Technical analysis - Page 99

October 29, 2024

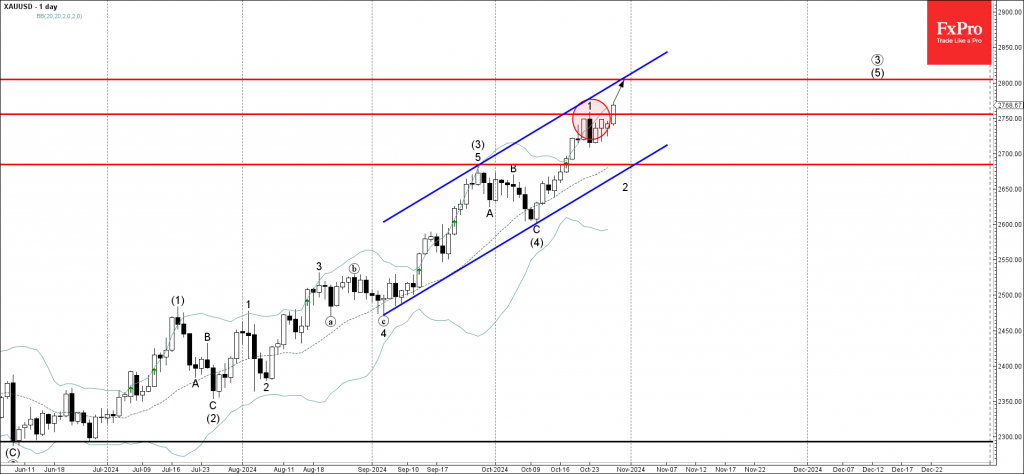

– Gold broke resistance level 2750.00 – Likely to rise to resistance level 2800.00 Gold recently broke above the minor resistance level 2750.00 (which stopped the previous minor impulse wave 1 earlier this month). The breakout of the resistance level.

October 29, 2024

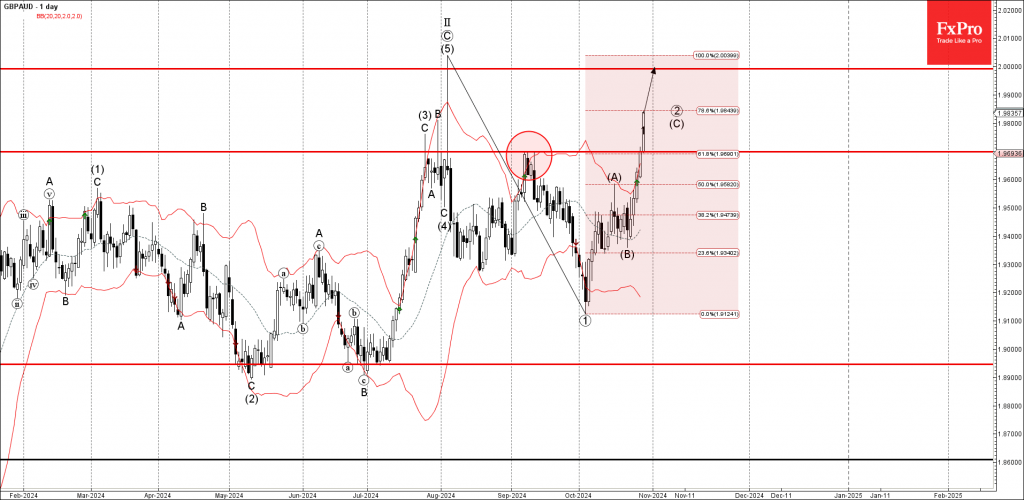

– GBPAUD broke resistance zone – Likely to rise to resistance level 2.0000 GBPAUD currency pair recently broke the resistance zone located between the resistance level 1.9700 (former multi-month high from September) and the 61.8% Fibonacci correction of the downward.

October 28, 2024

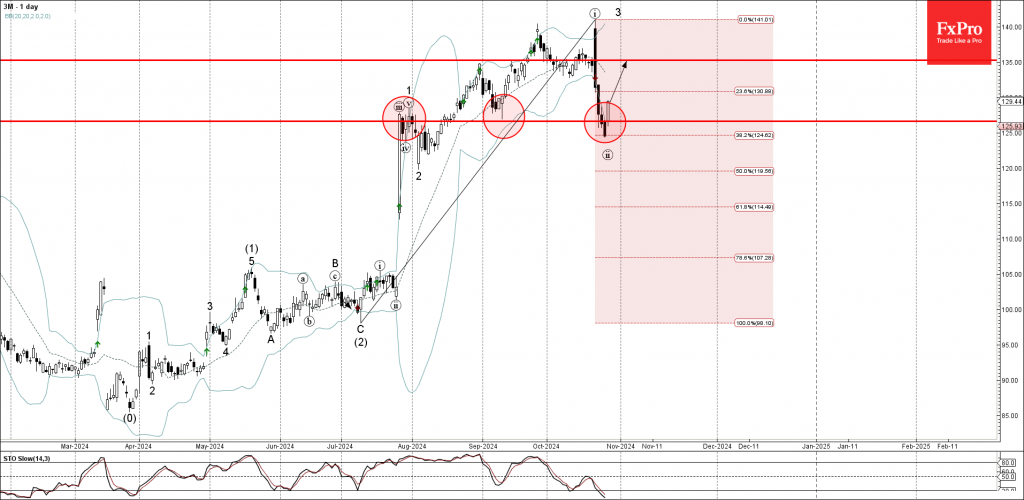

– 3M reversed from support zone – Likely to rise to resistance level 135.00 3M recently reversed up from the support area between the pivotal support level 126.65 (former resistance from July and the support from September). The support zone.

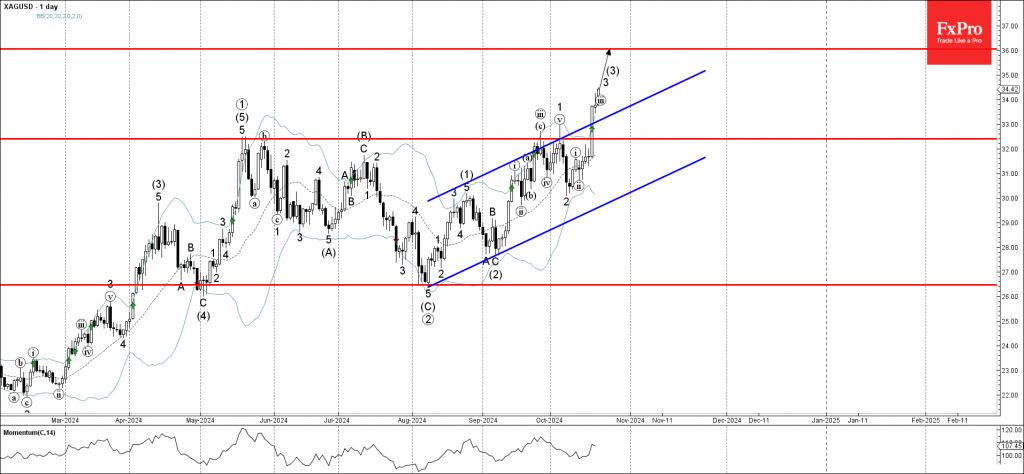

October 28, 2024

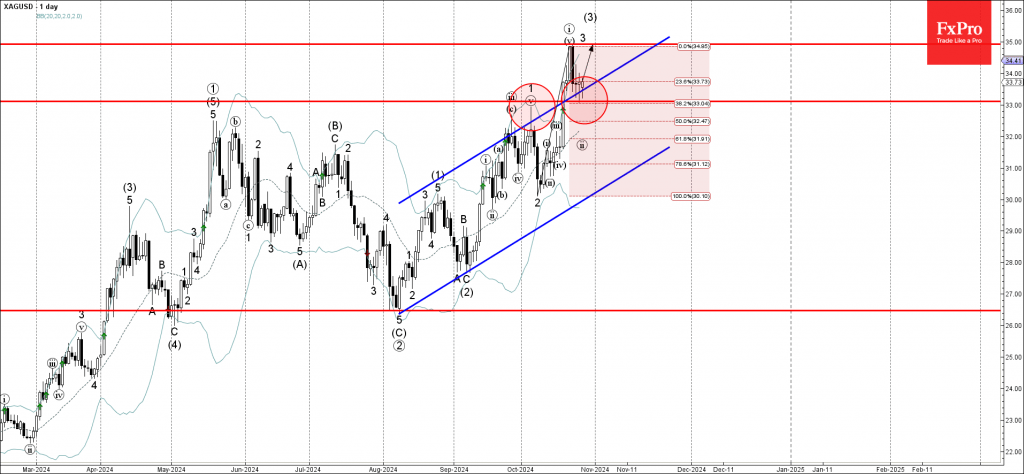

– Silver reversed from support zone – Likely to rise to resistance level 35.00 Silver recently reversed up from the support zone located between the key support level 33.00 (which stopped wave 1 last month) and the 38.2% Fibonacci correction.

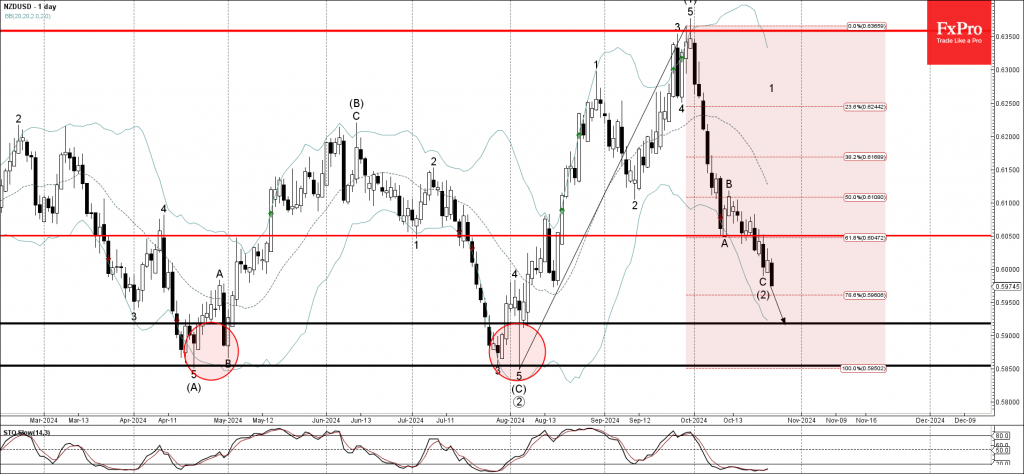

October 25, 2024

– NZDUSD broke support zone – Likely to fall to support level 0.5920 NZDUSD currency pair recently broke the support zone set between the support level 0.6050 (which stopped wave A at the start of October) and the 61.8% Fibonacci.

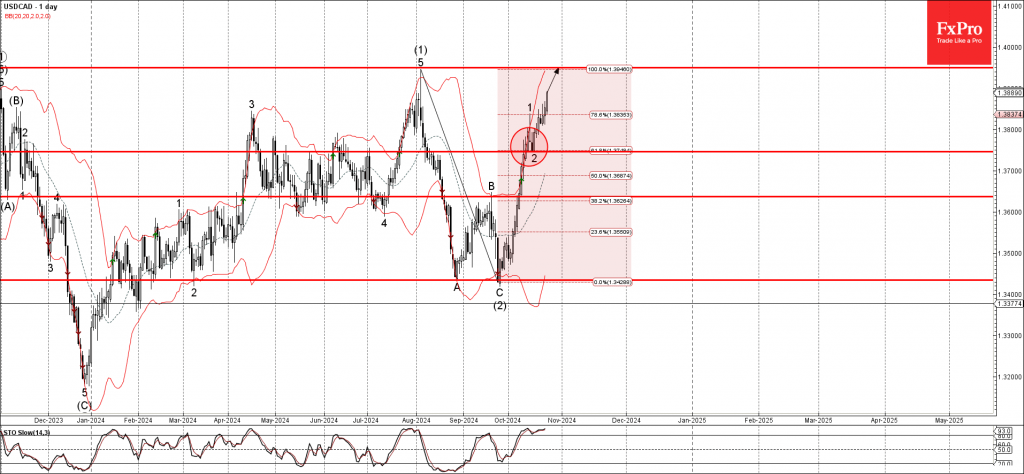

October 25, 2024

– USDCAD reversed from support zone – Likely to rise to resistance level 1.3950 USDCAD currency pair recently reversed up from the support level 1.3745 (former resistance from the middle of August, serving as the support after it was broken.

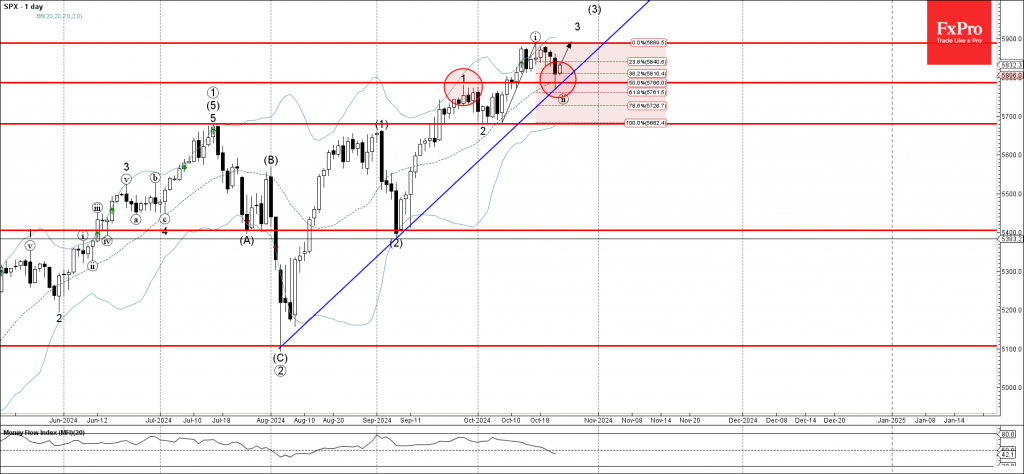

October 24, 2024

– S&P 500 index reversed from support zone – Likely to rise to resistance level 5900.00 S&P 500 index recently reversed up from the support zone located between the key support level 5785.00 (former top of wave 1 from September),.

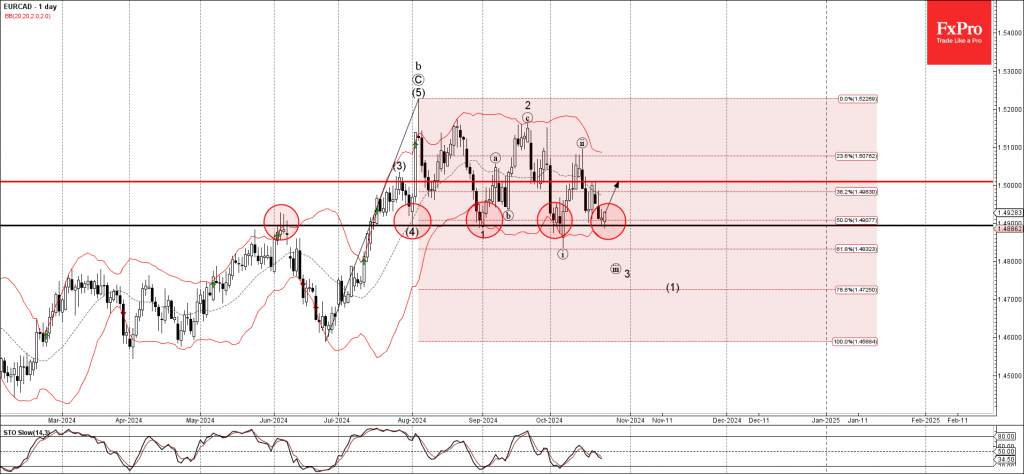

October 24, 2024

– EURCAD reversed from support zone – Likely to rise to resistance level 1,5000 EURCAD currency pair recently reversed up from the support zone located between the key support level 1.4900 (former resistance from June), lower daily Bollinger Band and.

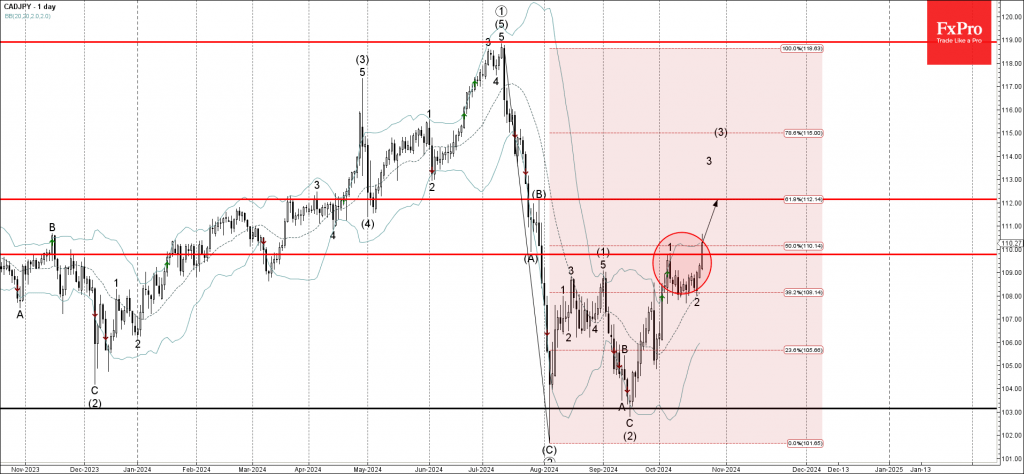

October 23, 2024

– CADJPY broke resistance zone – Likely to rise to resistance level 112.00 CADJPY recently broke the resistance zone between the resistance level 110.00 (which stopped the previous impulse wave 1) intersecting with the 50% Fibonacci correction of the downward.

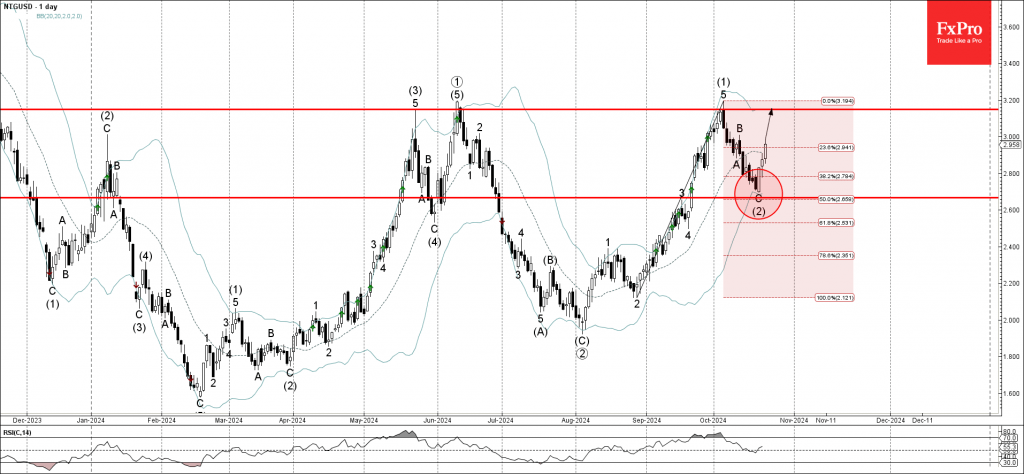

October 23, 2024

– Natural gas reversed from support zone – Likely to rise to resistance level 3.150 Natural gas recently reversed up from the support zone between the support level 2.665 (former minor resistance from September) intersecting with the lower daily Bollinger.

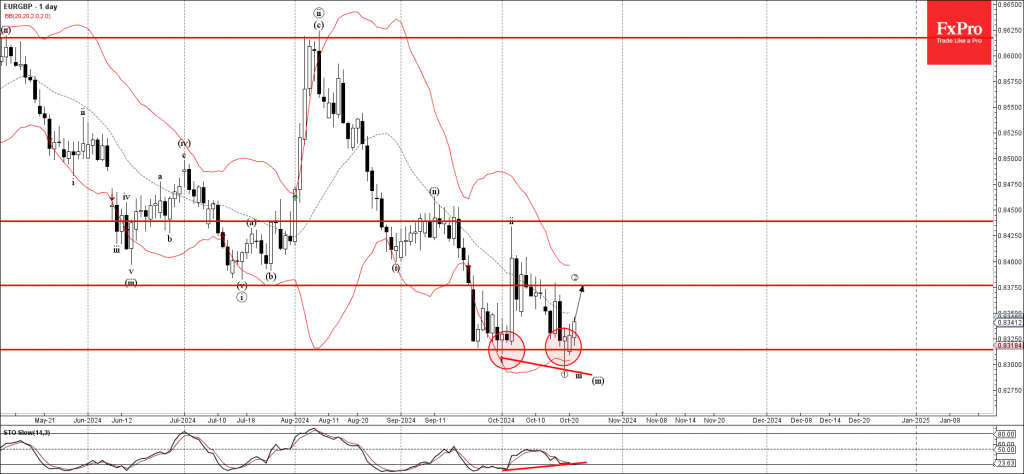

October 22, 2024

– EURGBP reversed from key support level 0.8315 – Likely to rise to resistance level 0.8375 EURGBP currency pair recently reversed up from the key support level 0.8315 (which reversed the pair multiple times in September) standing close to the.