Market Overview - Page 400

March 13, 2020

Bitcoin has a history of heart-stopping volatility but they all pale in comparison to what happened in the last 24 hours. The king cryptocurrency bowed down to macro forces as it lost nearly 40% of its value in yesterday’s trading..

March 13, 2020

While much of the attention in the bond market has focused on the Treasury side, corporate fixed income has been in its own state of turmoil. Interest rates on the lowest-rated companies have spiked, rising above their government bond counterparts.

March 13, 2020

Cryptocurrencies took a battering following a global sell-off in stocks, with bitcoin seeing a near 40% plunge. The market capitalization, or total value of the entire cryptocurrency market plummeted around $93.5 billion in the space of 24 hours as of.

March 12, 2020

The number of Americans filing for unemployment benefits unexpectedly fell last week as employers continued to hold on to their workers, but the coronavirus pandemic is expected to lead to an increase in layoffs as companies battle supply chain disruptions.

March 12, 2020

European markets posted their worst one-day drop in history on Thursday, as investors reacted to President Donald Trump’s decision to impose restrictions on travel to the U.S. from some countries in Europe, and the European Central Bank’s decision not to.

March 12, 2020

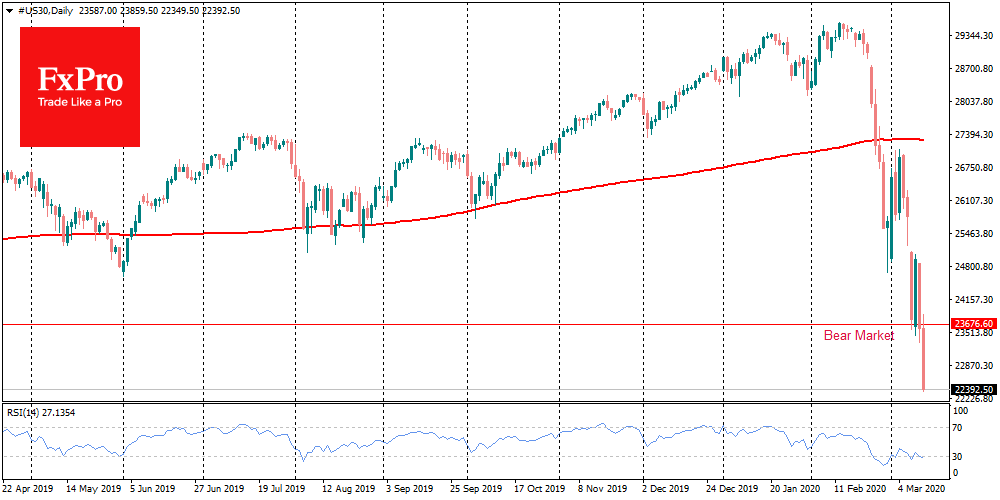

Major indices have entered the bear market territory, breaking the 11-year bull-cycle. The Dow Jones index closed trading on Wednesday with a 20.2% loss from the peaks of a month ago, which triggered increased turbulence and pressure from sellers. As.

March 12, 2020

Bitcoin extended declines a second day, falling past a key $7,500 support level to lead cryptocurrencies lower amid a wider global risk asset sell-off over the intensifying coronavirus crisis. The largest digital currency fell as low as $7,353 and was.

March 12, 2020

During the mainstream market’s current decline, investment advisors are giving out a myriad of advice, with some even mentioning Bitcoin (BTC). Morgan Creek Digital co-founder and partner, Anthony Pompliano, or “Pomp,” tweeted an inquiry to his followers, asking what their.

March 12, 2020

Fear about the coronavirus has pulled the S&P 500 down nearly 20% from its record high. So what? For many investors, Wall Street’s recent deep losses are marking the end of the longest S&P 500 bull market on record, and.

March 12, 2020

Oil prices fell for the second straight day on Thursday amid a broad decline in global markets after the United States banned travel from Europe following the World Health Organization’s decision to declare the coronavirus outbreak a pandemic. The slump.

March 12, 2020

China’s central bank is expected to cut key rates soon, following a directive from a meeting led by the country’s second-in-command, Premier Li Keqiang. Li chaired an executive meeting of China’s highest administrative body, the State Council, on Tuesday. In.

March 12, 2020

Italy has tightened its nationwide lockdown further in response to the rising death toll from coronavirus, ordering all non-essential shops and services to close. Announcing the measures Wednesday evening, Italian Prime Minister Giuseppe Conte said supermarkets and pharmacies will be.