Market Overview - Page 342

June 22, 2020

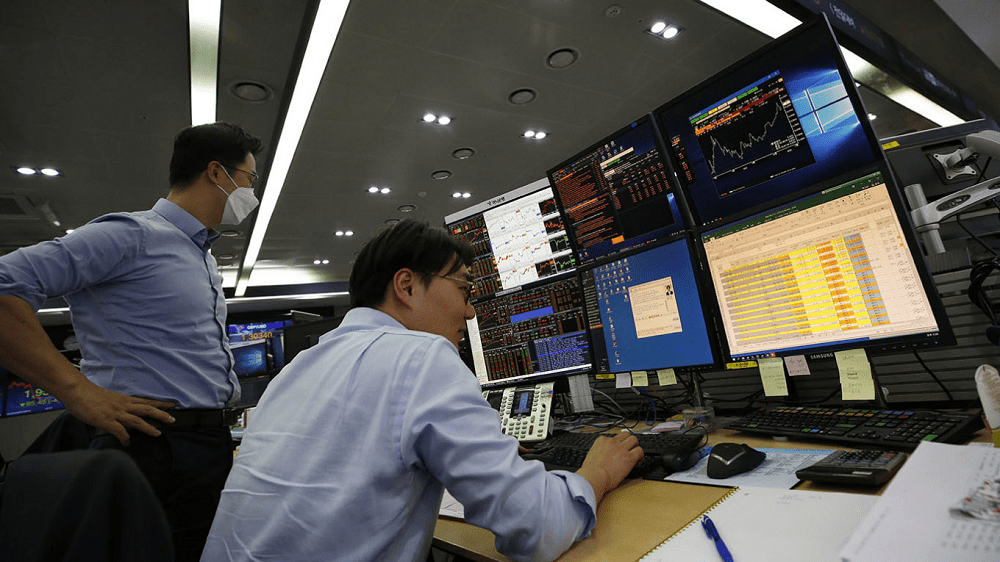

The currency markets are currently facing “multiple cross-currents” amid fears over a potential second wave of coronavirus cases in the world, said Deutsche Bank’s Sameer Goel, who is chief Asia macro strategist. A “big question” for investors right now over.

June 22, 2020

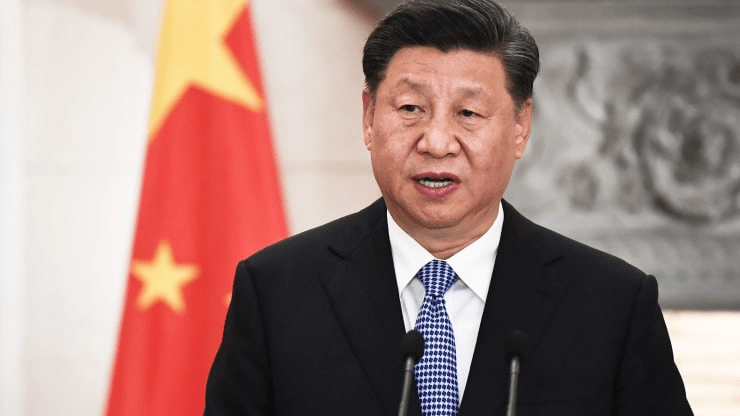

A major plan that will form part of China’s global technology push has been dubbed as hype and will face a number of challenges, a technology industry body told CNBC. China Standards 2035 is an ambitious 15-year blueprint that Beijing.

June 22, 2020

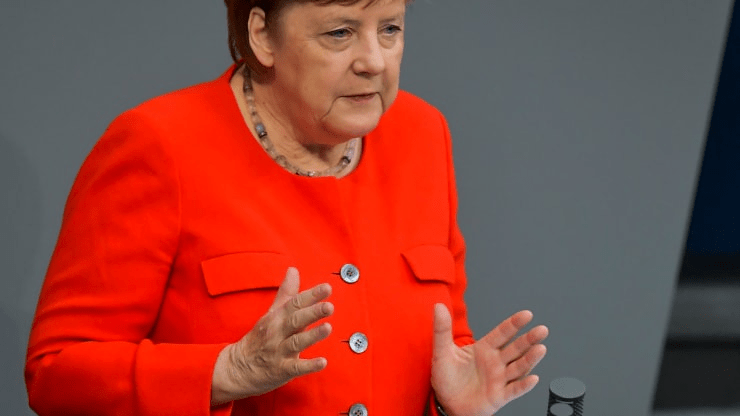

A surge in coronavirus cases in the U.S. and Brazil, and further outbreaks in Germany — where the reproduction rate of the disease has risen substantially — are concerning global health experts, but international financial markets don’t seem too worried..

June 22, 2020

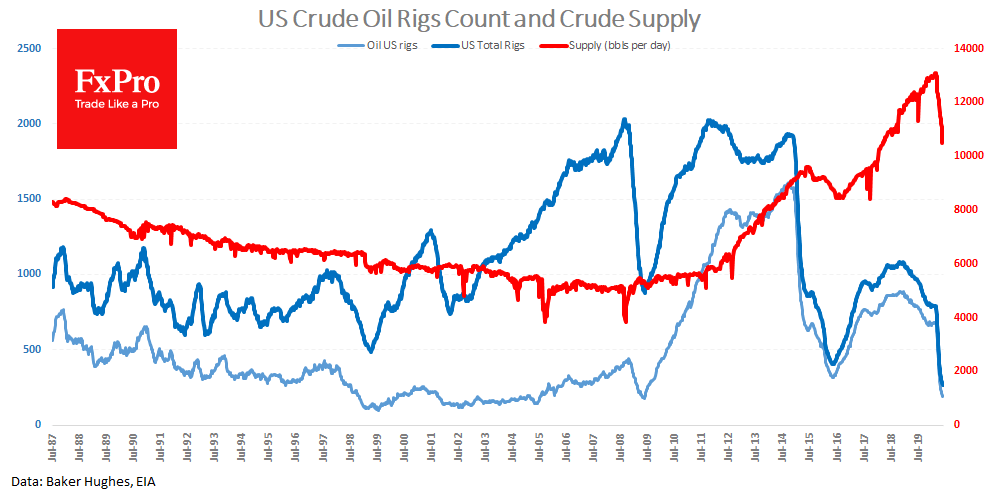

American companies continue to cut production and drilling activity despite the growth in oil prices. The data published on Friday showed that the number of oil rigs fell to 189 (-10 per week). The situation now indicates the end of.

June 19, 2020

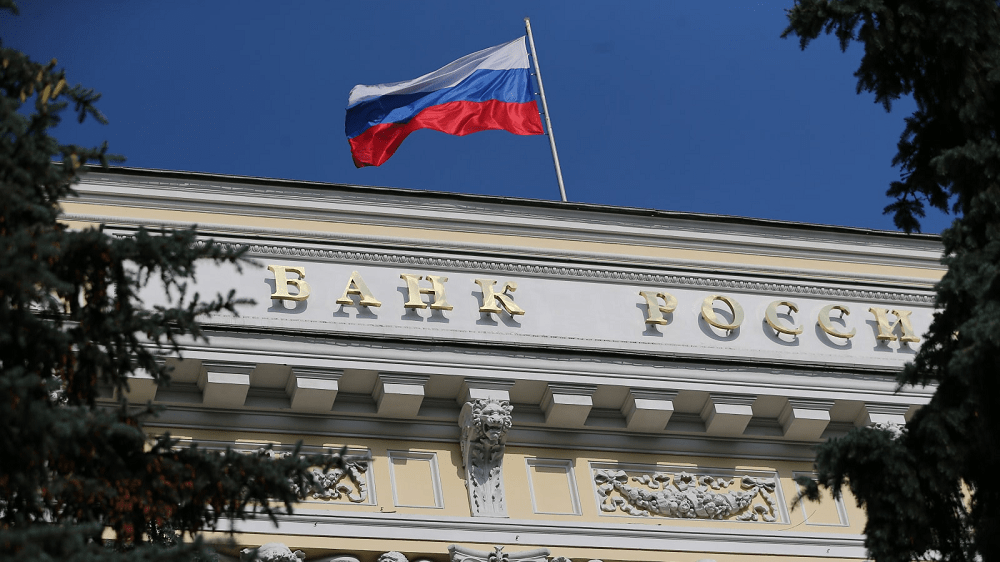

The Central Bank of Russia on Friday cut interest rates by 100 basis points to 4.5%, their lowest level since the fall of the Soviet Union, as it looks to shore up an economy reeling from the impact of the.

June 19, 2020

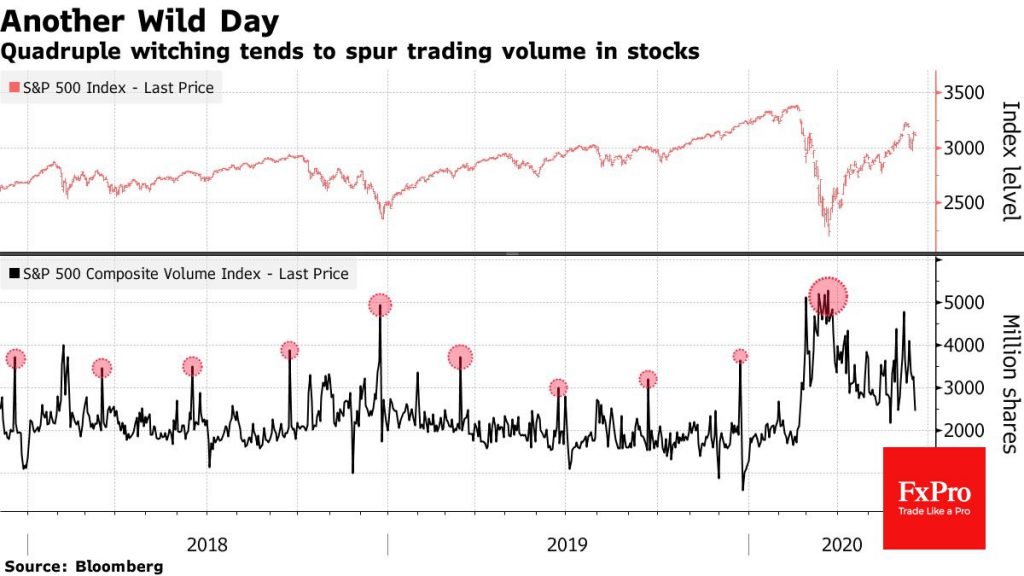

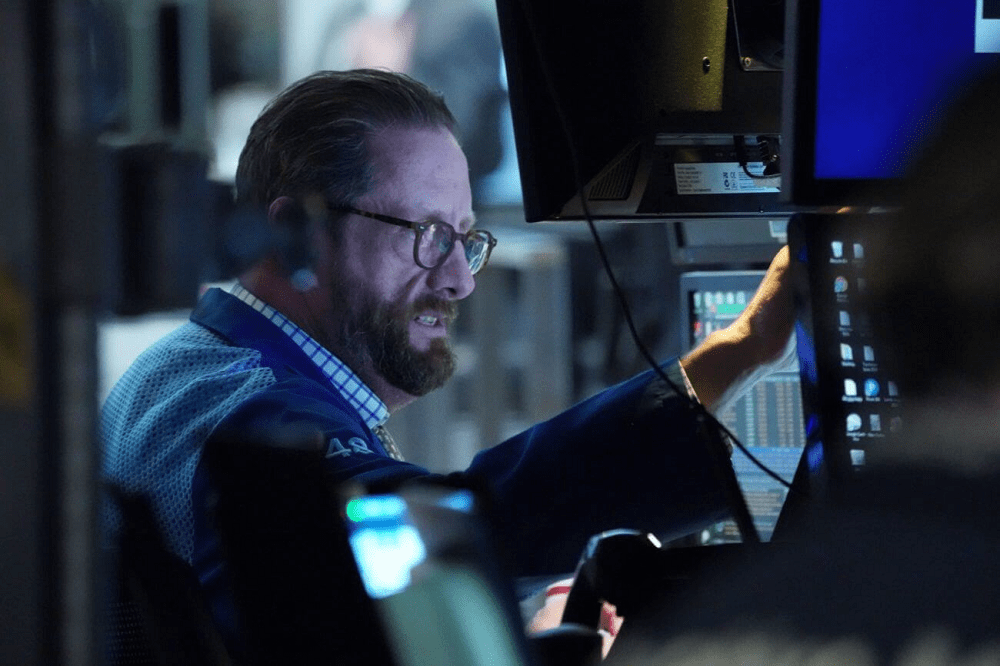

This Friday may be very turbulent for stock markets on the so-called Quadruple witching day. There are four such days a year when market participants switch from expiring futures and options to individual stocks contracts and futures and options on.

June 19, 2020

The Dow Jones slipped again on Thursday. A quiet day of trade showed bulls struggling to lift the index higher. Another weak initial jobless claims release was little help to the Dow, as economists continue to stress that the unemployment.

June 19, 2020

Emerging market stocks were set for weekly gains on Friday as investors looked to monetary stimulus to fuel a post-coronavirus recovery, while markets awaited a Russian central bank meeting at which a cut in interest rates is widely anticipated. The.

June 19, 2020

China’s Center for Information and Industry Development, or CCID, revealed on June 18 that its 18th CCID Global Public Chain Technology Evaluation Index. This index ranked 37 well-known global cryptos using technical specifications. According to the table published by local.

June 19, 2020

Asian shares and U.S. stock futures teetered in choppy trade on Friday as lingering concerns about an fresh spike in coronavirus cases offset growing hopes for a quick economic recovery. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.1%..

June 19, 2020

The 27 European governments are negotiating for the first time Friday a proposal for 750 billion euros ($841 billion) to tackle the Covid-19 crisis. However, the new stimulus plan has sparked division among EU countries and it is unclear when.