Market Overview - Page 283

September 30, 2020

Chancellor Angela Merkel has vowed to avoid another full national lockdown as coronavirus infections begin to spike again in Germany. Like its European neighbors, Germany has not been spared a second wave of the virus after the region’s economies reopened.

September 30, 2020

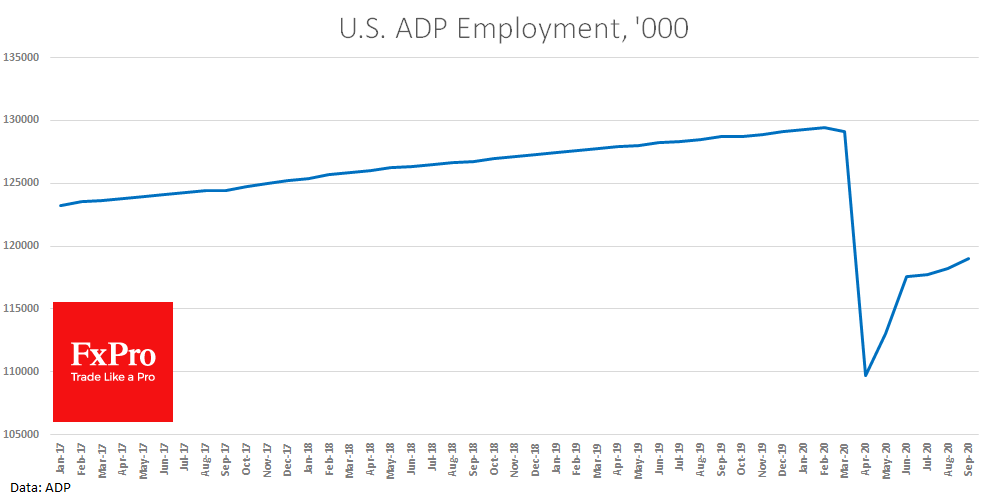

The ADP employment data for September showed an increase of 749K private employments, better than the forecasted 650K. Most of this growth above expectations should be attributed to the lower expectations after three months of a significant undershoot. We should.

September 30, 2020

A Major Money Manager Doesn’t See a Contested Election Ruining the MarketsAccording to WealthWise Financial CEO Loreen Gilbert, a highly contested and controversial election is unlikely. Even then, the S&P 500 would be able to gauge the winner as the.

September 30, 2020

Over the last few months, DeFi protocols including Yearn.Finance, Compound, Synthetix, and Chainlink have seen their token prices go through the roof, sparking talk that the long-awaited bull market might be here. The DeFi boom is built on Ethereum and.

September 30, 2020

Volatility across asset markets is fueling a bounce in the battered dollar, showcasing the currency’s safe-haven status amid worries over growth abroad and U.S. political strife. The buck is up nearly 2% in September as of Tuesday against a basket.

September 30, 2020

German retail sales rose much more than expected in August and unemployment fell further in September, boosting hopes that household spending in Europe’s largest economy will power a strong recovery in the third quarter from the coronavirus shock. The upbeat.

September 30, 2020

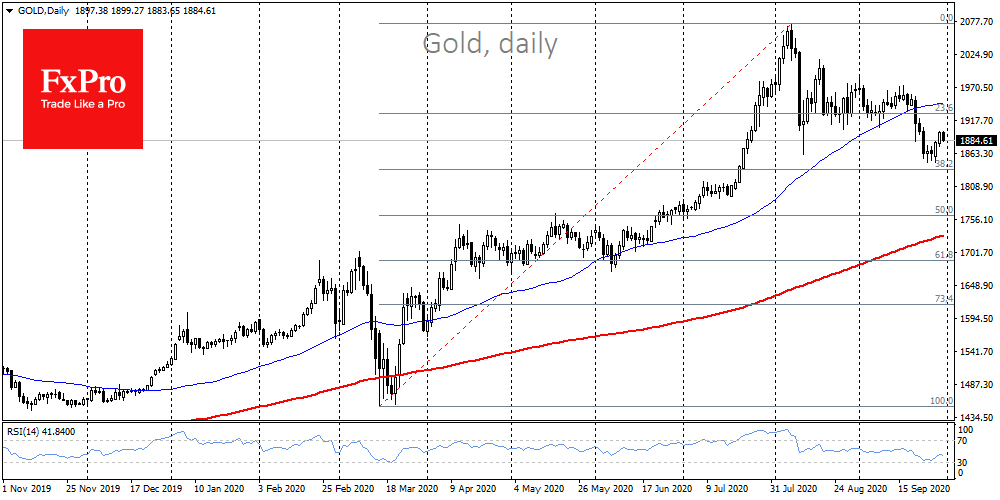

Gold prices rose above $2,000 per ounce last month, but have since experienced a sharp decline, cementing the reputation of serious resistance. The strengthening of the dollar that followed in September put even more pressure on quotations. However, the stabilization.

September 30, 2020

U.S. stock futures declined early Wednesday as traders digested the first U.S. presidential debate. Dow Jones Industrial Average futures pointed to an opening loss of more than 200 points. S&P 500 futures and Nasdaq 100 futures were also in negative.

September 30, 2020

As China’s leaders get ready to release their national development plan for the next five years, some government advisors emphasize the priority is building up China’s domestic strength. Chinese authorities have stepped up their efforts to shift the economy from.

September 29, 2020

The United States’ trade deficit in goods increased in August, with imports surging as businesses rebuild inventories which were depleted early in the COVID-19 pandemic, suggesting trade could be drag on economic growth in the third quarter. Still, the widening.

September 29, 2020

Industrial and construction material stocks will be among the sectors that will benefit as U.S. markets hit fresh highs over the next year, JPMorgan Private Bank’s Grace Peters told CNBC Tuesday. Peters, head of equities strategy at the wealth management.