Market Overview - Page 404

March 6, 2020

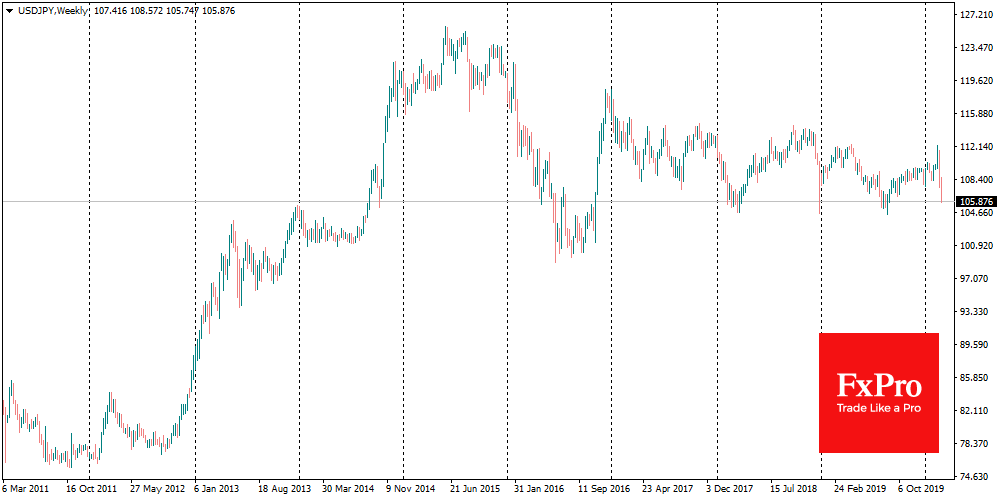

In recent days, the foreign exchange market has consistently points to a high level of concerns among investors. However, the stock market has had a short break in the form of a bounce. As it often happens, currency movements act.

March 6, 2020

U.S. job growth likely slowed in February, but the pace probably remained consistent with a healthy labor market despite the coronavirus outbreak, which stoked financial market fears of a recession and prompted an emergency interest rate cut from the Federal.

March 6, 2020

The coronavirus crisis could wipe out $211 billion from economies across Asia Pacific, according to a Friday report from S&P Global Ratings. Australia, Hong Kong, Singapore, Japan, South Korea and Thailand “will enter or flirt with recession,” the ratings giant.

March 6, 2020

Futures on Friday morning pointed to further declines for Wall Street on Friday as stocks stateside head toward the end of a turbulent trading week. As of 12:20 a.m. ET Friday, Dow Jones Industrial Average futures fell 322 points, pointing.

March 5, 2020

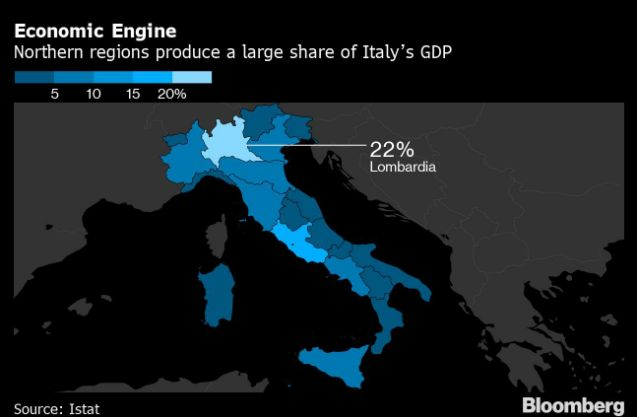

Italy will double the amount planned to help contain the impact of the coronavirus outbreak on the economy to 7.5 billion euros ($8.4 billion.)The announcement marks a dramatic escalation in the government’s response, which has so far included measures such.

March 5, 2020

The Canadian economy’s resilience could be “seriously tested” by a coronavirus outbreak depending on its severity and duration, Bank of Canada Governor Stephen Poloz said on Thursday. Poloz spoke a day after the central bank slashed a key interest rate.

March 5, 2020

Bitcoin (BTC) will reach $100,000 and Jamie Dimon will be “begging” the United States Federal Reserve for money to buy some. Those were just two of the predictions from Max Keiser on March 5, as the coronavirus outbreak sees financial.

March 5, 2020

OPEC has agreed to impose a deeper round of production cuts in order to support oil prices, paving the way for crunch talks with non-OPEC leader Russia, who still has to agree to the plan. The 14-member group, led by.

March 5, 2020

Global markets in turmoil. Central banks rushing to arrest panic. But in China, the country most affected by the virus outbreak, it’s boom time for traders. A gauge of stocks in Shanghai and Shenzhen has jumped 14% in just over.

March 5, 2020

U.S. stocks could be in line for another double-digit decline in the near-term because of damage from the spread of coronavirus, index provider MSCI said on Thursday, citing its scenario-based analysis, “We’ve conducted a what-if scenario analysis that assumes a.

March 5, 2020

The U.S. dollar fell on Thursday amid expectations of the Federal Reserve will cut interest rates further, after slashing them by 50 basis points this week in an emergency move to shield the economy from the effects of coronavirus. The.