Market Overview - Page 45

July 17, 2024

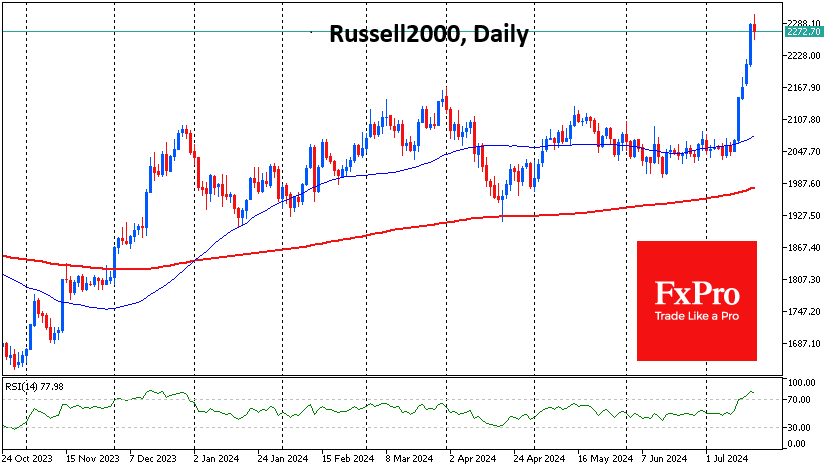

US equity indices have been in a state of surprising divergence for over a week, with the Dow Jones and Russell 2000 shooting up, the Nasdaq-100 working its way down, and the S&P500 treading water. Russell 2000 futures had racked.

July 17, 2024

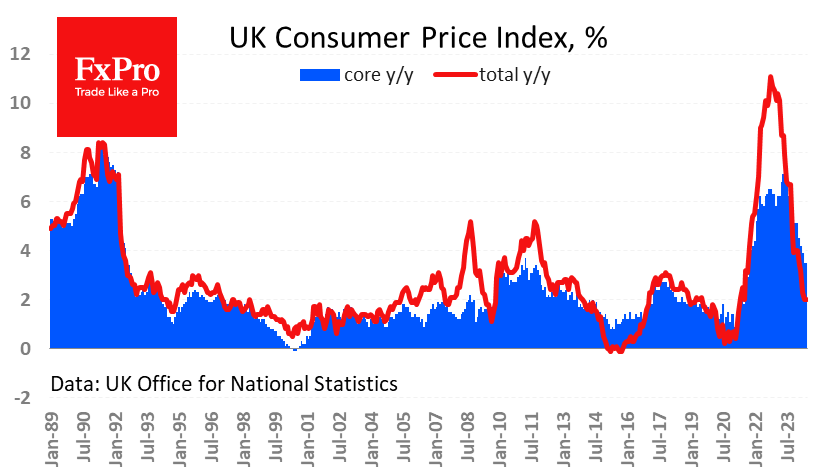

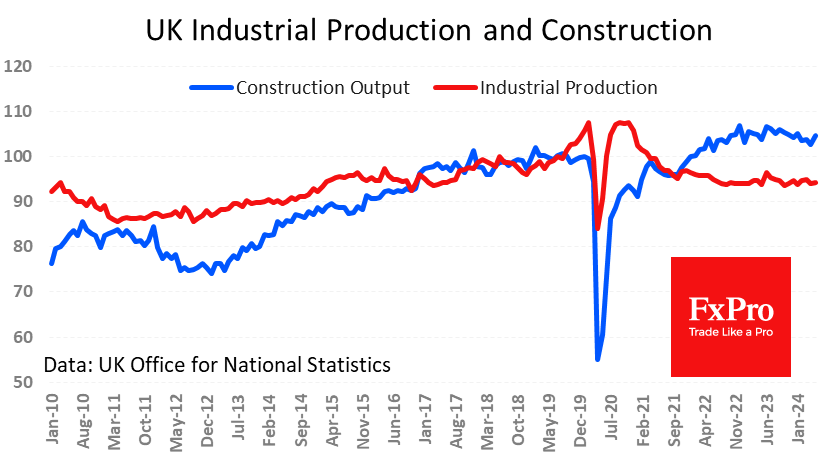

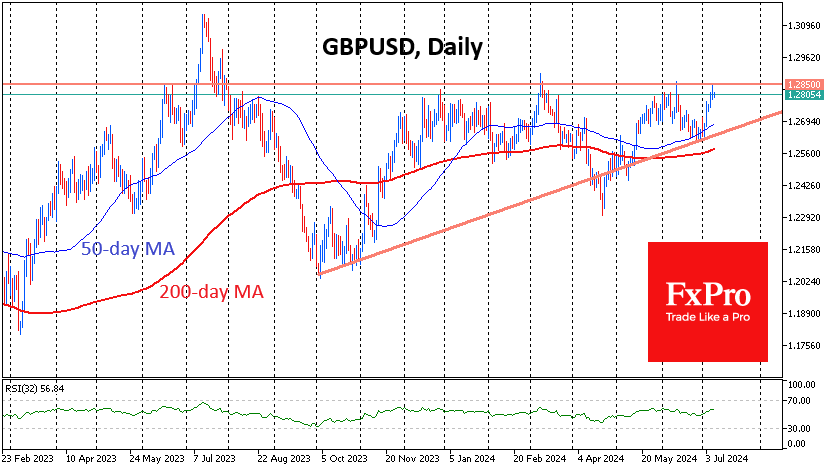

A batch of inflation statistics from the UK seems to have fuelled the Pound’s rally against the Dollar and Euro, which has been going strong since the beginning of the month. Consumer inflation remained at 2.0%, with the core index.

July 16, 2024

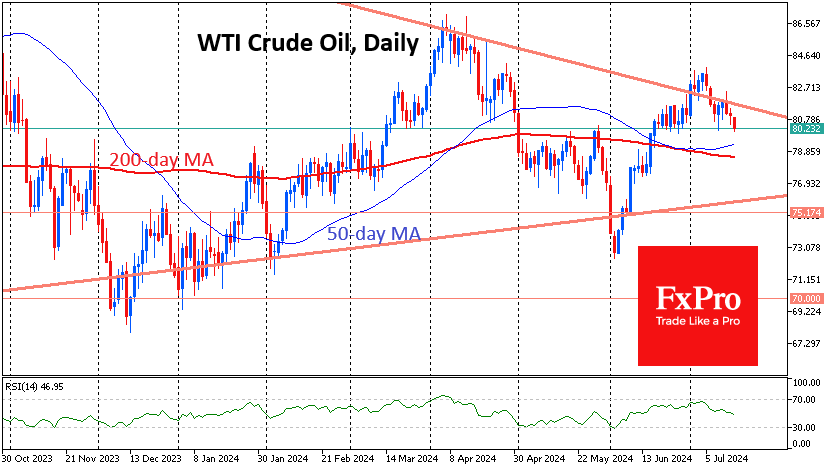

Oil is losing ground, once again threatening to fall below $80 per barrel WTI, despite a weaker dollar and strong gains in gold and equities. We may be seeing market participants trying to stay within the established pattern, but there’s.

July 15, 2024

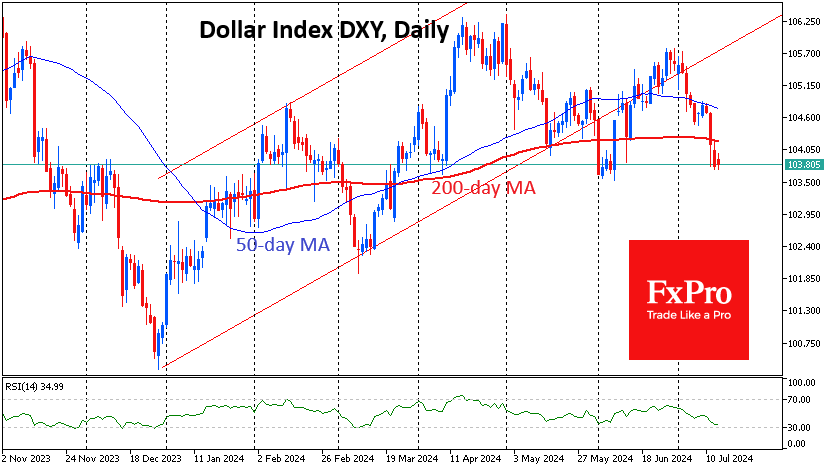

While Trump’s rise to power is widely seen as a positive for the dollar, the dollar index hit a one-month low on Monday as it continues to rebound from the Fed’s latest softening tone and inflation slowdown. The impact of.

July 12, 2024

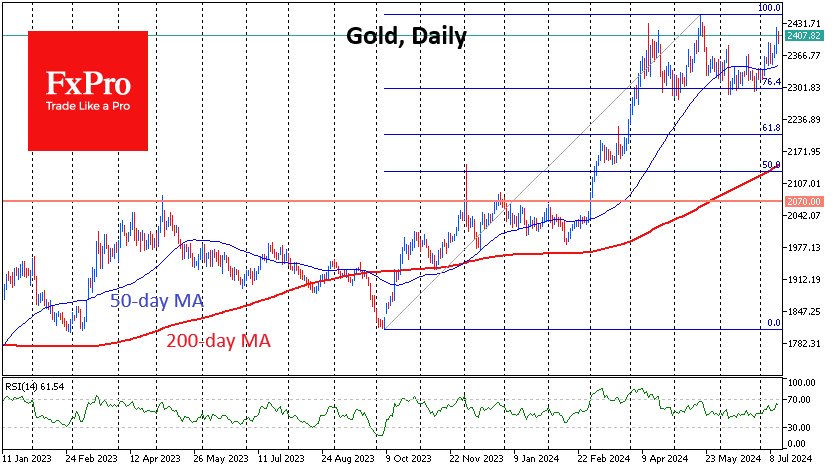

A soft US CPI report pushed gold above the $2400 mark. The price only climbed above it for a couple of hours in April and barely spent three days above this level in May. In both cases, these climbs shifted.

July 11, 2024

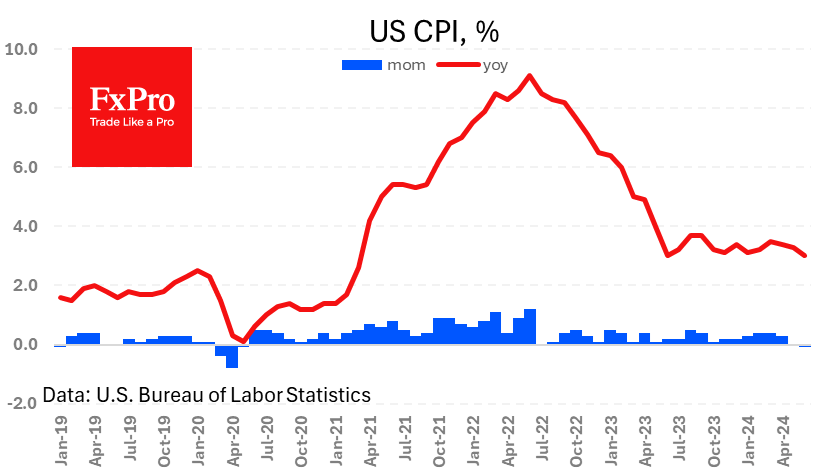

The US consumer price index fell 0.1% instead of the expected 0.1% increase, slowing annual inflation to 3.0% from 3.3% last month and below the expected 3.1%. The price index excluding food and energy slowed to 3.3%, also weaker than.

July 11, 2024

Positive news for the Pound, beyond the fact that England will play in the Euro-24 final. The monthly estimate showed that the economy grew by 0.4% in May (twice as much as expected) and that growth in the last three.

July 10, 2024

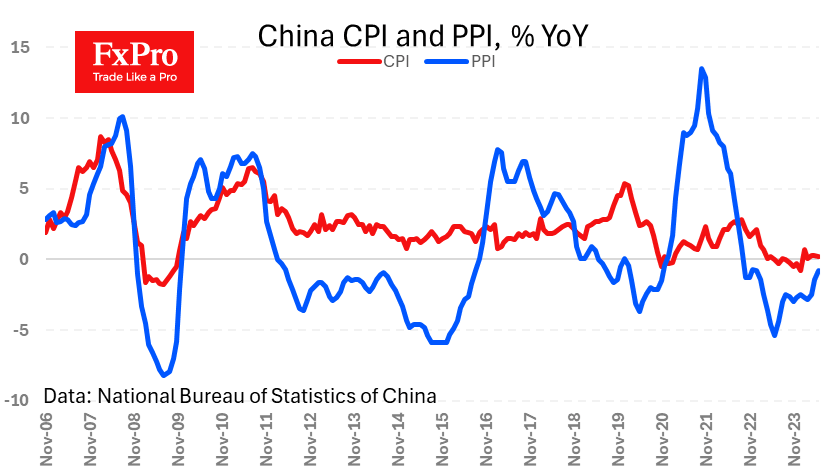

China’s consumer inflation slowed from 0.3% y/y to 0.2% instead of the expected acceleration to 0.4%, bringing investors’ attention back to weak demand. Meanwhile, manufacturing price deflation slowed from -1.4% y/y to -0.8% y/y, staying in negative territory for the.

July 10, 2024

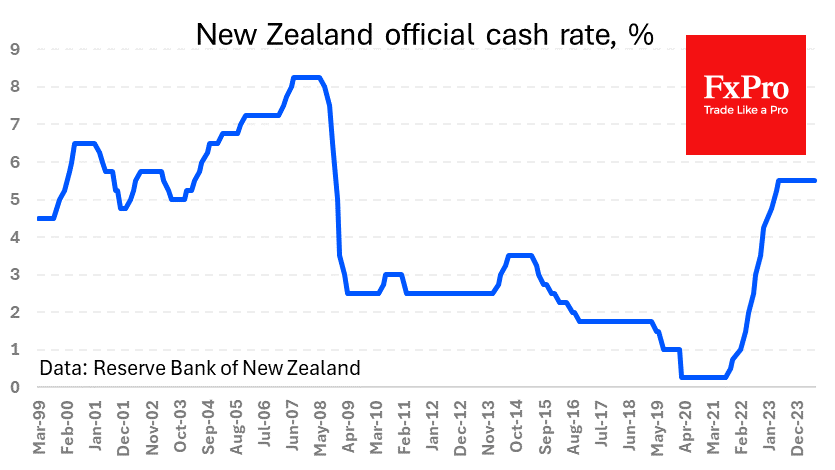

The Reserve Bank of New Zealand kept its benchmark interest rate at 5.5% for the eighth consecutive meeting, which was in line with analyst expectations. However, the central bank’s comments were softer than expected, dragging down NZDUSD by around 1%.

July 9, 2024

GBPUSD is trading near 1.28, which has acted as an area of resistance in the pair since last December. At the same time, the range of fluctuations of the pound is narrowing, as since October, the downside impulses have become.

July 9, 2024

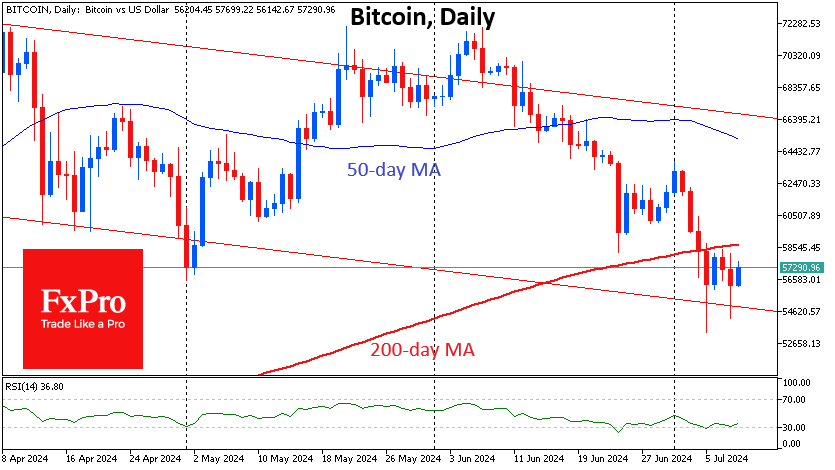

Market picture Bargain hunters are showing themselves in full force in crypto. Cryptocurrency market capitalisation rose 3.6% in 24 hours to $2.11 trillion, climbing back to the top of the range of the past five days. It will take the.