Market Overview - Page 297

September 7, 2020

Sterling has weakened against the U.S. dollar on Monday morning as escalating tensions between the U.K. and the EU are threatening any chances of a post-Brexit trade deal in the coming months. Sterling dropped about 0.5% against the USD in.

September 7, 2020

German officials are increasing pressure on the Kremlin to cooperate in the investigation into the suspected poisoning of Russian opposition politician Alexei Navalny, with one lawmaker noting this weekend that Berlin could rethink its joint massive gas pipeline project with.

September 7, 2020

The end of last week was unexpectedly stormy. The movements in the stock market were marked by a deep selloff of FAANG and Tesla. Most observers do not see the decline in the indices on Thursday and Friday and some.

September 4, 2020

Stocks fell once again on Friday as a sell-off in tech, the best-performing market sector in 2020, continued for a second day. The Dow Jones Industrial Average fell 521 points, or 1.9%. Earlier in the day, the Dow was up.

September 4, 2020

A key forecast is predicting the U.S. will top more than 410,000 Covid-19 deaths by the end of the year as the country heads into the fall and winter, according to a new forecast from the Institute for Health Metrics.

September 4, 2020

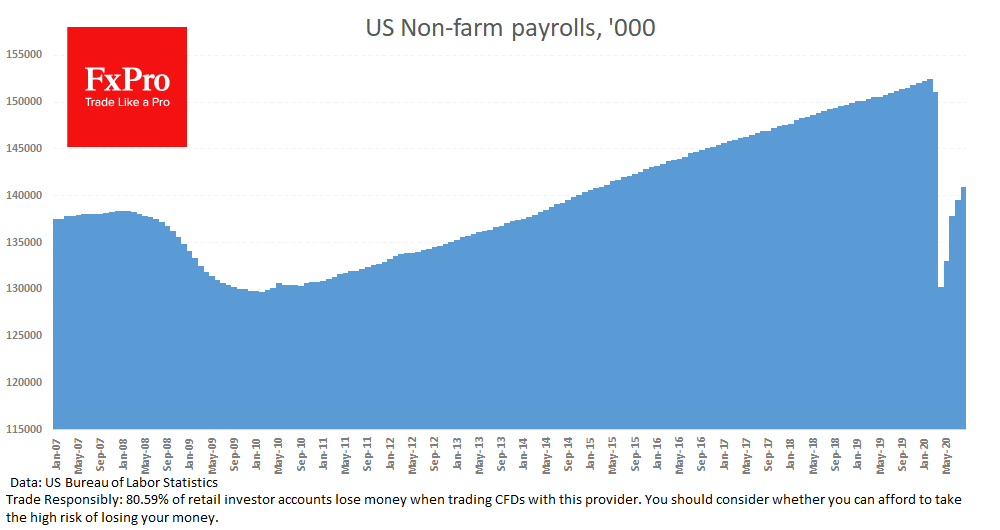

The US labour market created 1,371K jobs in August, which was very close to expectations. In four months of recovery, the US has returned 48% of the jobs lost in March and April. However, with the acceleration of wage growth,.

September 4, 2020

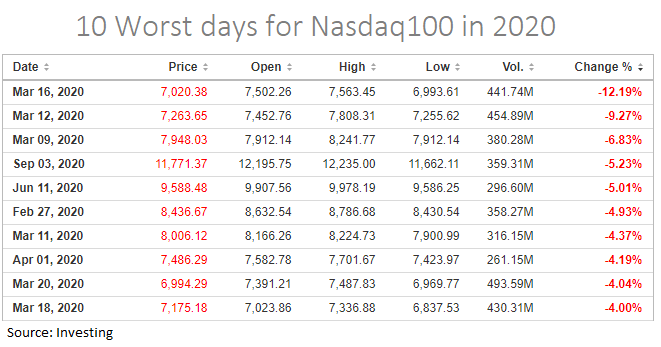

The financial markets were pretty turbulent on Thursday. The Nasdaq100 lost 5% in one day, the biggest selloff since early June and the fifth largest one-day drop so far this year. The S&P500 and Dow Jones 30 lost noticeably less,.

September 4, 2020

The U.S. economy’s long journey back to recovery appears to have taken another step forward in August as more people returned to work, but growing evidence suggests companies are rehiring workers at a slower pace compared to earlier in the.

September 4, 2020

The rise of DeFi protocols and the demand for tokens in liquidity pools may be contributing to a huge surge in the supply of stablecoins. According to an Sept. 3 tweet from Coin Metrics co-founder Nic Carter, the current supply.

September 4, 2020

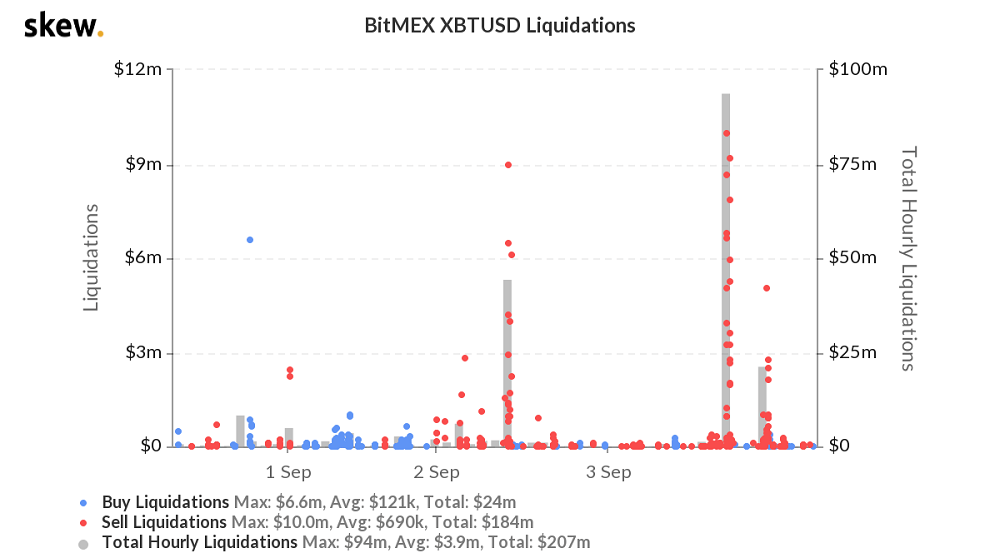

BTC below its 10-day and 50-day moving averages, a bearish signal for market technicians. Bitcoin continues its downward trend Thursday, with prices descending as low as $10,468 on spot exchanges such as Coinbase. While it has recovered a bit, traders.

September 4, 2020

Asia’s stock markets had their worst session in two weeks on Friday following a tech-led plunge on Wall Street, though gains in safer assets like bonds and dollars were muted as investors awaited U.S. job data to see if it.