Market Overview - Page 345

June 16, 2020

The International Energy Agency said on Tuesday that it expects the fall in oil demand this year to be the largest in history, but believes there are signs the market could reach “a more stable footing” over the coming months..

June 16, 2020

The number of people on British company payrolls fell by more than 600,000 in April and May as the coronavirus lockdown hit the labour market, and vacancies plunged by the most on record, official data showed on Tuesday. The jobless.

June 16, 2020

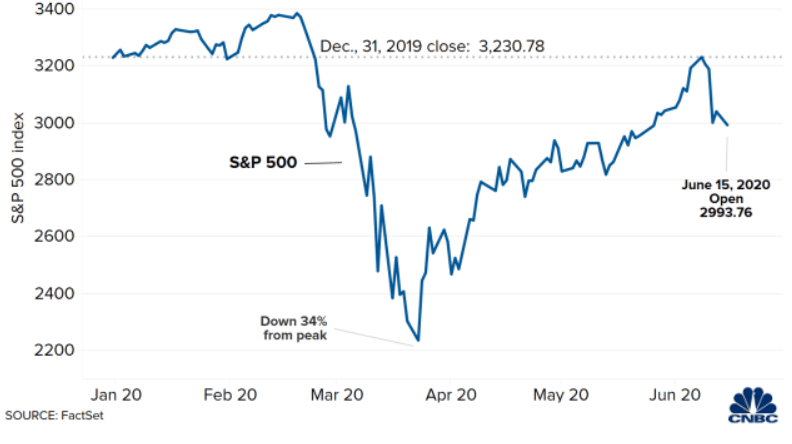

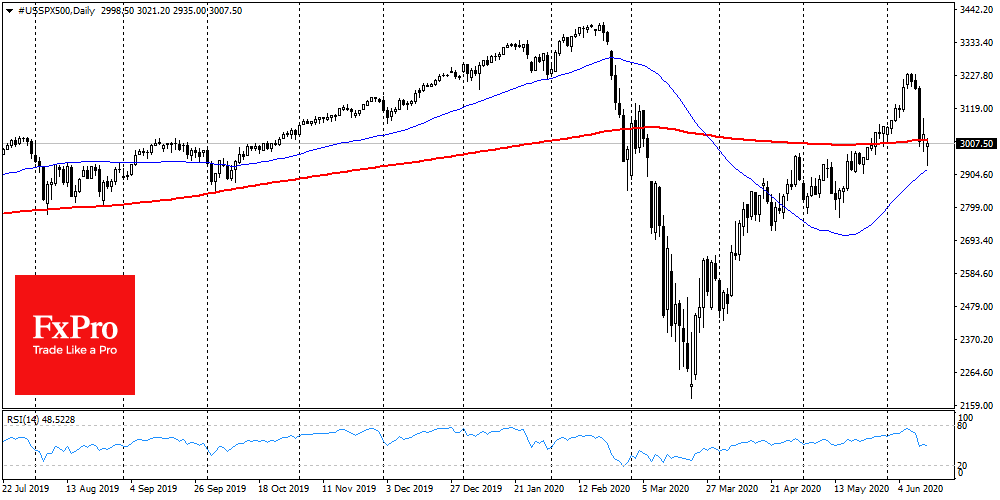

The S&P 500 plunged 6% last Thursday as investors fretted the possibility of a second wave of infections. But analysts are still bullish about the U.S. stock market. Morgan Stanley is confident that the recovery from the pandemic will be.

June 16, 2020

The markets managed to return to growth thanks to the Fed’s announcement to start buying corporate bonds (previously, only ETFs). At the beginning of the program, the central bank made deals on higher volumes, and then gradually reduced them. Thus,.

June 16, 2020

Futures contracts tied to the major U.S. stock indexes rose early Tuesday morning as a Bloomberg report said President Donald Trump’s administration is preparing a $1 trillion infrastructure proposal. Dow Jones Industrial Average futures rose 503 points, suggesting an open.

June 16, 2020

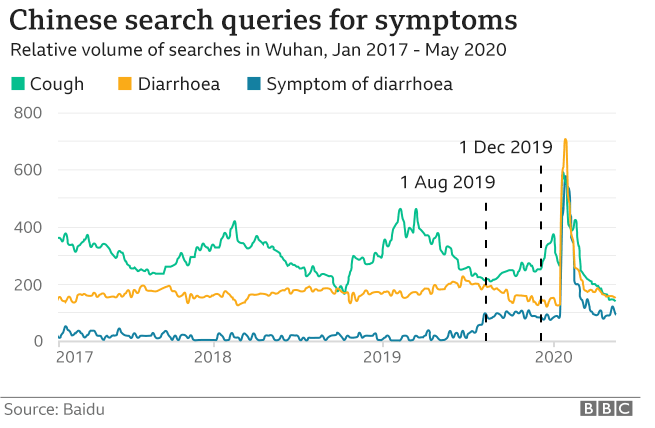

There’s been criticism of a study from the US suggesting that the coronavirus could have been present in the Chinese city of Wuhan as early as August last year. The study by Harvard University, which gained significant publicity when it.

June 15, 2020

The global economy is in a new expansion cycle and output will return to pre-coronavirus crisis levels by the fourth quarter, according to Morgan Stanley economists. “We have greater confidence in our call for a V-shaped recovery, given recent upside.

June 15, 2020

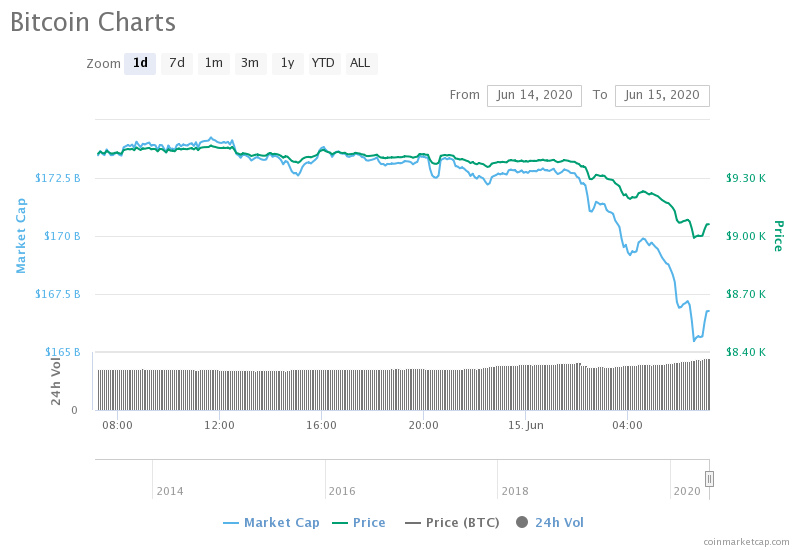

With markets declining over a weekend of protests and rising Covid-19 cases in reopened states, one would expect a few assets to be holding up well. One of those assets should be gold. But as with stocks in general and.

June 15, 2020

The S & P500 index managed to reverse the pressure of the bears, formed on fears of the second wave of the spread of coronavirus, within the day. Futures on the S & P500 within the day lost more than.

June 15, 2020

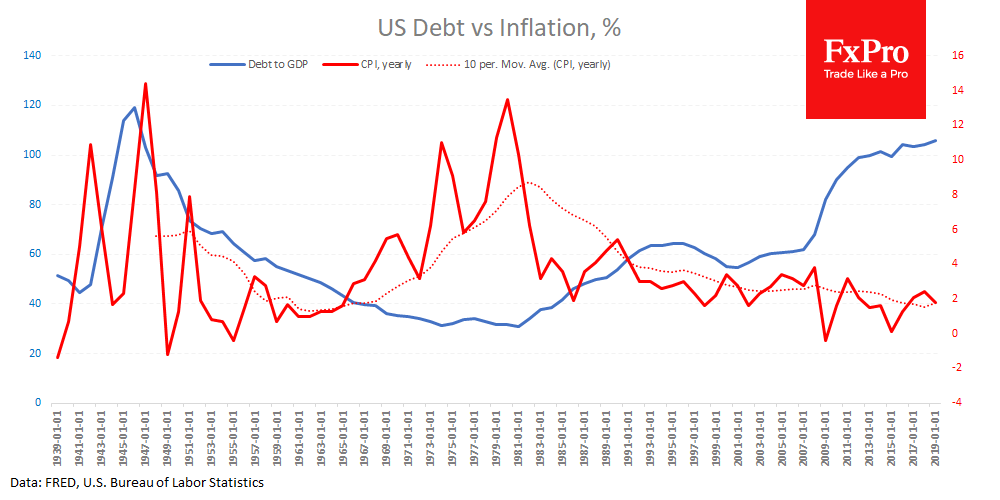

The German government will request authorization from parliament to raise a further 62 billion euros ($70 billion) in debt to help pay for its massive stimulus program, according to two people with direct knowledge of the plan. That would bring.

June 15, 2020

Stock Market-Boosting Stimulus Will Start To FadeThe U.S. consumer has been the epicenter of pandemic stimulus payments. The American economy is heavily dependent on consumer spending, so lawmakers are focused on keeping consumers strong. The belief that U.S. consumers will.