Market Overview

February 20, 2026

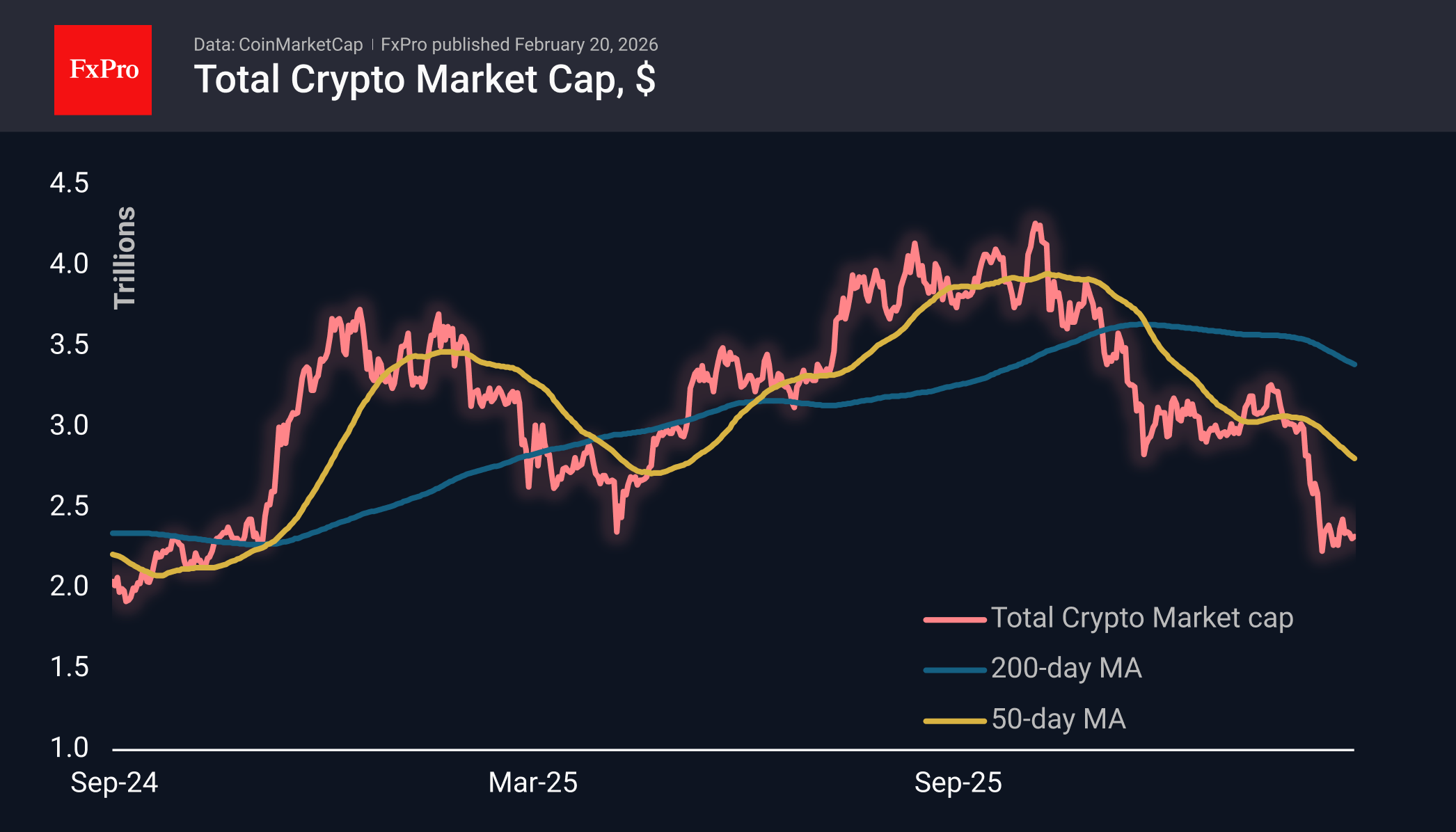

The crypto market is consolidating, with Bitcoin and Trump Coin rebounding. Ethereum developers outline upgrades, while altcoins face selling pressure.

February 20, 2026

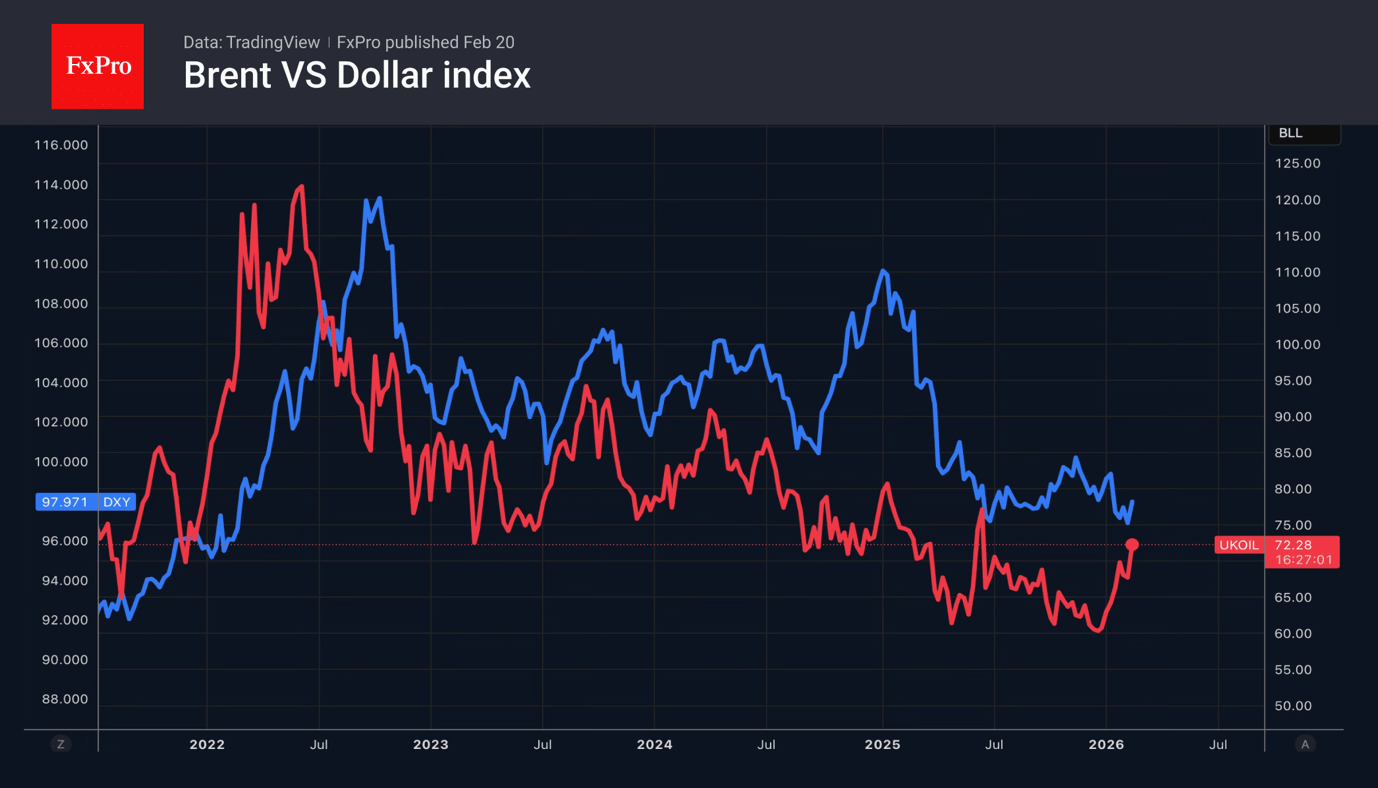

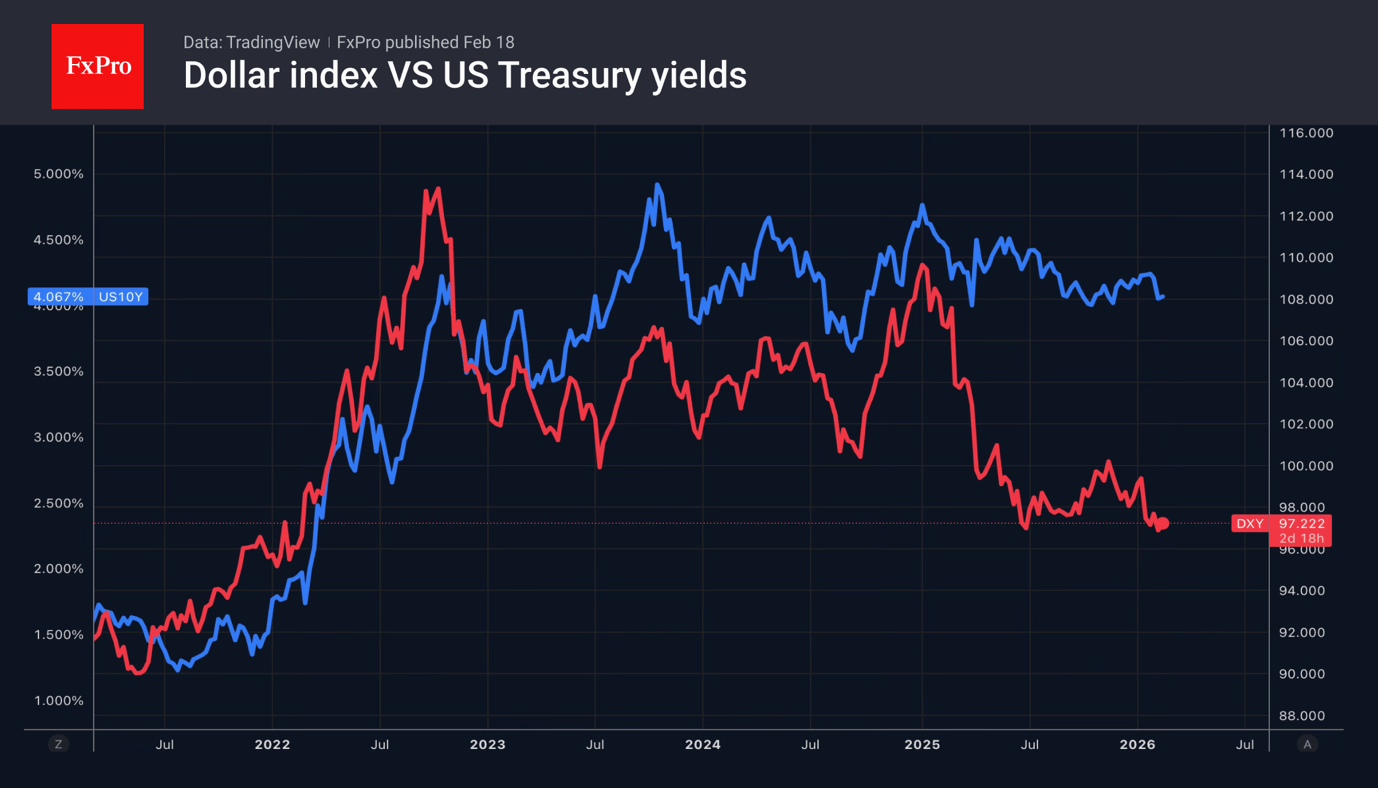

Geopolitical tensions and economic data boost the US dollar's safe-haven status, impacting JPY, EUR, oil, and gold markets.

February 20, 2026

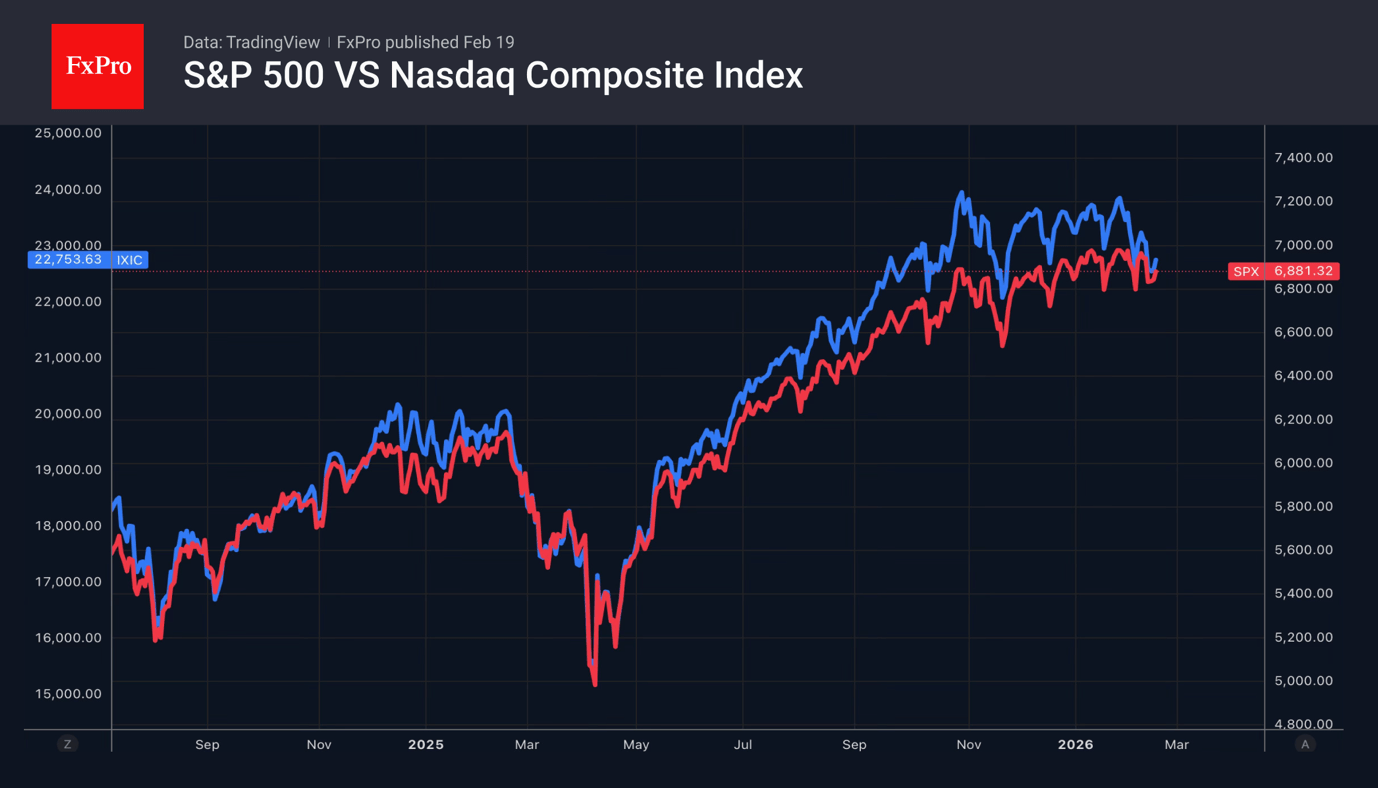

Renewed investor interest in tech giants follows valuation drops, with major AI investments and rising foreign investment in US securities.

February 19, 2026

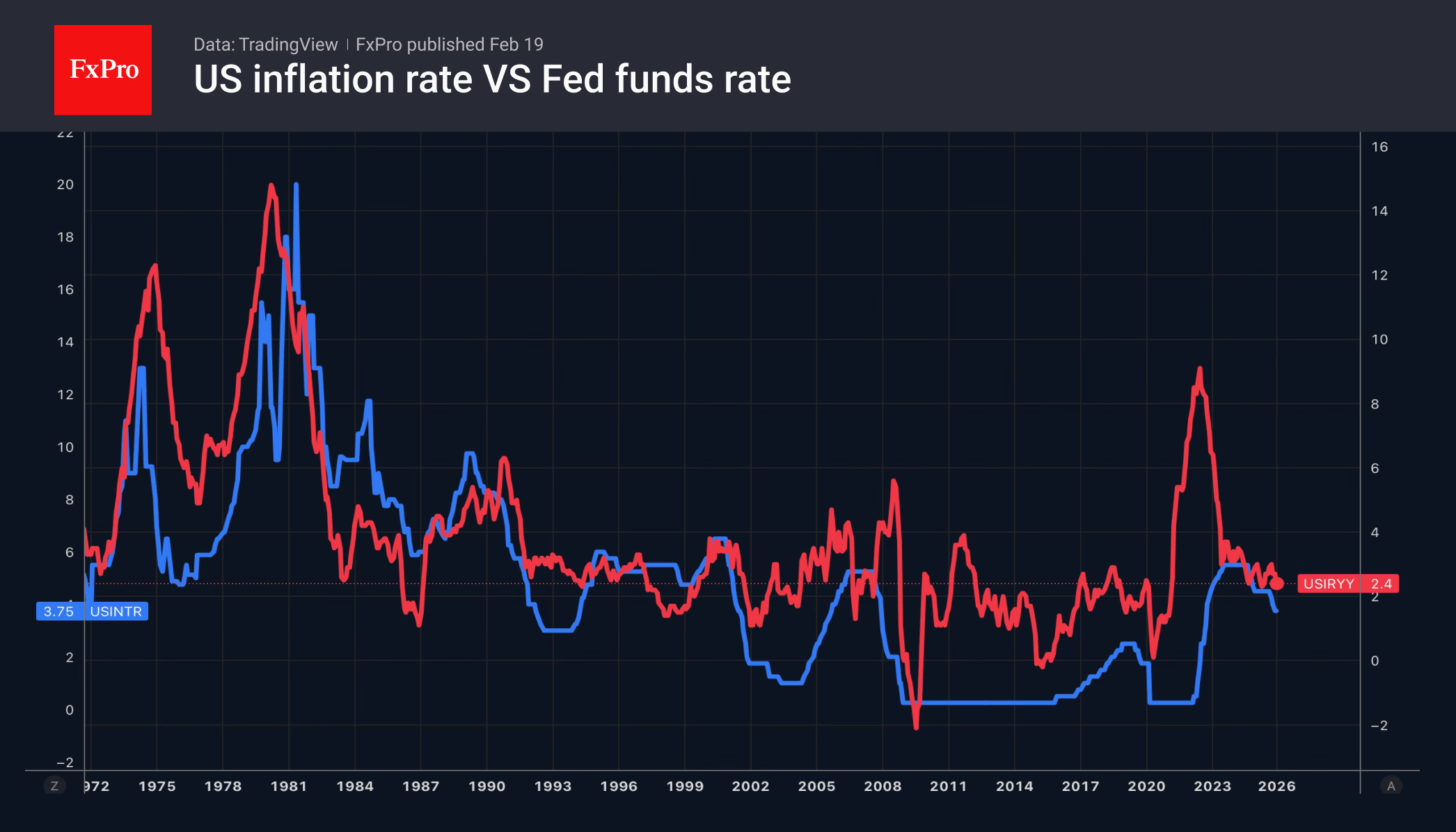

The FOMC minutes boosted the dollar, while slowing inflation weighed on the pound. USDJPY rose amid US market gains and Japanese political shifts.

February 18, 2026

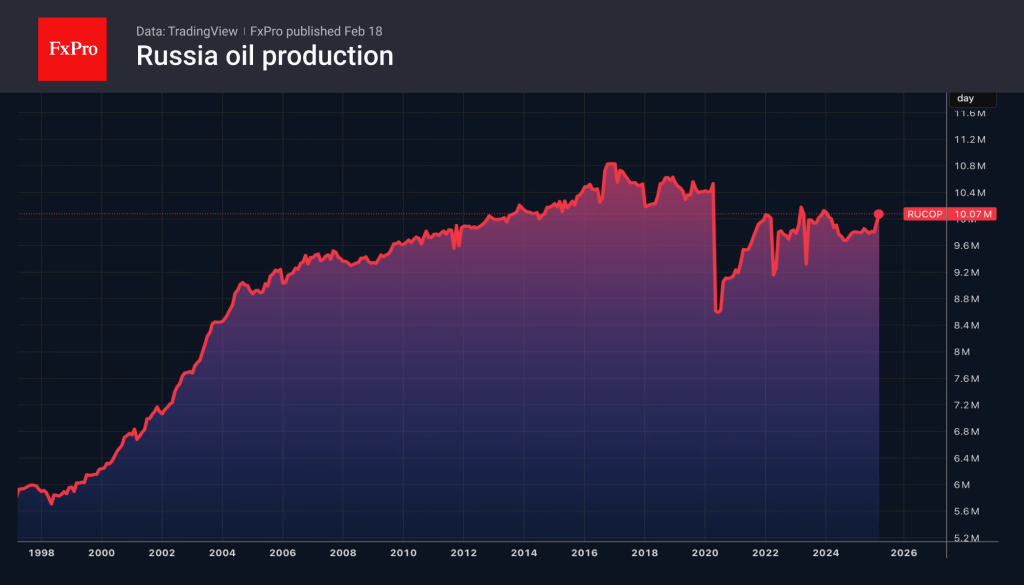

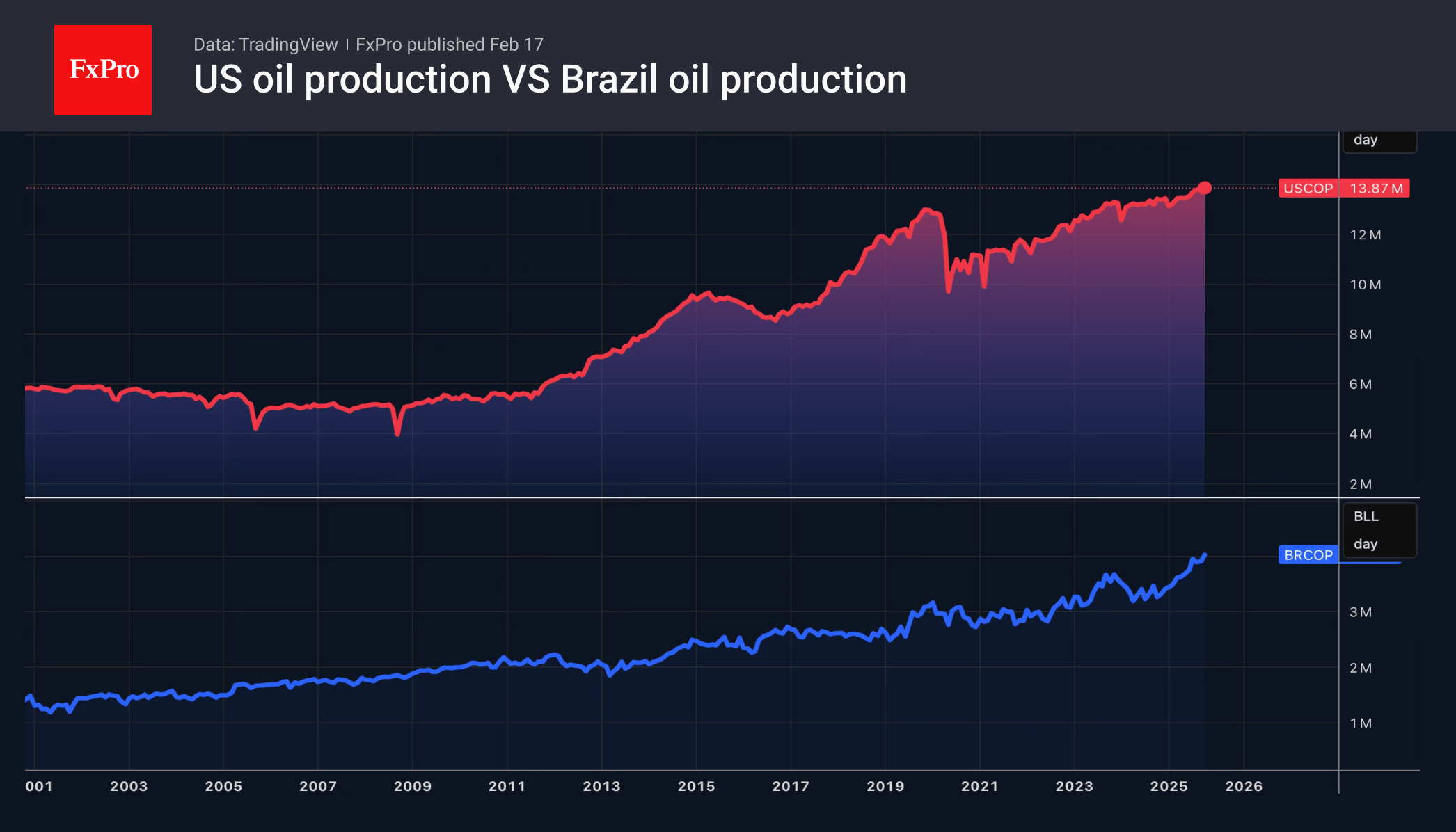

Brent bulls believe that sooner or later, Russia and Iran will reduce production and exports of Crude. This will lead to price increases. The bears are convinced of the opposite: thanks to discounts, barrels of oil will be absorbed by.

February 18, 2026

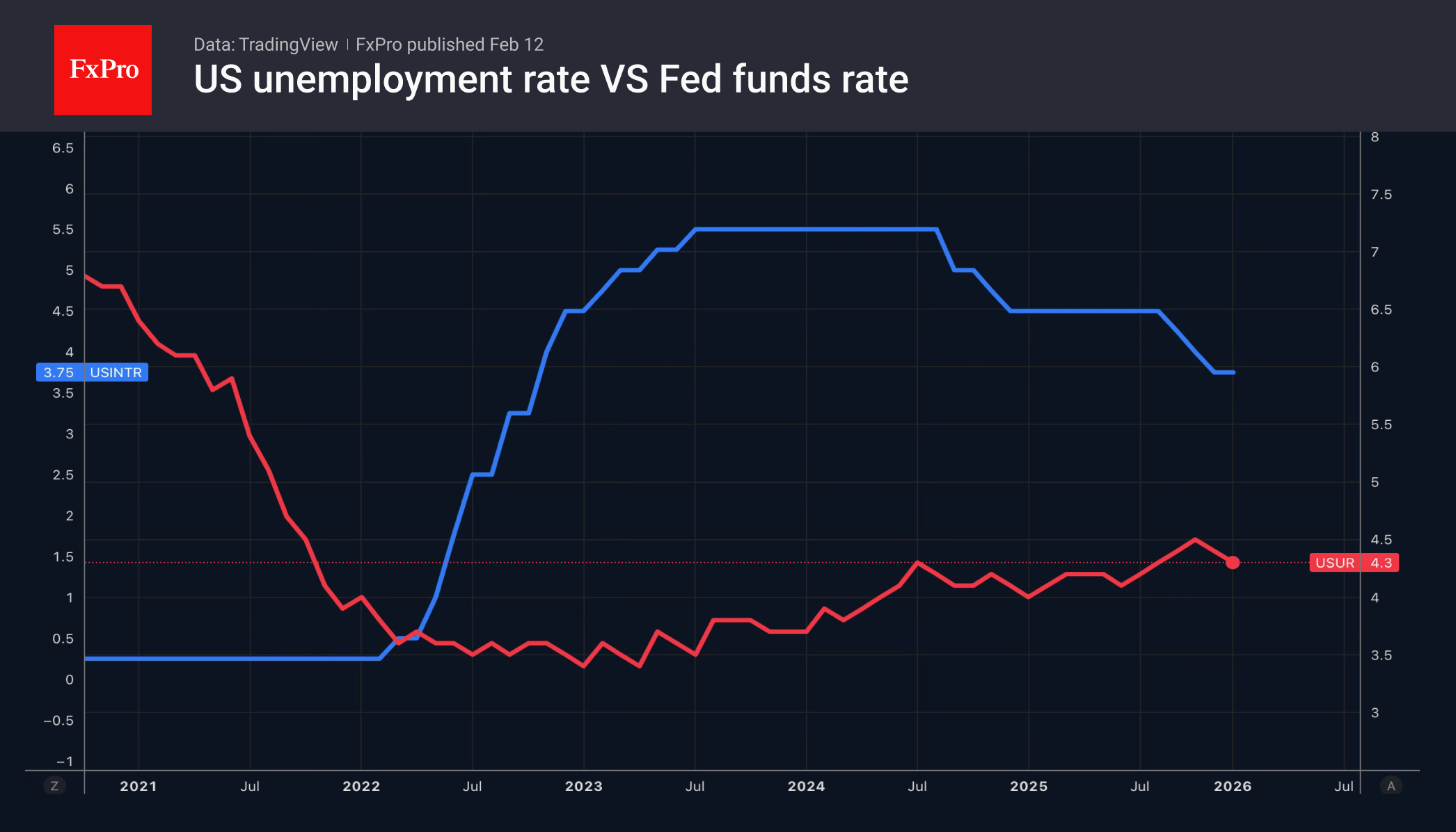

Weakness in the labour market forces the Bank of England to cut rates. India's near-record imports provide support for precious metals.

February 17, 2026

During crises and turmoil in the global economy or politics, market sentiment outweighs fundamental factors. Geopolitical risk premiums are currently estimated at $5-7 per barrel. At the same time, negotiations between the US and Iran, and between Russia and Ukraine,.

February 17, 2026

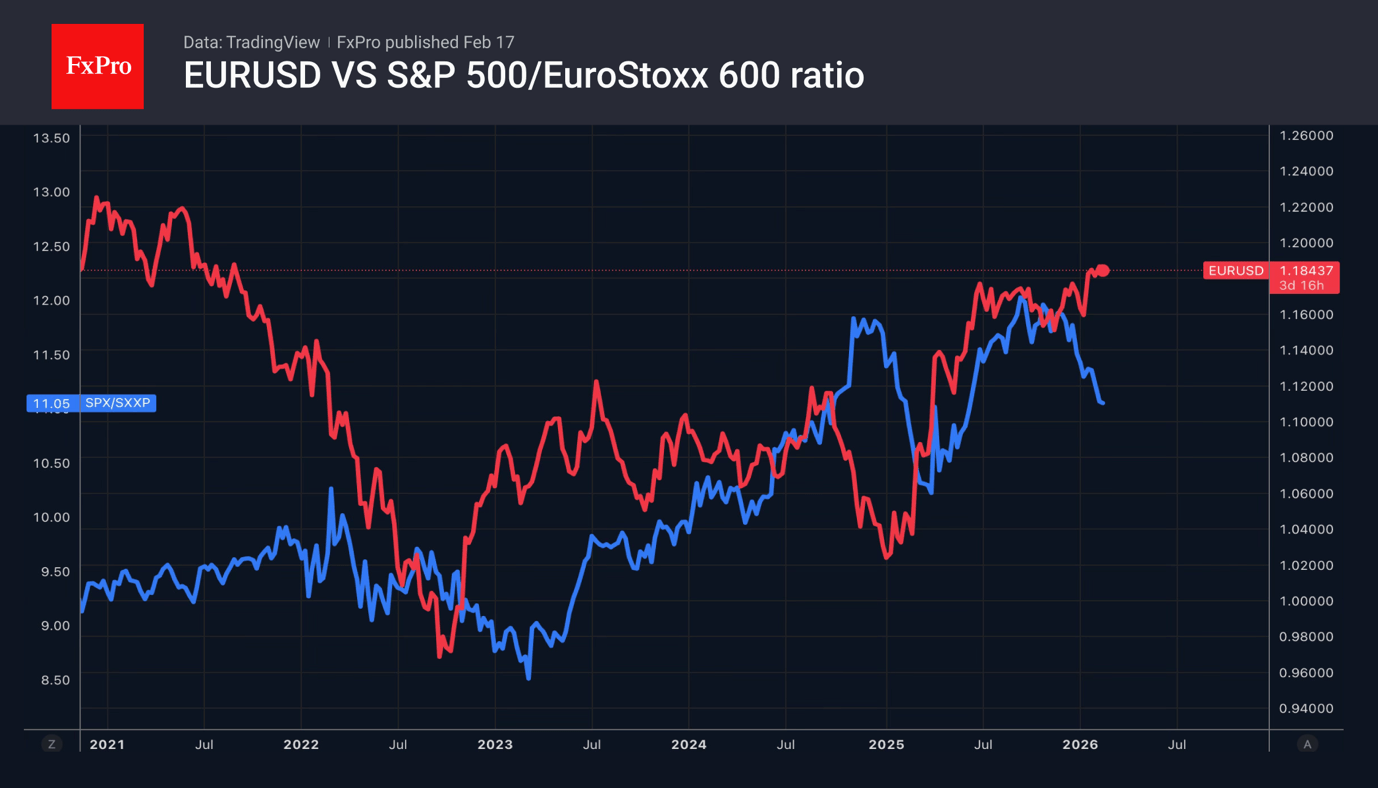

EURUSD remains prone to consolidation. The yen is strengthening thanks to capital flows.

February 16, 2026

Silver diverges from gold, pressured by market surplus and falling demand; dollar weakens amid US economic concerns, while yen strengthens on political stability.

February 13, 2026

Traders sold gold to meet margin requirements. The unwinding of currency hedging operations supports the US dollar.

February 12, 2026

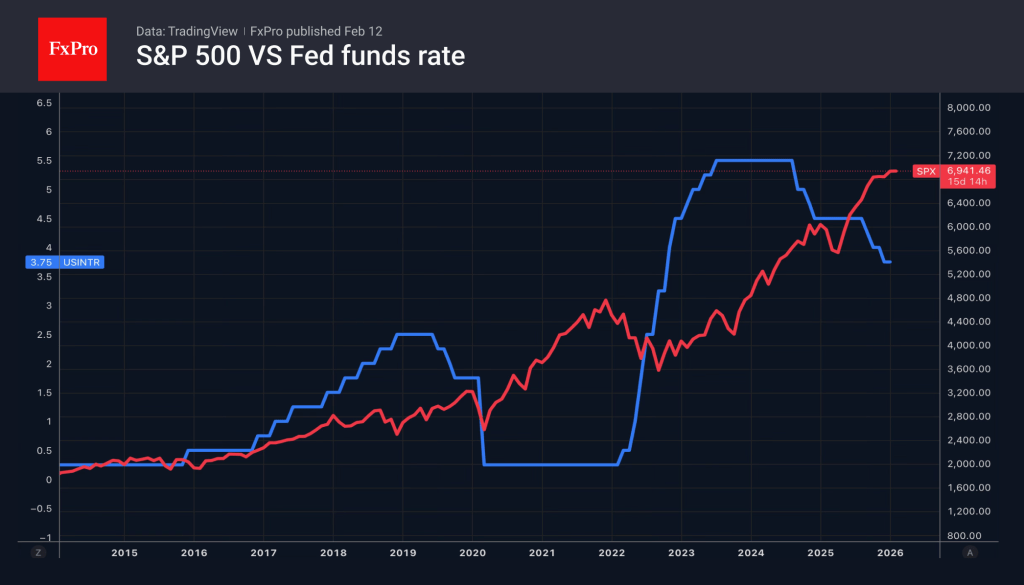

US stock indices went on a rollercoaster ride after the release of January jobs data. They first hit new local highs but then fell sharply. Good news for the economy was bad news for the S&P500. Investors reacted to the.