Market Overview - Page 403

March 9, 2020

Last month’s brutal stock market correction wiped $3.6 trillion from equities in one week. Further, within the space of nine days the S&P 500 Index crashed 10% from an all time high in the shortest ever amount of time. After.

March 9, 2020

This week started with a massive decline in bitcoin from well above USD 8,500. BTC/USD tumbled around 10% and it broke many supports near the USD 8,400 and USD 8,000 levels. The price is currently correcting higher, but upsides are.

March 9, 2020

Pacific Investment Management Co (PIMCO), one of the world’s largest investment firms, told clients on Sunday the coronavirus outbreak is likely to cause a relatively mild and short recession though tight credit markets could worsen the downturn. The worst for.

March 9, 2020

Cryptocurrency markets plunged following a plummet in oil prices and further sell-off in stocks. The market capitalization or entire value of cryptocurrencies was down $26.43 billion from a day earlier at around 1:17 p.m. Singapore time, according to data from.

March 9, 2020

Oil prices plunged after OPEC’s failure to strike a deal with its allies regarding production cuts caused Saudi Arabia to slash its prices as it reportedly gets set to ramp up production, leading to fears of an all-out price war..

March 9, 2020

Italy’s extended quarantine measures restricting the movement of people in the northern regions have provoked panic among residents and accentuated the country’s north-south divide. On Sunday, Prime Minister Giuseppe Conte signed a decree imposing restrictions to the movement of people.

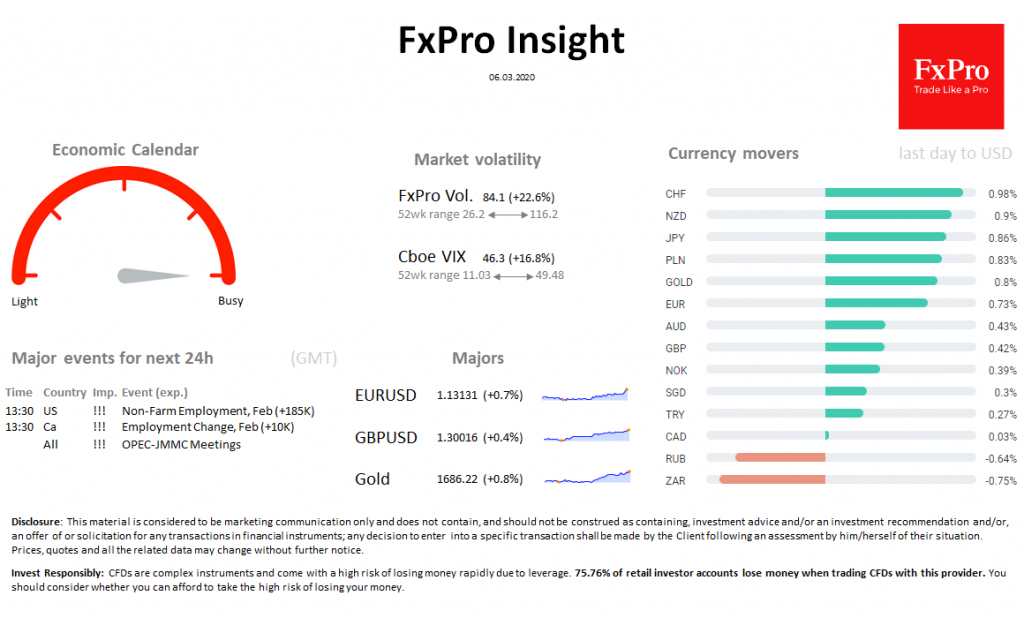

March 6, 2020

Nonfarm payrolls grew far more than expected in February as companies continued to hire leading into a growing coronavirus scare. The Labor Department reported Friday that the U.S. economy added 273,000 new jobs during the month, while the unemployment rate.

March 6, 2020

OPEC and non-OPEC allies have reportedly failed to agree on how much production to cut amid the coronavirus outbreak, with Russia refusing to give the green light to the deepest supply cuts since the global financial crisis. Oil prices slipped.

March 6, 2020

Market overview There is no shortage of strong moves on Friday, despite the proximity of the US NFP publication, in anticipation of which the markets often subside. A day earlier, the S & P500 lost 3.4%, and before the start.

March 6, 2020

After many failed attempts, bitcoin finally managed to pop above the $8,950 and $9,000 resistance levels against the US Dollar. BTC price settled nicely above the $9,000 level and the 100 hourly simple moving average. A new weekly high is.

March 6, 2020

OPEC holds crunch talks with its allies on Friday after the group told Russia and others it wanted an additional 1.5 million barrels per day (bpd) of oil cuts until the end of 2020, saying a big move was needed.