Market Overview - Page 194

March 19, 2021

The Fed gave an unpleasant, albeit mild, surprise to the markets for the second time in a week (after the FOMC statement) by announcing that it will not extend the relief for treasury dealers introduced in the pandemic’s early months.

March 19, 2021

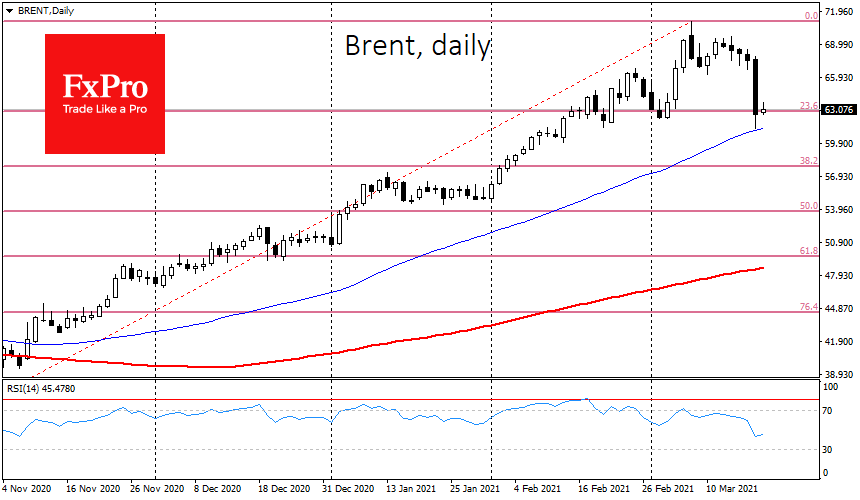

Oil took a steep fall yesterday, showing an almost 10% intraday trading range and a 7.5% drop for the day. Brent on the spot market moved down to $61.27 at one point, while WTI fell to $58.27. Both had a.

March 19, 2021

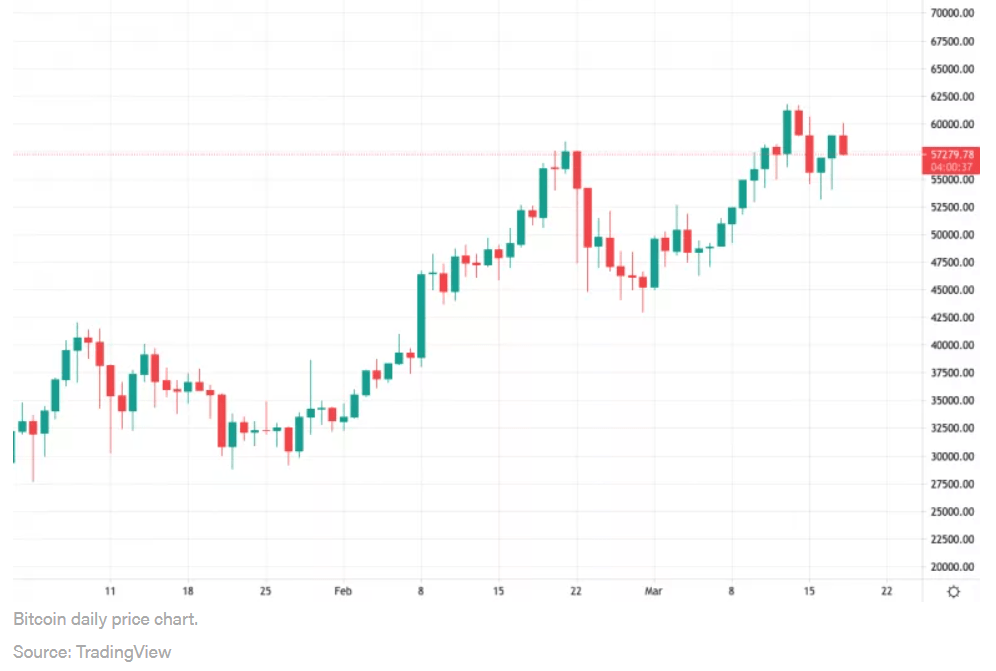

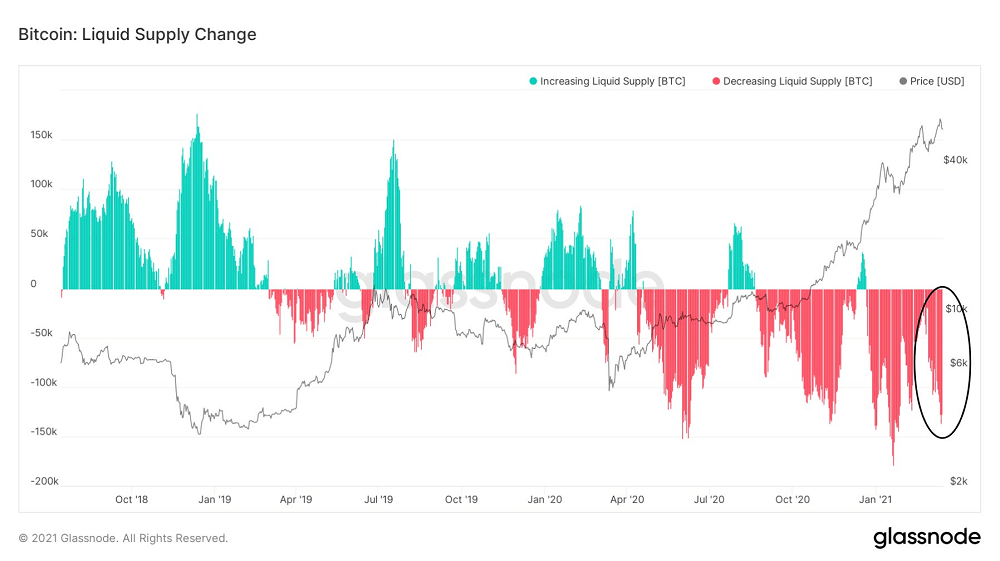

Bitcoin’s (BTC) price slid Thursday, retreating along with U.S. stocks and oil prices as U.S. Treasury yields touched some of the highest levels in a year. The 10-year Treasury note yield, which moves in the opposite direction from the price,.

March 19, 2021

The now infamous Bank of America research note slamming Bitcoin also contains research suggesting that it takes just $93 million worth of inflows to move Bitcoin’s price by one percent. Bitcoin is extremely sensitive to increased dollar demand,” said the.

March 19, 2021

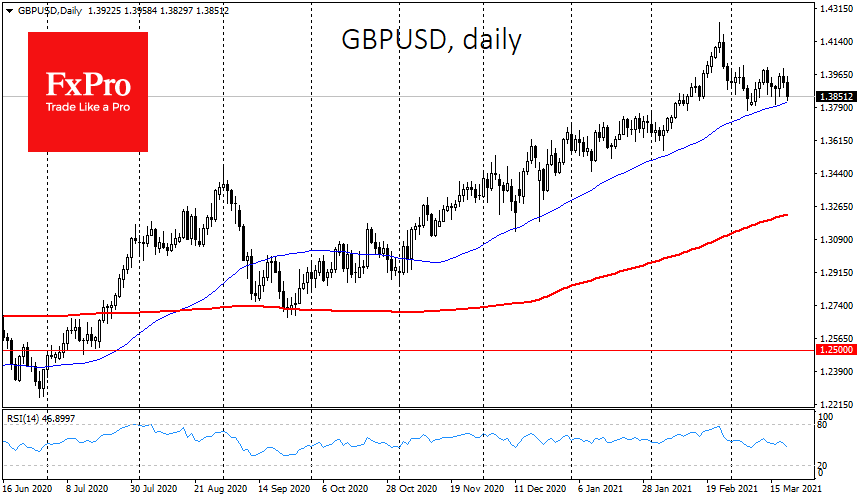

The safe-haven U.S. dollar held firmer on Friday, supported by higher Treasury yields and falling stock markets, as investors digested the Federal Reserve’s pushback against expectations of any early interest-rate hikes. The dollar index was slightly higher following a 0.5%.

March 19, 2021

Oil prices edged up on Friday, but were still down more than 8% for the week as a new wave of COVID-19 infections across Europe spurred fresh lockdowns and dampened hopes that an anticipated recovery in fuel demand would come.

March 19, 2021

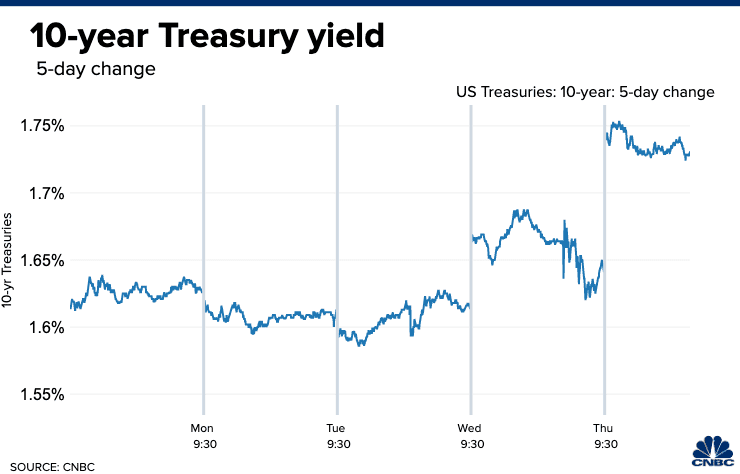

The 10-year U.S. Treasury yield jumped above 1.7% on Thursday, its highest level in more than a year, despite reassurance from the Federal Reserve that it had no plans to hike interest rates anytime soon, nor taper its bond-buying program..

March 19, 2021

The Bank of Japan on Friday widened the band at which it allows long-term interest rates to move around its target, as part of a raft of measures to make its ultra-easy policy more sustainable amid a prolonged battle to.

March 19, 2021

Treasury yields flared on Thursday as bond market players grappled with the Federal Reserve’s willingness to allow inflation to heat up. The 10-year Treasury yield shot up from 1.64% late Wednesday to 1.75% Thursday, a 14-month high. It was at.

March 19, 2021

The first high-level gathering of U.S. and Chinese officials under President Joe Biden kicked off with an exchange of insults at a pre-meeting press event in Alaska on Thursday. A planned four-minute photo session for the officials to address reporters.

March 18, 2021

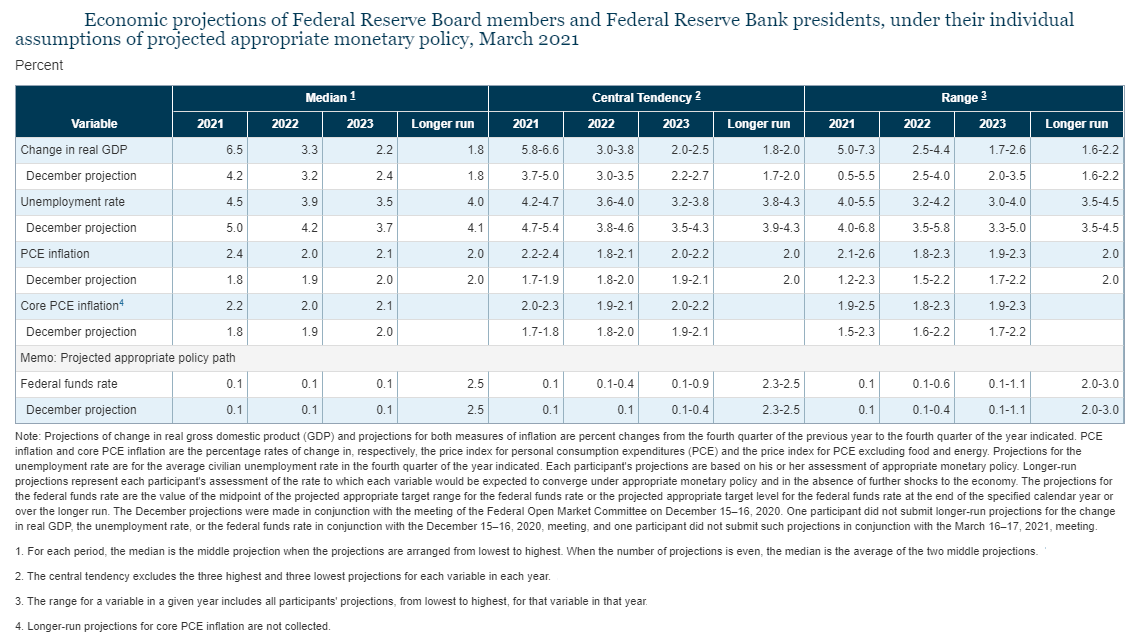

The Fed tried to return positive sentiment to the markets by suppressing expectations of an imminent policy tightening. Thanks to the announced economic stimulus, the FOMC has drastically raised this year’s GDP growth estimate to 6.5% from 4.2% and forecast.