Market Overview - Page 303

August 26, 2020

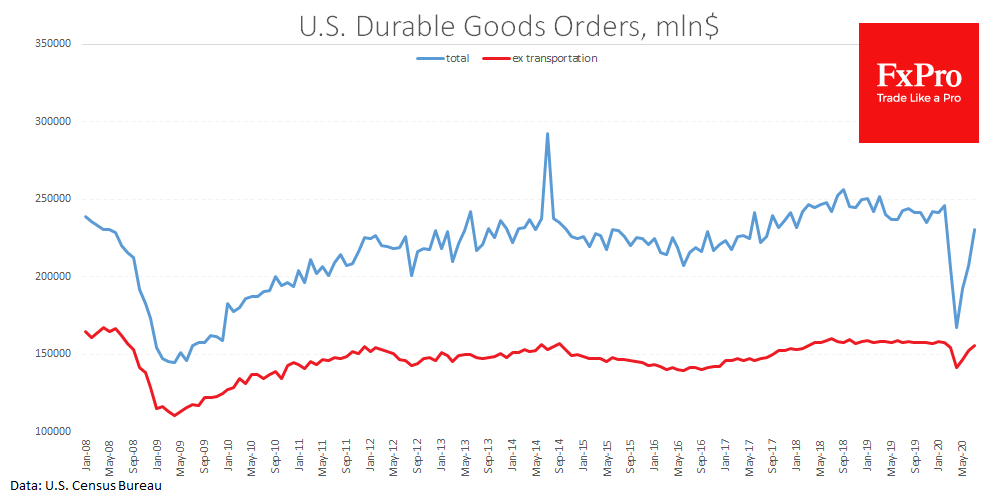

Orders for durable goods in the US significantly exceeded expectations in July. The latest Census Bureau report showed an 11.2% jump last month vs 7.7% a month earlier and 4.4% expected. The increase in orders over the last three months.

August 26, 2020

U.S. equity futures wavered as investors reviewed expectations for loose monetary policy and mulled the pace of recent gains. Treasuries and European government bonds declined. S&P 500 futures fluctuated after the index closed at a record high on Tuesday. Software.

August 26, 2020

Despite DeFi’s meteoric growth, only half a dozen projects represent more than 90% of the capital locked in the sector. The total value of capital locked in decentralized finance protocols has increased 271% in less than two months to surpass.

August 26, 2020

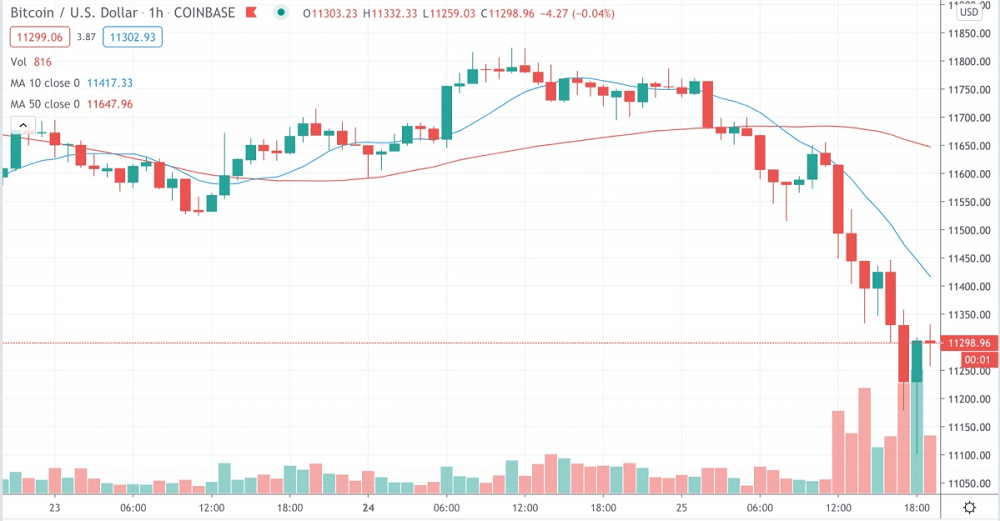

Bitcoin’s price declined to as low as $11,102 on spot exchanges such as Coinbase Tuesday, wiping out long derivatives traders on BitMEX. In just one hour, up to $5.6 million in leveraged positions were automatically liquidated, the crypto analog to.

August 26, 2020

The U.S. stock market is climbing upwards on positive earnings. Strategists say that the markets might be entering a “euphoria” phase. The U.S. stock market marches forward with strong momentum buoyed by optimistic earnings from tech giants. While there are.

August 26, 2020

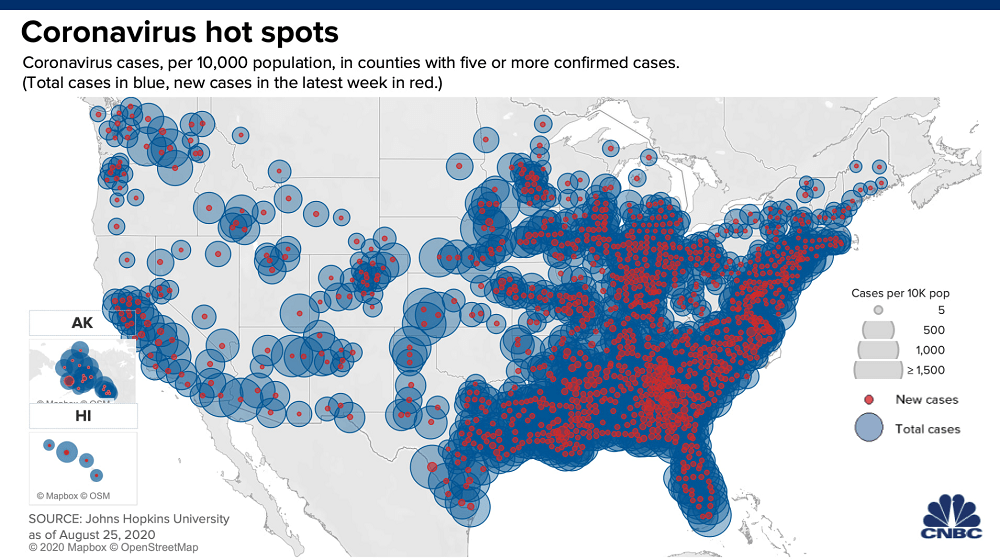

Investors have never had to deal with so much uncertainty as a result of the current health and economic crises, Erik Nielsen, group chief economist at UniCredit, told CNBC’s Squawk Box Europe. The coronavirus pandemic keeps spreading across the world..

August 26, 2020

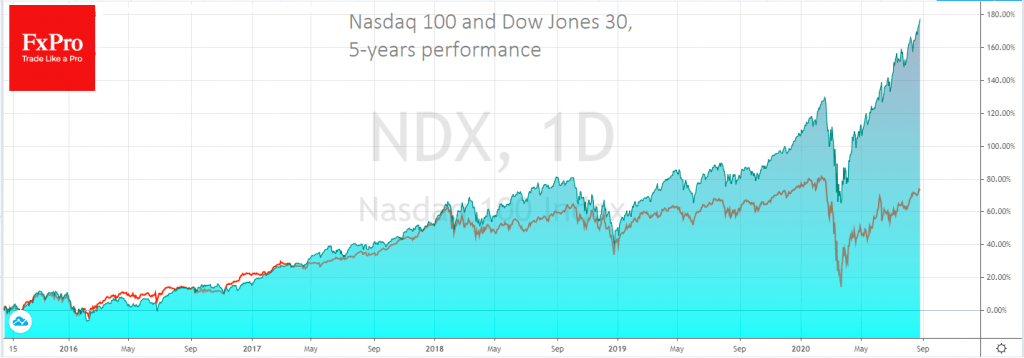

The phrase “winner takes it all” has never seemed as accurate for markets as it now, as recent times show high polarisation. It is impossible to predict how long this shaky equilibrium may last. Potentially, it could be months or.

August 26, 2020

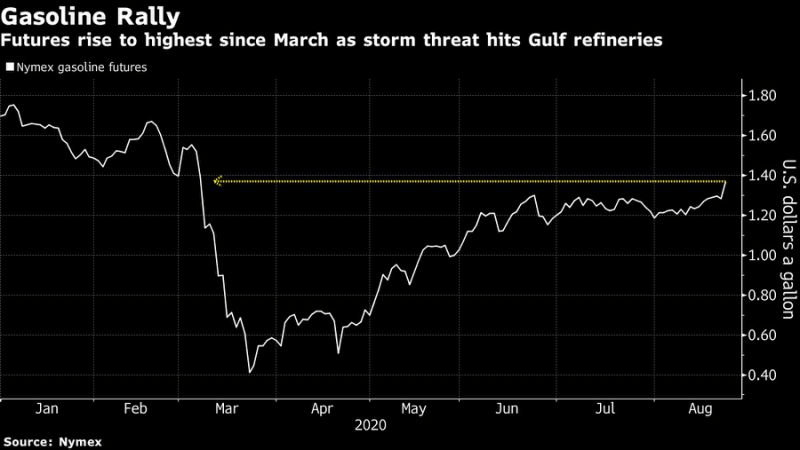

Brent crude oil prices rose on Wednesday, lifted by U.S. producers shutting most of their offshore output in the Gulf of Mexico ahead of Hurricane Laura and optimism over China-U.S. trade talks. But gains were capped amid renewed concern over.

August 26, 2020

The dollar held steady against most currencies on Wednesday as traders braced for U.S. data expected to show a slowdown in durable goods orders and a key speech by Federal Reserve Chairman Jerome Powell. The yuan rose toward a seven-month.

August 26, 2020

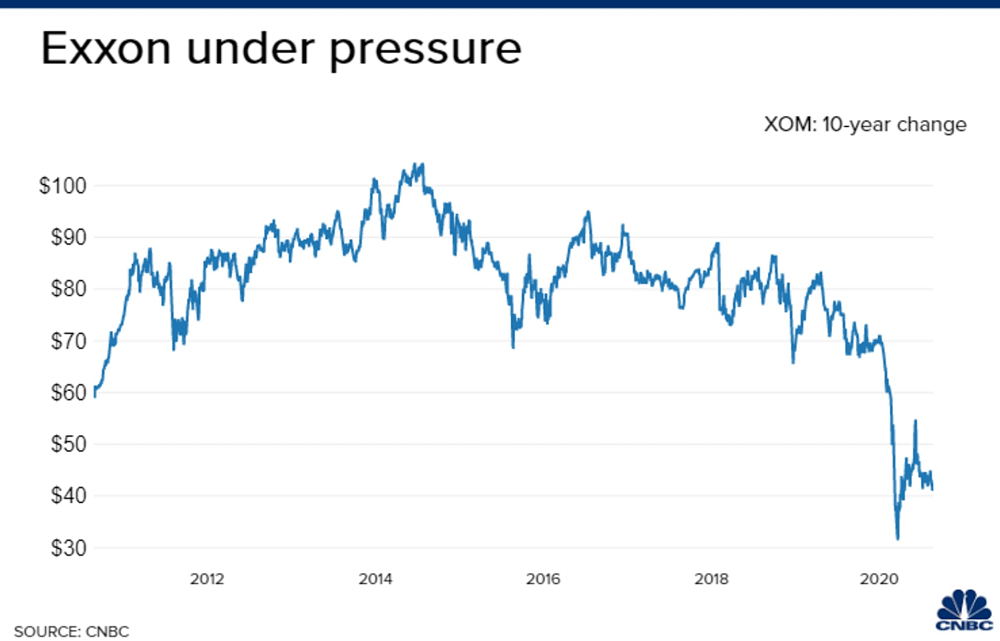

Exxon Mobil’s been in the Dow in some form since 1928, but its tenure as the longest-serving component is coming to an end. On Monday, S&P Dow Jones Indices announced the largest changes to the 30-stock benchmark in seven years..

August 25, 2020

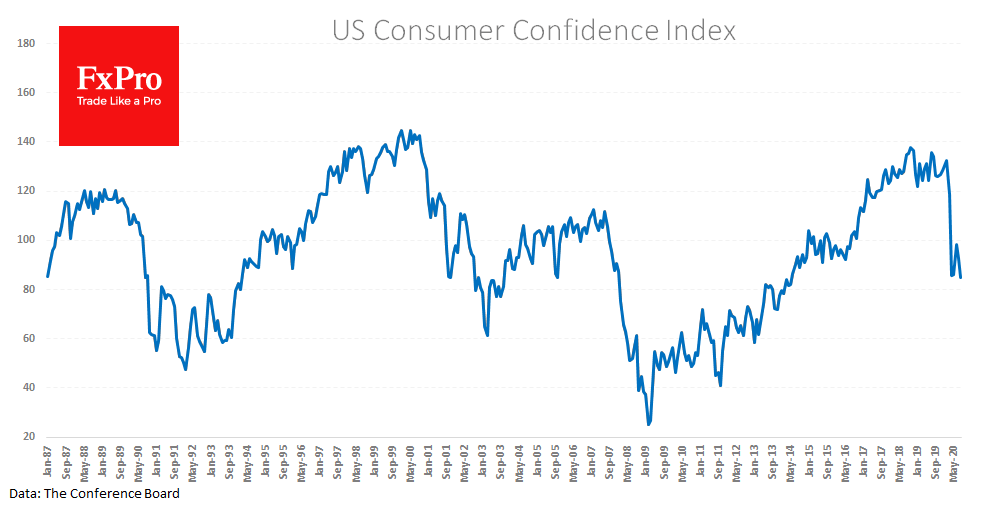

The Conference Board noted an unexpected and sharp deterioration in consumer sentiment in August. The Index in August fell to 84.8, the lowest level in 6 years, against an expected increase from 92.6 to 93.0. Both the assessments of business.