Market Overview - Page 41

September 4, 2024

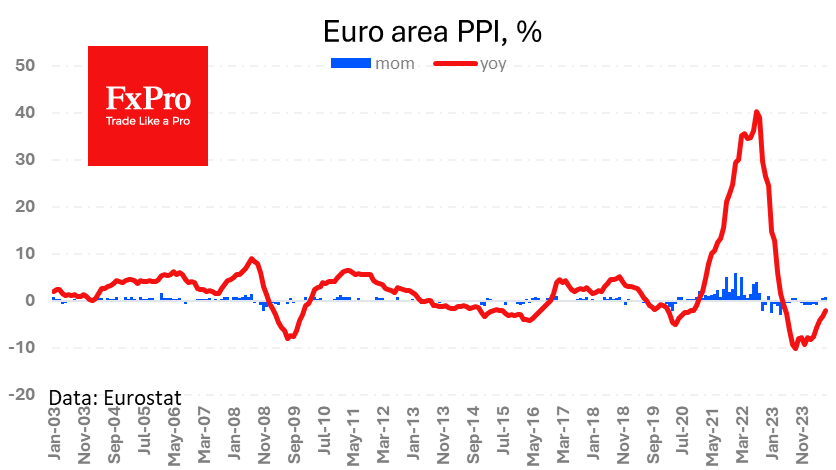

Perhaps disinflationary trends in the eurozone are giving way to pro-inflationary ones. The eurozone’s producer price index rose 0.8% in July after rising 0.6% in the previous month. Prices are still lower year-on-year for the fifteenth month, with a reading.

September 4, 2024

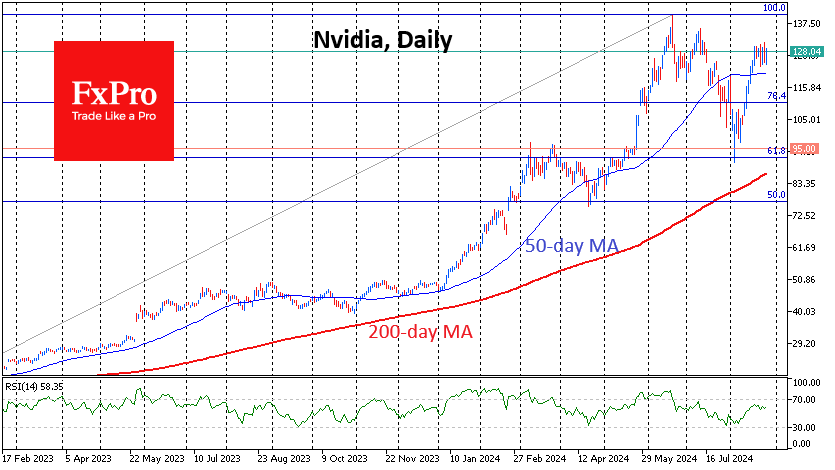

US equity markets have been hit by a sell-off, with the Nasdaq100 down more than 3% and the S&P500 down more than 2%, the biggest drop in almost a month. Nvidia’s share price fell more than 10% as the antitrust.

September 3, 2024

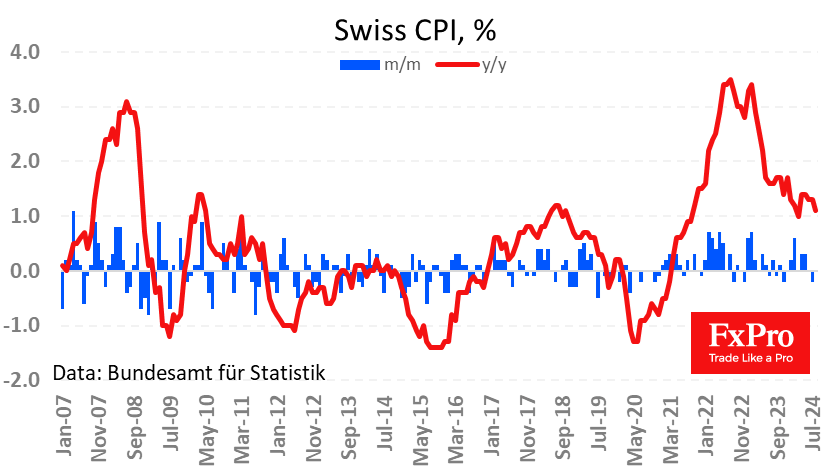

Swiss inflation slowed to 1.1% y/y in August from 1.3% the previous month, below the 1.2% expected. In April and May, the rate of price increases rose to 1.4% y/y but later started to fall again, losing 0.2% in the.

September 3, 2024

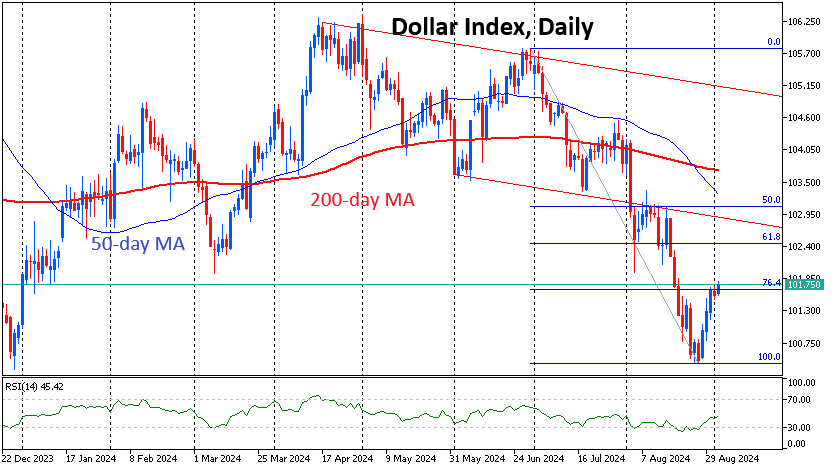

The US dollar’s recovery continues, and other markets are starting to notice. The dollar index is up 1.4% to 101.7, having found support twice in the first half of last week before falling to 101.4. The bounce has seen the.

September 2, 2024

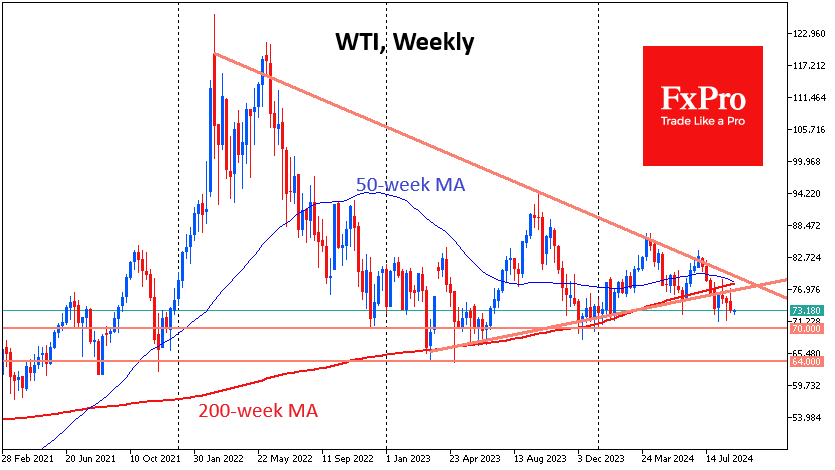

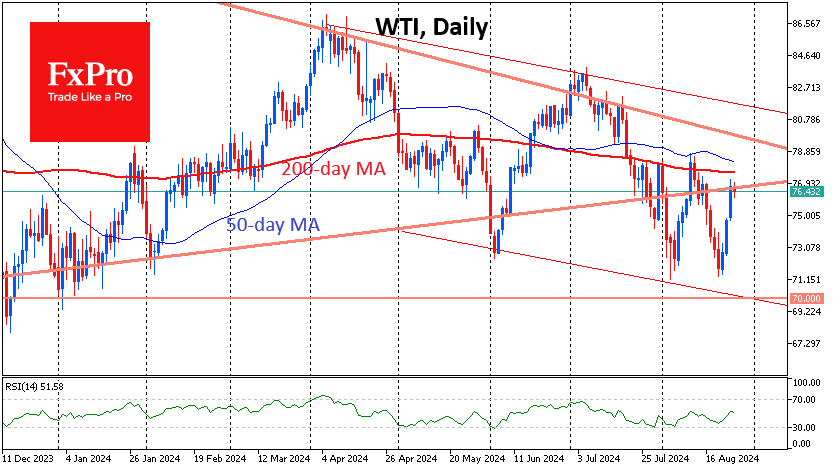

Often the release of fundamental data such as oil inventories and production or economic activity influences the market, although sometimes the price behaves independently, as was the case last week. The cost of a barrel of WTI fell by 2%.

August 30, 2024

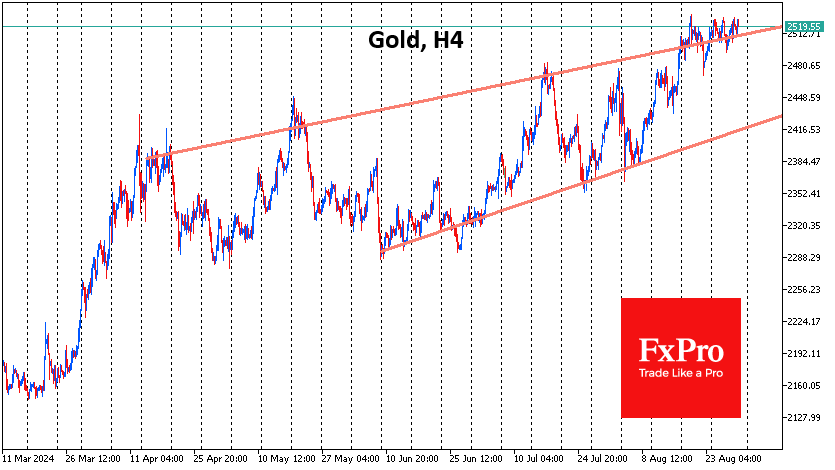

Gold has hit a glass ceiling at $2525 an ounce on the spot market, which it has been battling against for the past two weeks. A series of smaller and smaller pullbacks and more frequent rallies to the resistance indicate.

August 29, 2024

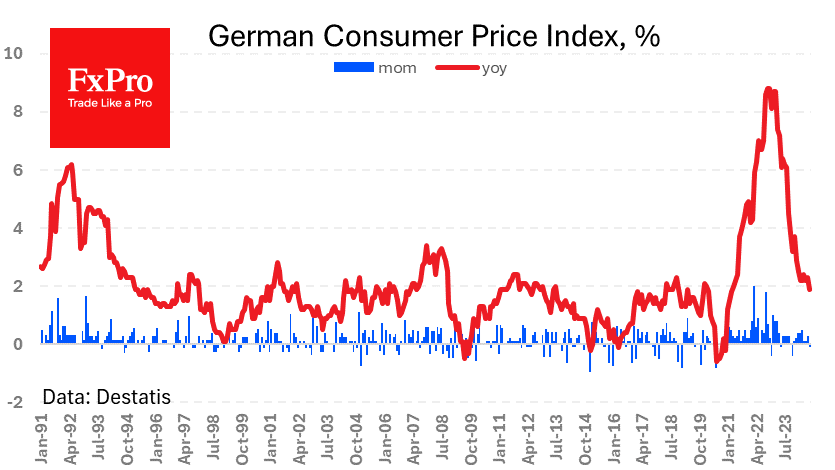

Germany data German inflation is slowing more than expected. According to a preliminary estimate from Destatis, the consumer price index fell 0.1% in August, and annual inflation slowed to 1.9%, compared to 2.3% in the previous month and the 2.1%.

August 29, 2024

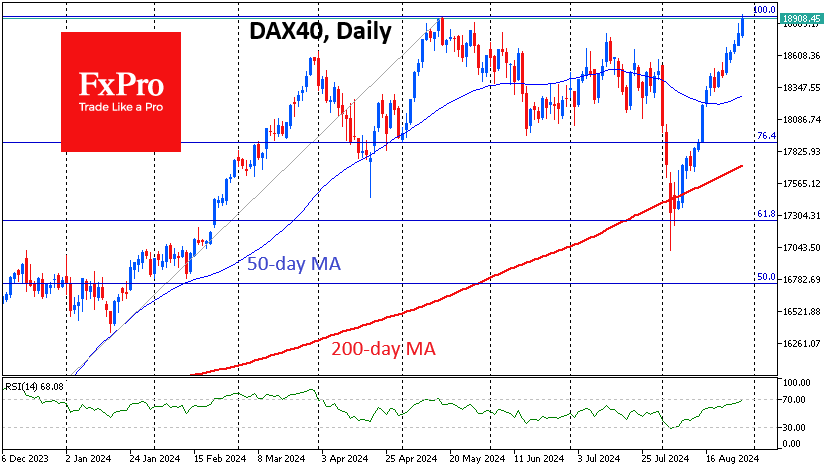

Market picture Germany’s DAX40 has returned to all-time highs above 18900. The sell-off in equities in early August lured investors waiting for a pullback to enter the market. From a technical point of view, the August plunge was a corrective.

August 28, 2024

The whole financial world, including the media, is waiting for Nvidia’s quarterly report. The company, which has a market capitalisation of almost $3 trillion, is expected to double its sales compared with last year. It is difficult to beat such.

August 28, 2024

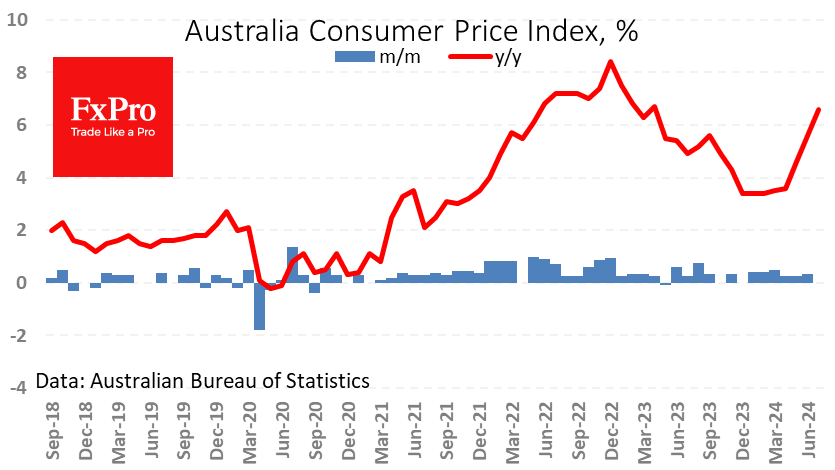

The Australian dollar hit its highest level since December 2023 against the US dollar, briefly topping 0.6800 following the release of the monthly inflation report. The Australian Bureau of Statistics reported that consumer price growth slowed to 3.5% y/y in.

August 27, 2024

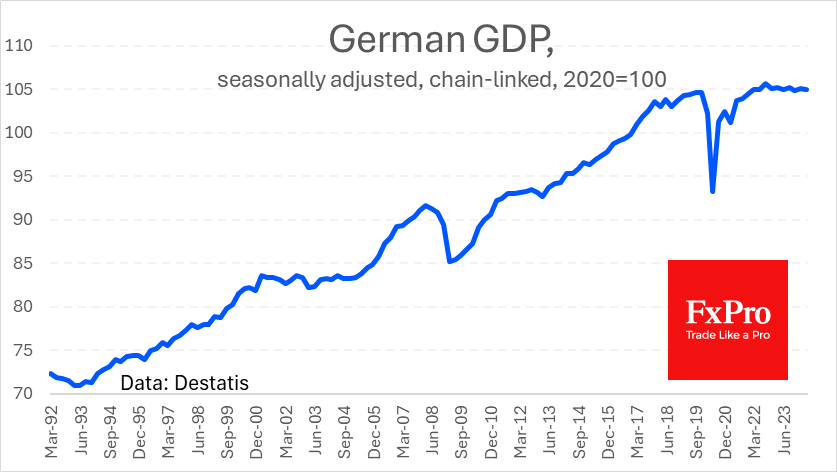

Market picture The final reading confirmed a 0.1% contraction in the German economy in the second quarter, with a modest growth of 0.3% y/y and stagnation close to the same level of March 2022, just 0.3% above the 2019 peak.