Market Overview - Page 402

March 10, 2020

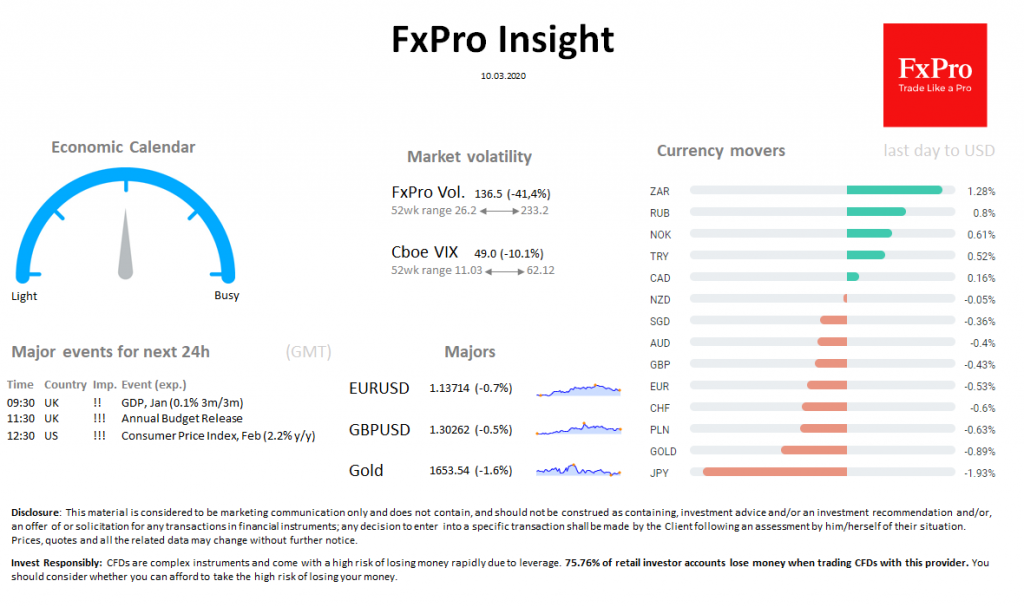

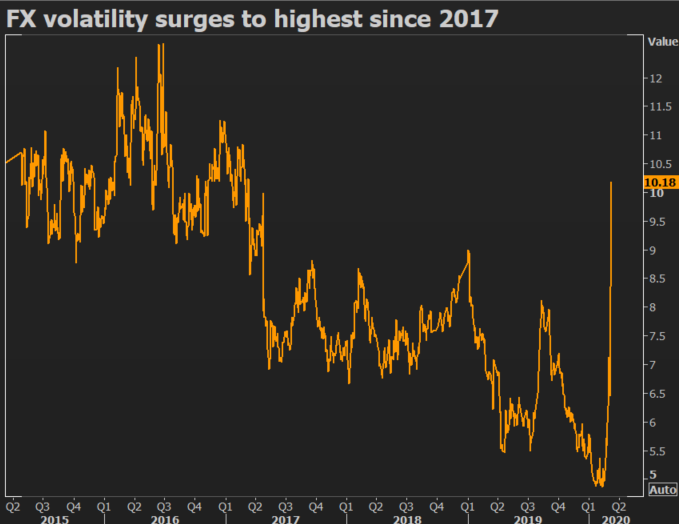

Market overview Stock volatility remains extremely high. After a strong, but short-lived rebound, indices again turned to decline. S&P500 adds 2.5%. EuroStoxx50 strengthened by 1%, FTSE100 is growing by 2.1%. The dollar index has returned to the lows since June.

March 10, 2020

The number of coronavirus cases in Italy has spiraled from 600 to over 9,000 in just 11 days. Meanwhile, the U.S. has seen 729 COVID-19 cases to date, raising the risk of a large-scale epidemic. Coronavirus can become significantly more.

March 10, 2020

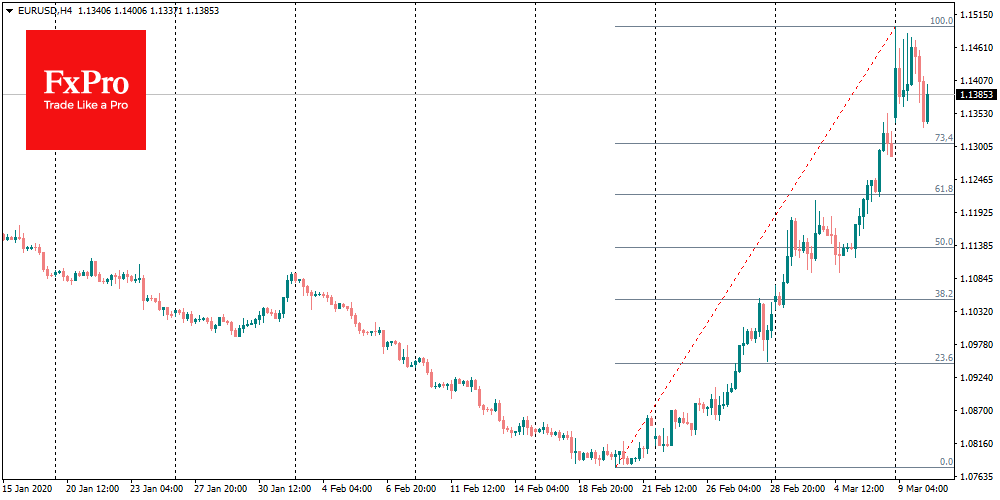

The dollar rebounded on Tuesday after huge losses against the yen and the euro, as investors turned hopeful that policymakers would introduce co-ordinated stimulus to cushion the economic impact of the coronavirus outbreak. The moves helped reverse some of Monday’s.

March 10, 2020

Chinese President Xi Jinping on Tuesday made his first visit to Wuhan since a coronavirus outbreak forced an unprecedented lockdown of the central city of 11 million people, in a sign that authorities’ efforts to control the virus are working..

March 10, 2020

Apple got off to a great start in 2020. Chief Executive Tim Cook lauded the company’s “blockbuster quarter” for the three months that ended in December 2019, in which the company posted market beating earnings and revenue. The iPhone 11.

March 10, 2020

Stock futures rallied back early Tuesday morning after the S&P 500′s worst day since the financial crisis. Around 5:30 a.m. ET Tuesday, futures on the Dow Jones Industrial Average indicated an opening surge of 1,000 points on Tuesday. S&P 500.

March 10, 2020

Global markets are growing on Tuesday morning in anticipation of coordinated central bank stimulus measures and government attempts to stop panic sales in the markets. Today, markets are moving in the opposite direction to Monday’s dynamics, offsetting some of the.

March 10, 2020

1. Distract yourself from alarming headlines If you’re a relatively young, long-term investor, don’t even look at your account balance, or the news of Monday’s stock-market fall It is too difficult at this point to predict the market’s levels years.

March 9, 2020

Earlier today, the market’s confidence that the Federal Reserve will slash its benchmark interest rate target to zero by next week temporarily soared to nearly 95%. But if the Fed cuts interest rates all the way to zero, there’s a.

March 9, 2020

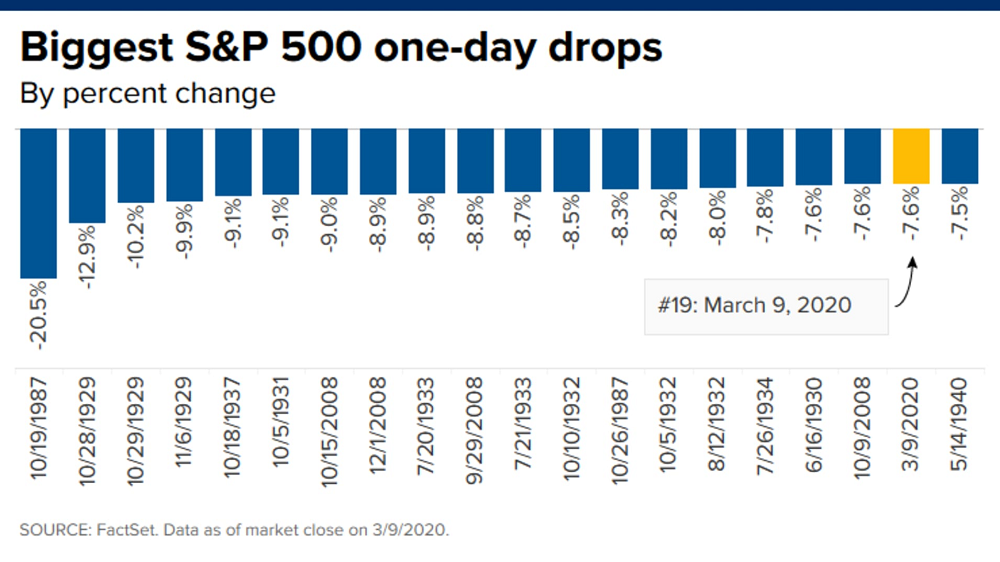

Stocks cratered Monday as investors grappled with the sinking price of oil and the spread of the coronavirus. The Dow Jones Industrial Average tanked 1,819 points — 7% — on pace for its worst day since December 2008, while the.

March 9, 2020

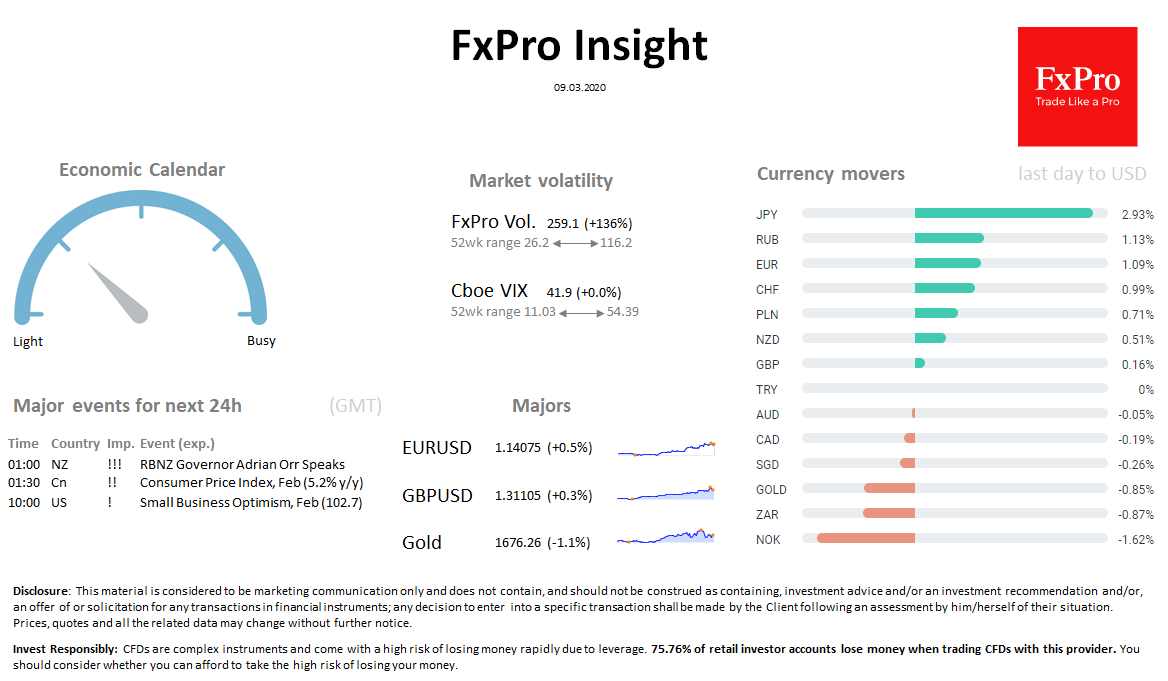

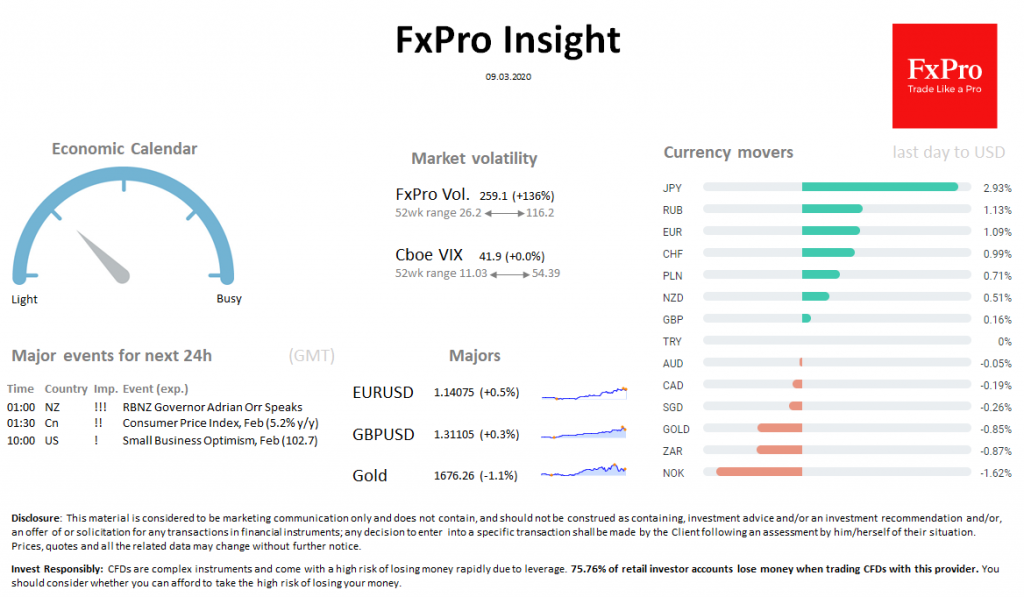

Market overview Stock market volatility rolls over. Trading in US indices trading halted during the day after reaching the limit-down, losing more than 8% from Friday’s closing level. EuroStoxx50 decreased by 7%, partially recovering from more than 10% intraday drawdown,.