Market Overview - Page 109

May 2, 2022

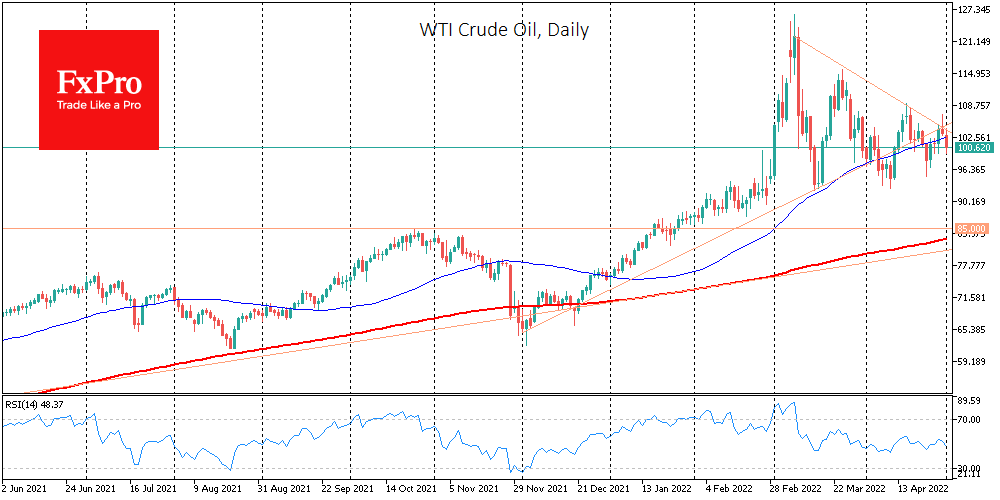

The price of crude is down more than 3% by the start of the New York trading session with a tug-of-war around $100 a barrel of WTI. And this is a rather remarkable market reaction, given reports that EU countries.

May 2, 2022

The US S&P500 closed Friday down 3.6%, while the Nasdaq lost as much as 4.2%, the sharpest one-day decline since June 2020. The decline was triggered by the market reaction to the disappointing reports of tech giants Amazon and Apple,.

April 29, 2022

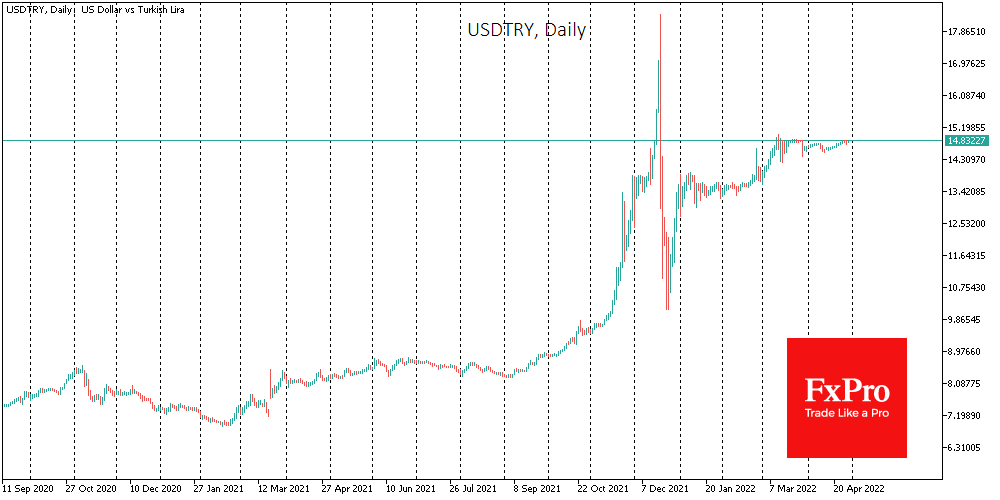

The Turkish lira rose 3.3% against the euro in April due to the latter’s weakness. However, a monthly close near 14.82 for USDTRY would be another all-time high, as the lira has little to counter the strengthening dollar. The remarkable.

April 28, 2022

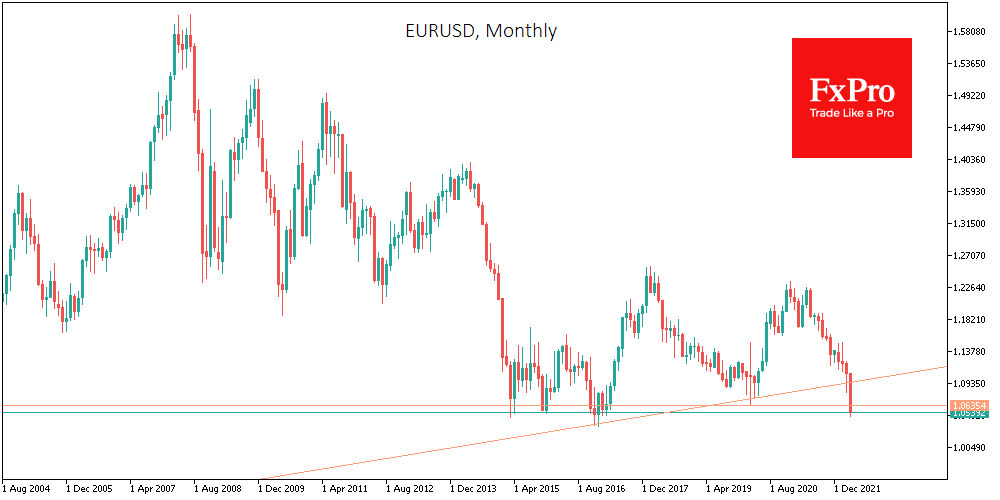

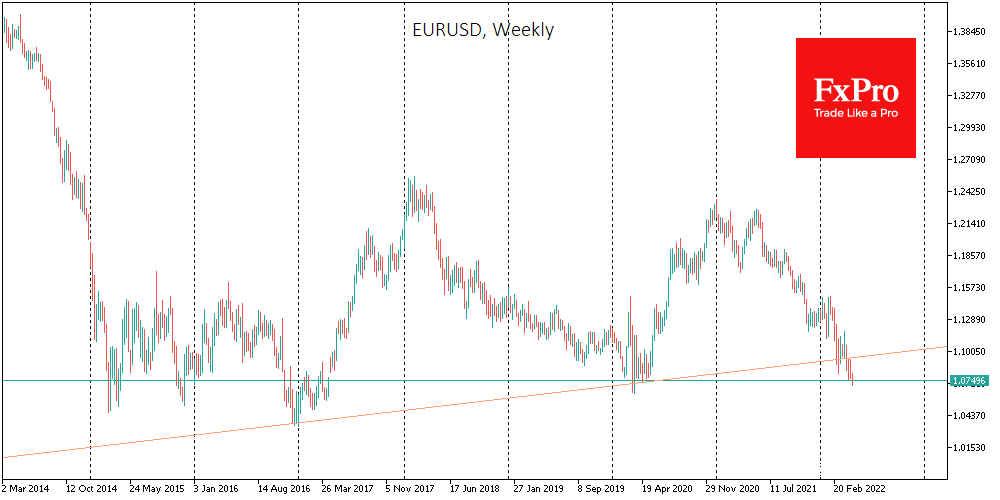

The currency market has gone a little crazy. Key currency pairs with the dollar have reached significant round levels, attracting attention, and the extent of US currency appreciation continues to pick up speed. EURUSD on Thursday morning fell to 1.05,.

April 27, 2022

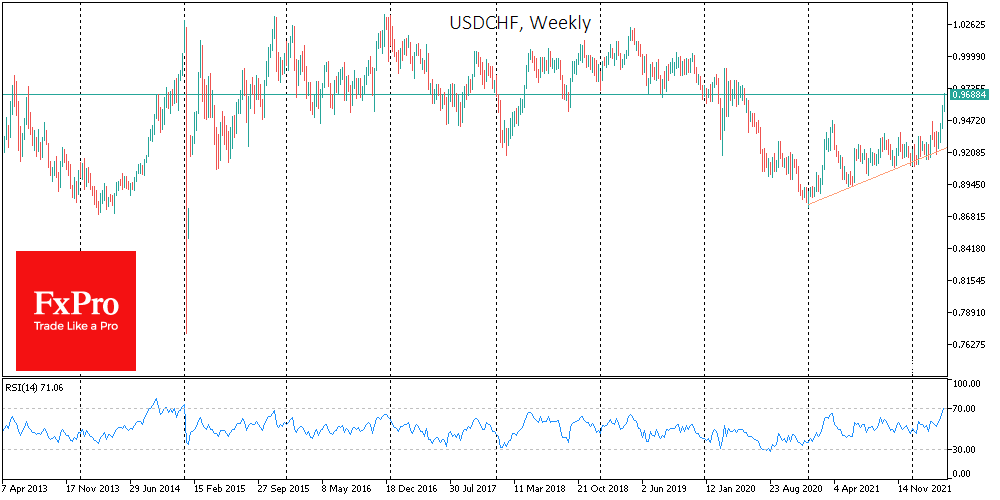

The Swiss franc is on track for its most substantial monthly decline against the dollar in almost ten years. The USDCHF pair chart has shown neat support on declines from increasingly higher levels since the beginning of last year. And.

April 27, 2022

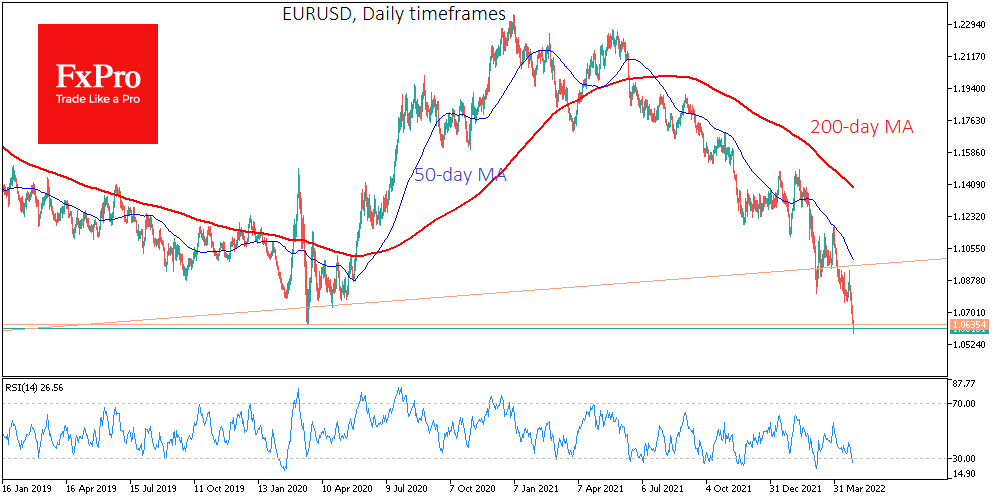

The single currency has fallen under 1.0590, below pandemic lows and at its lowest level since April 2017. The 1.0600 area for EURUSD has repeatedly worked as a turning point since 2015. In 1997 and 1998 the selloffs also stopped.

April 26, 2022

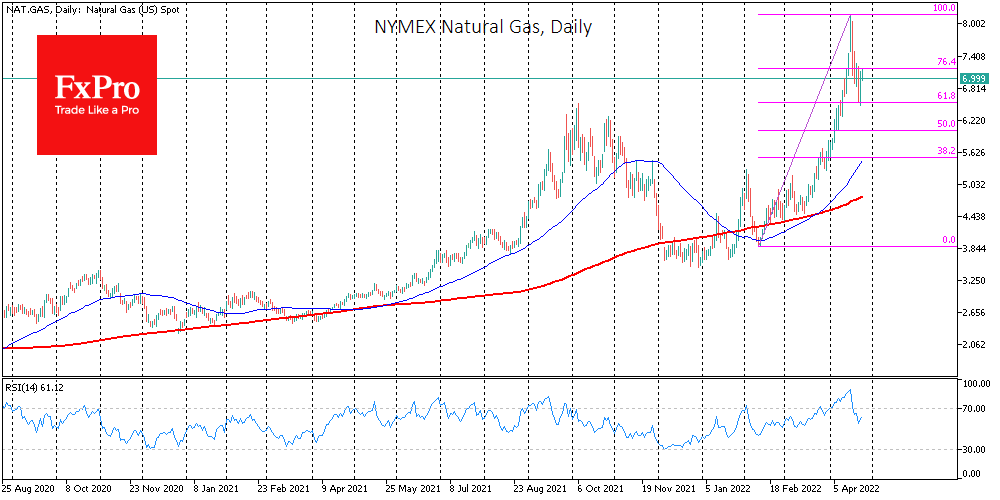

NYMEX Natural gas price has again surpassed $7 and may well have completed a corrective pullback from the February-April momentum and may soon be preparing to go to a multi-year high above $8.2. It spiked 110% from the Feb lows.

April 26, 2022

Twitter’s Board of Directors has agreed to a takeover offer from Elon Musk of $44 billion. The Tesla conglomerate and the world’s richest man initially offered to buy Twitter for $54.20 on the 14th of April, not long after revealing.

April 26, 2022

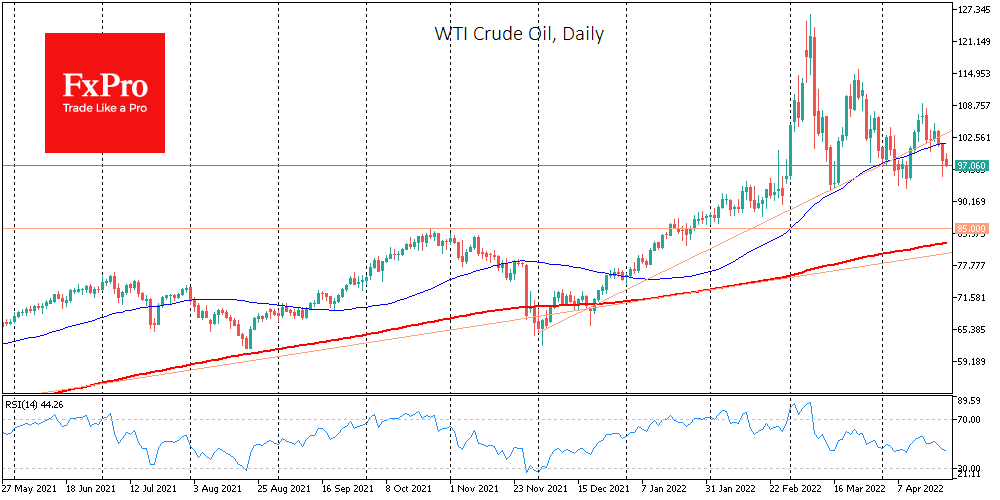

Following Gold, the uptrend formed in early December is also breaking in oil. Intraday on Monday, the WTI price lost more than 6%, recovering about half of the decline on some return of risk appetite in the last couple of.

April 25, 2022

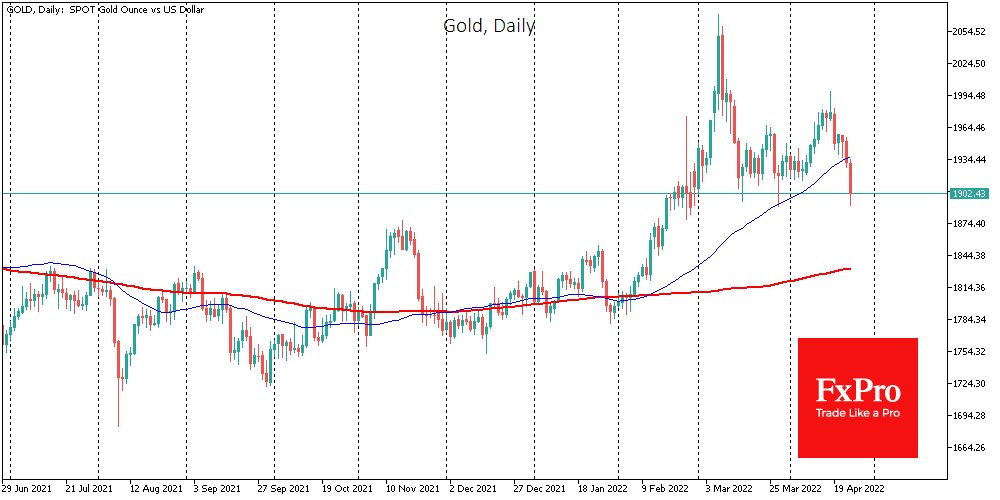

Gold lost 1.6% since the beginning of the day on Monday, testing $1900 precisely one week after an unsuccessful attempt to get above $2000. The essential factor that puts pressure on gold is the Fed’s toughening rhetoric that triggers a.

April 25, 2022

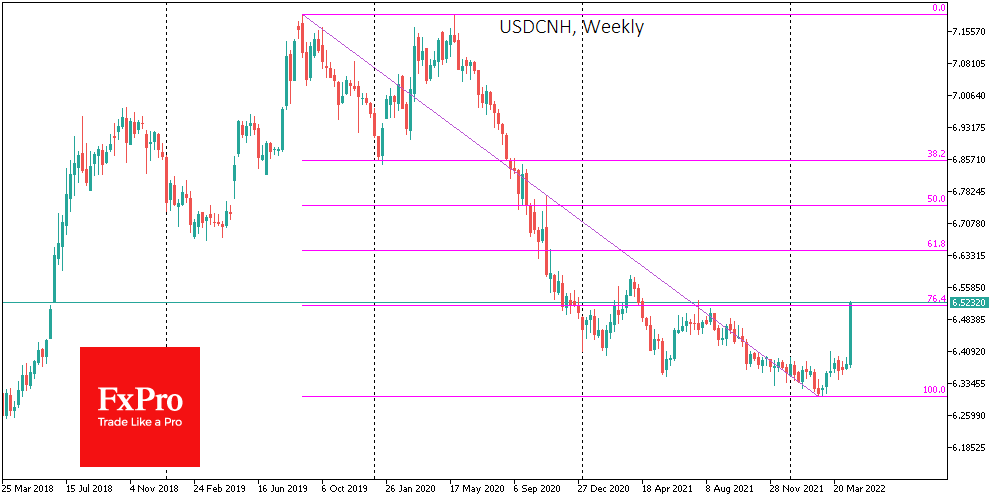

The dollar continues to push back against competitors in global markets, going on the offensive against a broader front of currencies and stock indices. Geopolitics is ceding to monetary policy its role as the primary driver. And that could be.