Market Overview - Page 42

August 26, 2024

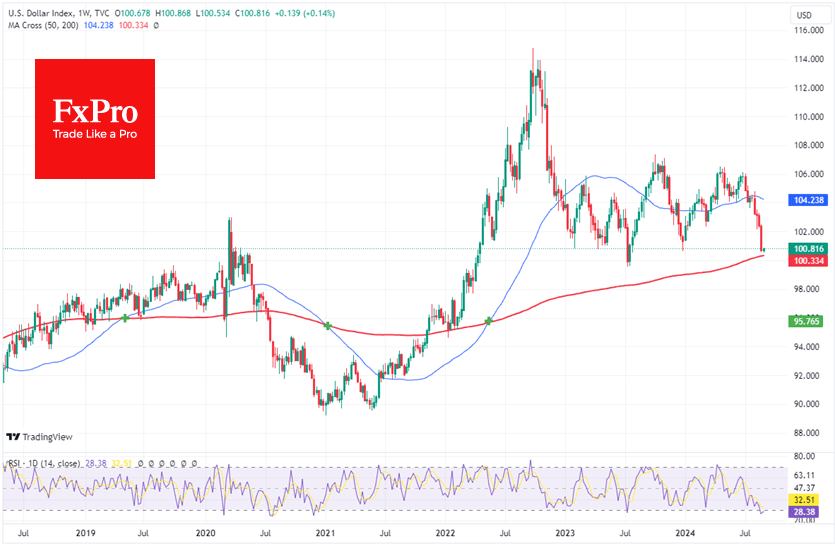

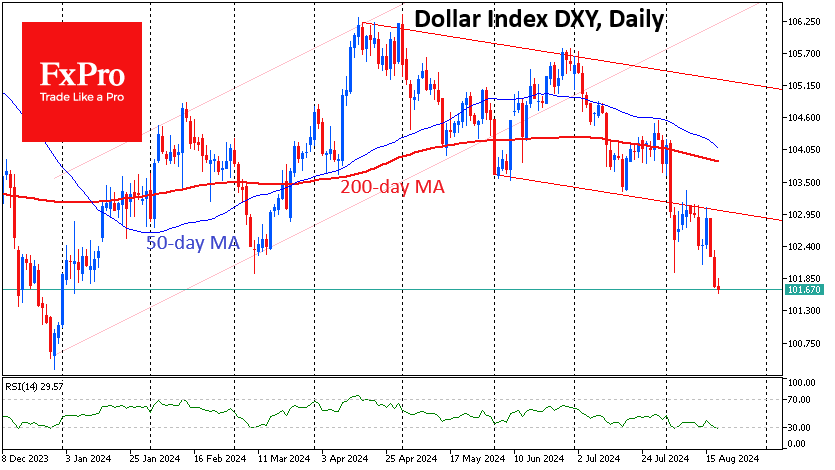

Current situation The Dollar Index closed last week at 100.55, its lowest level since July 2023. It has not been consistently below this level since April 2022. Technical analysis Although the change of monetary regime in the US is of.

August 26, 2024

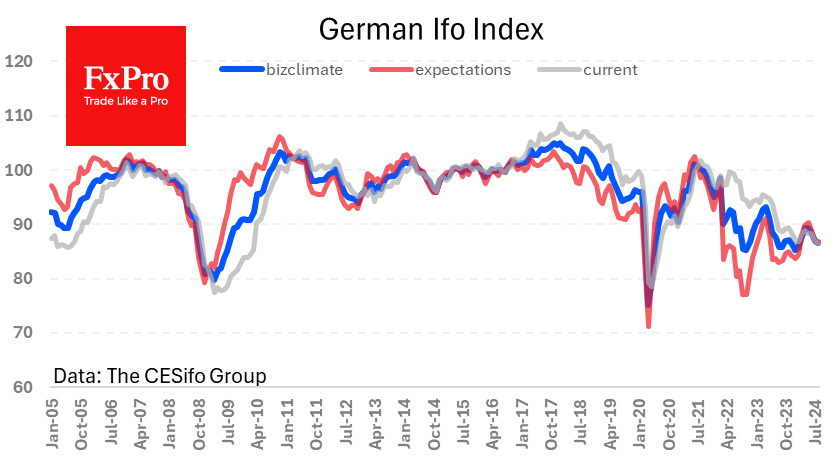

Germany’s business climate Germany’s business climate deteriorated in August but was better than expected. The Ifo business climate indicator fell from 87.0 to 86.6, the fourth consecutive month of decline, but better than the forecast of 86.0. Both the expectations.

August 22, 2024

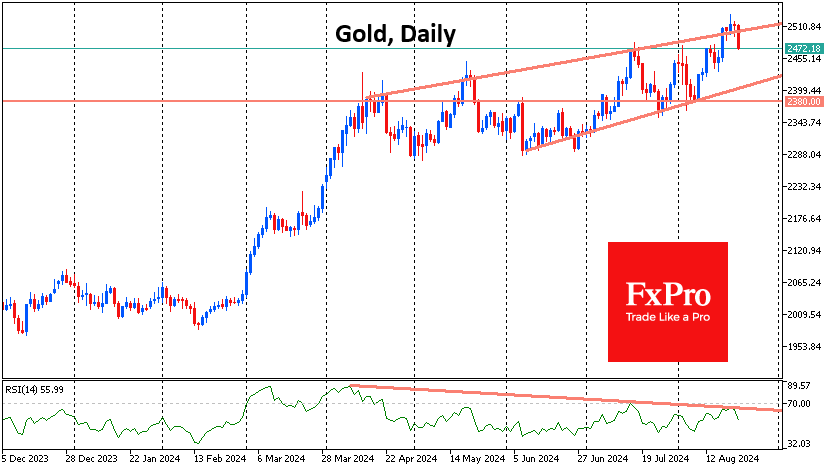

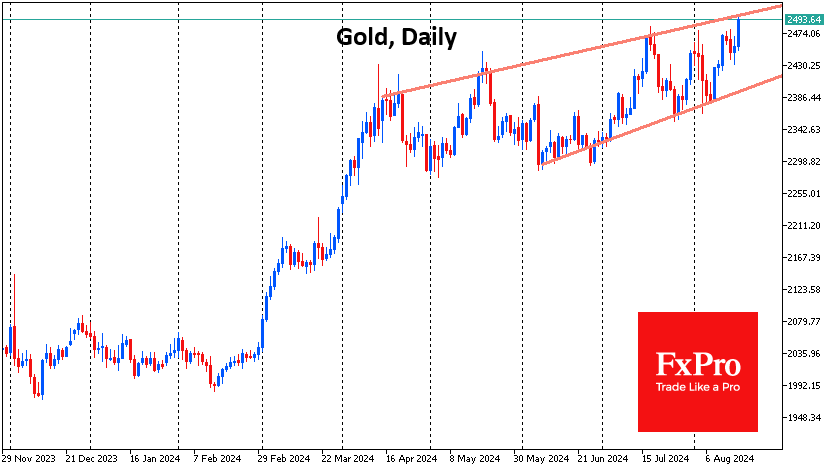

Gold started the week with a decisive renewal of all-time highs, reaching the maximum spot price of $2531 per troy ounce. However, the bulls failed to seize the initiative finally, and on Thursday, gold lost more than 1%, falling back.

August 22, 2024

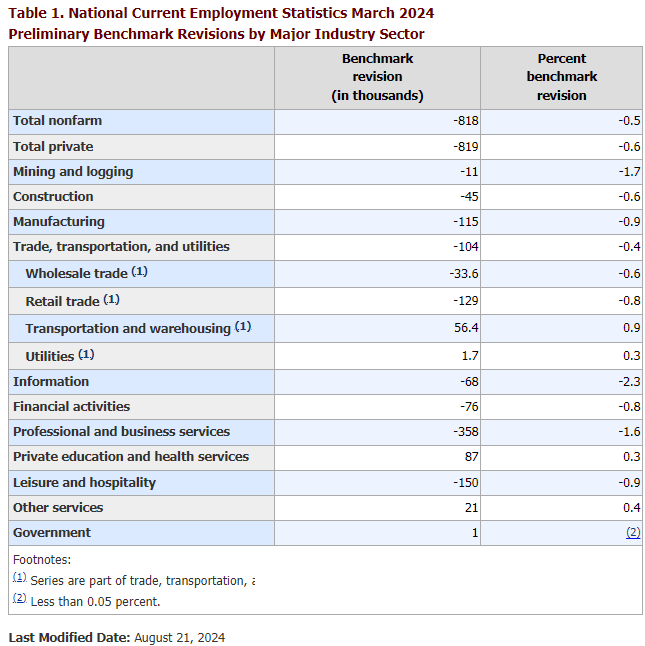

The US Bureau of Labour Statistics revised its employment data for the 12 months to March, cutting its estimate of the number of people employed by 818K or 0.5%. Investment bank forecasts had predicted a drop of 600-1000K. This revision.

August 21, 2024

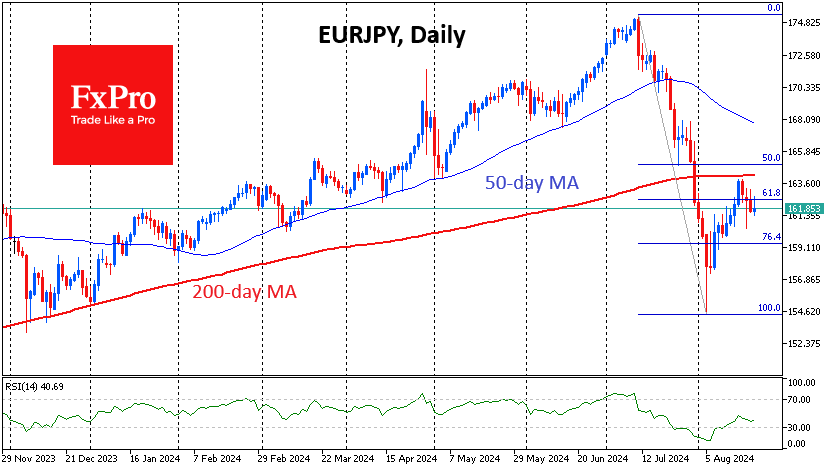

Since the end of last week, the Yen has regained ground against the Dollar and the Euro in what looks like a new round of appreciation. So far, this seems to be an independent theme for the Yen’s rise, without.

August 21, 2024

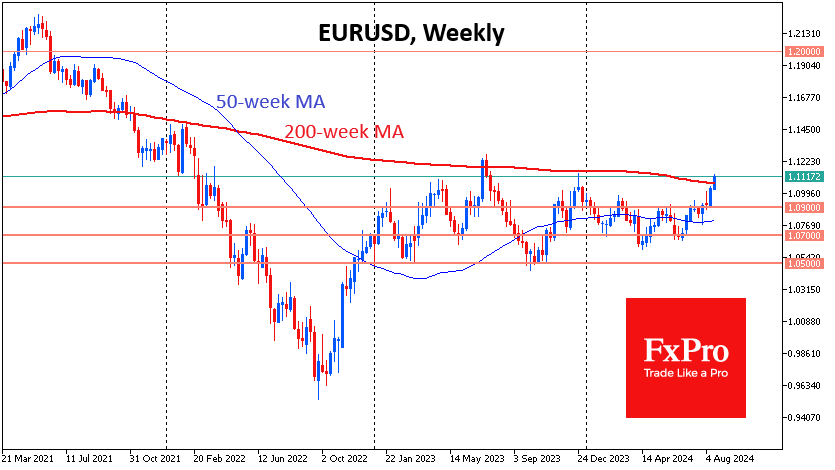

The single currency has risen above $1.11, almost repeating its late December peak. At current levels, the pair is within the upper boundary of its trading range, and the technical analysis suggests that a breakout is more likely than a.

August 20, 2024

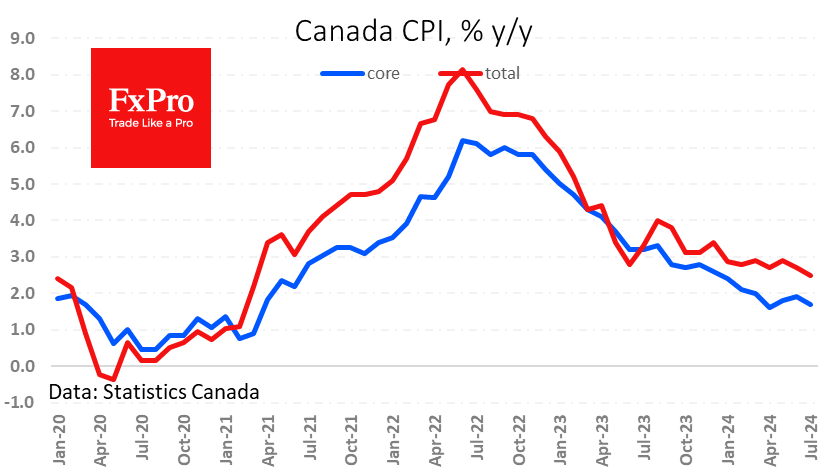

Canadian inflation slowed to 2.5% y/y, the lowest since March 2021, in line with expectations. Several core indices tracked by the Bank of Canada (common, median and trimmed) also fell back to three-year levels. In this case, prices rose more.

August 20, 2024

The US dollar has fallen to its lowest levels of the year, losing more than 2.3% from its August peak and around 4% since early July as expectations of a Fed rate cut in September began to be priced in..

August 19, 2024

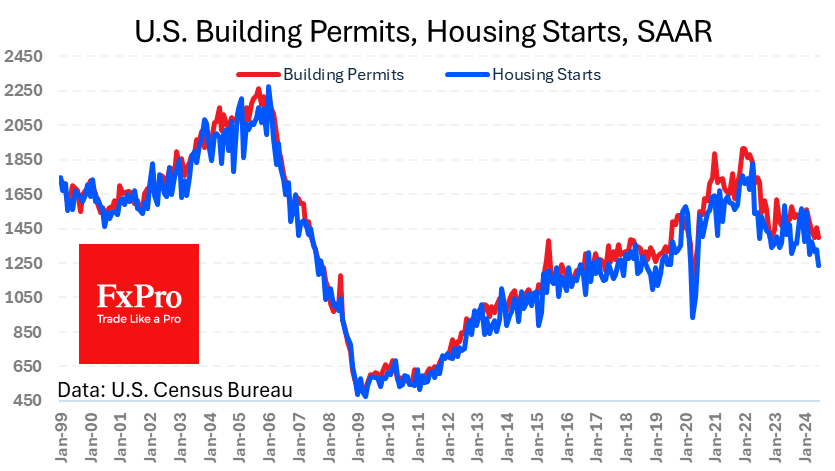

Economic data from the US in recent weeks has reduced the risk of recession and encouraged the purchase of risk assets, but the construction sector is bucking the trend. Building permits fell 4% in July to 1.396 million, the lowest.

August 19, 2024

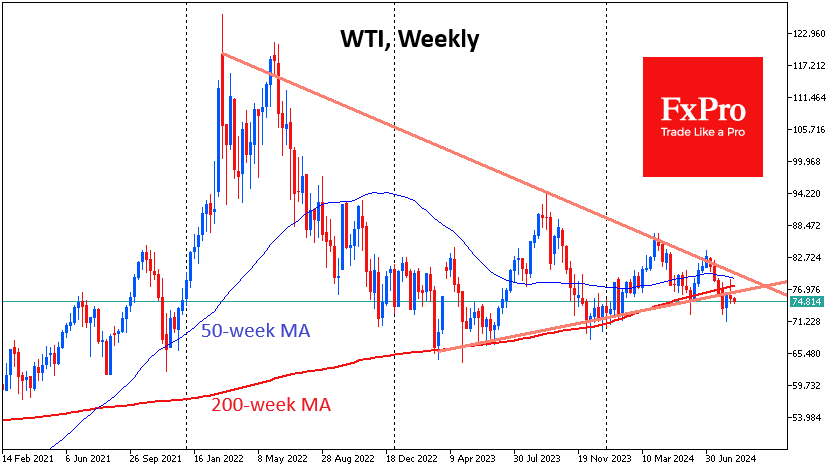

The cost of a barrel of WTI has fallen four out of the last five sessions, underlining the bears’ dominance. Selling is intensifying as the price rises above $78, which is close to important technical levels. Last week, oil failed.

August 16, 2024

Gold has been rising steadily since the end of last week and is attempting to consolidate above $2470 per troy ounce on the spot market for the third time in the last 30 days. Gold has moved in tandem with.