Market Overview - Page 373

April 29, 2020

The world is facing its biggest health crisis in decades but one of the world’s most promising technologies — artificial intelligence (AI) – isn’t playing the major role some may have hoped for. Renowned AI labs at the likes of.

April 29, 2020

Oil prices jumped in the afternoon of Asian trading hours on Wednesday following a report that showed a smaller than expected crude inventory build stateside. West Texas Intermediate for June delivery surged 14.75% to $14.16 per barrel. International benchmark Brent.

April 28, 2020

The economy could take one to two years to rebound to full strength and the Federal Reserve and Congress, having already committed historic sums to fight the coronavirus pandemic, will have to commit trillions more, according to respondents to the.

April 28, 2020

Optimism had just returned to Greece after 10 years of severe financial difficulty, some civil unrest and gloomy economic prospects. But the global pandemic is now making Greeks even more concerned about their futures. “I do expect to be(come) unemployed,”.

April 28, 2020

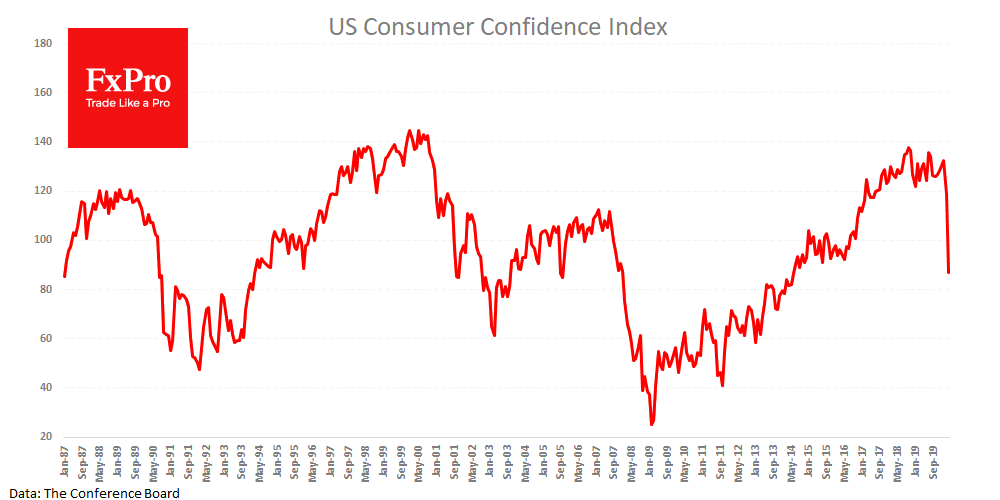

The US consumer confidence index fell to 86.9 in April from 118.8 a month earlier. Although this is the sharpest drop in the indicator in history, the index remained at comfortably high levels. It was steadily lower from the beginning.

April 28, 2020

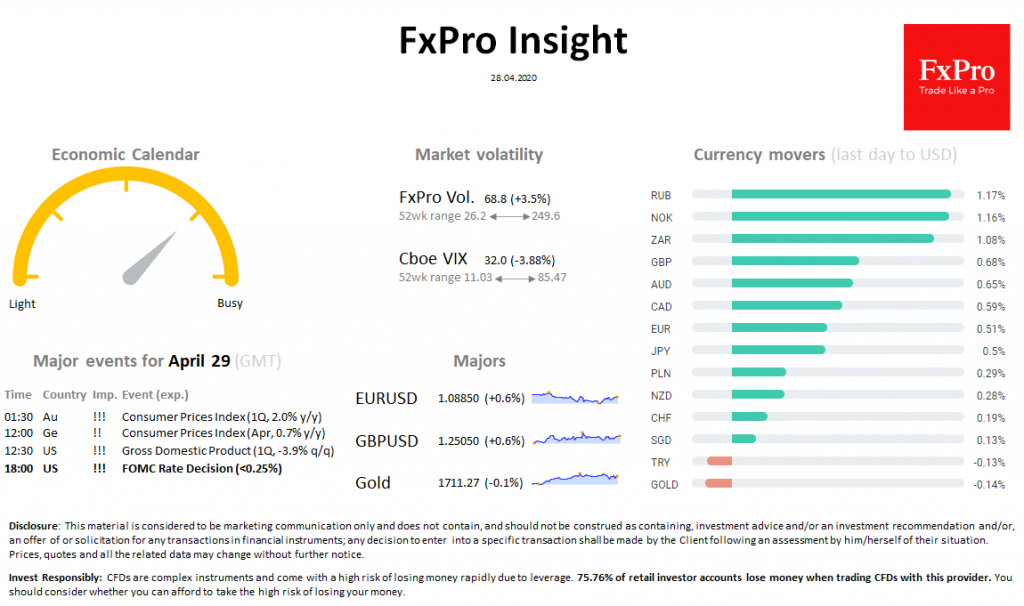

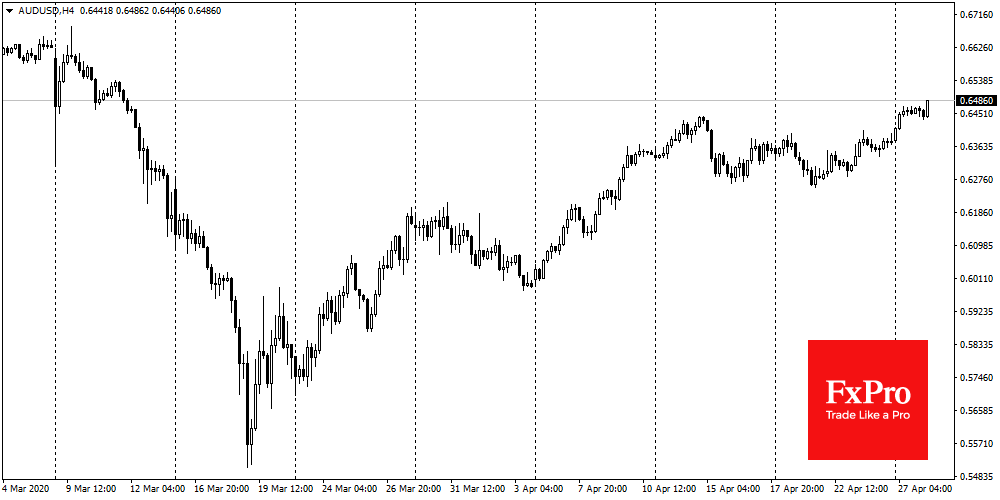

Market overview Futures on the SP500 added 1.4% before the start of the New York trading session after rising 1.4% a day earlier. Positive dynamics is ensured by a decrease in the number of daily new infected and the gradual.

April 28, 2020

Chinese scientists say the novel coronavirus will not be eradicated, adding to a growing consensus around the world that the pathogen will likely return in waves like the flu. It’s unlikely the new virus will disappear the way its close.

April 28, 2020

A major Bitcoin whale has implied that the upcoming halving is already priced in and BTC price can crash after the reward reduction. The third Bitcoin (BTC) block reward halving is set to occur in 14 days and this event.

April 28, 2020

Oil prices plunged for a second day in a row on Tuesday on concerns about dwindling global capacity to store more crude and fears that demand may be slow to recover even after countries ease restrictions to combat the coronavirus.

April 28, 2020

Most Asian shares made gains while U.S. stock futures fell on Tuesday amid choppy trade as a renewed decline in oil prices partially offset optimism about the easing of coronavirus-related restrictions. MSCI’s broadest index of Asia-Pacific shares outside Japan was.

April 28, 2020

The world markets started trading session on Tuesday with a dive into the red zone. However, they managed to return to growth in the wake of news about the spread of coronavirus. Growth in the number of cases on April.