Market Overview - Page 29

February 14, 2025

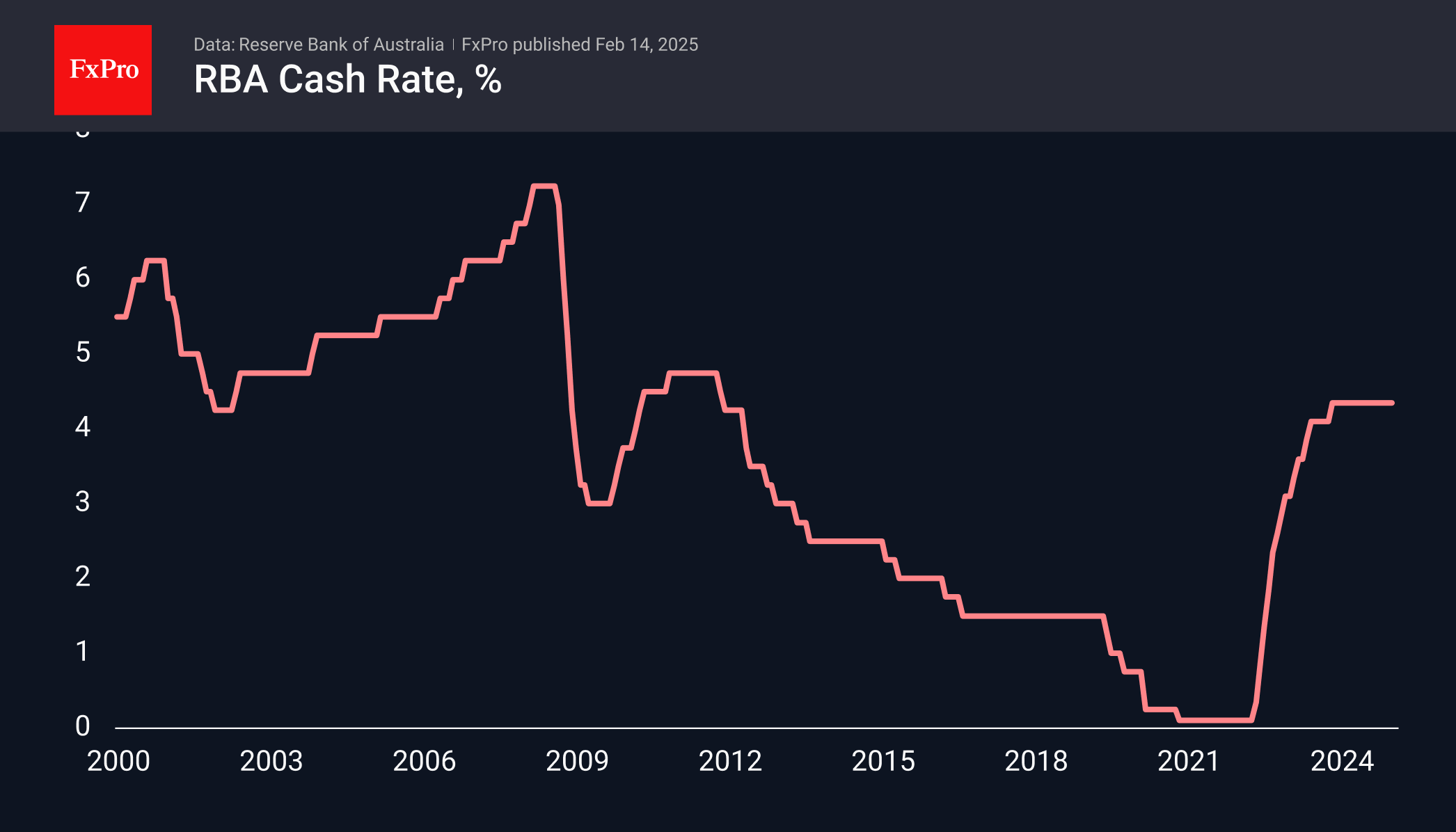

This week's key macro events include rate decisions in Australia and New Zealand, Canadian CPI, and flash PMIs for Europe.

February 14, 2025

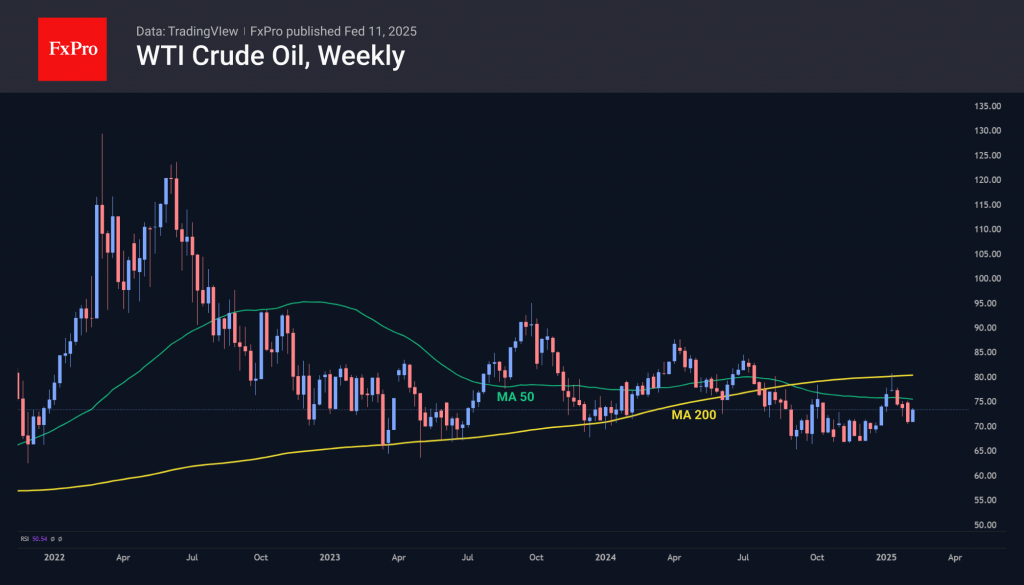

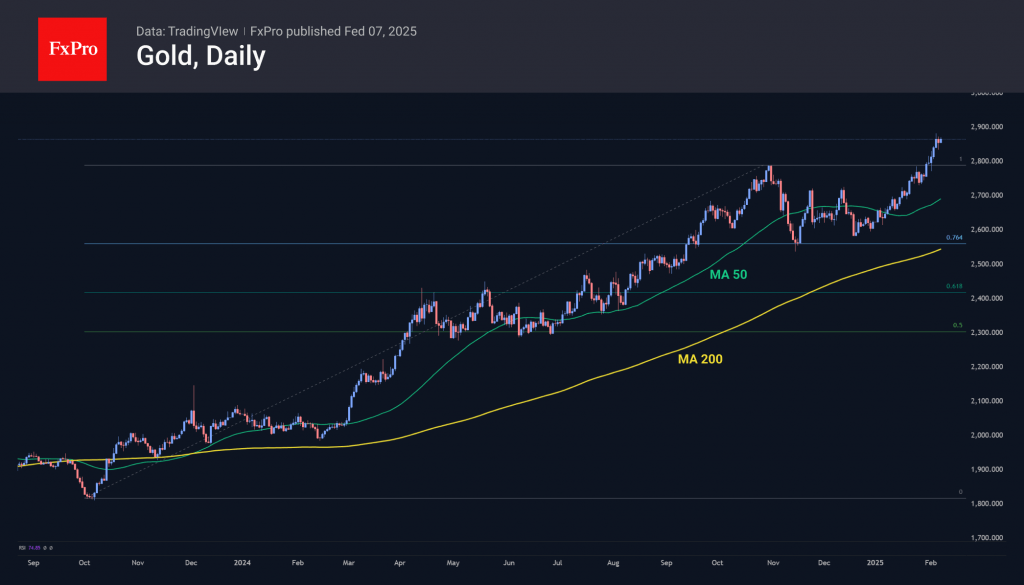

Gold saw a rise followed by a pullback but started to rise again. Buyers are cautious but pushing the price up. Oil swings on geopolitical news but the long-term technical picture favours sellers.

February 14, 2025

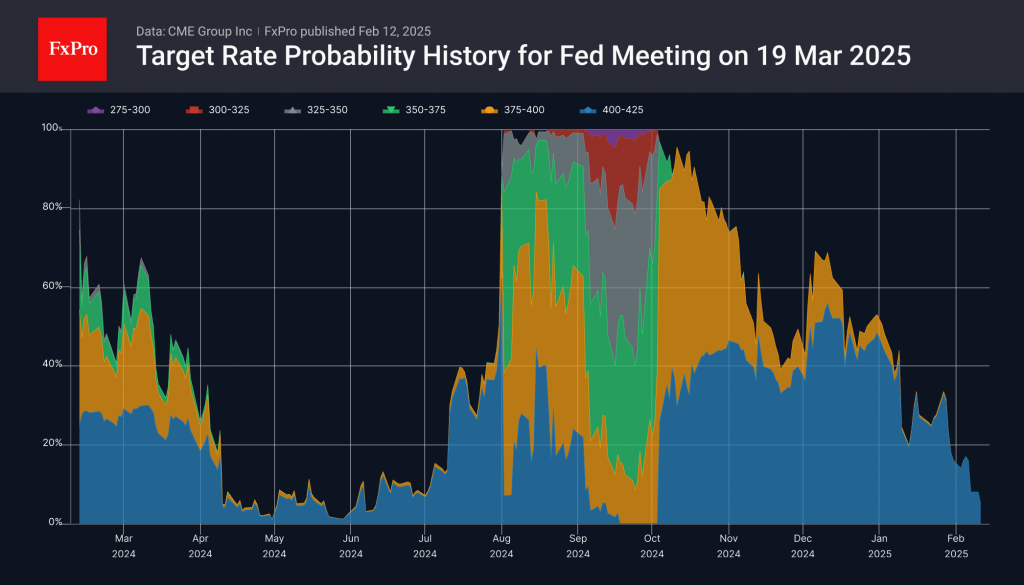

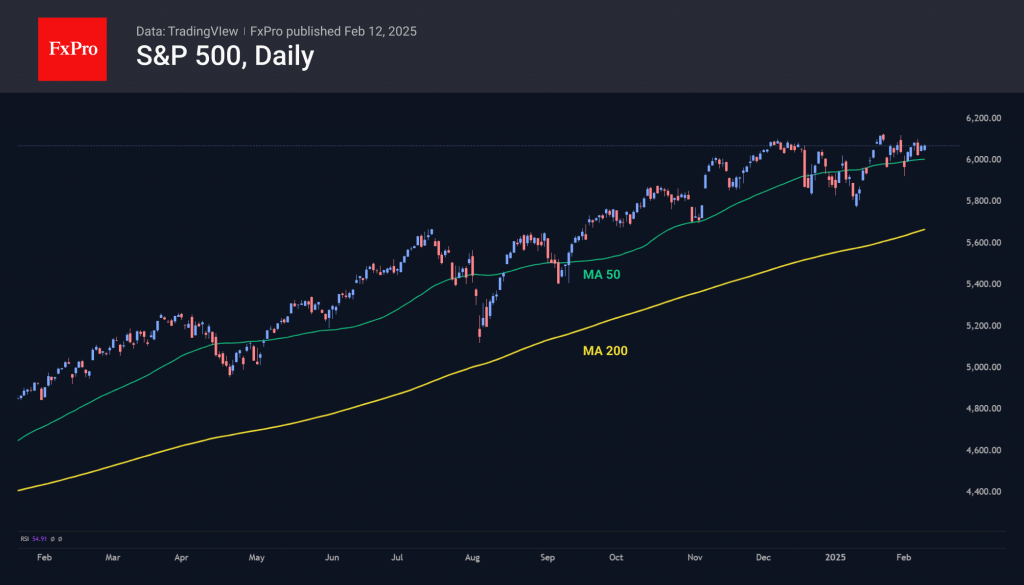

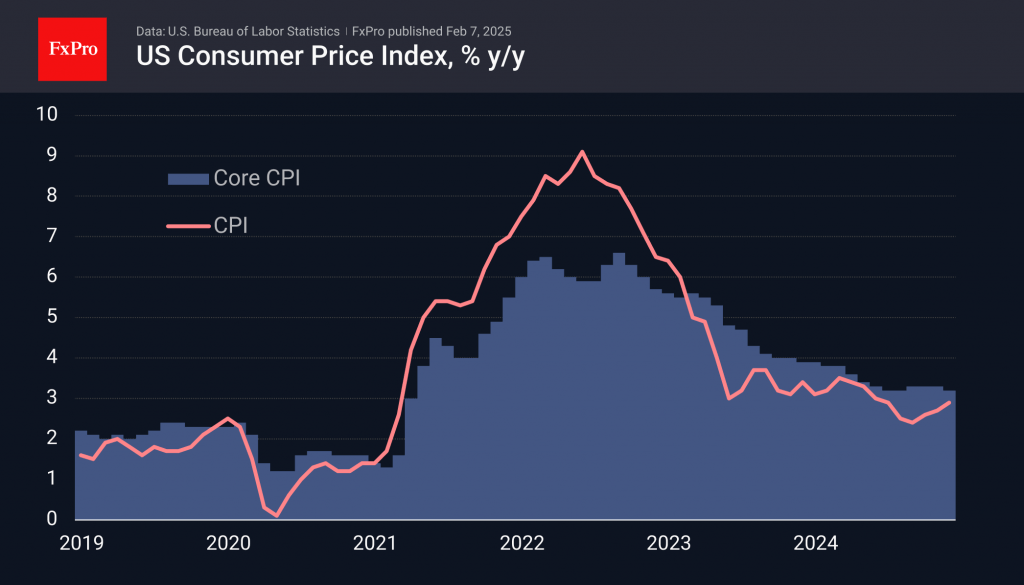

The Fed's statement on not rushing rate cuts and higher-than-expected inflation indicators can't wipe upbeat sentiment. The Nasdaq100 and S&P500 made attempts to break their respective resistances at the 22,000 and 50-day moving average levels.

February 14, 2025

The US dollar decreased to its lowest level since January due to reports of a delay in US tariffs. This news overshadowed the Federal Reserve's hawkish shift and inflation increase.

February 12, 2025

US stocks have remained stagnant despite a strong economy, while European indices have been hitting new highs. This difference in performance is explained by the divergence in monetary policy and the effects of a high base and inflated expectations in the US.

February 11, 2025

Despite rising inventories, oil prices rose for the third trading session, driven by higher gas prices in Europe and reduced oil supply from US sanctions against Russia's shadow fleet.

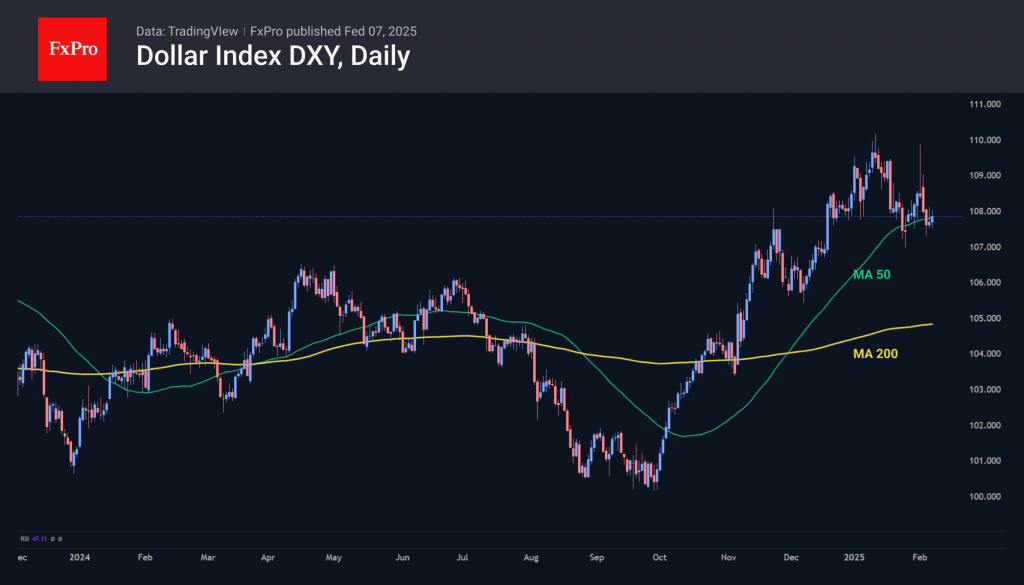

February 7, 2025

The dollar's difficulty in rising could signal a reversal, but its upward trend is not broken yet, with support from Fed policy and strong macroeconomics.

February 7, 2025

This week, key events to watch for include Fed Chief Powell speaking to Congress, US CPI release, UK GDP estimates, and US retail sales.

February 7, 2025

Gold has been rising steadily, reaching all-time highs and showing a 2.5% gain in the past week. This is in contrast to other markets which have been more unstable. Silver, while still below its previous peaks, has also been performing well recently.

February 6, 2025

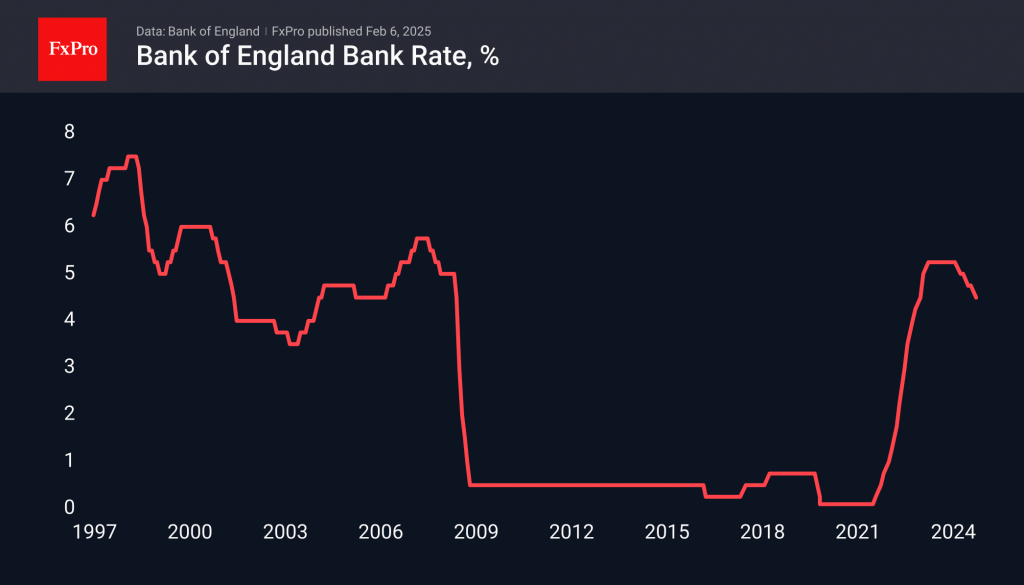

The Bank of England has cut its key rate by 25 points to 4.5% and suggested further cuts may be on the way, leading to pressure on the British pound. Market expectations are now for three more rate cuts this year.

February 6, 2025

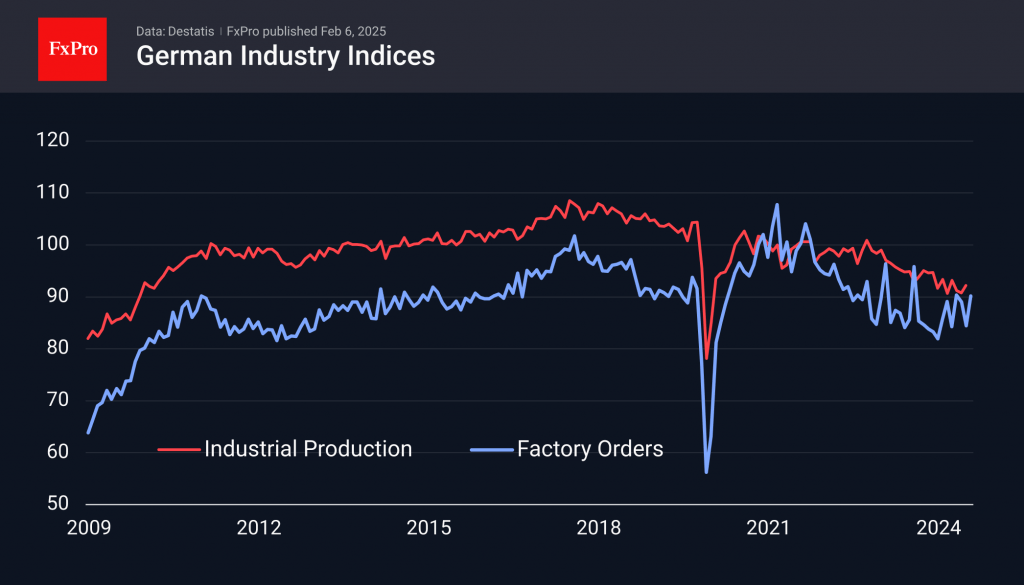

German industry is showing signs of growth and improvement, with industrial orders and production increasing, offering hope for the Eurozone economy.