Market Overview - Page 347

June 12, 2020

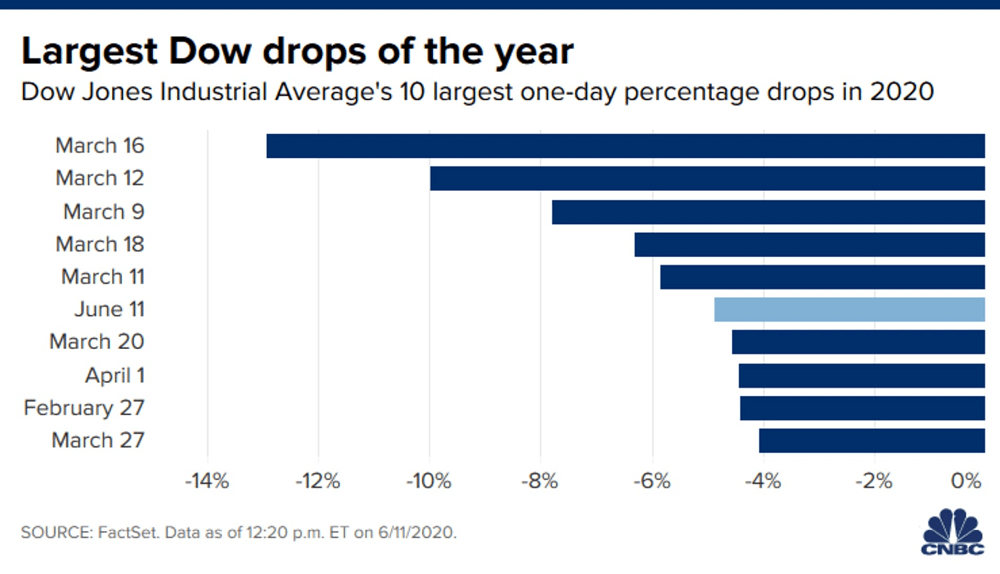

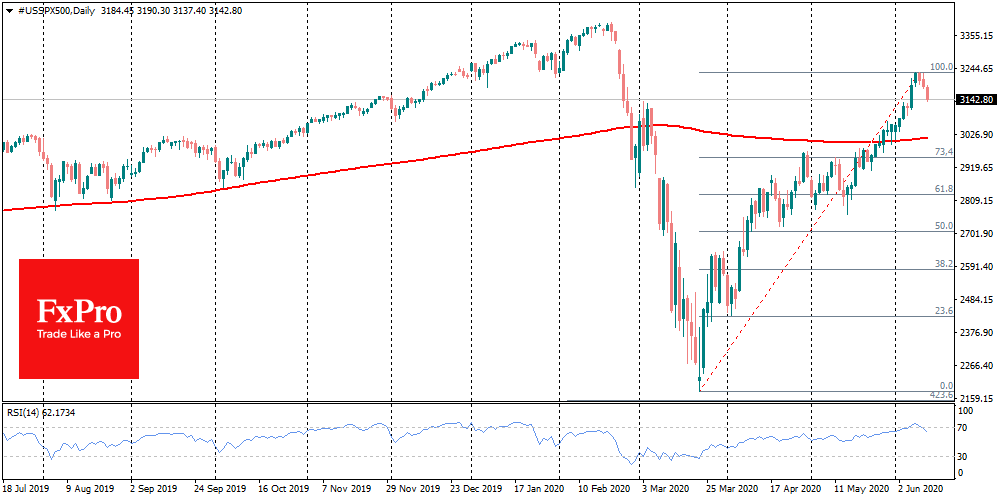

Stock indices are recovering some of their losses after a powerful sale the day before, comparable to what we saw in mid-March. On Thursday Dow Jones lost 6.9%, S&P 500 collapsed by 5.9%, Nasdaq dropped by 4.6%. The trigger was.

June 11, 2020

Debt surged and household net worth tumbled in the first three months of the year as the initial impact of the coronavirus pandemic hit, according to Federal Reserve data released Thursday. Total domestic nonfinancial debt jumped by 11.7% to $55.9.

June 11, 2020

The Dow Jones Industrial Average plunged more than 1,500 points on Thursday and was on pace for its worst day since the March sell-off as coronavirus cases increased in some states that are reopening up from lockdowns. Shares that have.

June 11, 2020

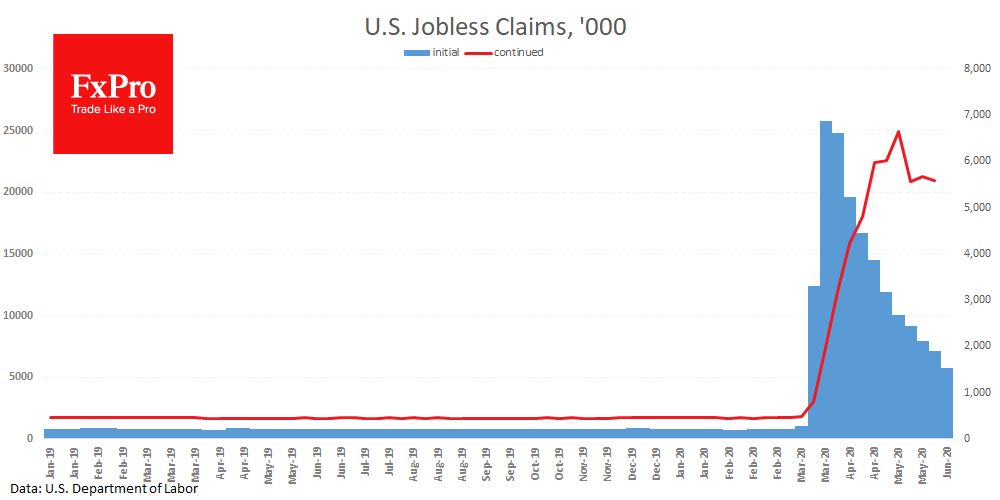

Last week, the US initial jobless claims amounted for 1.54M people (near expectations). The number of continued claims amounted to 20.9M, which is significantly worse than the expected 20M. The continuous decrease in the number of initial applications for benefits.

June 11, 2020

Today the value of Tesla stock set a new record high at $1,027, bringing the market capitalization to $188 billion, and also surpassing the total market cap of Bitcoin (BTC), which hovers at $181 billion. While the value of Tesla.

June 11, 2020

The Japanese yen and the Swiss franc gained on Thursday as expectations that the global economy will recover swiftly from the coronavirus pandemic took a beating after a U.S. central bank policy meeting. The Federal Reserve signaled it plans years.

June 11, 2020

Layoffs in the United States are abating, but millions who lost their jobs because of COVID-19 continue to draw unemployment benefits, suggesting the labor market could take years to heal from the pandemic even as businesses resume hiring workers. The.

June 11, 2020

Stock futures fell in early morning trading on Thursday as investors evaluate the pace of economic recovery and the coronavirus developments. Futures on the Dow Jones Industrial Average fell 616 points, implying a Thursday opening drop of around 630 points..

June 11, 2020

The number of confirmed coronavirus cases in Russia surpassed 500,000 on Thursday, and the rate of new daily cases remains high, but restrictions are being lifted quickly ahead of key political events. Experts say Russia is keen to lift unpopular.

June 11, 2020

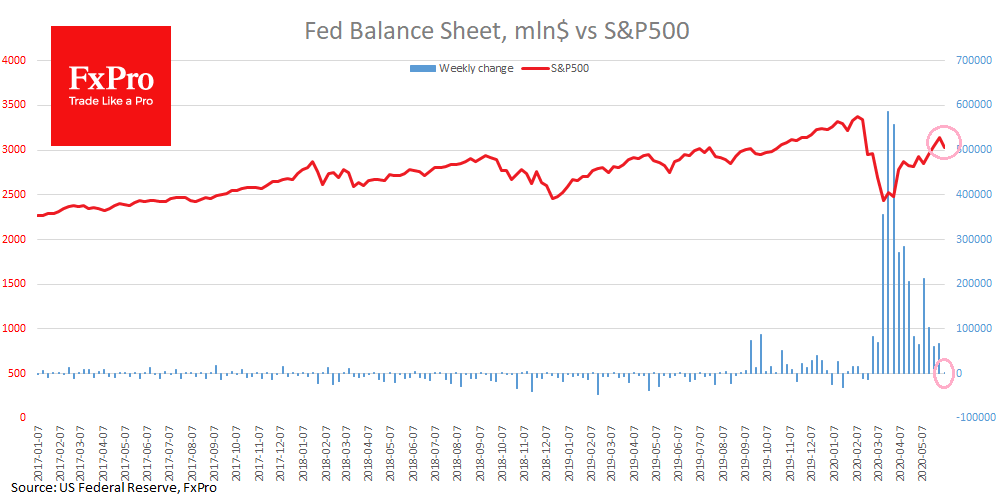

On Thursday morning, financial markets saw an increasing demand for safe assets. Investors seem to be taking profits on an increasingly wide range of assets. American Nasdaq fell back to 10,000, losing 1.5% of its peak levels after the Fed.

June 11, 2020

U.S. pressure on Chinese stocks looks set to accelerate the growth of capital markets in Hong Kong and mainland China, as investors remain intent on chasing opportunities in the world’s second-largest economy. Congress is mulling a new law that could.