Market Overview

February 16, 2026

Silver diverges from gold, pressured by market surplus and falling demand; dollar weakens amid US economic concerns, while yen strengthens on political stability.

February 13, 2026

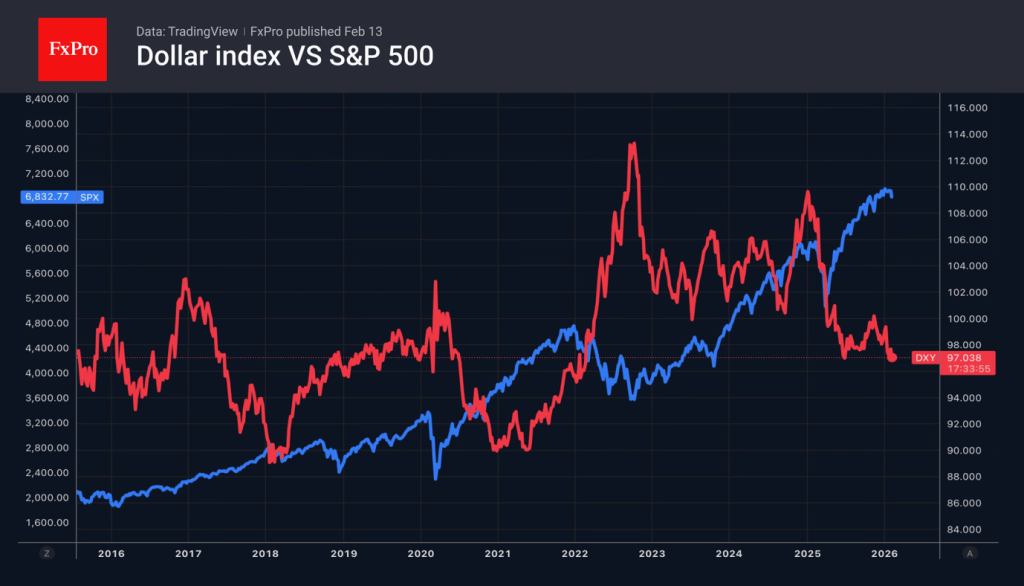

Traders sold gold to meet margin requirements. The unwinding of currency hedging operations supports the US dollar.

February 12, 2026

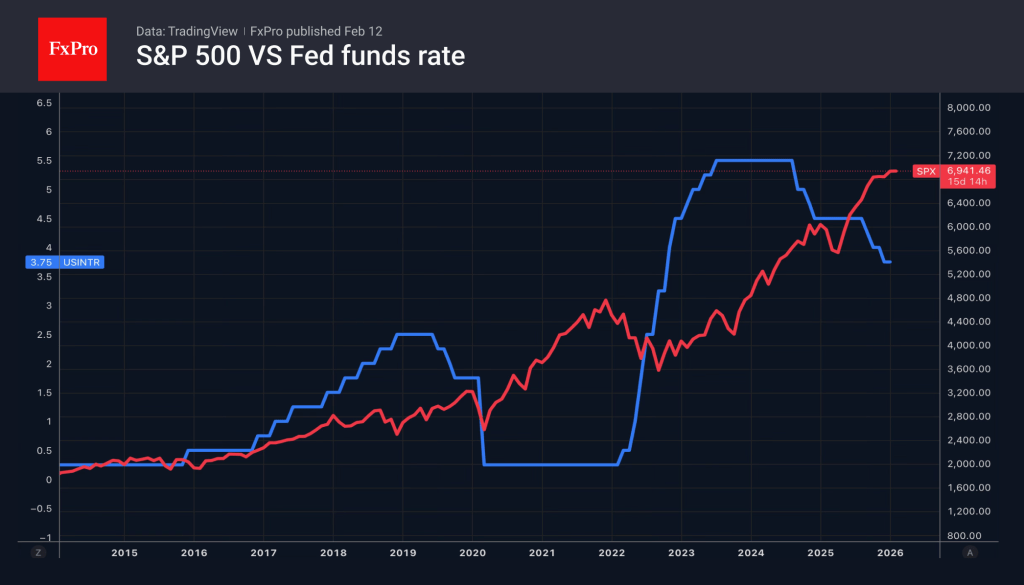

US stock indices went on a rollercoaster ride after the release of January jobs data. They first hit new local highs but then fell sharply. Good news for the economy was bad news for the S&P500. Investors reacted to the.

February 12, 2026

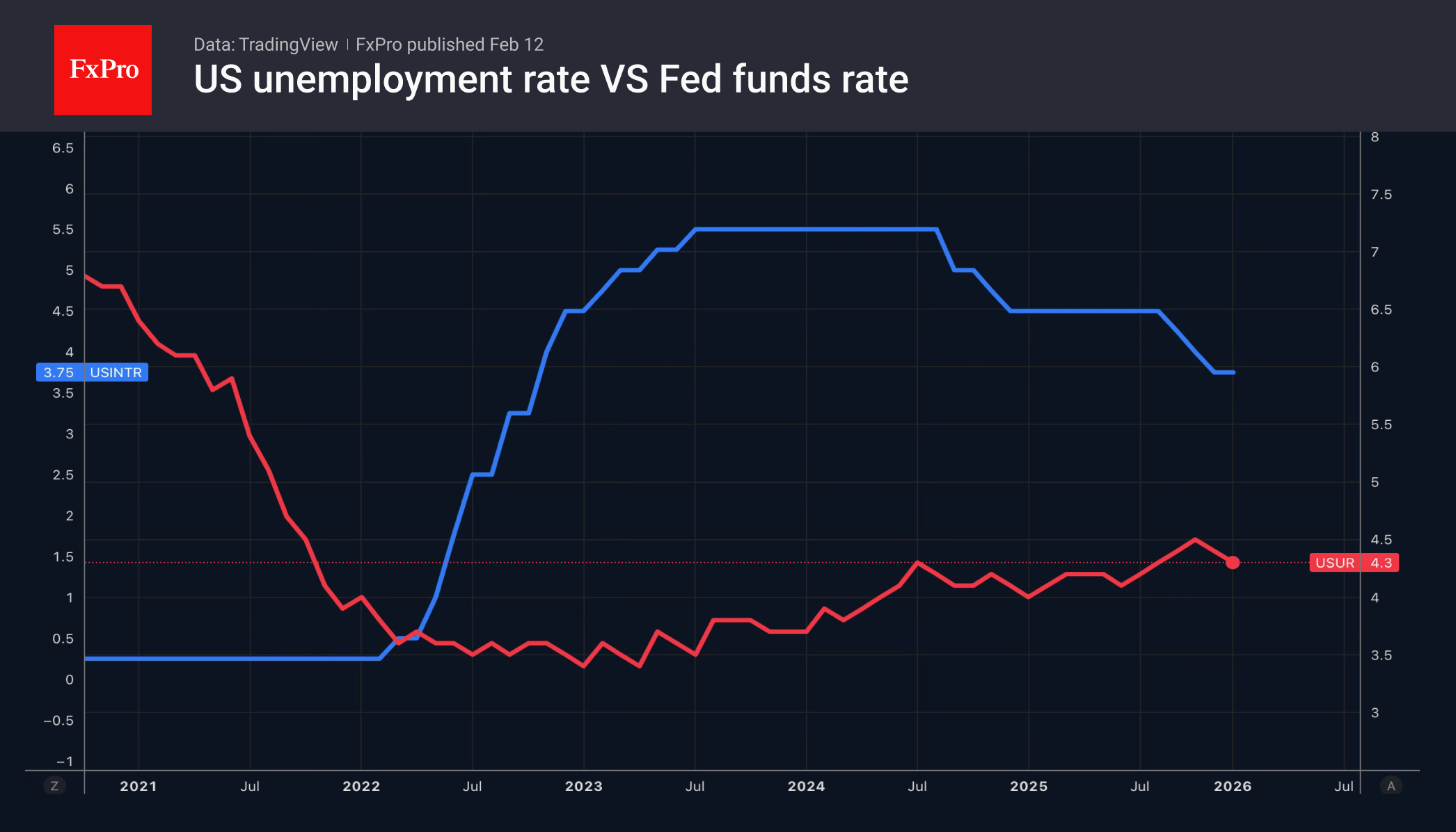

Strong US jobs data gives the Fed more room to pause rate cuts, boosting the dollar and weighing on the pound and gold, with yen gains on capital repatriation.

February 11, 2026

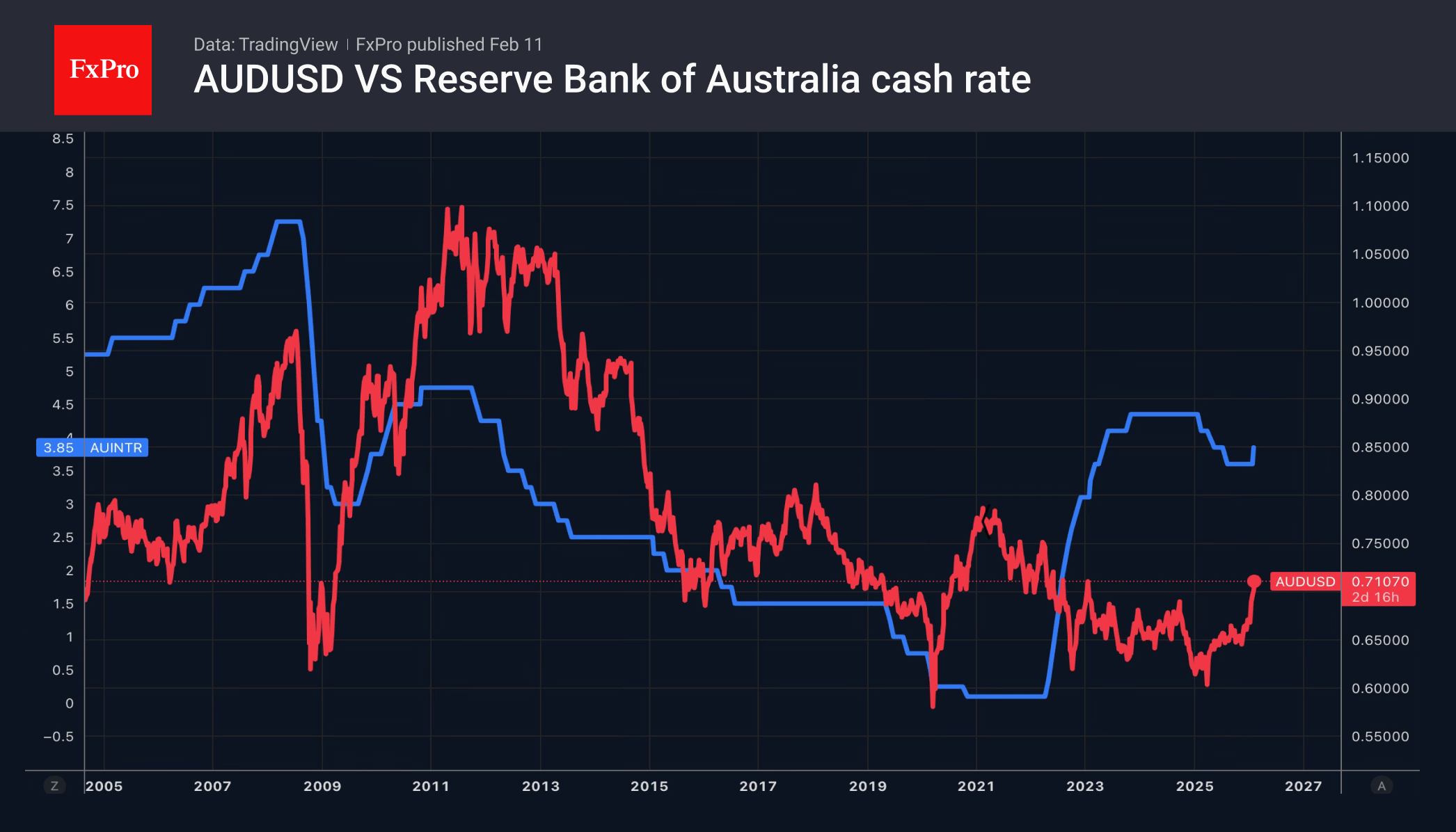

AUD leads Forex; US dollar pressured by jobs, retail sales, and possible rate cuts. JPY strengthens on capital inflows. Gold eyes Fed policy.

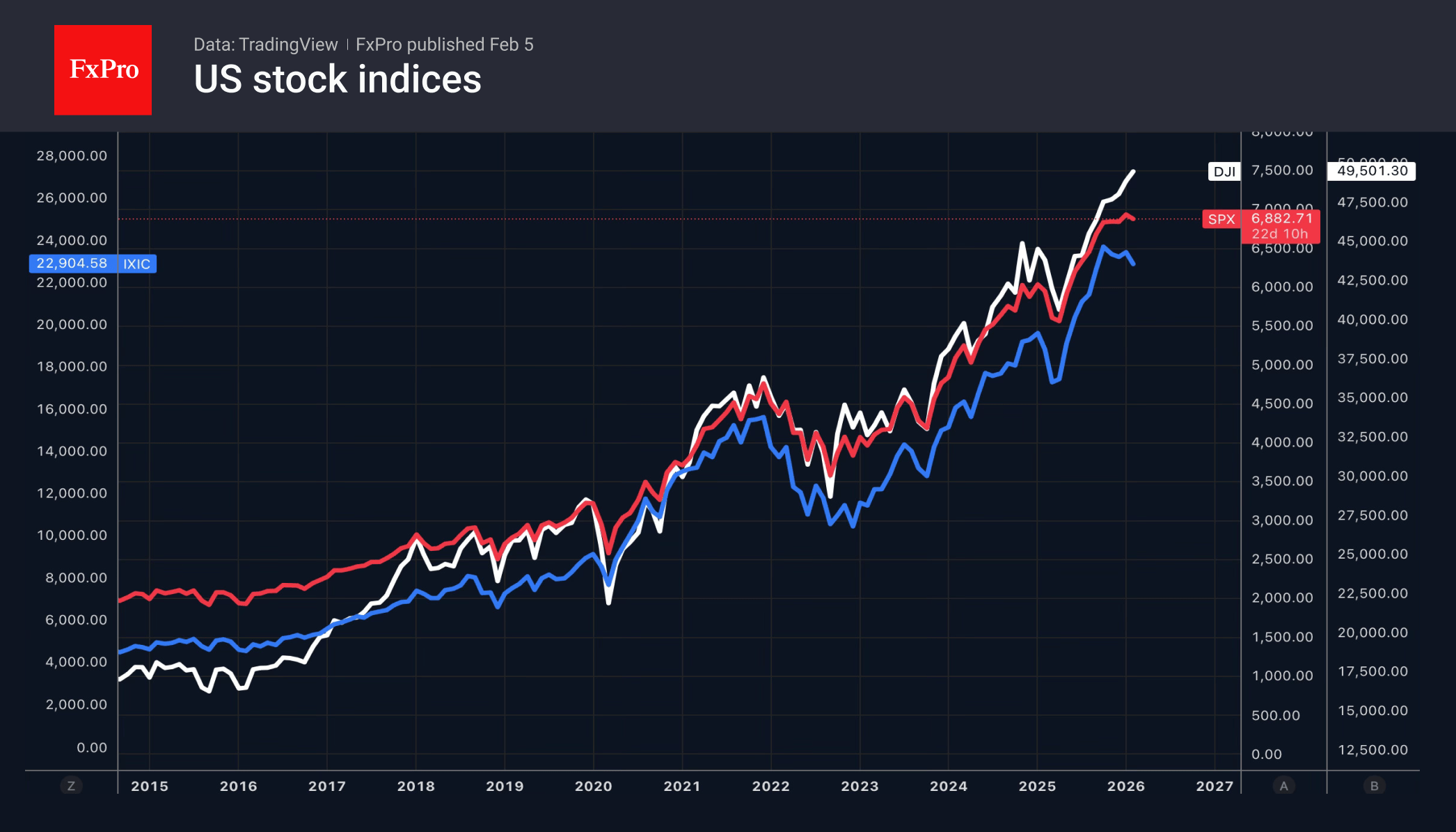

February 11, 2026

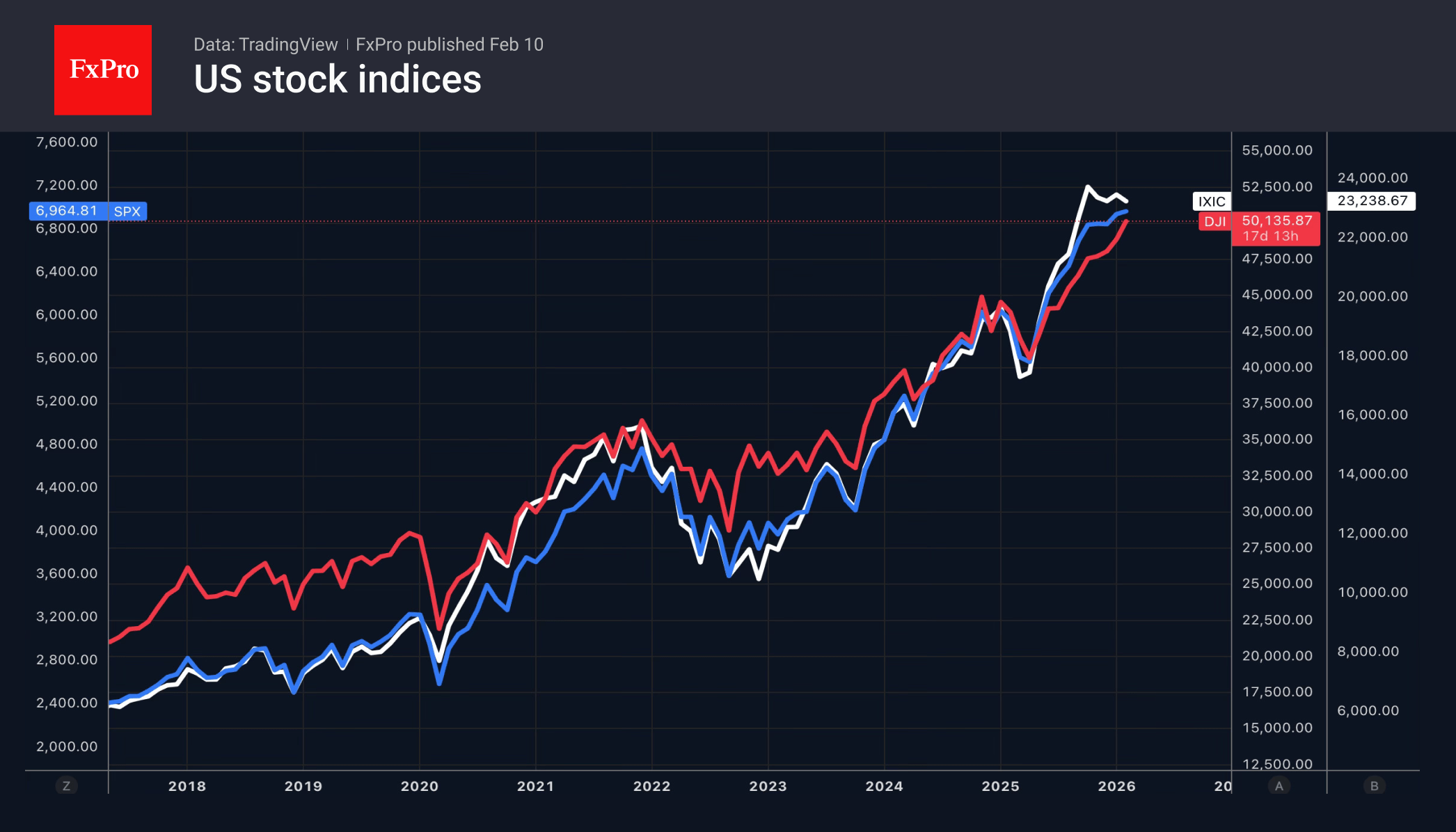

The Dow Jones hit 50,000 for the first time, outperforming other indexes due to investor rotation and economic optimism.

February 10, 2026

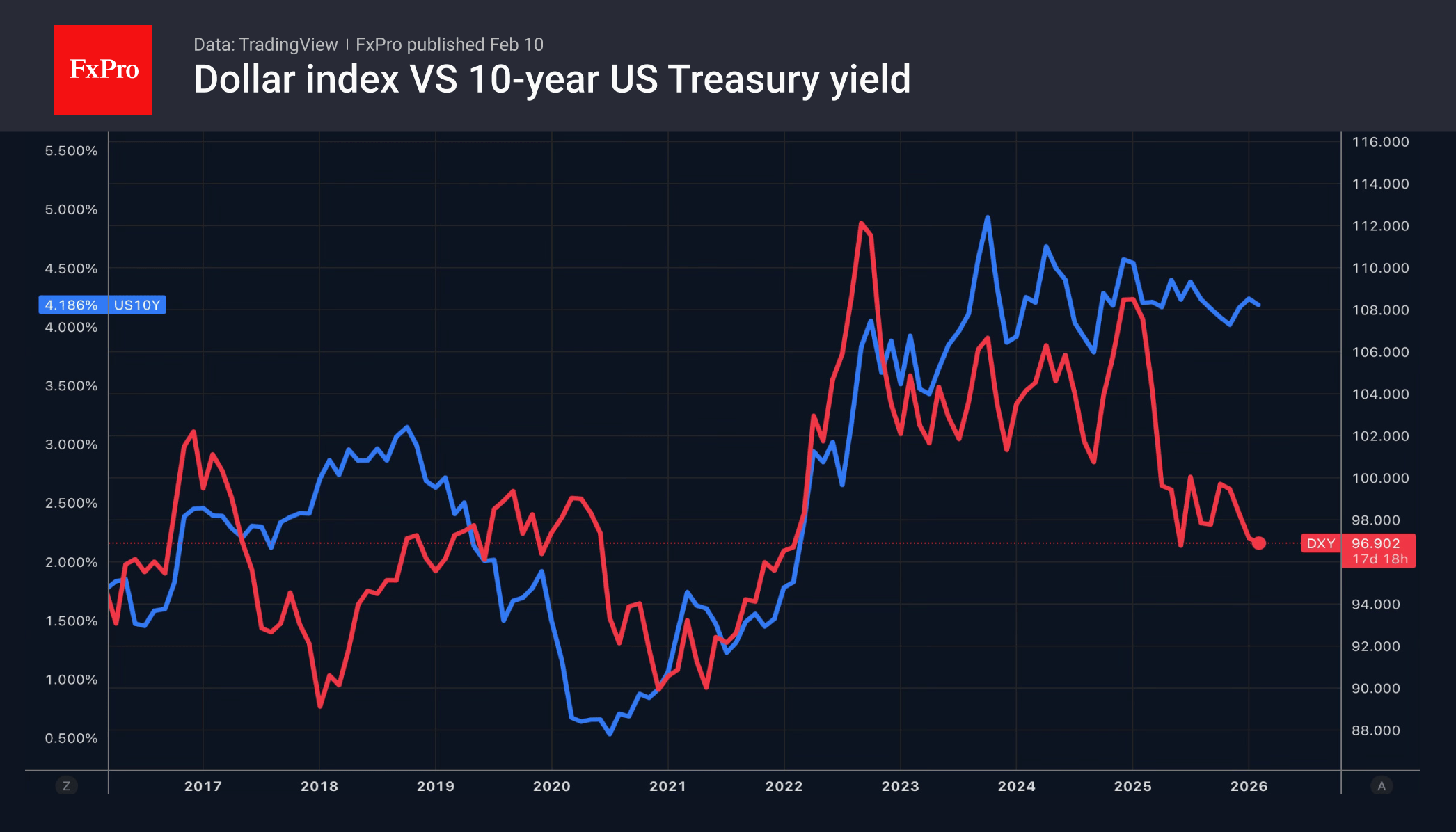

While the IMF is urging investors not to focus on the dollar’s short-term weakness, EURUSD is posting its best daily gain since the end of January. According to the International Monetary Fund, the greenback will retain its power on the.

February 9, 2026

Key events: delayed US jobs and inflation data may affect rate decisions; Middle East tensions and rising oil boost the US dollar as a safe haven.

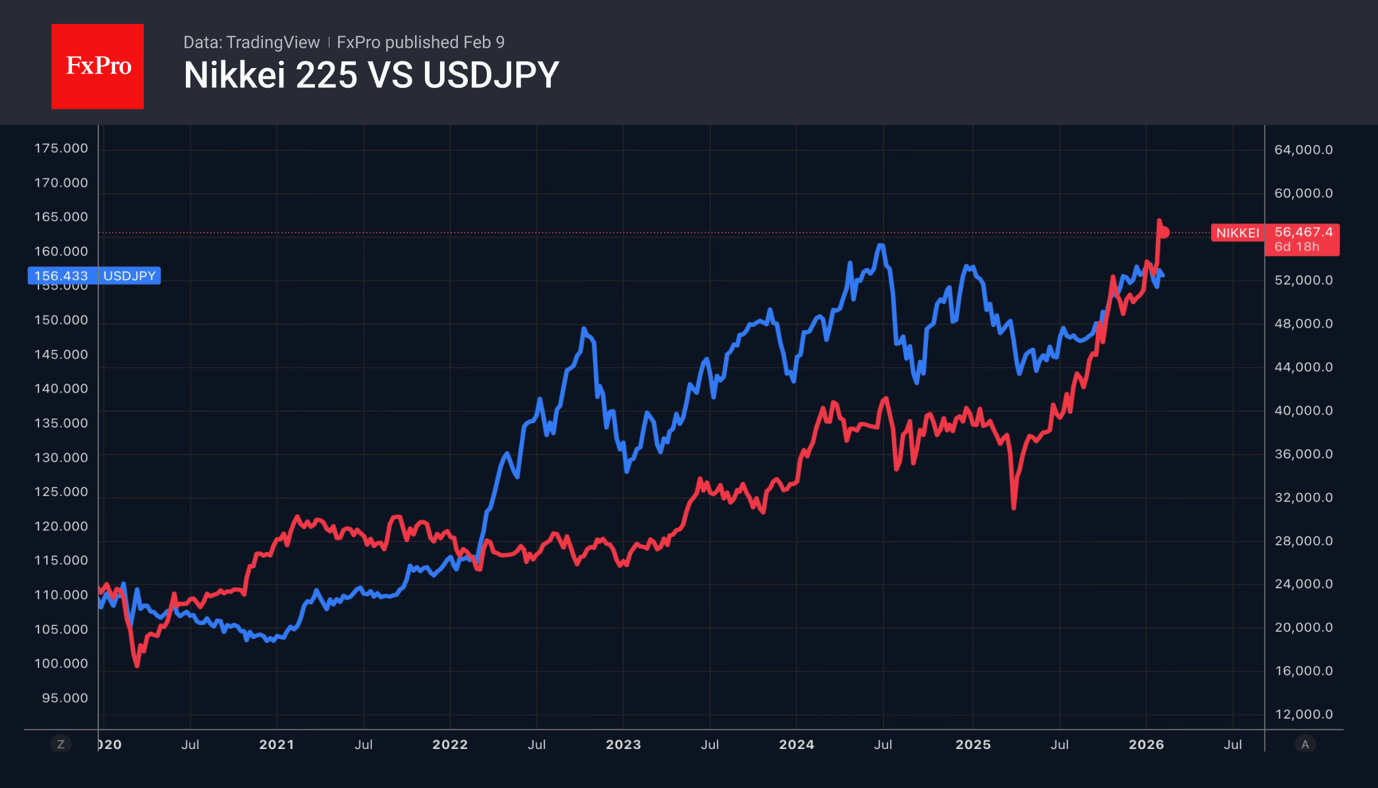

February 9, 2026

The yen strengthened post-LDP win, China boosts gold prices, US dollar weakens as global risk appetite improves.

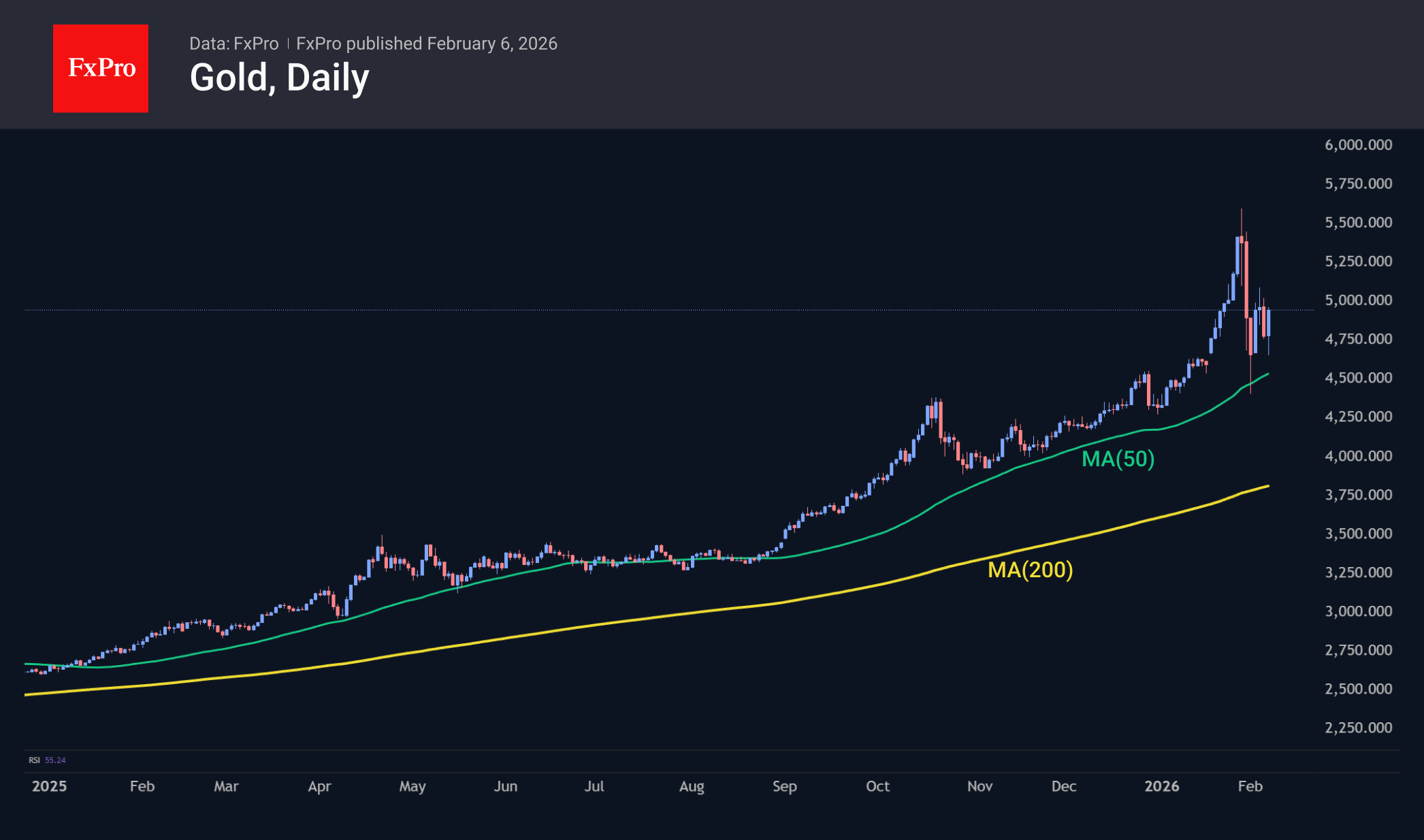

February 6, 2026

After the most significant sell-off since 1980, gold is attempting to stabilise. Bears argue that the bubble has burst and events will unfold as they did in 2011. Back then, after falling from record highs, the precious metal entered a.

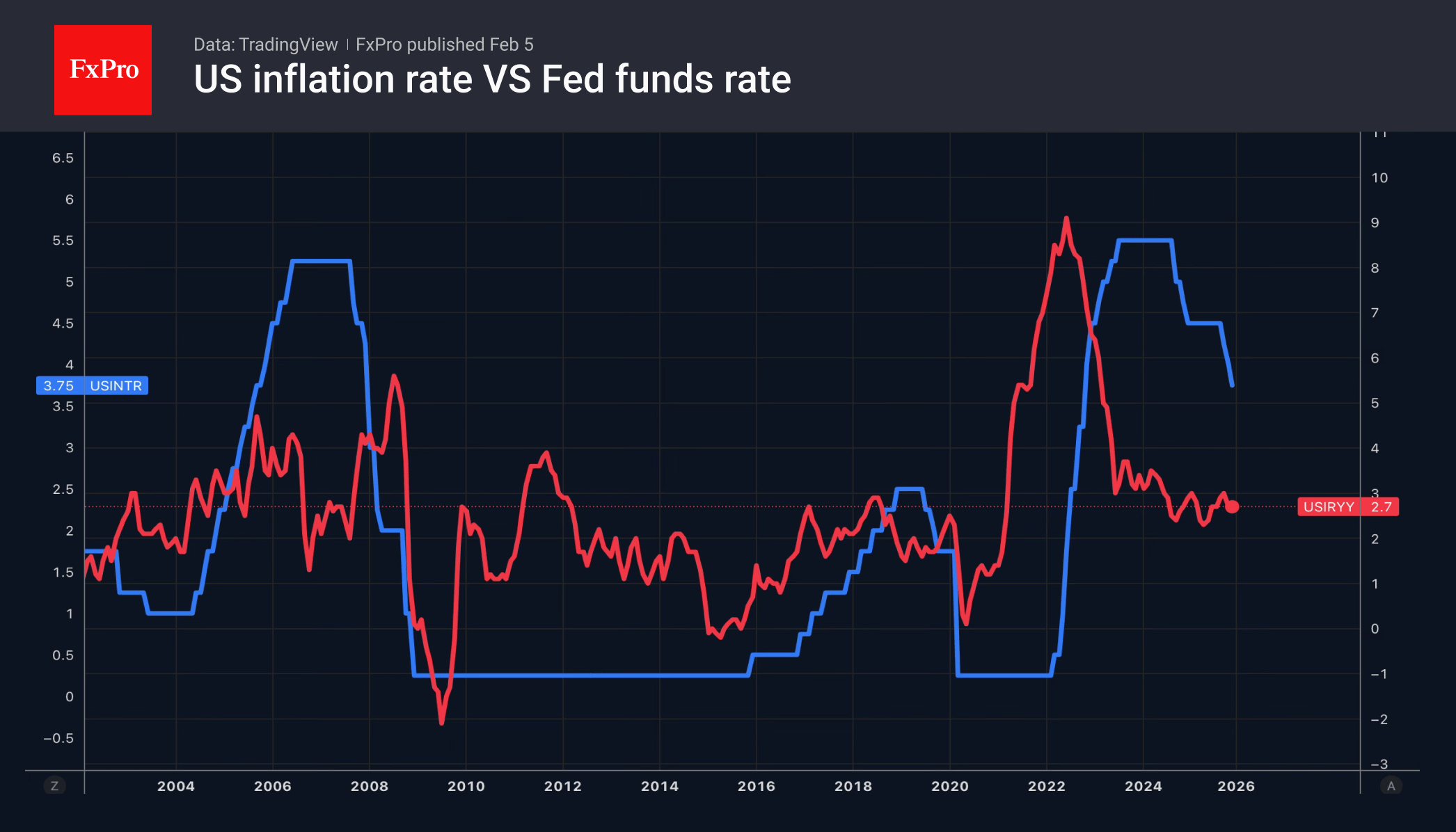

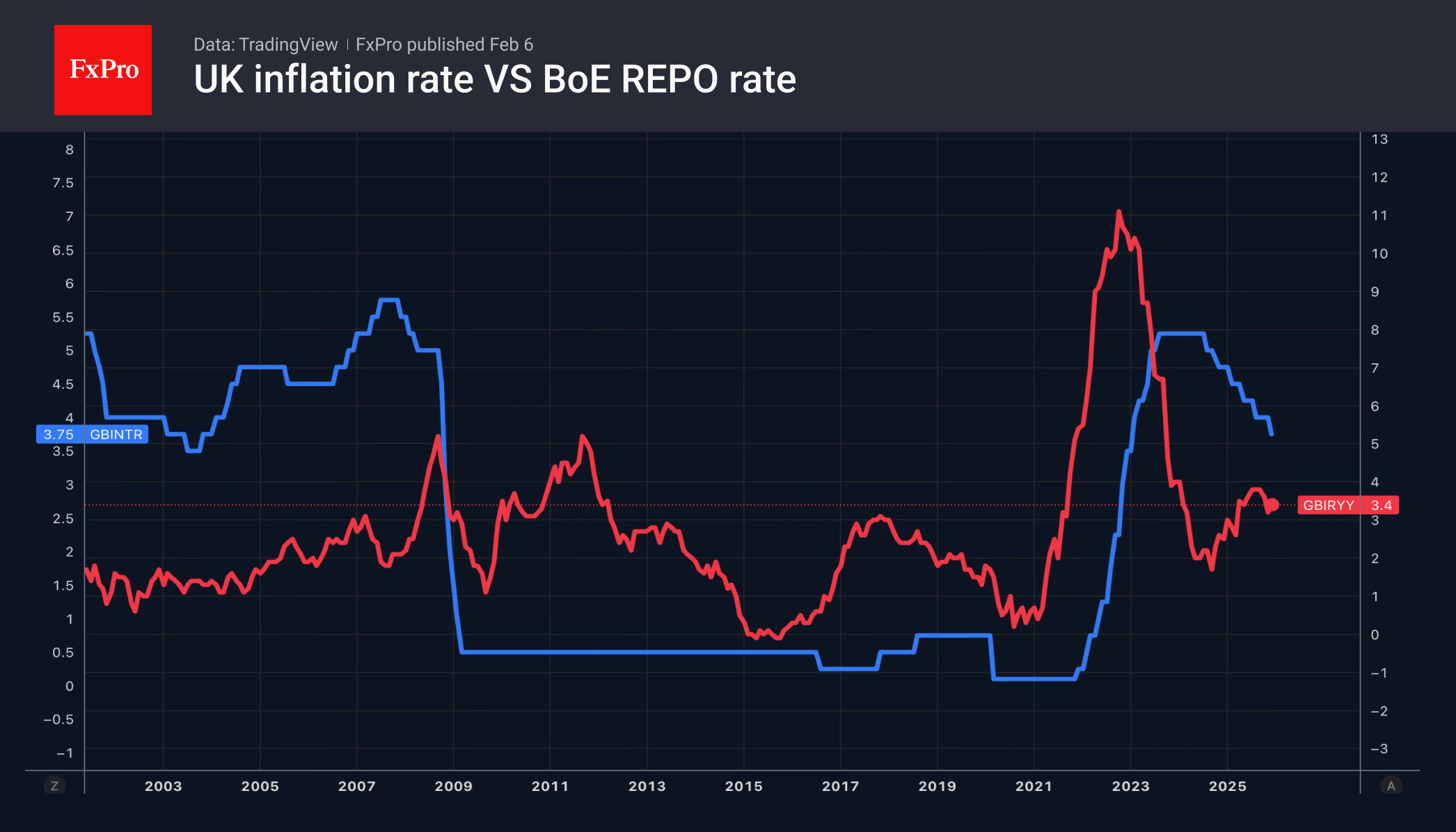

February 6, 2026

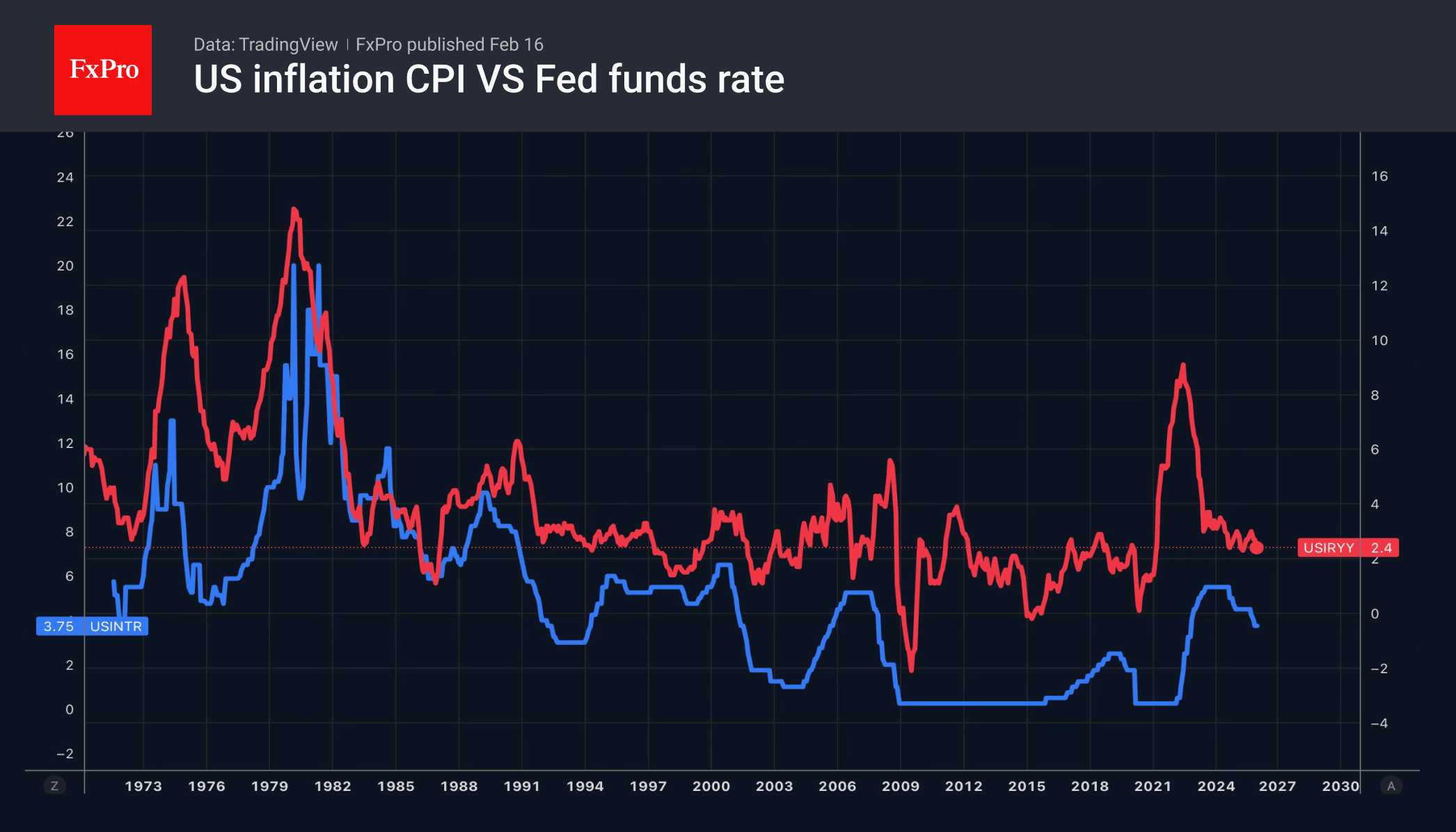

The Bank of England signalled rate cuts, weakening the pound, while the ECB supported the euro. US economic weakness fuels Fed rate cut expectations.