Market Overview - Page 390

March 31, 2020

With the worldwide economic turbulence wrought by the coronavirus crisis and nationally enforced lockdowns across major markets, global growth is set to be pushed toward zero, analysis from S&P Global Ratings predicts. “In response to the ongoing extraordinary impact of.

March 31, 2020

Sweden’s government expects the economy to contract as deeply as it did during the global financial crisis of 2008 as the coronavirus pandemic brings life to a virtual standstill. “The virus outbreak has had a serious impact on economic growth,.

March 31, 2020

Leading United States-based cryptocurrency exchange Coinbase has published a report providing detailed insights into how its users responded to the violent crypto market crash suffered on March 12. While many in mainstream markets were panicking as President Trump’s travel ban.

March 31, 2020

Wet markets in China have reportedly reopened after easing of lockdown measures across several cities. Studies dating back to 2007 have suggested that wet markets and the consumption of bats are a “time bomb” for a coronavirus outbreak. Wild animal.

March 31, 2020

U.S. stock index futures rose on Tuesday at the end of one of Wall Street’s worst first quarters on record, as an unexpected expansion in Chinese factory activity raised hopes of a more stable economic recovery from the coronavirus pandemic..

March 31, 2020

Huawei reported slowing profit growth in 2019 as the U.S. blacklisting the Chinese technology giant weighed on its business. Meanwhile, a top executive at the company told CNBC the impact from the coronavirus on its business is unclear. Revenue for.

March 31, 2020

Oil prices are on pace to register their worst quarterly performance on record, as the coronavirus pandemic continues to crush global demand for crude. A public health crisis has meant countries around the world have effectively had to shut down,.

March 31, 2020

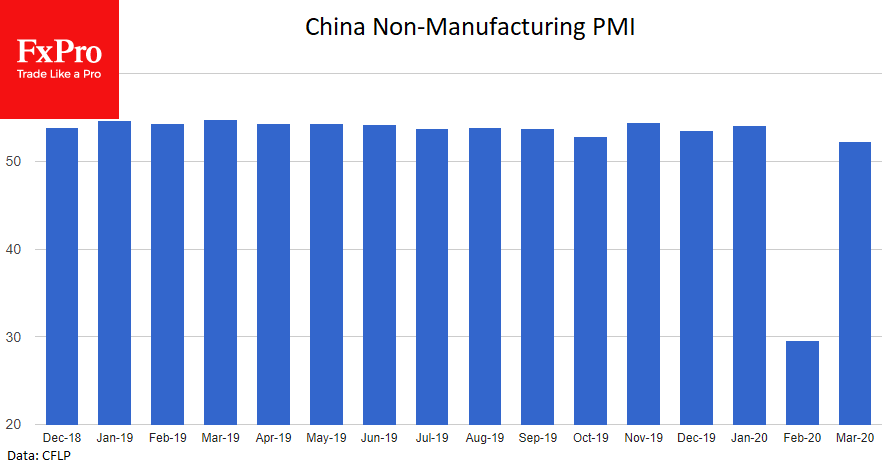

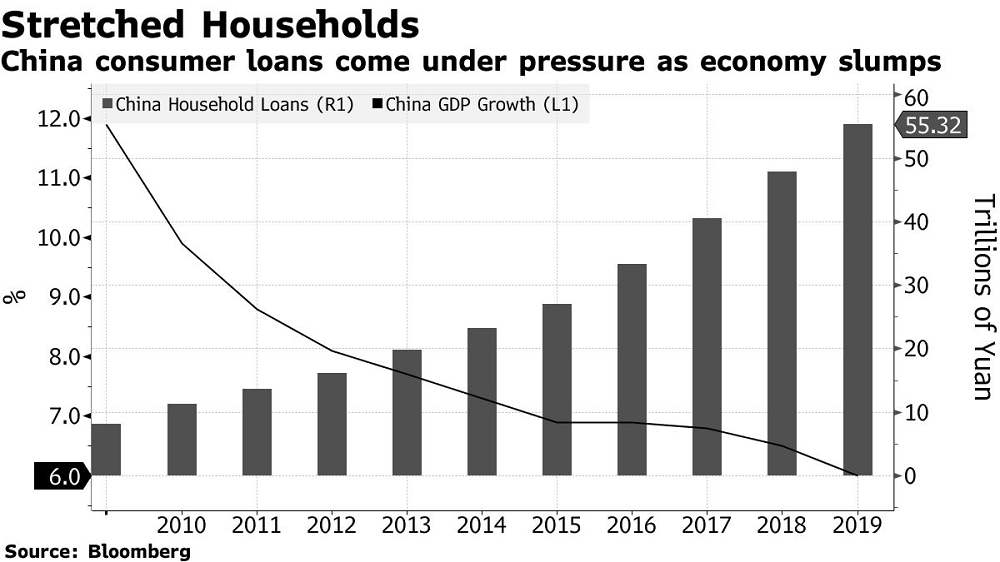

The phrase “Chinese miracle” this year finds a new meaning. First of all, in recent weeks, it is commendable how quickly the Politburo recognized the danger of the situation in Wuhan and managed to contain its spreading across the country..

March 30, 2020

Now that consumers have stocked up on toilet paper, disinfectant wipes and other household necessities, they’re turning their attention to appliances that aid in cooking and health and wellness, experts and retailers say. Small appliance sales grew 8% for the.

March 30, 2020

1. Selling Fatigue Has Kicked In UBS strategists said we are seeing a “selling fatigue” in the markets as investors no longer overreact to bad news. Stock market volatility has finally cooled down after worries about coronavirus pandemic fueled weeks.

March 30, 2020

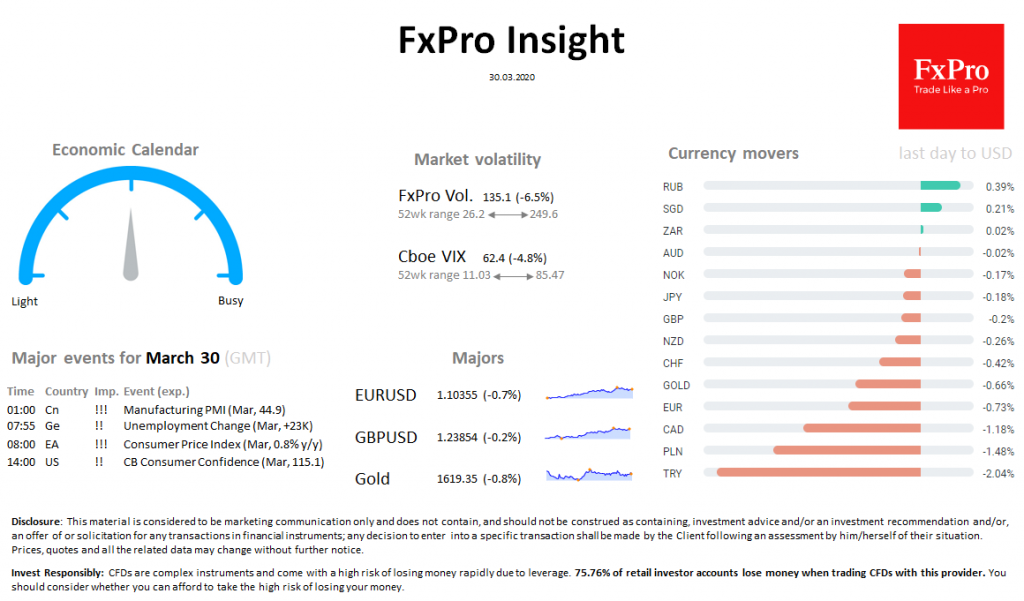

Market overview US markets have added 1.4% since the start of trading on Monday, after falling 3.4% on Friday. Markets balance between news of a slowdown in new infections (positive) and the prospect of more extended quarantine (negative). DXY added.