Market Overview - Page 46

July 8, 2024

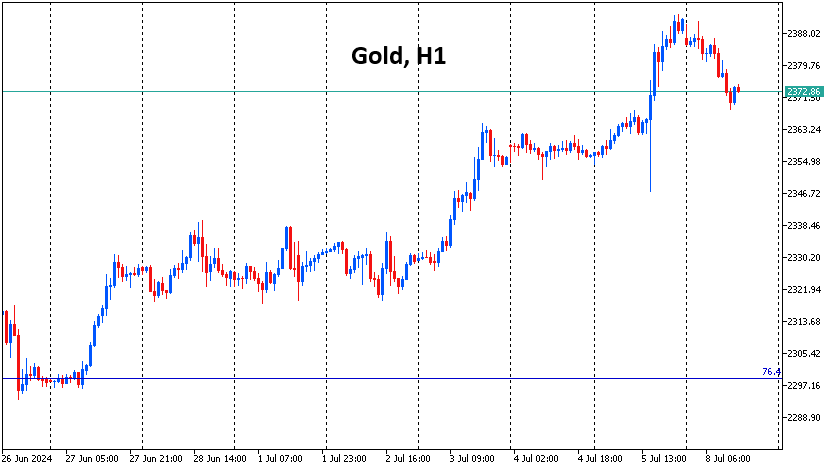

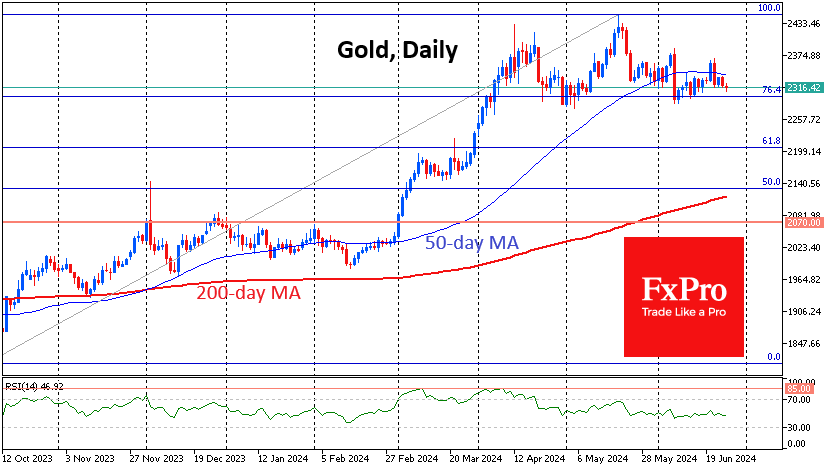

Gold has lost 0.9% since the start of Monday, almost back to the point where it was trading before the release of jobs data on Friday. Perhaps the very first market reaction to the data release highlighted the mindset of.

July 5, 2024

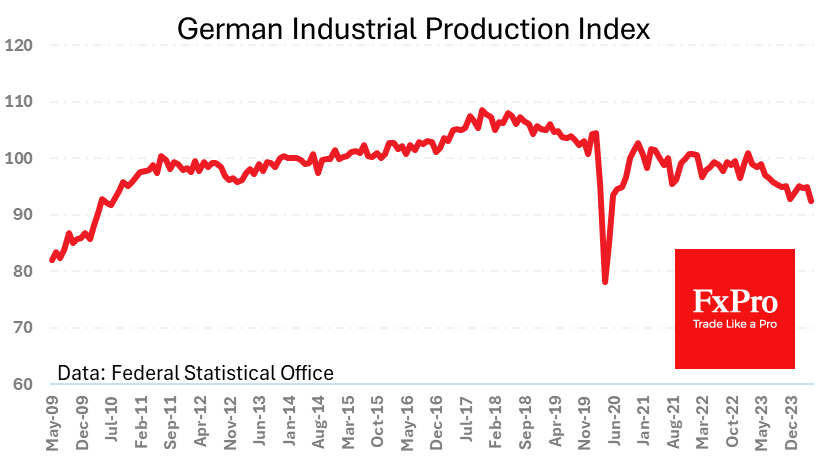

Industry in the Eurozone is under pressure. Germany’s industrial production index plunged 2.5% in May. By the same month a year earlier, the loss was 6.7% – the worst result since August 2020. Excluding the failure at the start of.

July 5, 2024

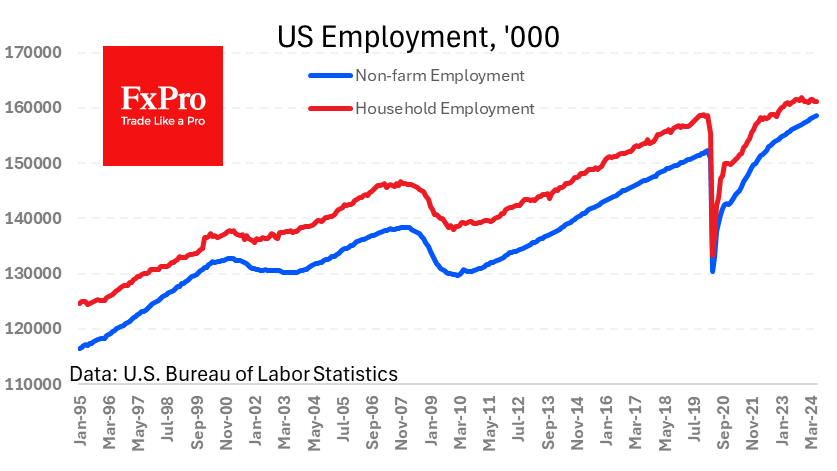

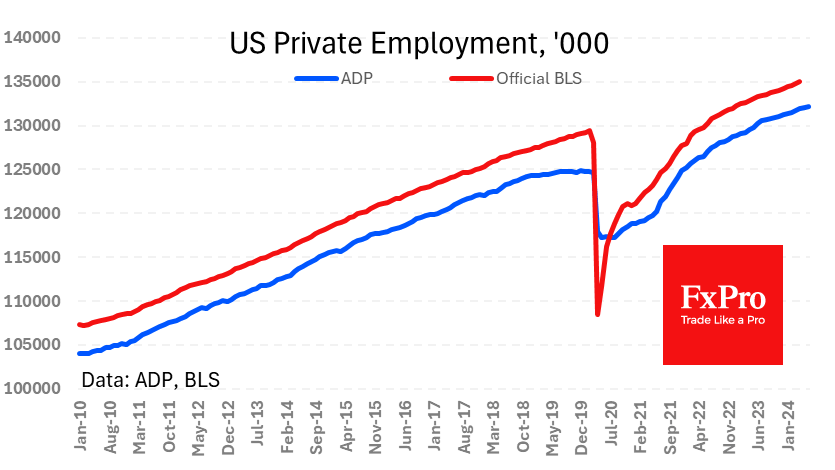

The US economy created 206k new jobs in June, slightly better than average expectations. However, May’s gain was downgraded from 272k to 206k, and April’s from 165k to 108k. The combined 123k downgrade of the previous two months’ estimates suggests.

July 5, 2024

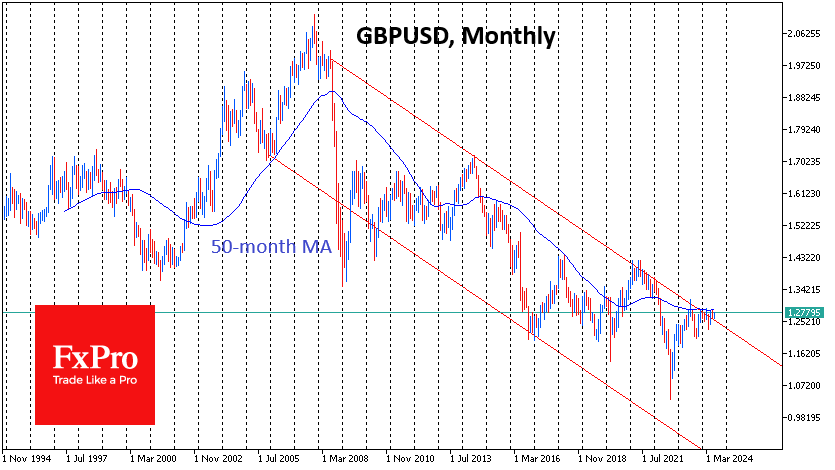

2024 has every chance of being the biggest election year, with well over half of the world’s population going to the polls. The next chapter in this saga is today, with the announcement of the results of the UK general.

July 4, 2024

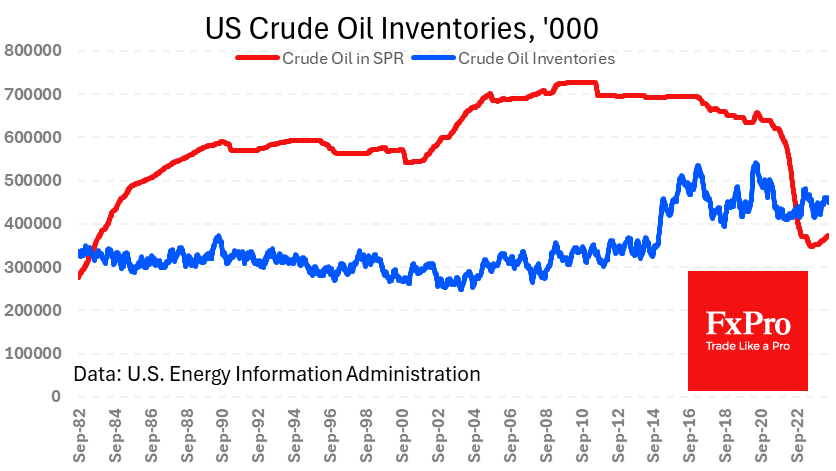

Crude oil inventories in US commercial storage fell by 12.2 million barrels last week, marking the sharpest decline since last July. The decrease is attributed to preparations for the start of the US driving season. Not only was the change.

July 3, 2024

The US private sector created 150K jobs in June, according to fresh ADP estimates. This is slightly weaker than expected and the lowest growth since January. Once again, the leisure sector (+63K) led the growth. Construction stands out, with net.

July 3, 2024

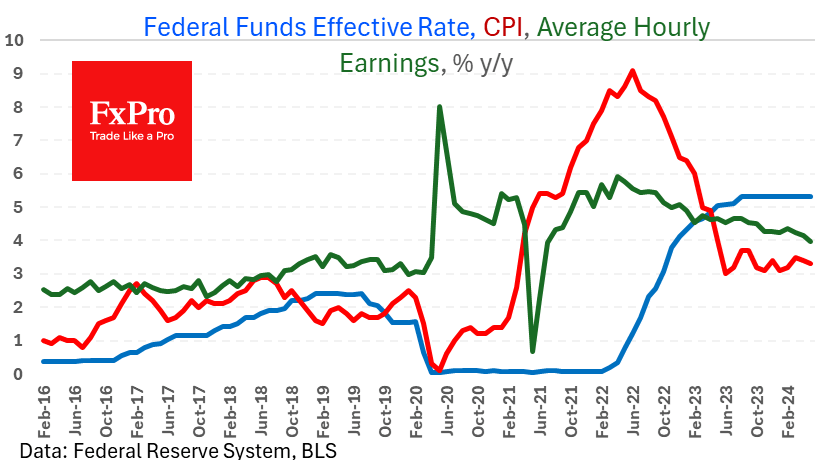

Fed Chairman Greenspan once said, ‘If I’ve made myself too clear, you must have misunderstood me’. It seems that over the past decade and a half, the Fed has become increasingly transparent in its reasoning and expectations. Therefore, there is.

July 2, 2024

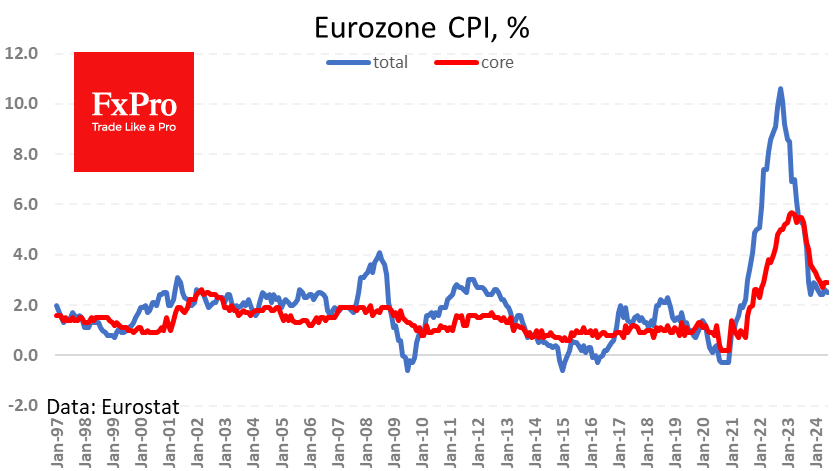

According to the Eurostat Flash estimate, the euro area CPI stood at 2.5% y/y, hovering between 2.4% and 2.6% for the past five months. There has been no apparent slowing since November when the rate first touched 2.4%. Core CPI.

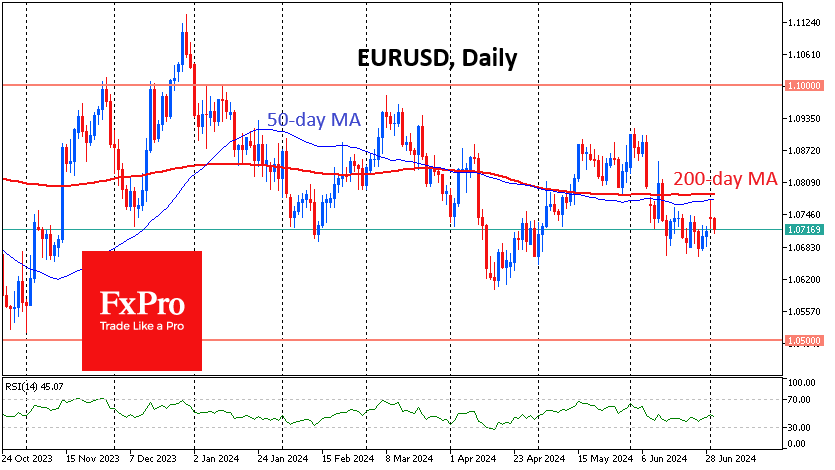

July 2, 2024

The US dollar has been settling near two-month highs since late last week, but this is a pick of the best among the worst. Expectations for the Fed’s key year-end rate have changed little over the past roughly three weeks..

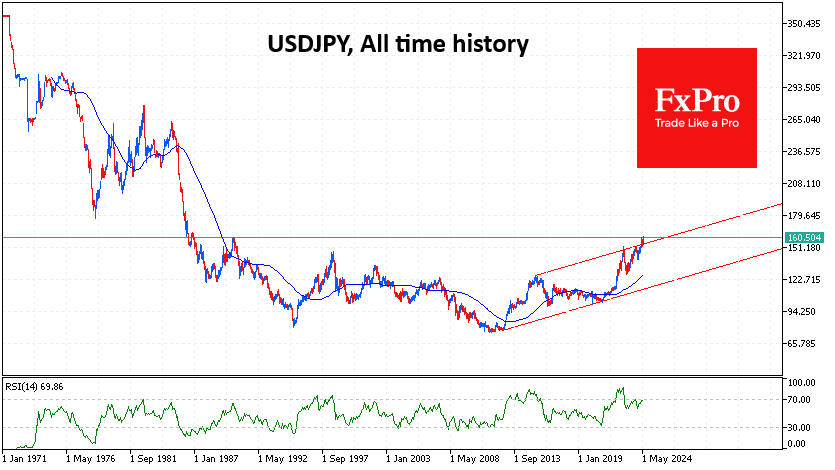

June 27, 2024

The Japanese yen has fallen to its lowest since 1986 against the dollar and a historic low against the euro. Its YTD loss is 12.5%, the third-worst performance after the Nigerian naira and the Egyptian pound among the 36 most.

June 26, 2024

Gold has been under moderate pressure since last Friday, when the price reversed sharply from above $2360. This is an important signal from the bears that they retain control of the market, forming a trend of lower local highs. On.