Market Overview - Page 405

March 5, 2020

OPEC ministers are expected to approve a large oil production cut on Thursday, but they still face an uphill battle to receive approval from non-OPEC leader Russia. The meeting of the 14-member group OPEC and 10 non-member allies, known collectively.

March 5, 2020

With the U.S.-China trade war last year and the outbreak of the new coronavirus, American technology firms Apple, Microsoft and Google have reportedly looked to move more production of their hardware products out of the world’s second-largest economy. But reducing.

March 4, 2020

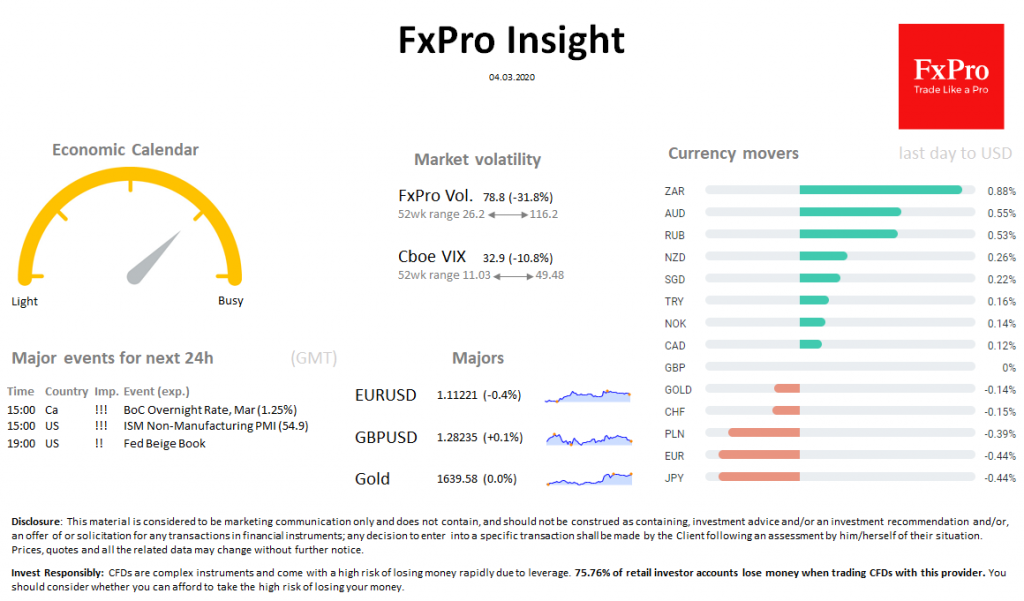

Market overview Market volatility declined after sharp jumps in both directions over the previous two weeks. Fed rate cuts and market guesses that more to come from other Central Banks, feed cautious demand for risky assets, supporting stock indices: futures.

March 4, 2020

The emergency interest rates cut from the Fed did not have a lasting impact on markets. And it is surprising if you pay attention to the fact that the last time an unplanned cut in interest rates occurred amid the.

March 4, 2020

The average hashing power on bitcoin (BTC) over the past seven days has reached a new high of around 117.5 exahashes per second (EH/s), up 5.4 percent from where it stagnated for a month beginning Jan. 28, according to data.

March 4, 2020

The euro held near two-month highs and the dollar recouped some losses on Wednesday as traders evaluated the impact of an emergency Fed rate cut a day earlier. The Fed surprised investors by slashing rates by 50 basis points to.

March 4, 2020

The use of fossil fuels such as coal and oil for generating electricity fell in 2019 in the United States, the European Union and India, at the same time overall power output rose, a turning point for the global energy.

March 4, 2020

While Donald Trump insists everything is fine in the United States, the Federal Reserve made an extraordinary move to implement an emergency interest rate cut and pump a colossal amount of cash into the repo market. The FOMC has almost.

March 4, 2020

The energy alliance between Saudi Arabia and Russia will likely come under intense scrutiny this week, as delegates from some of the world’s most powerful oil-producing nations discuss how best to cushion the impact of the coronavirus outbreak. OPEC and.

March 4, 2020

Around half of young people across Africa said that if they were offered $100, they would use it to start a business, a survey has shown. This entrepreneurial spirit was revealed in a study by the Ichikowitz Family Foundation charity,.

March 3, 2020

Shares of Tesla Inc. shot higher Monday, putting them on track to snap a sharp 5-day selloff, but Morgan Stanley analyst Adam Jonas suggested it was still too early for investors to jump in. Jonas reiterated the underweight rating he’s.