Market Overview - Page 39

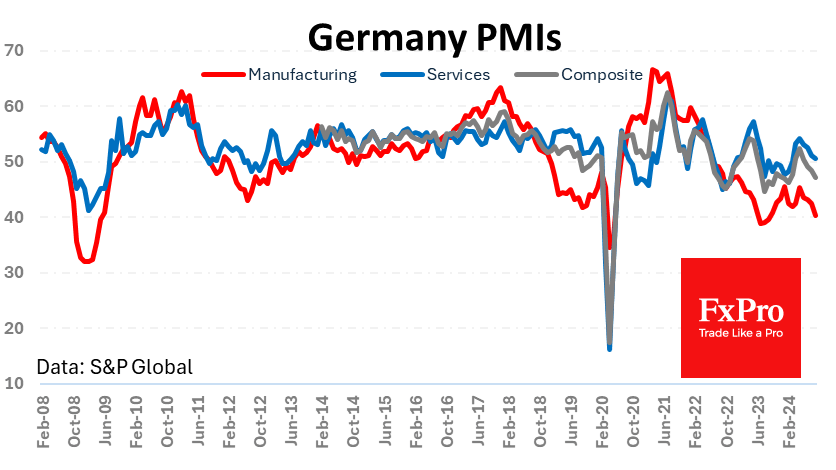

September 30, 2024

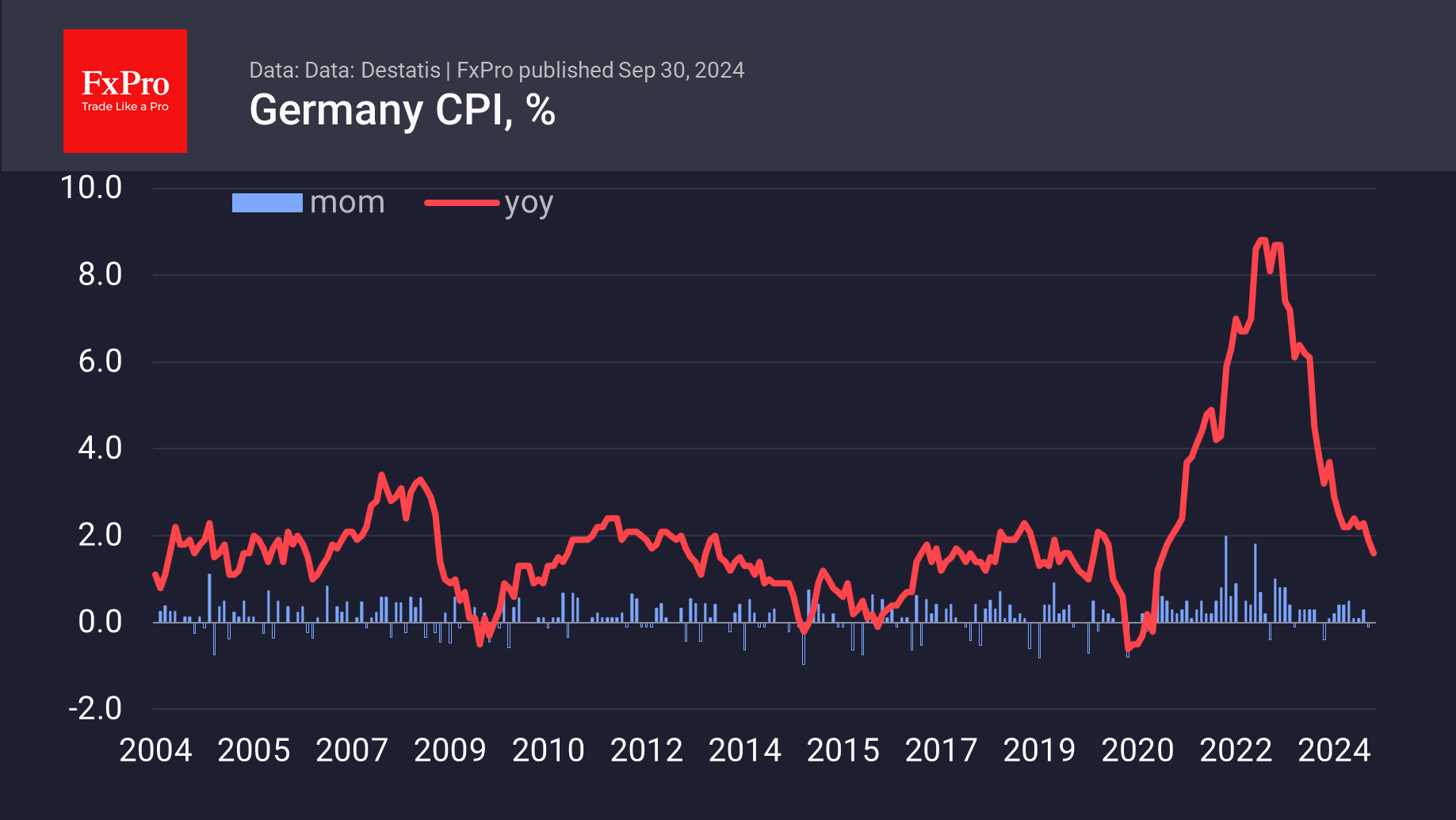

Inflation in Germany and Italy is slowing faster than expected, setting the stage for a slowdown in the eurozone as a whole and clearing the way for further and more aggressive rate cuts. Germany’s consumer price index slowed to 1.6%.

September 30, 2024

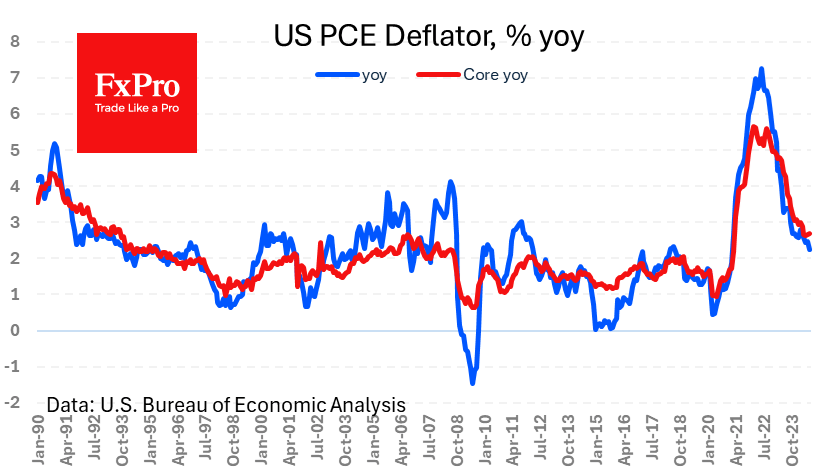

The core US personal consumption price index (the Fed’s preferred inflation gauge) rose slightly less than expected to show inflation at 2.7% y/y. The indicator is above the target of 2% in February 2021 and accelerated with 2.6% in the.

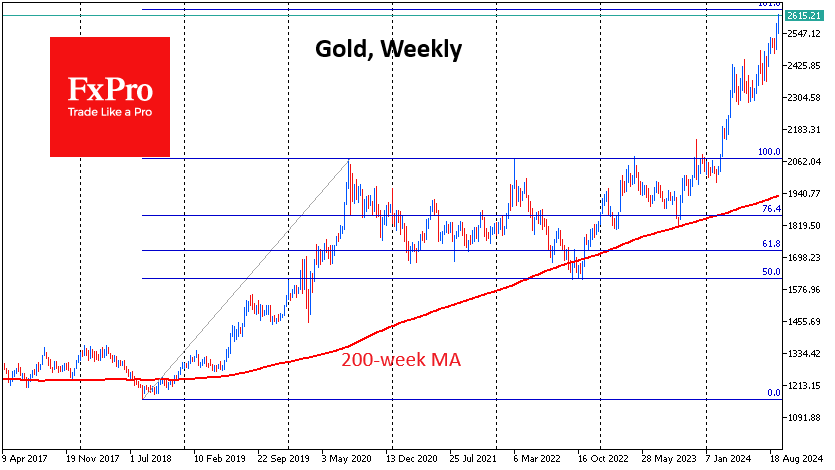

September 27, 2024

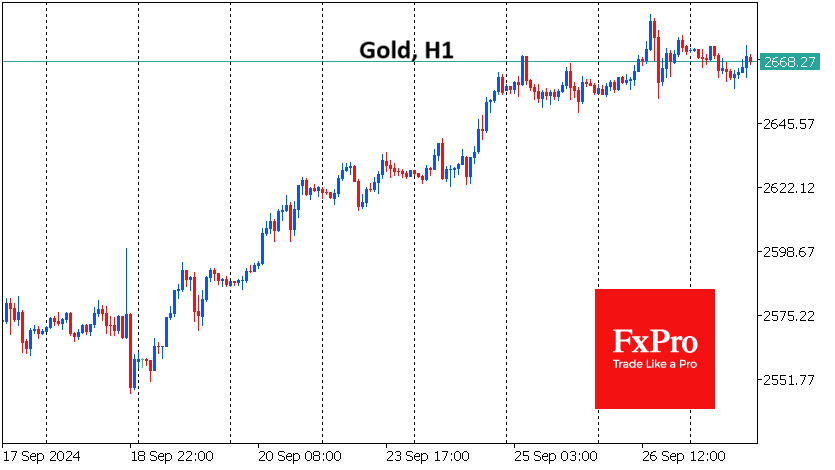

Gold has hit all-time highs on each of the last six trading days, reaching $2685. The price has broken above the 161.8% Fibonacci level and the RSI is close to the 80 level on the weekly timeframe, indicating overbought conditions.

September 26, 2024

Saudi Arabia plans to abandon the $100 per barrel price target and increase production, which is reminiscent of events in 2020. Technically, Brent is testing support at $70 and a break below this level could trigger a free-fall, although a rebound is also possible.

September 26, 2024

The Swiss National Bank met expectations by cutting its key interest rate by 0.25 percentage points to 1.0%, slowing the pace of the move to normalisation after two cuts of 0.50 percentage points each in March and June. The central.

September 25, 2024

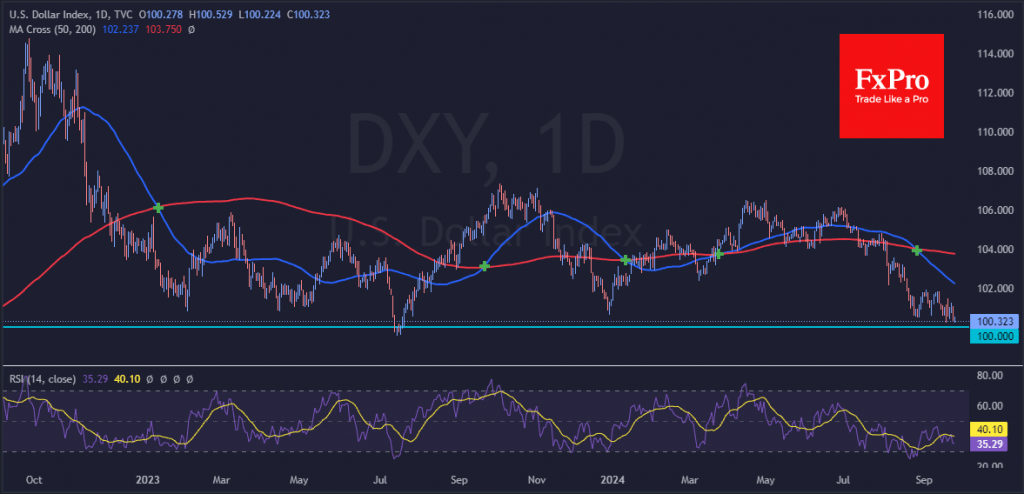

The Dollar Index (DXY) is rising after dipping below the 100 level, attracting buyers but failing to reverse the trend. The index has fallen below its 200-week moving average, historically followed by significant declines.

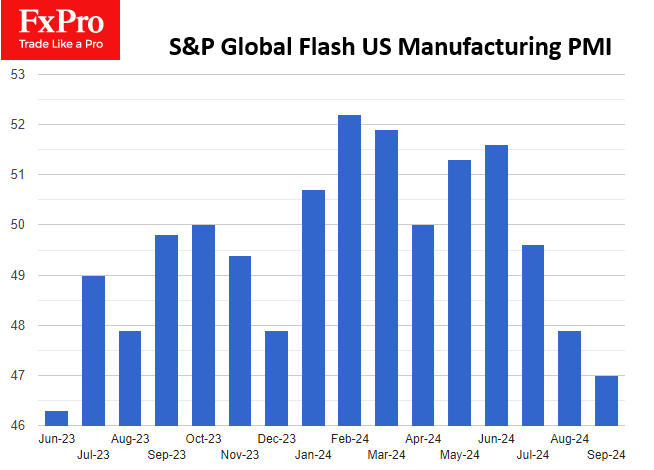

September 24, 2024

The US manufacturing PMI fell to 47.0 in September. The services sector remains a solid driver of the economy with a PMI of 55.4.

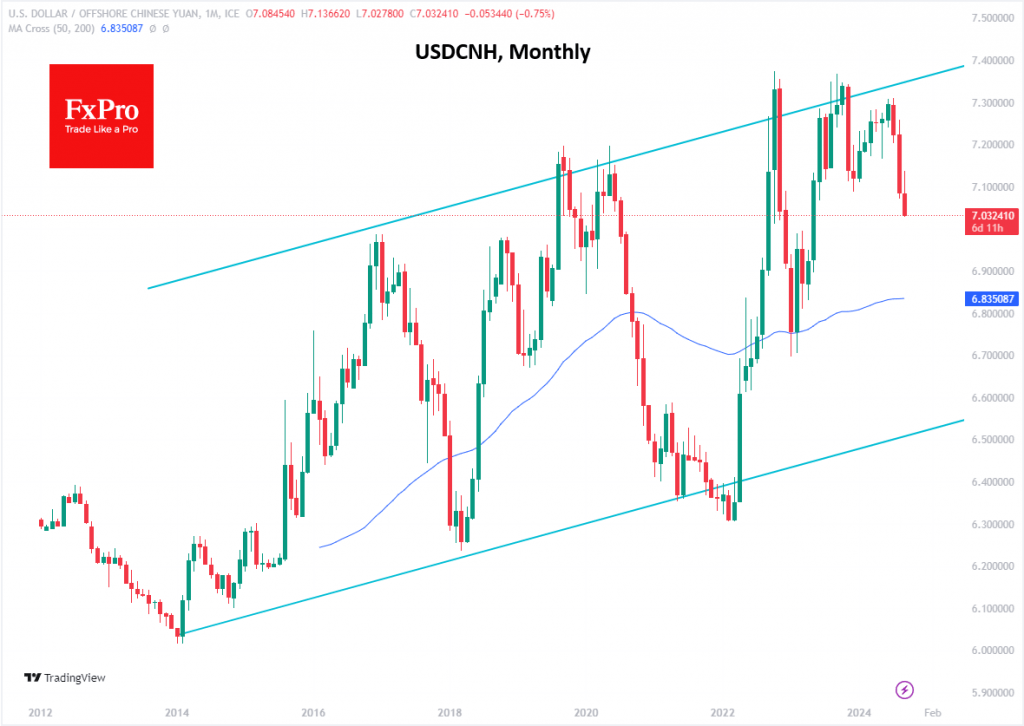

September 24, 2024

China announced a cut in key interest rates and reserve ratios, freeing up 1 trillion yuan ($142bn) and reducing the burden of mortgage payments. These measures are aimed at accelerating the economy and preventing it from slowing down.

September 23, 2024

Preliminary Eurozone PMI estimates came in weaker than expected, sending EURUSD down 0.67% within an hour and increasing pressure on the ECB to continue easing monetary policy. The PMI weakness pushed the EURUSD below 1.11 for the second time in a month.

September 20, 2024

Gold started the week with new highs and ended the week up 1.3%, despite a 2% dip on profit-taking following the Fed's rate decision. The wildest part of the rally may be ahead with a massive short squeeze, but traders should be on the lookout for signs of growth exhaustion.

September 19, 2024

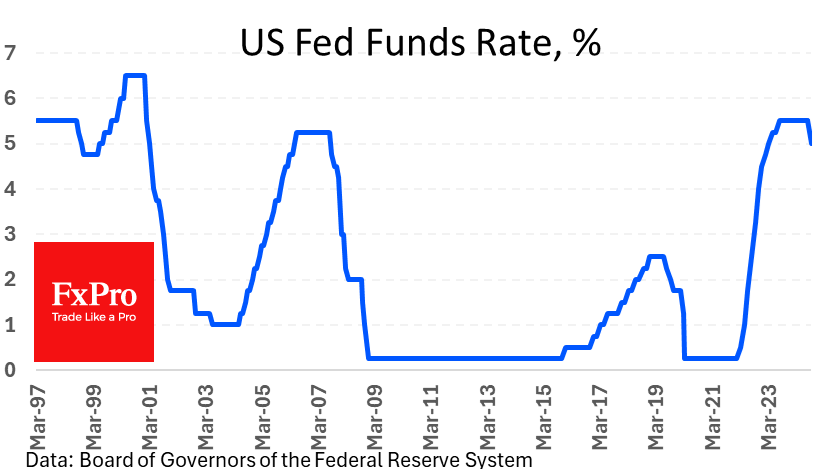

The Fed cut the rate by 50 bps, This change was not fully factored into expectations, so it has the potential to trigger a prolonged market revaluation and change the rules of the game for the USD.

September 18, 2024

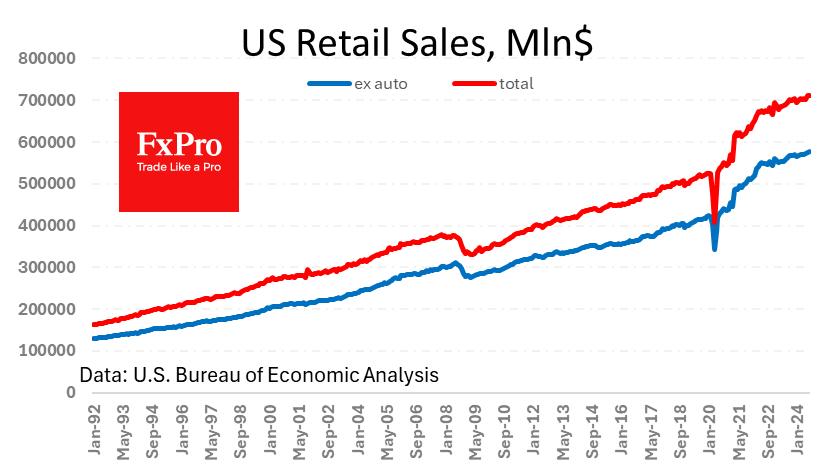

US retail sales rose 0.1% m/m in August, better than forecast, but sales growth in monetary terms slowed to 2.2% y/y. The industrial production index also rose by 0.9%, reversing two months of declines. Despite the strong economic data, markets regained confidence in a 50bp Fed rate cut.