Market Overview - Page 351

June 5, 2020

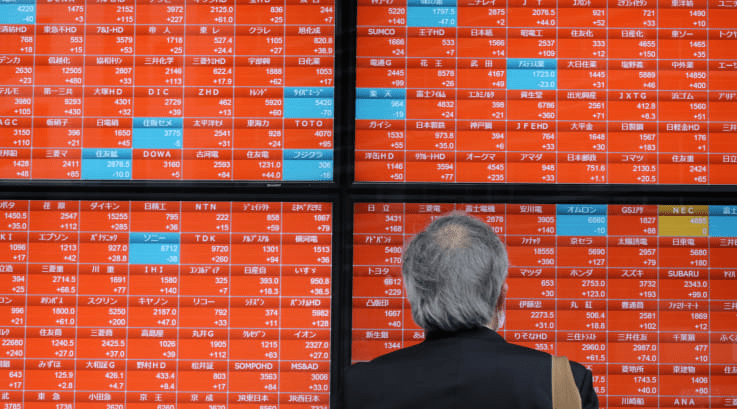

Major markets in Asia Pacific have bounced back strongly following a historic period of volatility and uncertainty in March, as the world grappled with a rapidly spreading coronavirus pandemic that left many economies on pause as lockdown measures were put.

June 4, 2020

The European Central Bank intensified its response to the “unprecedented contraction” facing the euro area with a bigger-than-anticipated increase to its emergency bond-buying program. President Christine Lagarde and her colleagues decided to expand purchases by 600 billion euros ($675 billion).

June 4, 2020

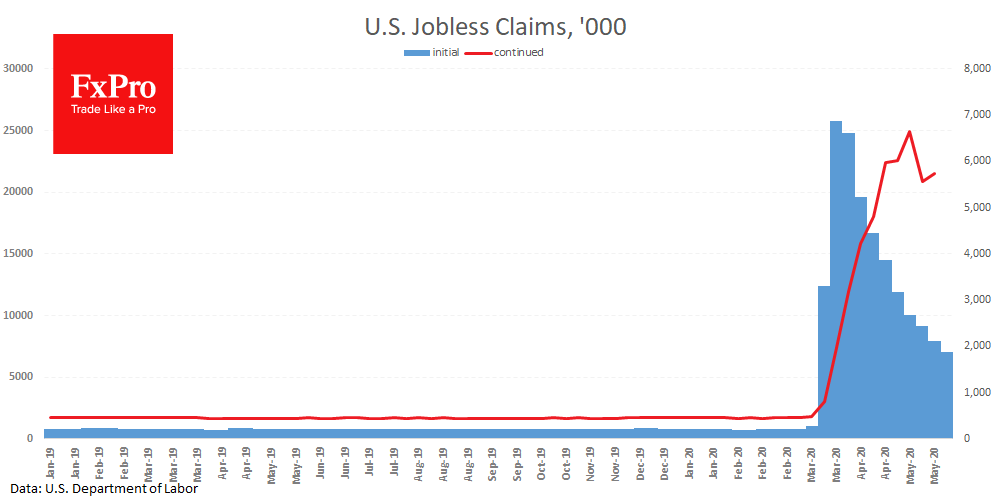

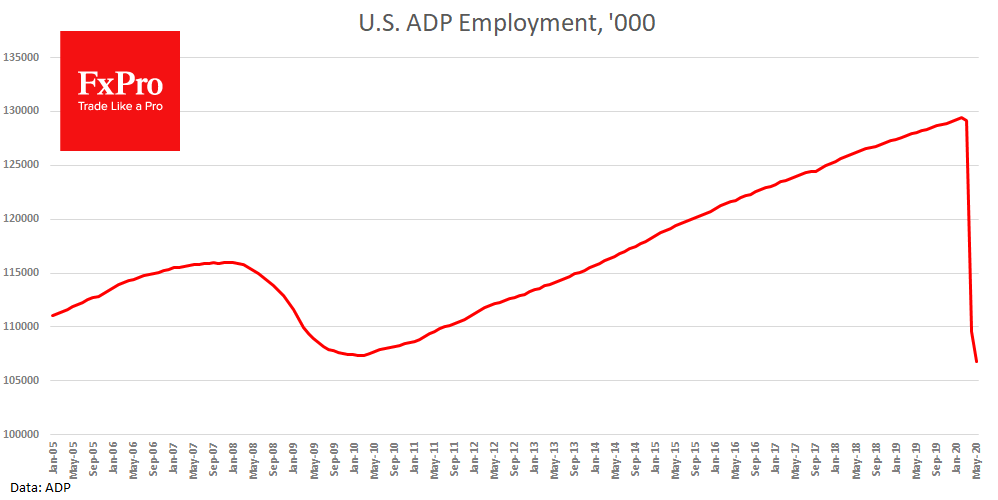

As business reopenings picked up nationwide, Americans filed nearly 2 million applications for unemployment benefits last week, reflecting a slowing — though far from a halt — in job losses. Initial jobless claims for regular state programs totaled 1.88 million.

June 4, 2020

The ECB has expanded the package of support measures by 600B euro (750B expected) to 1350B. The deadline for the implementation of this program has been postponed, at least until June 2021. The remaining parameters of the monetary policy are.

June 4, 2020

Battered by crisis after crisis, President Donald Trump appears to be in political peril as never before. Since taking office in 2017, Trump has weathered storm after storm, always emerging with a fighting chance at being re-elected. After he survived.

June 4, 2020

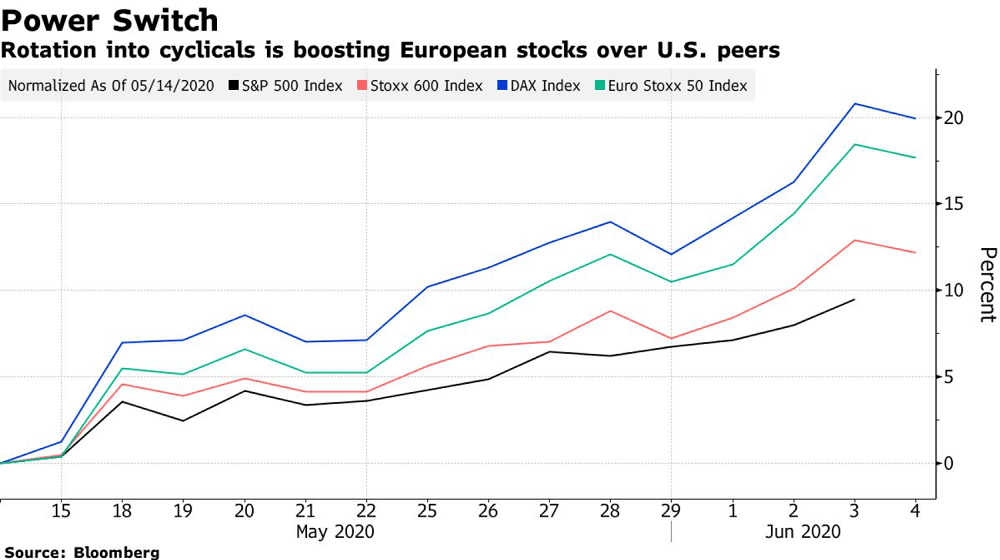

In a switch from the longer-term trend, European equities are beating their U.S. peers in the latest leg of the rebound. Boosted by a strong outperformance of cyclical shares on bets of a swift economic recovery and after a string.

June 4, 2020

Just recently Russia’s State Duma released a draft of proposed litigation toward cryptocurrencies and companies that deal with the technology. The draft called “On Digital Financial Assets,” is an updated version on how lawmakers might regulate the crypto industry in.

June 4, 2020

As oil and gas companies began shutting offshore production before the first tropical storm of the season in the U.S. Gulf of Mexico, experts said restarting wells and refineries will take longer and prove more costly this year because of.

June 4, 2020

The bond market has caught a tiny bit of the stock market’s optimism, and it’s selling off on the idea that the economy may have hit rock bottom in April. Bond yields, which move opposite price, have been edging up,.

June 4, 2020

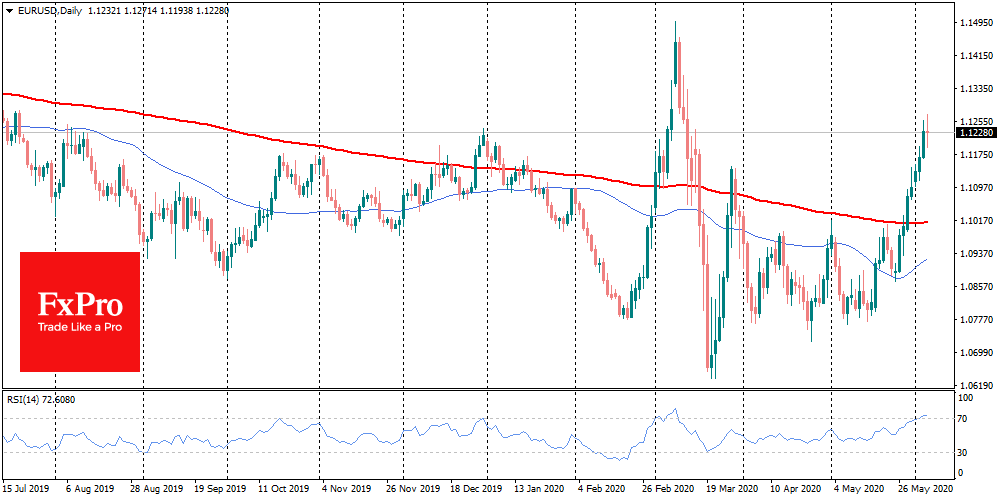

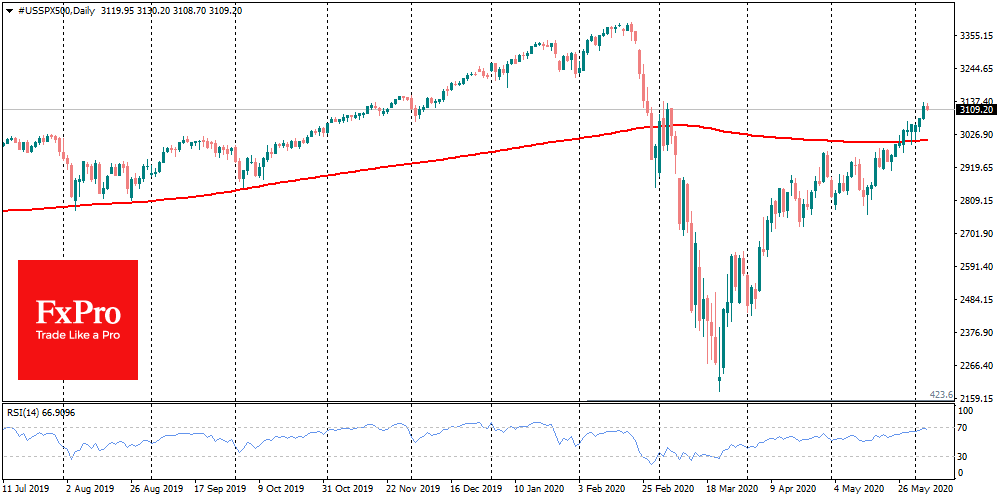

On Thursday morning, markets paused the impressive growth of stock indices the day before. The S&P 500 added 1.4% to 3115, which is in line with March’s high and only 7.8% below its historical highs. The German DAX was 10%.

June 3, 2020

The European Central Bank (ECB) is expected to increase its coronavirus crisis asset-purchase program at this week’s meeting, amid fears of falling inflation and the steepest economic contraction since World War II for the euro zone. In March, the ECB.