

The Ifo German Business Climate Index declined in June as expectations worsened, confirming a reversal of the downward trend. The Ifo index fell from 89.3 to 88.6 instead of the expected increase to 89.4, making it the second month of.

June 24, 2024

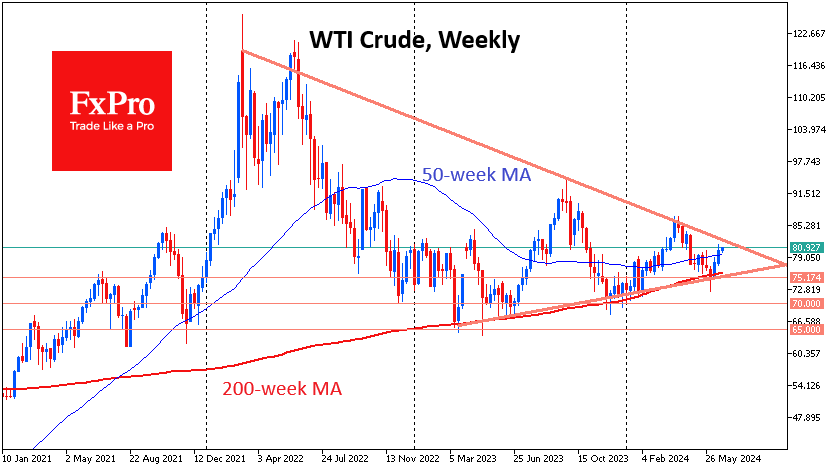

The price of crude Oil rose steadily in the previous fortnight and is starting the new week with a positive trend. This rise emphasises the importance of the 200-week moving average, below which the price has not fallen for a.

June 21, 2024

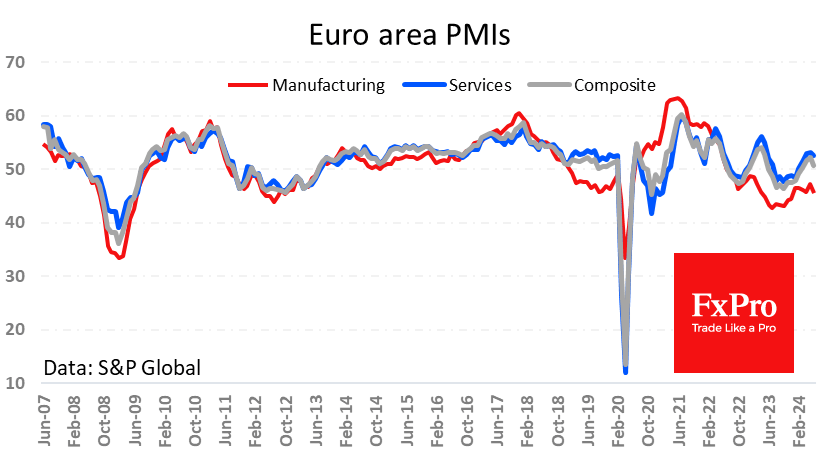

The European session on Friday started with a new wave of euro selling, which was supported by weak preliminary PMIs. According to June estimates, the strengthening of economic activity in the eurozone, which has been gaining momentum since October, is.

June 20, 2024

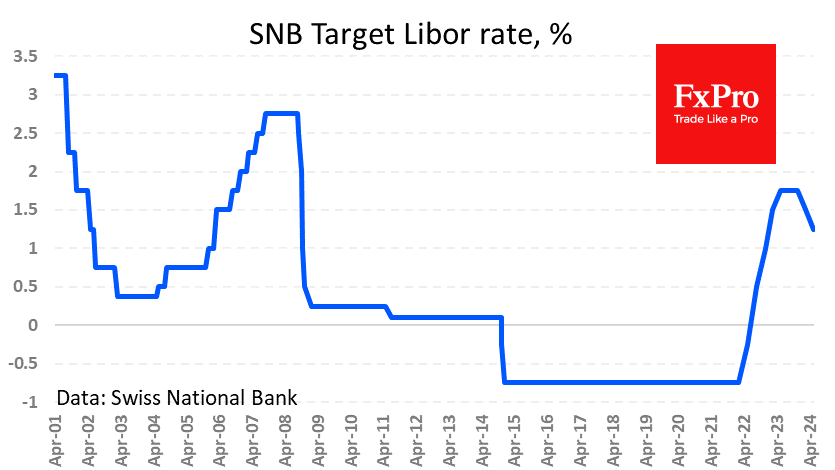

The Swiss National Bank cut its key rate by 0.25 percentage points to 1.25%. The decision surprised markets, which, on average, expected no change after a similar move in March. The SNB also issued a warning that it is ready.

June 18, 2024

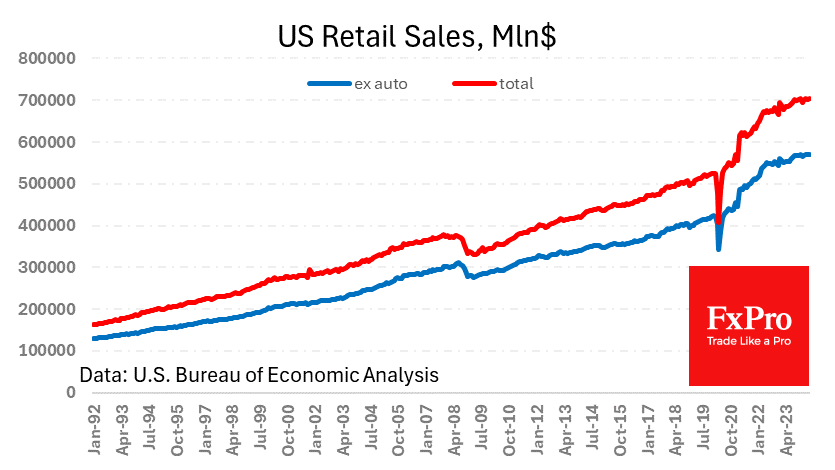

US retail sales rose 0.1% in value for May, worse than the 0.3% rise expected after a 0.2% decline a month earlier. Total sales were 2.5% higher than a year earlier, lagging the 3.3% inflation over the same period. In.

June 18, 2024

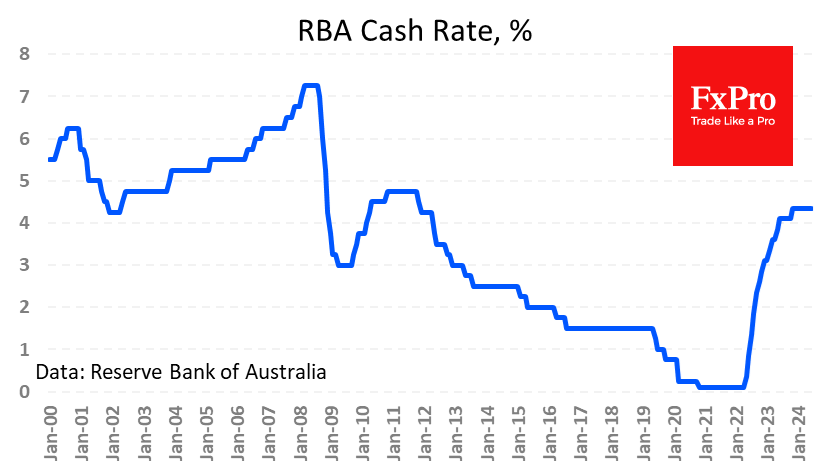

The Reserve Bank of Australia kept its key rate at a 12-year high of 4.35%. The market widely expected the decision, so it did not cause a spike in volatility. However, we note that the RBA warned that it was.

June 17, 2024

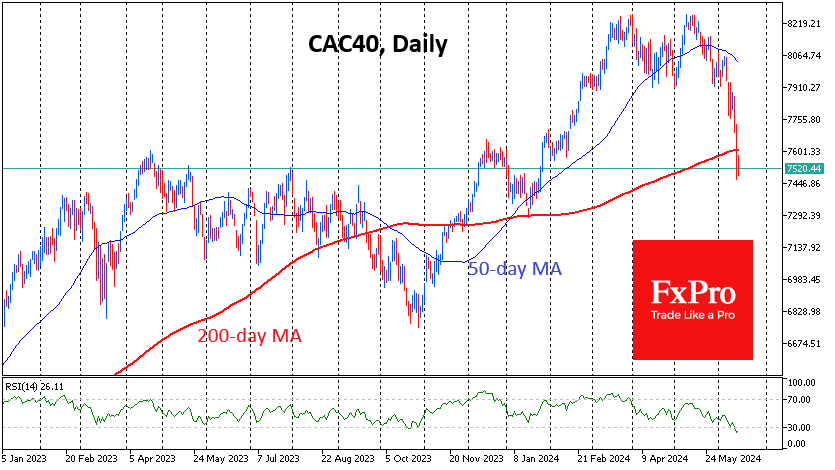

French stocks were under intense pressure last week due to political fears. Although paused on Monday, that sell-off has probably already undermined index gains. France’s CAC40 lost 6.2% last week, the sharpest decline in two years, and the sell-off only.

June 17, 2024

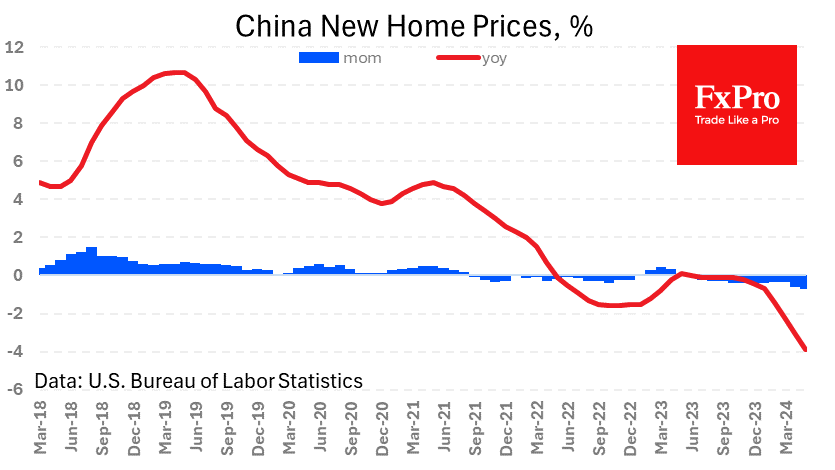

China’s housing price decline is gaining momentum. New home prices for May fell 0.71% vs. 0.58% and 0.34% in the previous two months. The year-over-year decline increased to 3.9%, with back-to-back slides over the 12 months. China has repeatedly announced.

June 14, 2024

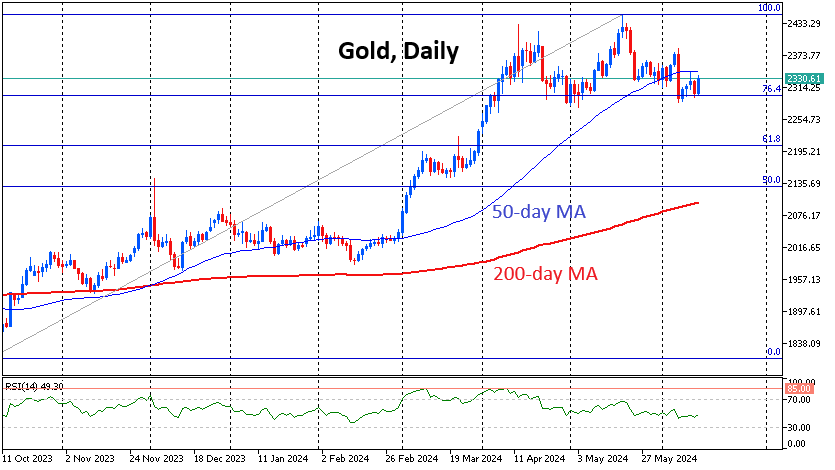

Gold is adding on Friday, and it appears that a flight to defensive assets, rather than the risk appetite that drove the price earlier this year, is behind it. Since the start of the week, gold has twice pushed off.

June 13, 2024

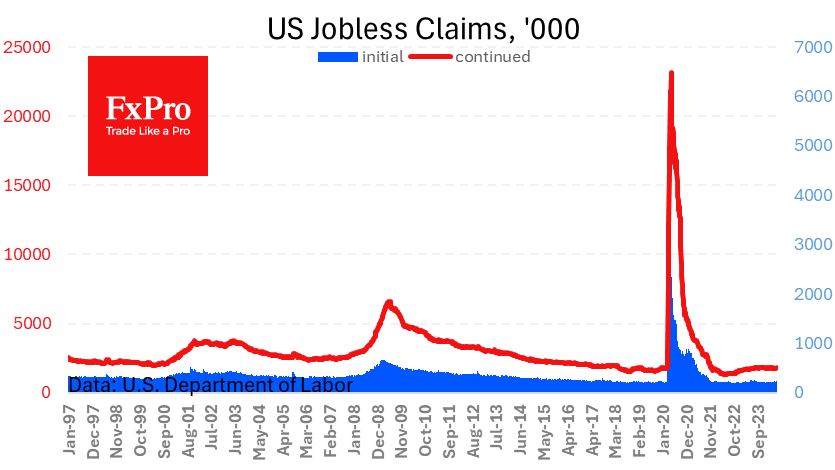

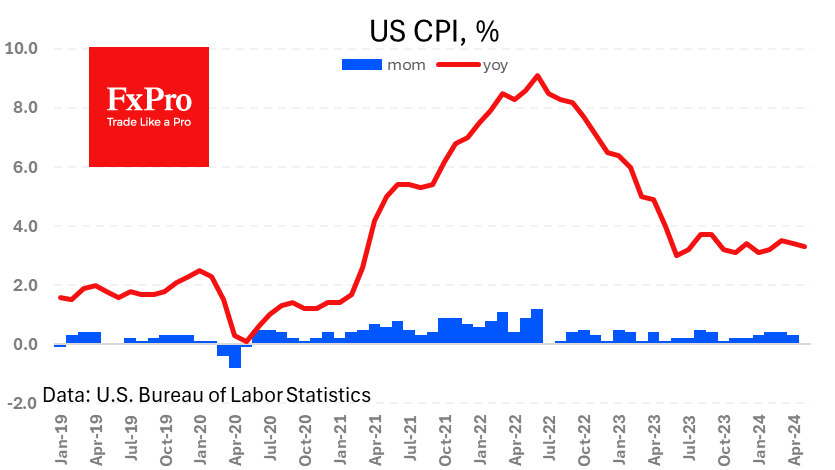

The black streak in US data continues. A sharp jump in weekly jobless claims was paired with a weak PPI, complementing the soft consumer inflation report the day before. Manufacturers cut prices by an average of 0.2% in May, and.

June 13, 2024

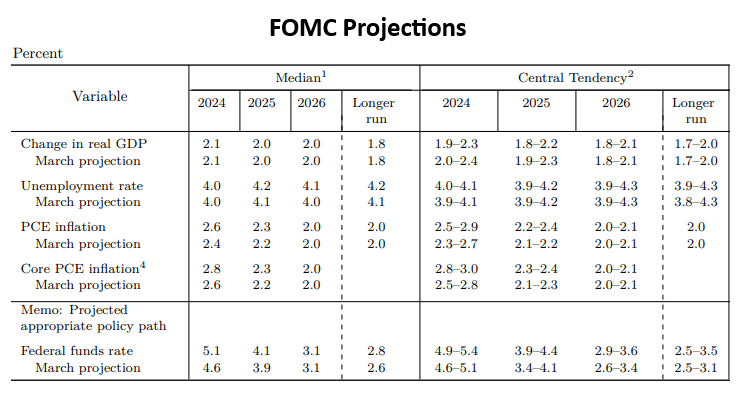

The Fed acted as a market balancer on Wednesday, smoothing out buyers’ bullishness following the earlier inflation report. There was little doubt that the FOMC would leave the key rate unchanged in the 5.25-5.50% range, so all eyes were on.