Market Overview - Page 3

February 2, 2026

Gold and silver plunged as the US dollar surged after Warsh’s Fed chair nomination; speculative trading unwound rapidly.

January 30, 2026

This week, we saw the long-awaited upward slide, which finally knocked out the short sellers and triggered a powerful sell-off, which often follows moments of final destruction for those who stood against the market. Interestingly, Thursday and Friday’s dramatic events,.

January 30, 2026

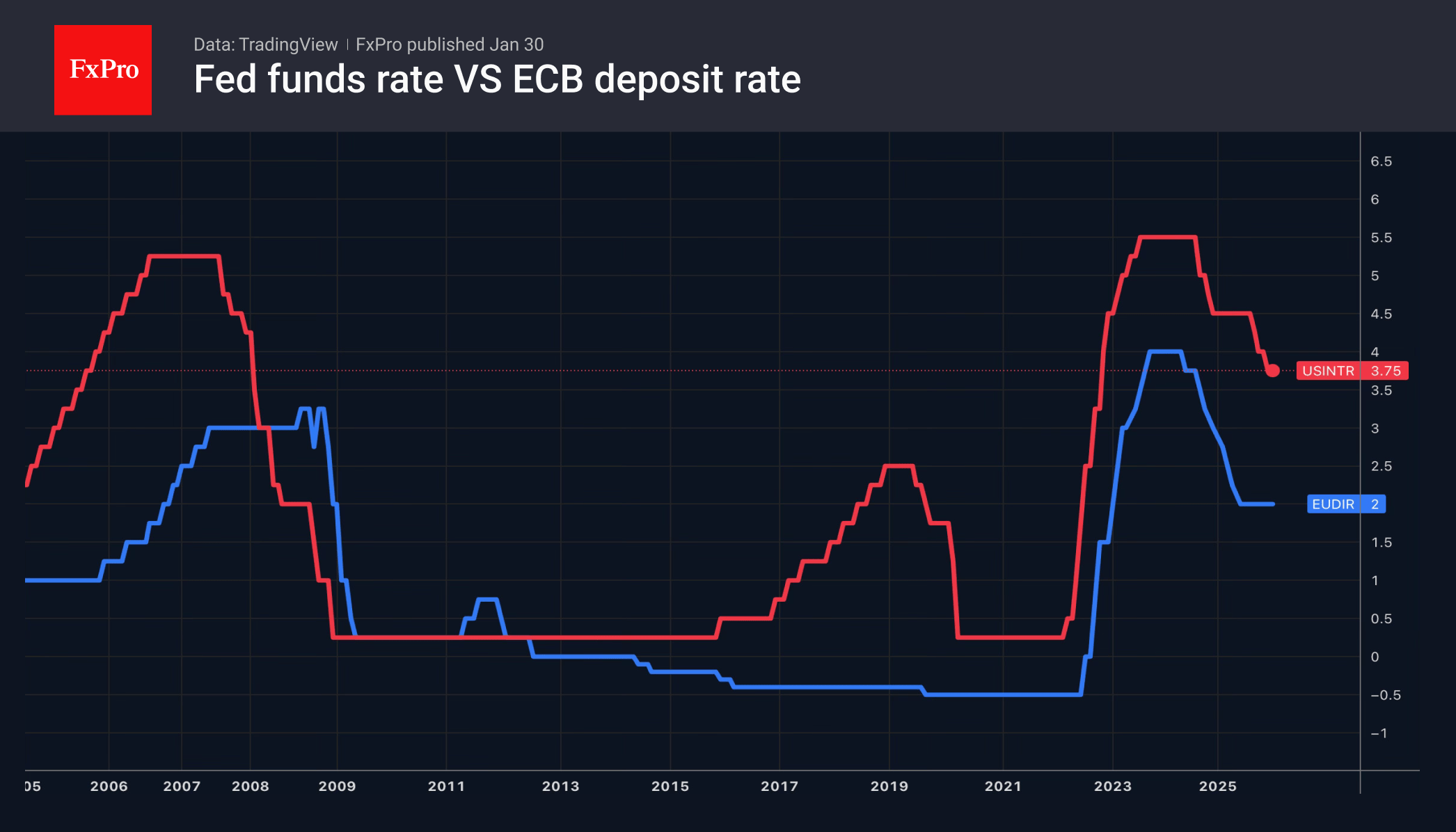

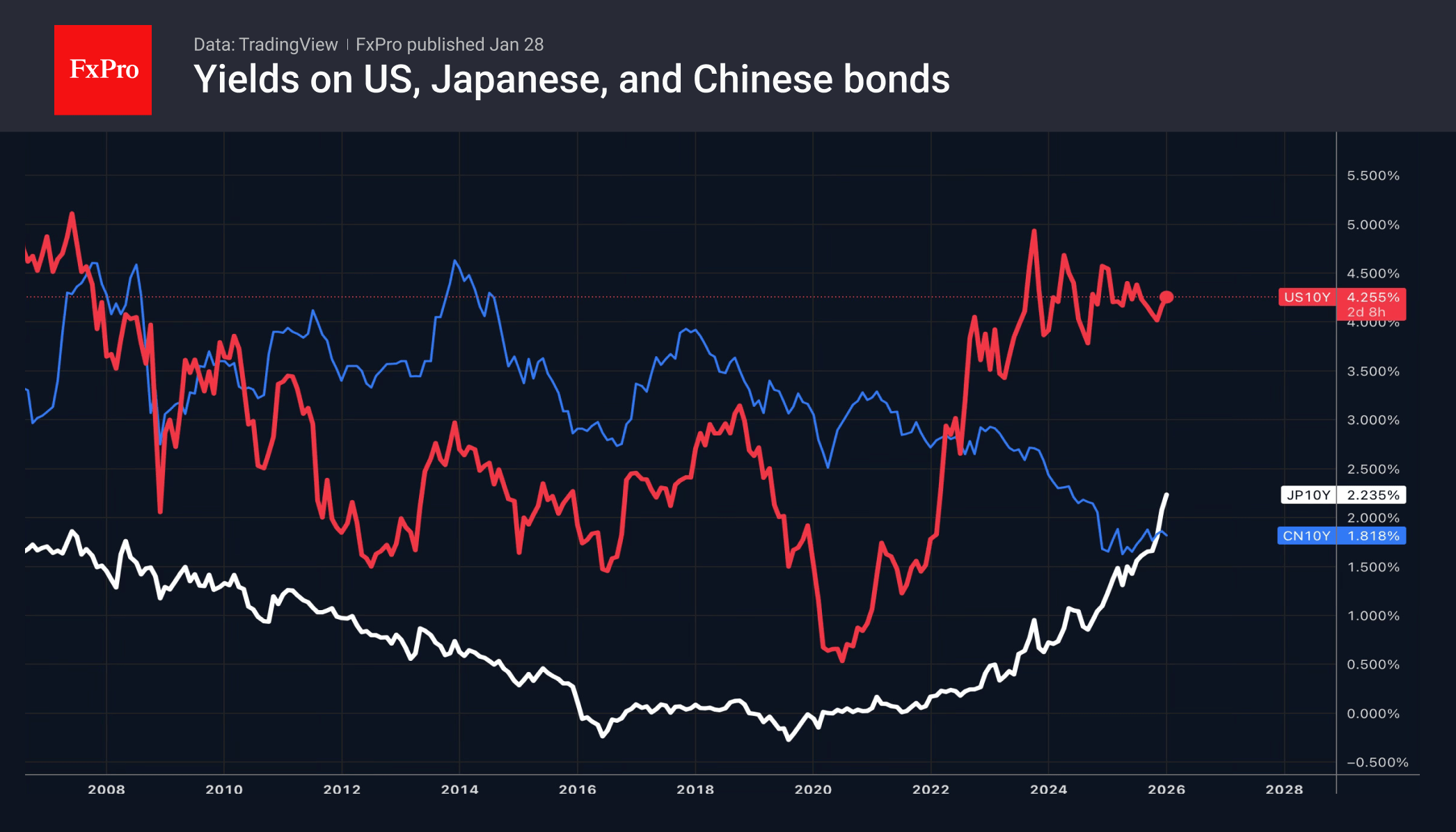

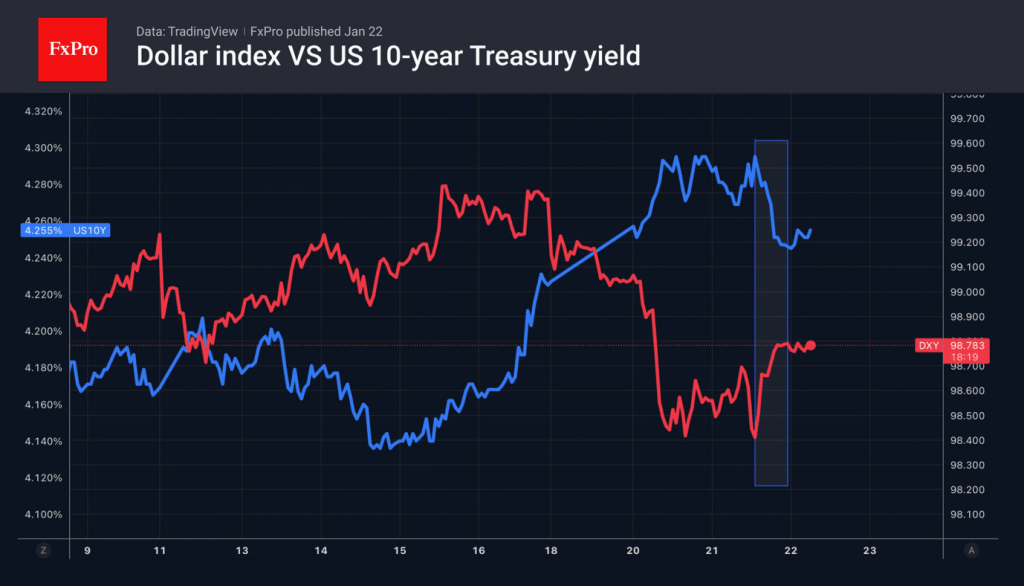

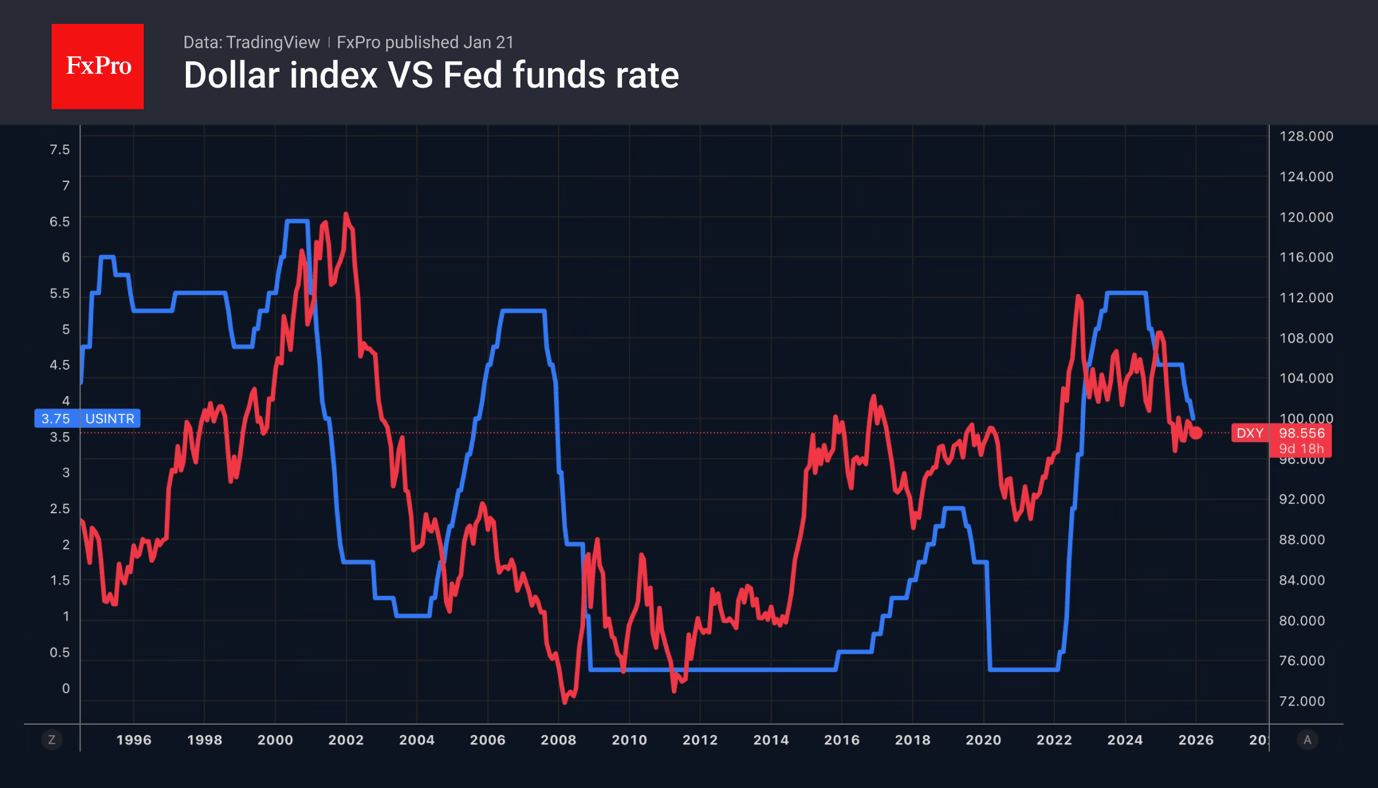

The euro's rally worries the ECB; possible rate cuts may follow. U.S. dollar strengthens, casting doubt on Japan's solo interventions.

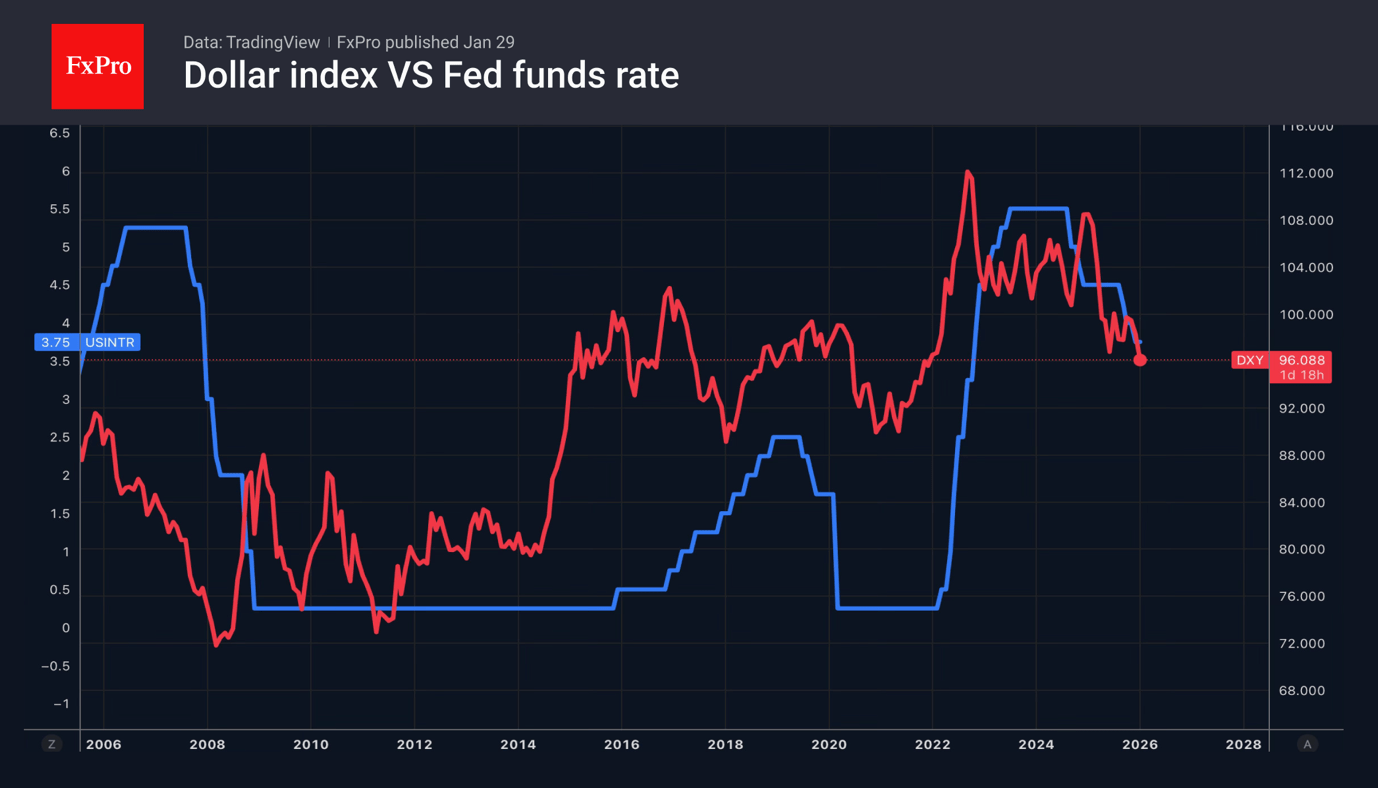

January 29, 2026

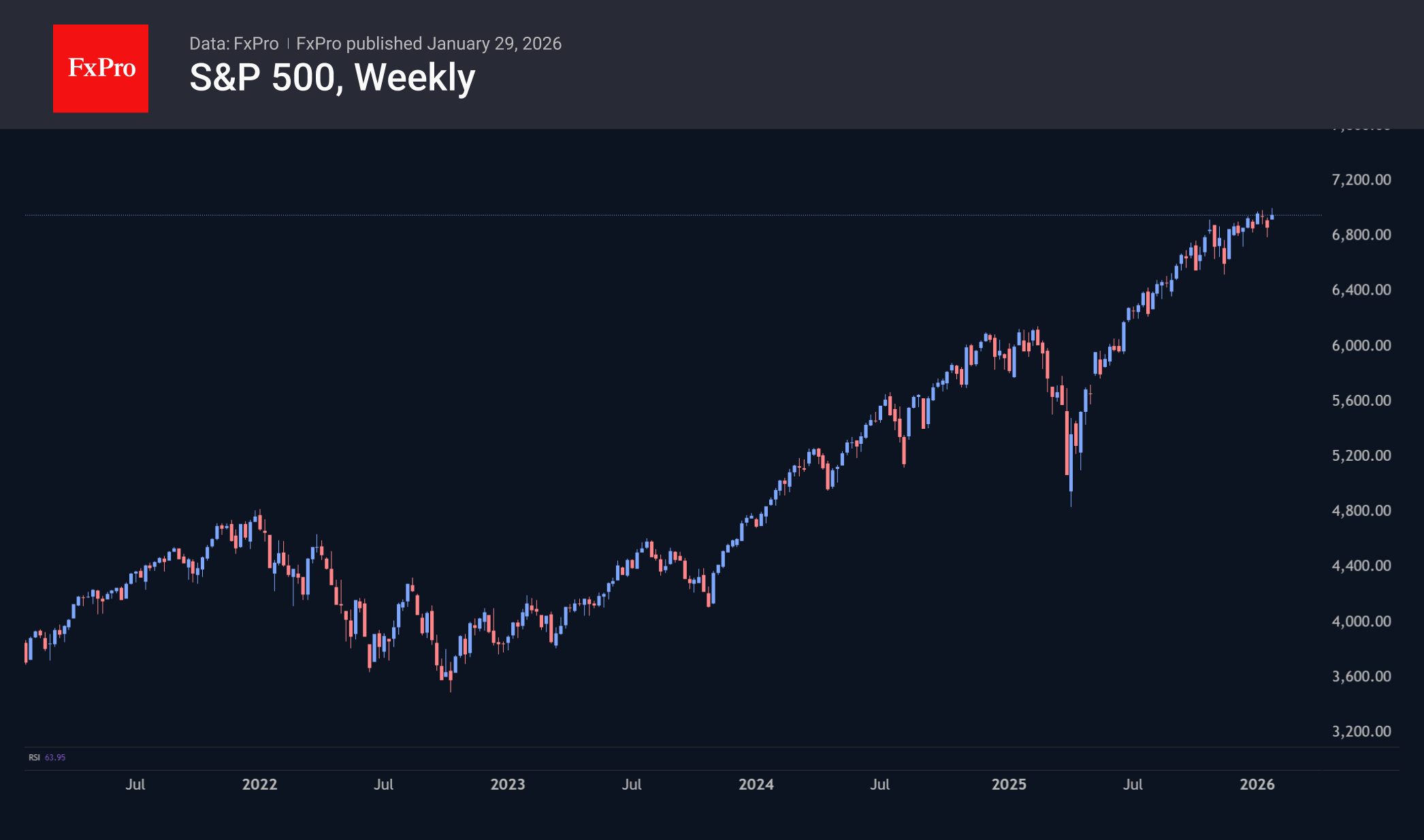

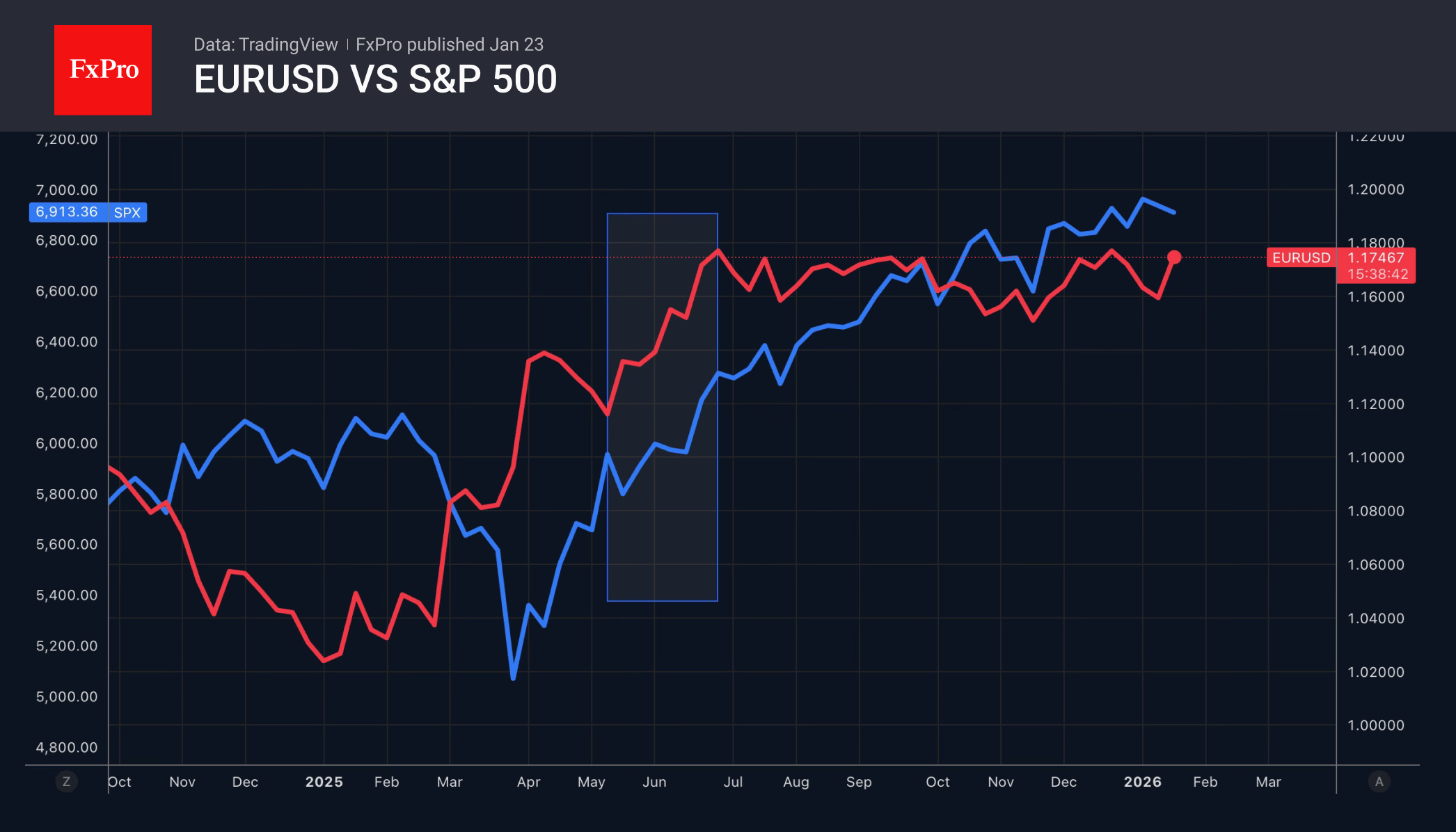

Tech earnings boost S&P500, offsetting Fed, geopolitics, and tariff concerns; market focus remains on robust US profit growth.

January 29, 2026

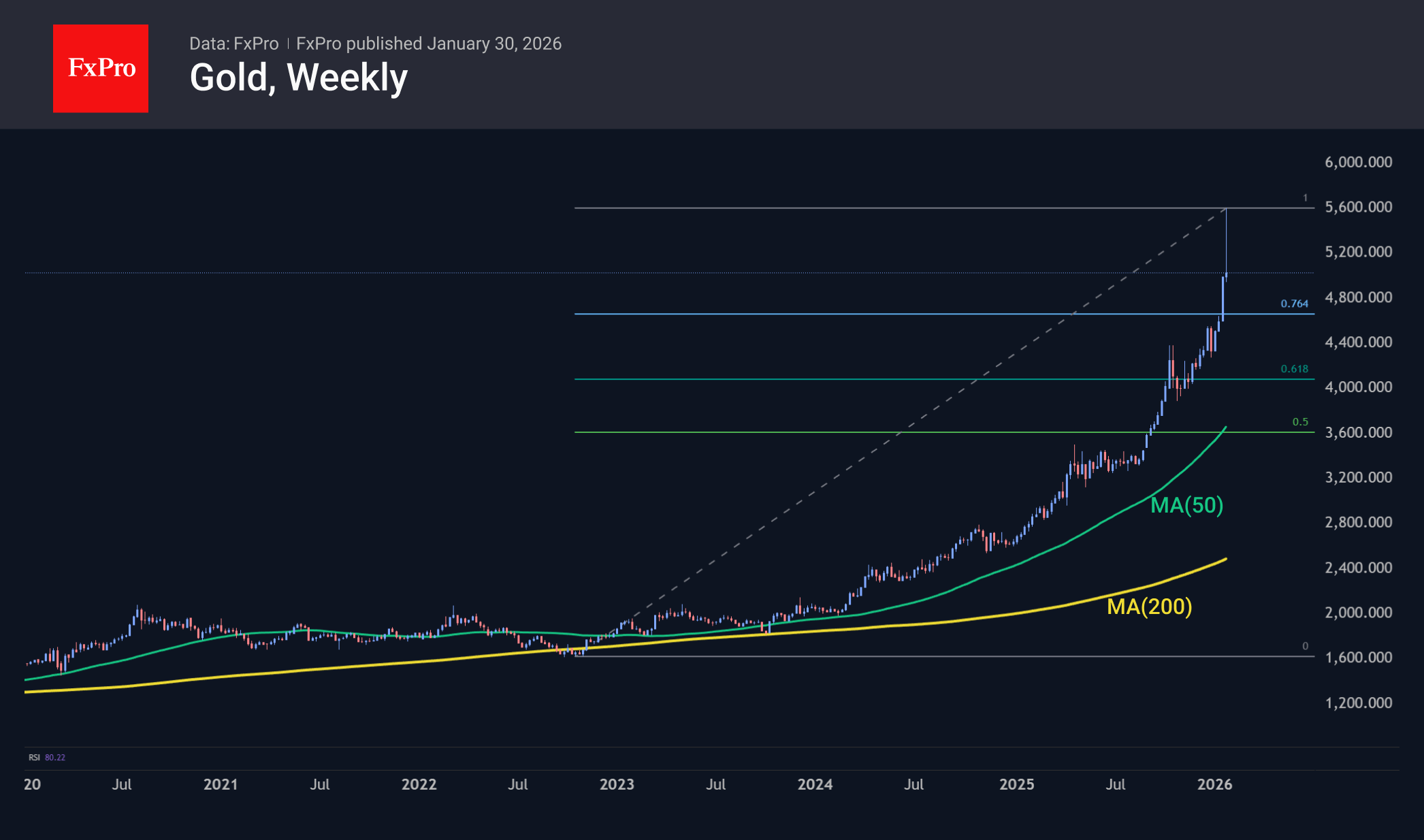

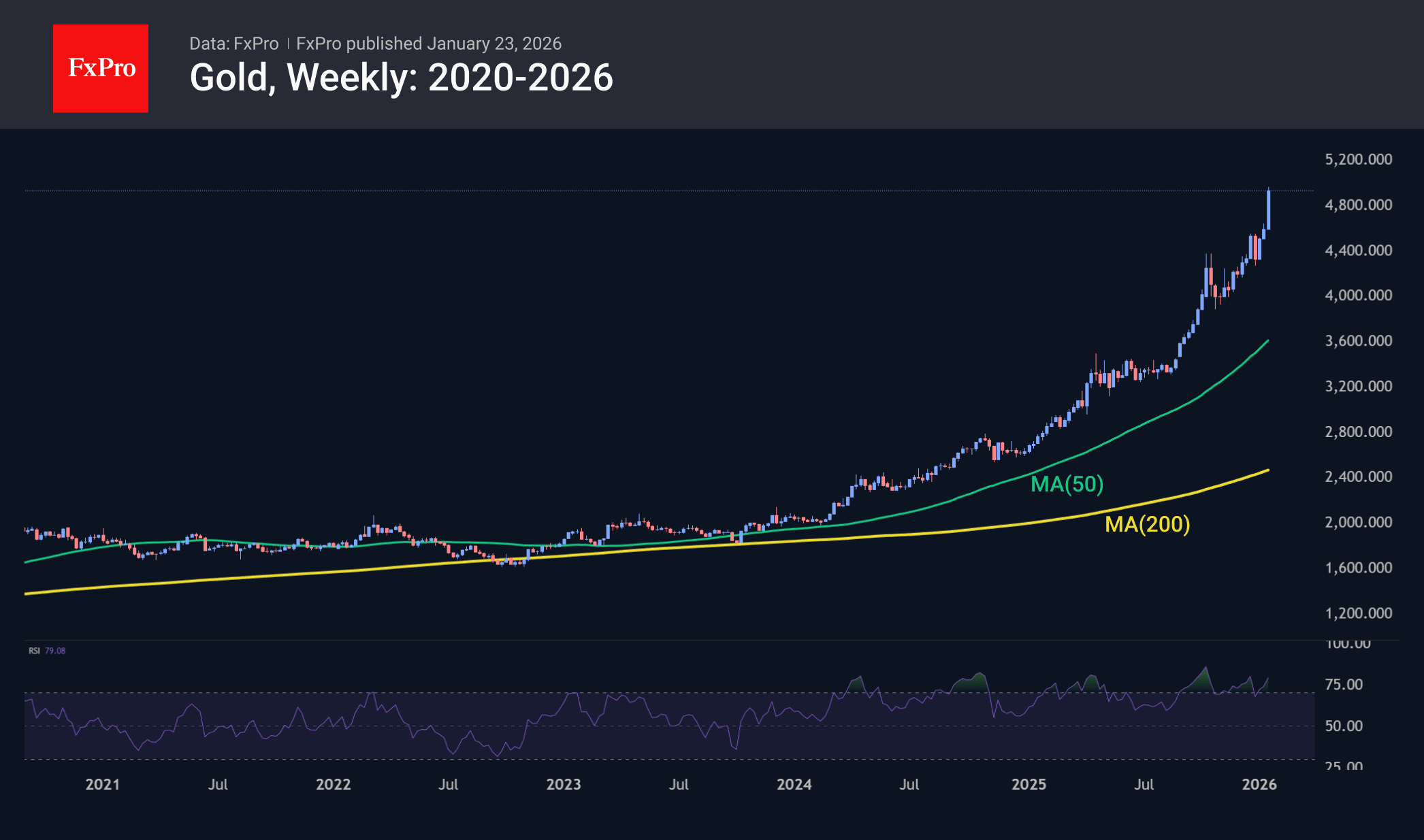

The Australian dollar confidently leads the G10 currency race. Thanks to geopolitics, gold may rise to $6,000.

January 28, 2026

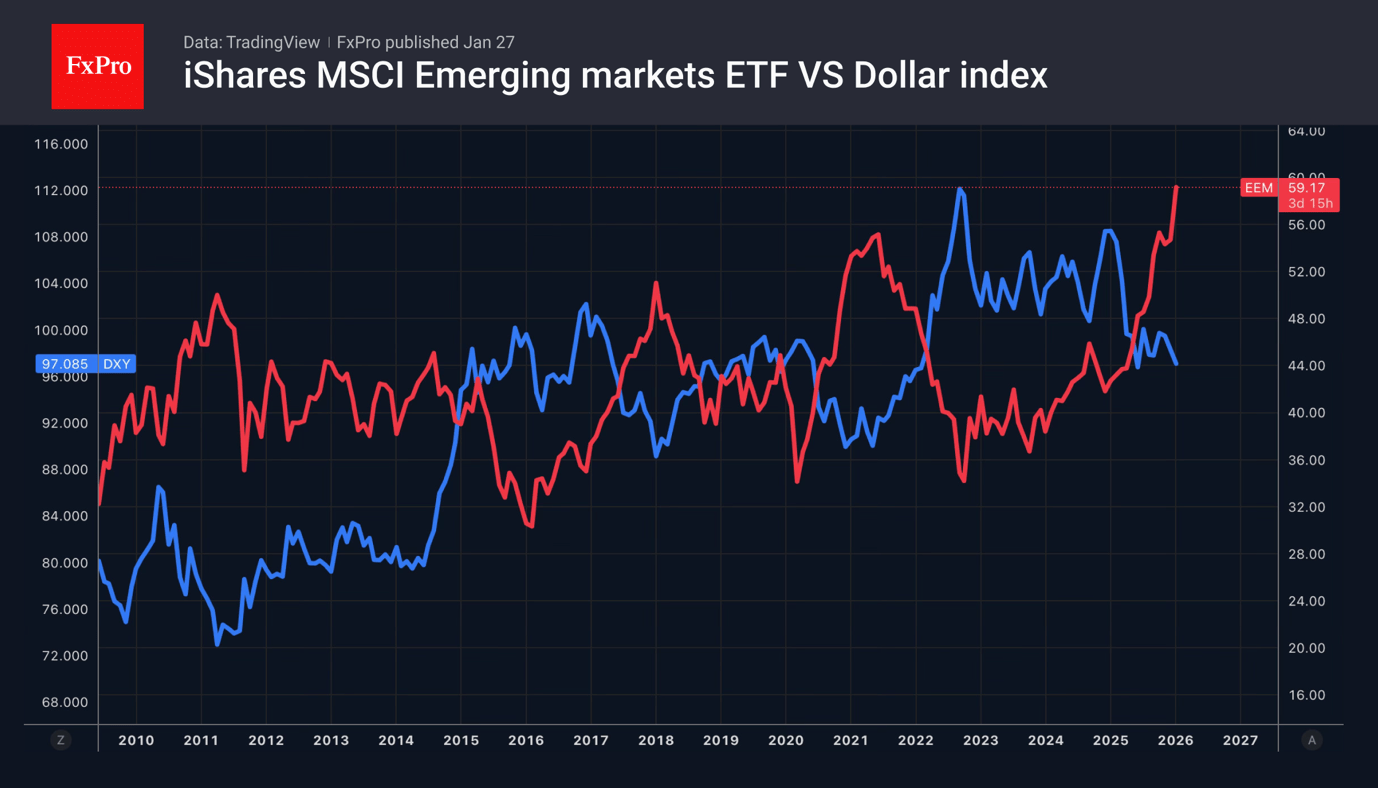

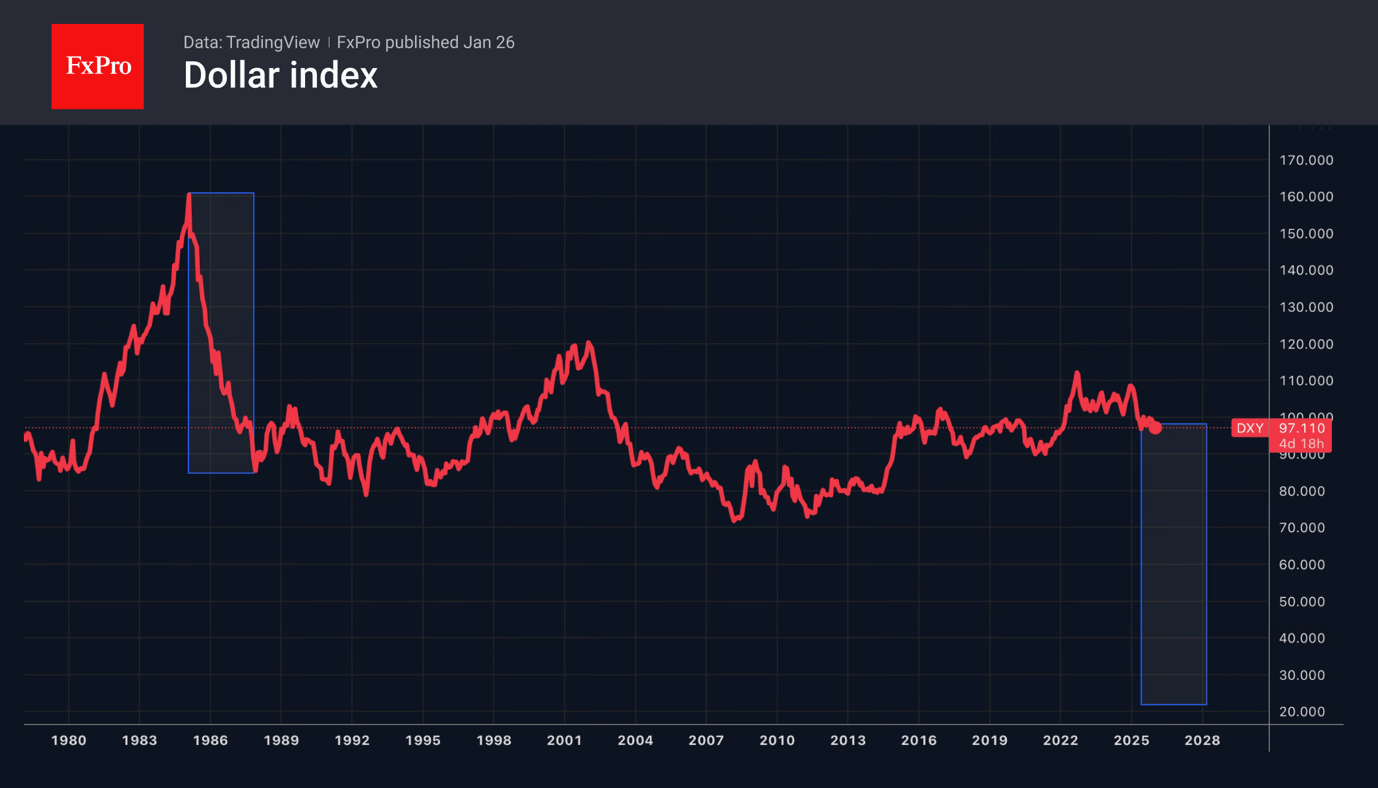

The US Dollar decline looks like a part of the White House's plan. Gold is rising on capital inflows.

January 27, 2026

The EURUSD rally has solid foundations. Gold is insurance against Trump's policies.

January 26, 2026

Rumours of coordinated intervention caused the USD to plummet, adding to pressure from the risks of a new government shutdown.

January 23, 2026

Gold surges to near $5,000/oz amid market shifts, echoing 2011, with forecasts rising but a reversal risk remaining.

January 23, 2026

The dollar is down as global risk appetite is up. Gold enjoys central banks' support.

January 22, 2026

Trump’s retreat, Fed defence, and dollar strength support USD; EURUSD weakens, USDJPY rises, gold forecast increases.