Market Overview - Page 115

March 16, 2022

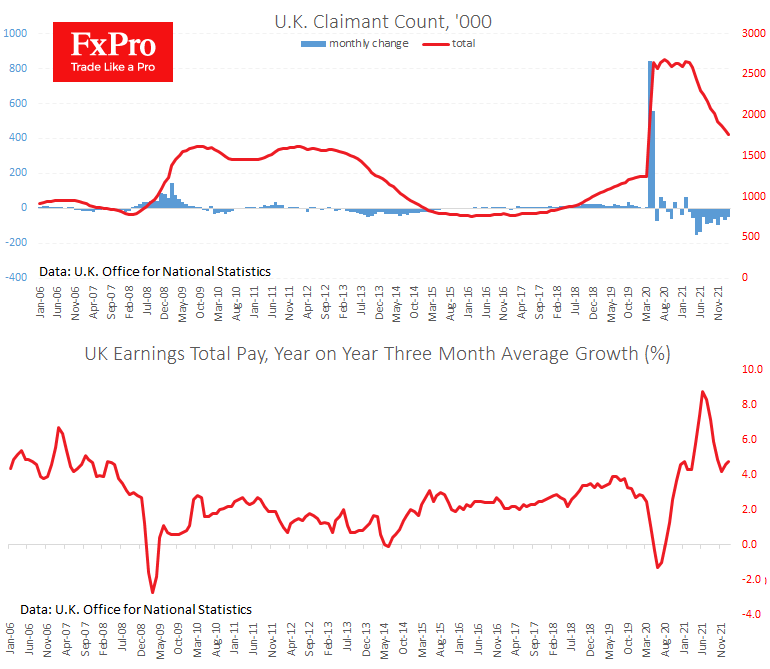

The UK economy continues to show strength in the January-February economic reports. A fresh batch of data noted a fall in the number of people receiving unemployment benefits of 48.1k last month. The January statistics have improved and now show.

March 14, 2022

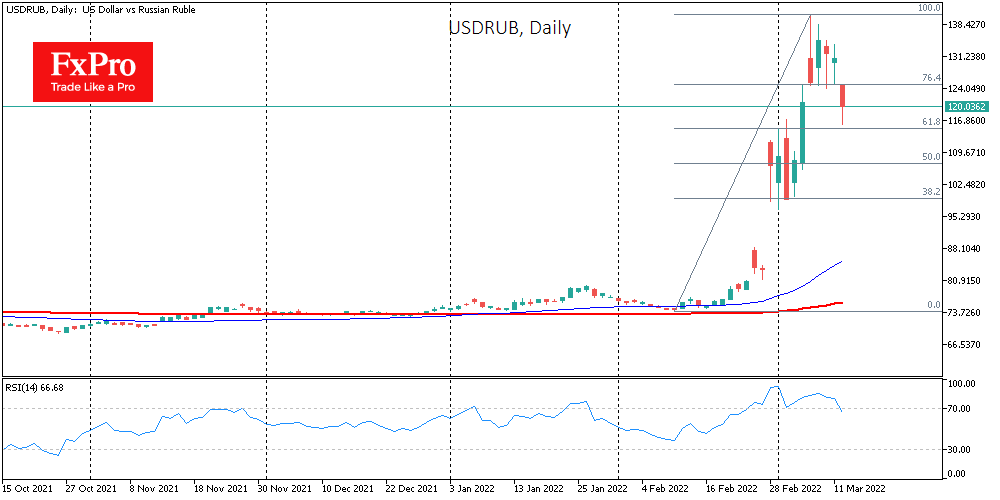

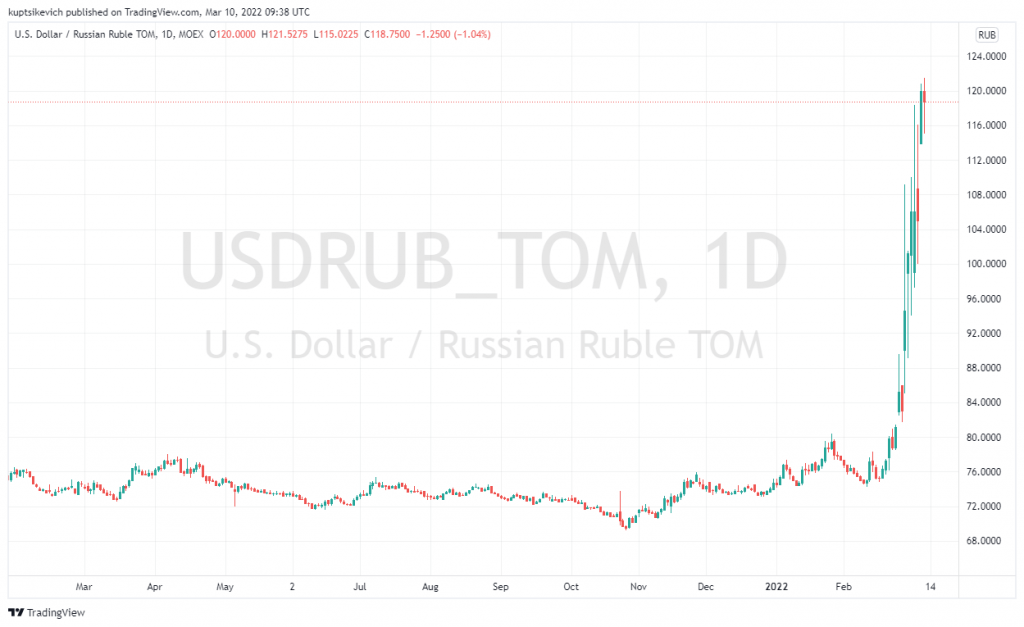

The Russian ruble is strengthening significantly, by 10%, to 118.8 on forex at the start of the new week. The growth momentum comes with signals from the presidents of Russia and Ukraine that negotiations are moving forward. In addition, the.

March 14, 2022

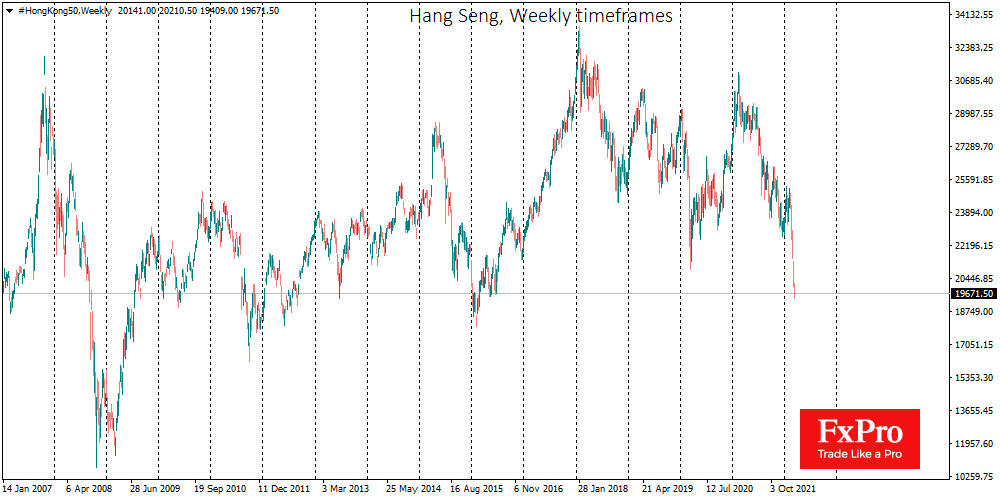

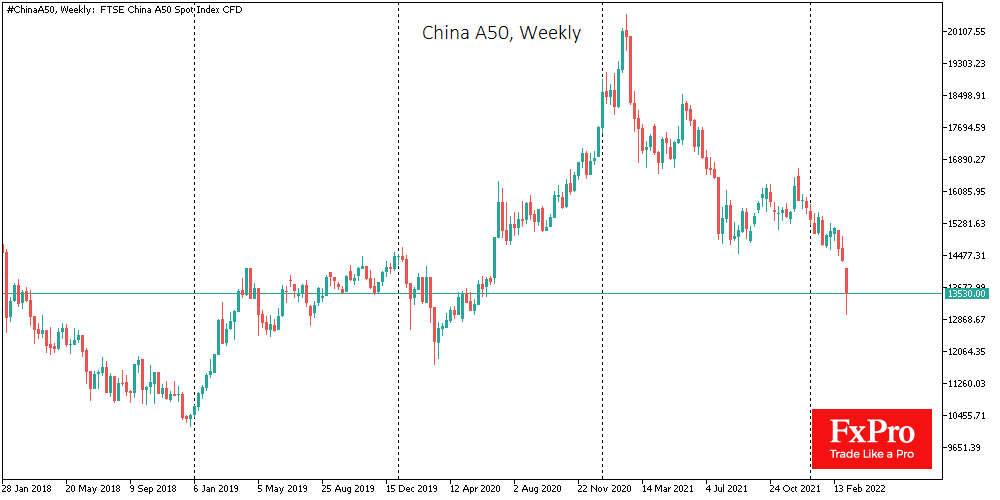

News from Ukraine remains the dominant topic on the financial markets but by no means the only one. Also noteworthy is the increased pressure on Chinese companies, which has intensified since February 17th, almost exactly one month ago. In that.

March 11, 2022

The US S&P500 closed Thursday with a 0.4% drop, but the sustained downward trend since the beginning of the year has formed a “death cross”, a bearish signal of Tech analysis when the 50-day Moving Average crosses down the 200-day.

March 11, 2022

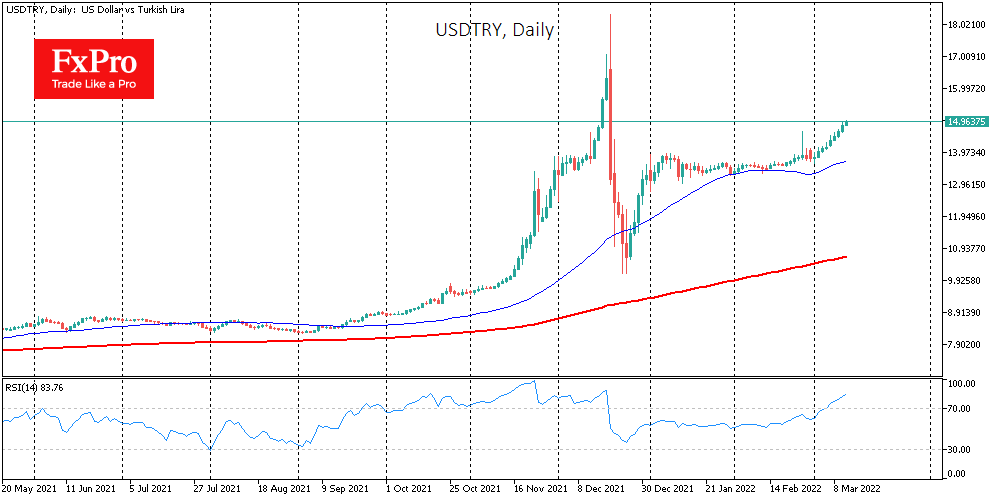

The Turkish lira has fallen back-to-back on each working day in March, having weakened against the US Dollar by 8.2% over this time and coming close to 15.0, where it was last seen in mid-December. The current development of the.

March 11, 2022

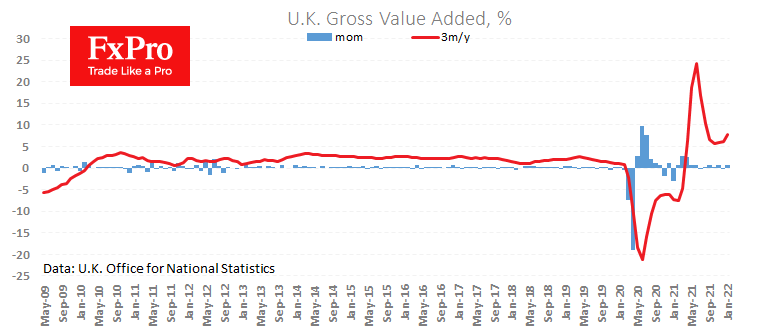

The new monthly package of UK statistics highlighted the fine shape of the economy in January. For the month, GDP rose by 0.8%, against an expected strengthening of 0.2% and the three-month growth rate accelerated from 1.0% to 1.1%. Industrial.

March 10, 2022

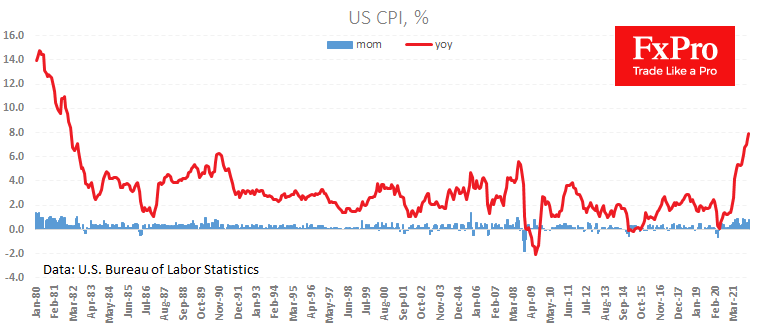

Consumer prices in the USA rose by 0.8% in February as expected. Inflation for the same month a year earlier was 7.9% compared to 7.5% a month earlier and in line with average forecasts. Over the last 12 months, the.

March 10, 2022

The Russian rouble has been on the decline, trading around 120 per dollar on the Moscow Exchange and making historic lows almost daily. Despite ever-increasing capital controls, the Russian currency is still unable to find a bottom, as tighter controls.

March 10, 2022

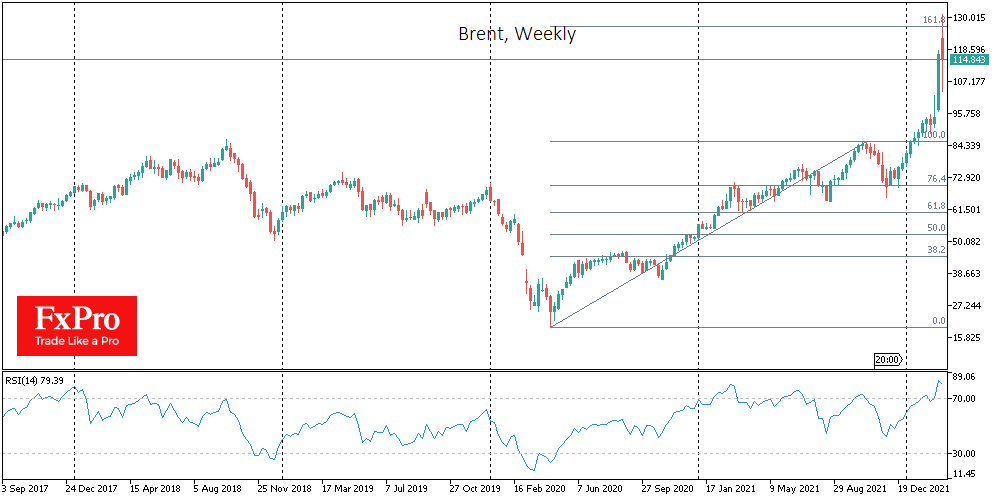

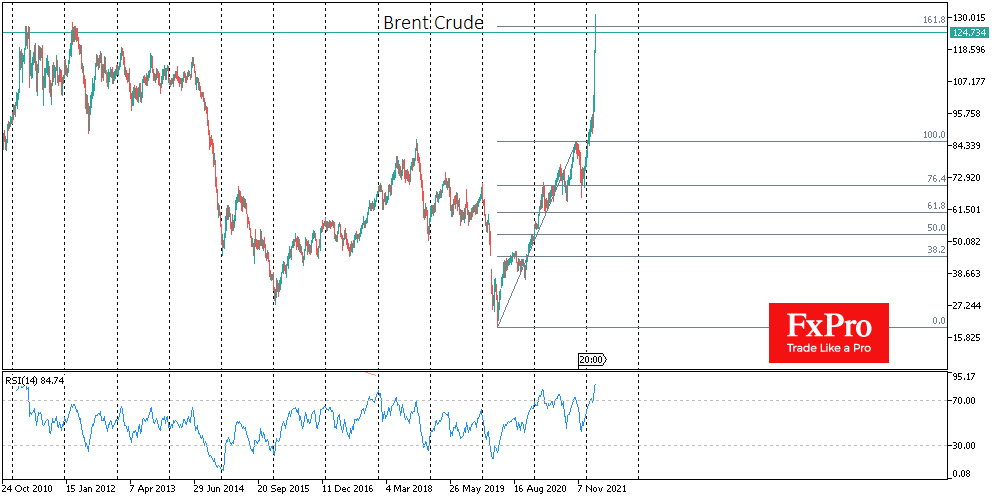

Brent crude experienced its biggest intraday decline yesterday, losing more than $17 on the day to $110, with the range of movements on the spot market exceeding $26.The momentum of the decline was triggered by Blinken’s (US Secretary of State).

March 9, 2022

A barrel of Oil on the spot market briefly topped $130 for Brent and $125 for WTI, having retreated to $127 and $121, respectively, by the start of European trading. Oil received its latest boost on expectations that the US.

March 9, 2022

While the end of last year and the beginning of this one was sentiments that growth momentum was shifting from the US to Europe and emerging markets, events in recent weeks have not only returned EM markets to the downward.