Technical analysis - Page 99

September 26, 2024

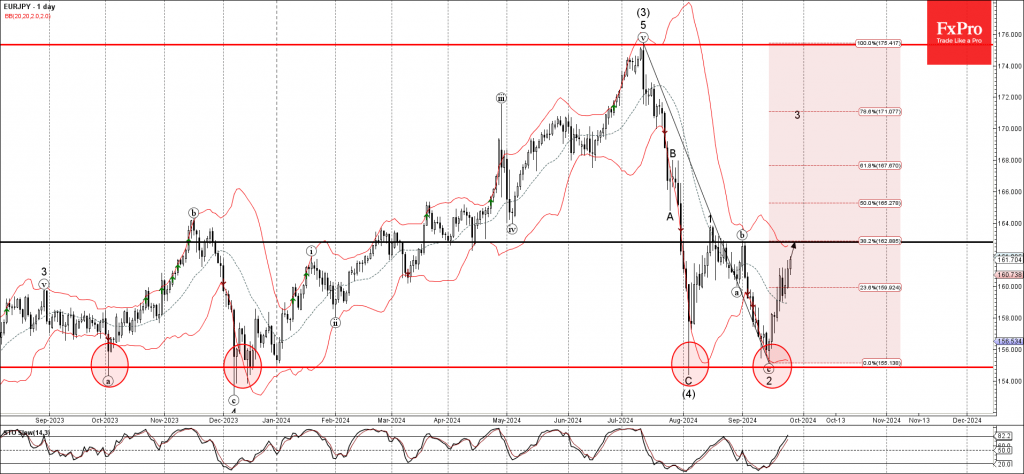

– EURJPY rising inside minor impulse wave 3 – Likely to reach resistance level 162.8 EURJPY currency pair earlier continues to rise inside the minor impulse wave 3, which started earlier from the support area located between the long-term support.

September 25, 2024

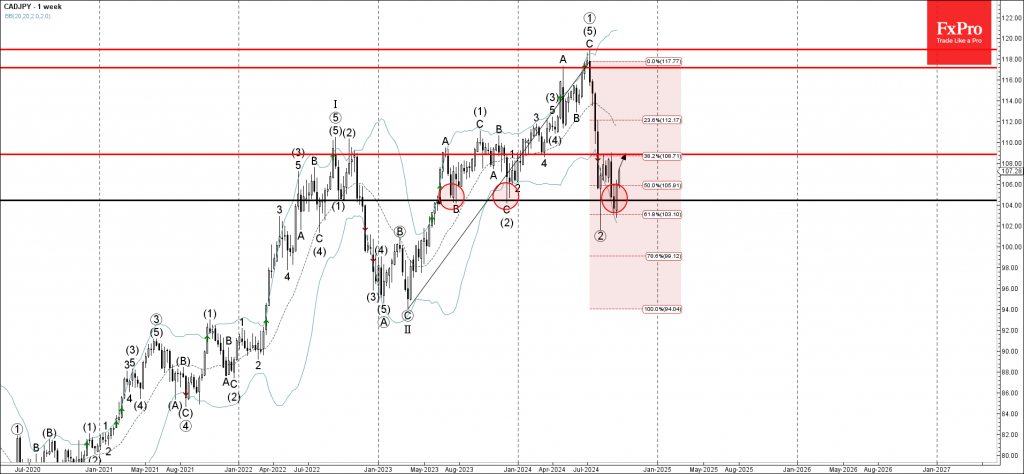

– CADJPY reversed from support area – Likely to rise to resistance level 108.85 CADJPY currency pair earlier reversed up with the weekly Bullish Engulfing from the support area located between the pivotal resistance level 104.50 (which has been reversing.

September 25, 2024

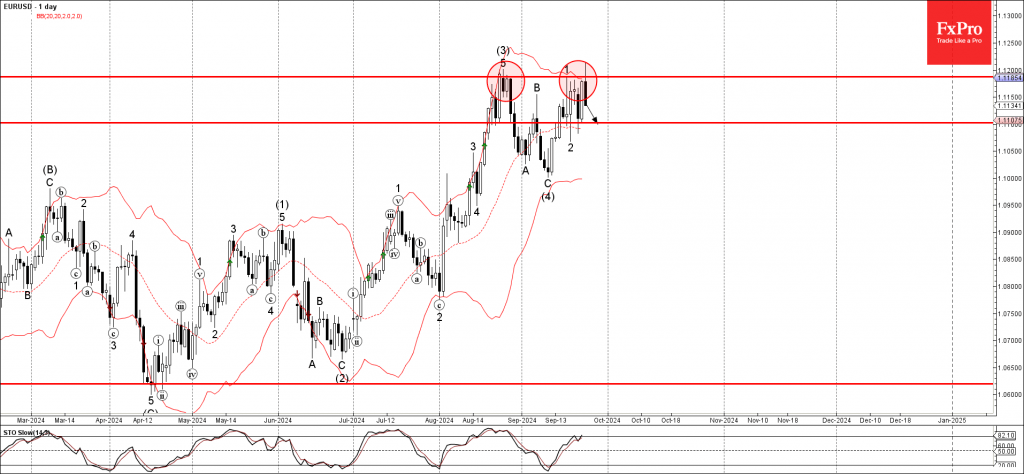

– EURUSD reversed from resistance area – Likely to fall to support level 1.1100 EURUSD currency pair recently reversed down from the resistance area between the pivotal resistance level 1.1185 (which has been reversing the pair from August, stopped earlier.

September 24, 2024

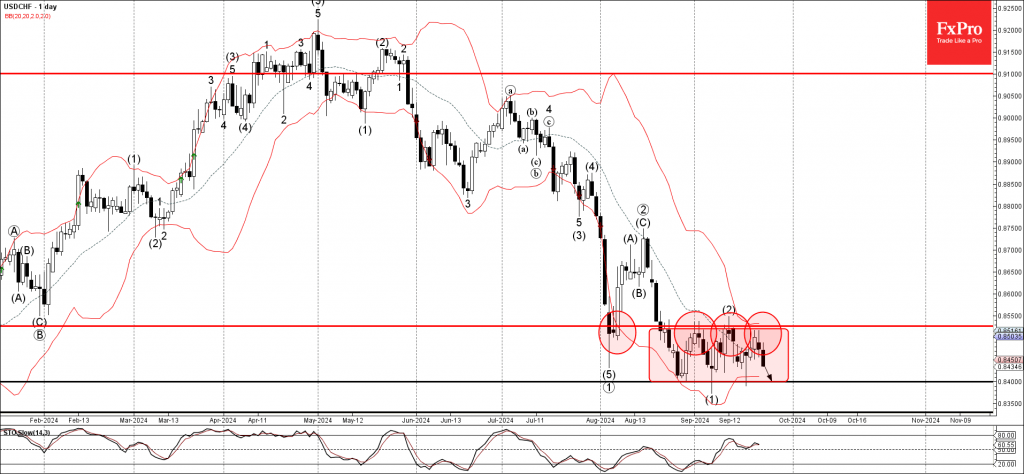

– USDCHF reversed from resistance area – Likely to fall to support level 0.8400 USDCHF currency pair recently reversed down from the resistance area located at the intersection of the key resistance level 0.8525 (upper border of the narrow sideways.

September 24, 2024

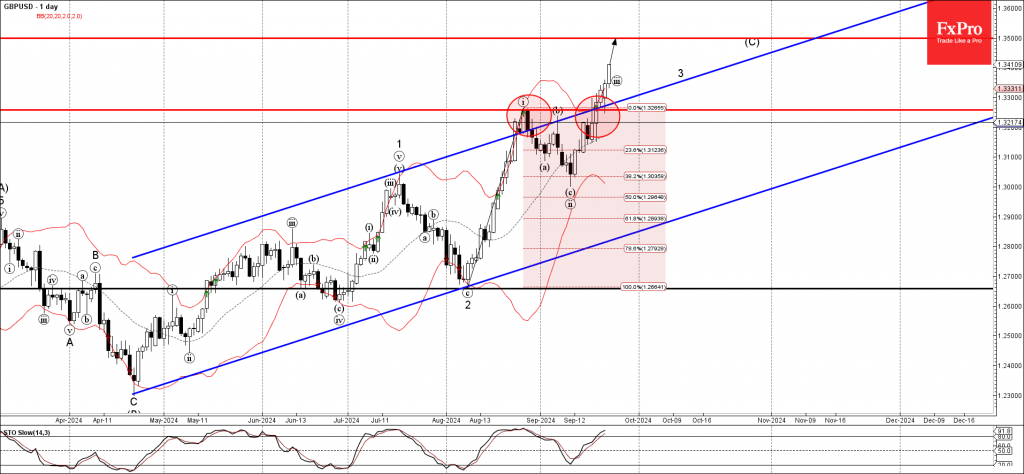

– GBPUSD broke resistance area – Likely to rise to resistance level 1.3500 GBPUSD recently broke the resistance area located at the intersection of the key resistance level 1.3255 (former monthly high from August) and the resistance trendline of the.

September 23, 2024

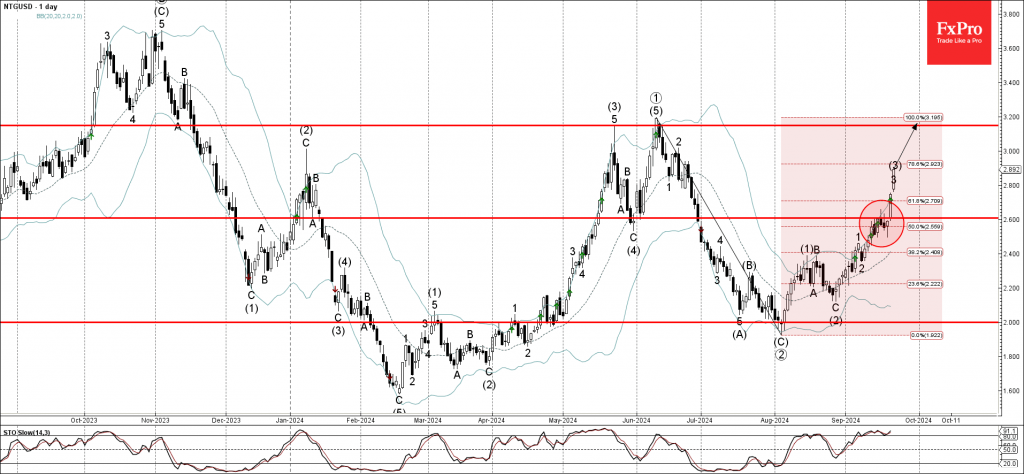

– Natural Gas rising inside impulse waves 3 and (3) – Likely to reach resistance level 3.150 Natural Gas continues to rise inside the impulse waves 3 and (3), which recently broke the resistance area located between the key resistance.

September 23, 2024

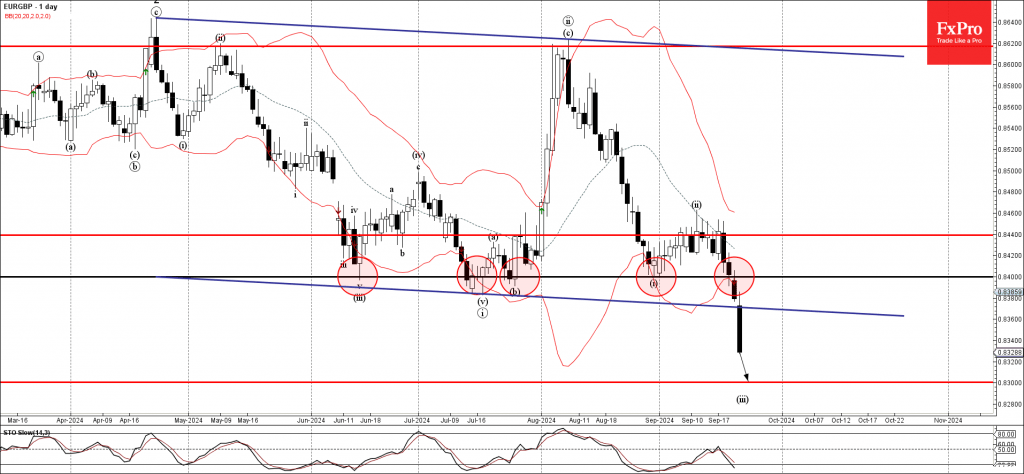

– EURGBP broke the support area – Likely to fall to support level 0.8300 EURGBP currency pair recently broke the support area located between the key support level 0.8400 (which has been reversing the price from June) and the support.

September 20, 2024

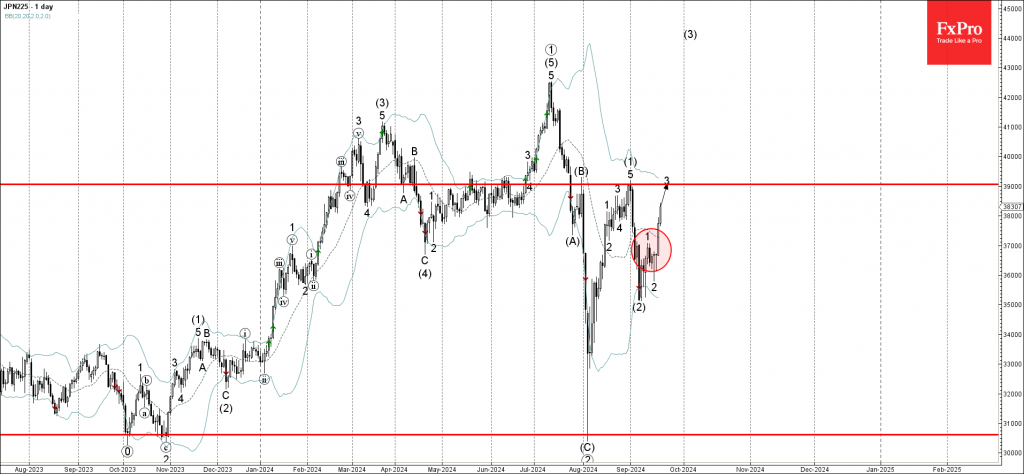

– Nikkei 225 index rising inside minor impulse waves 3 – Likely to reach resistance level 39000.00 Nikkei 225 index continues to rise inside the minor impulse waves 3, which belong to the intermediate impulse wave (3) from the start.

September 20, 2024

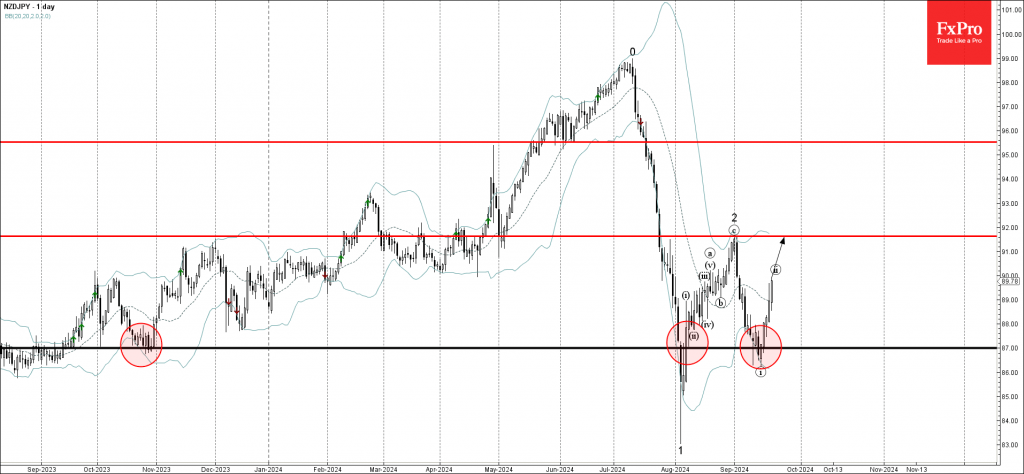

– NZDJPY rising inside corrective wave ii – Likely to rise to resistance level 91.65 NZDJPY currency pair continues to rise inside the minor corrective waves ii, which started earlier from the powerful support level 87.00, which has been reversing.

September 19, 2024

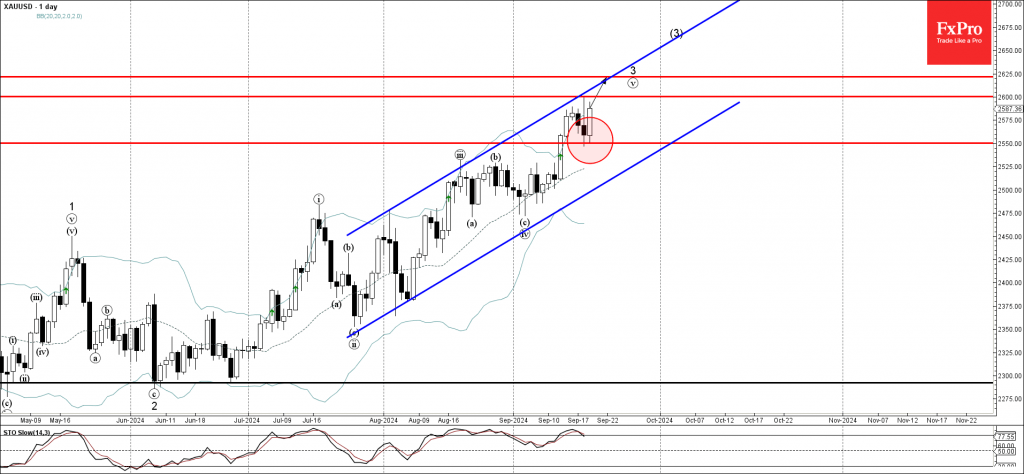

– Gold reversed from support level 2550.00 – Likely to rise to resistance level 2600.00 Gold continues to rise inside the minor impulse waves v and 3, which belong to the intermediate impulse wave (3) from the start of June..

September 19, 2024

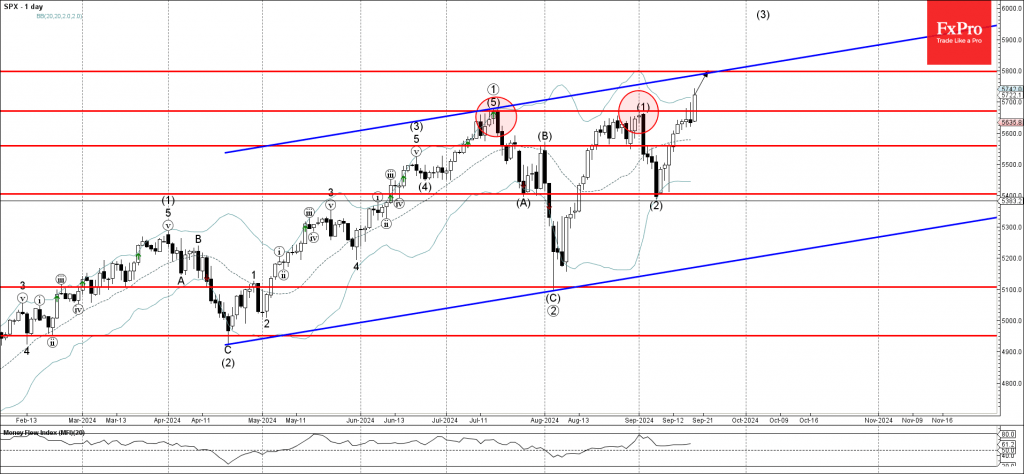

– S&P 500 broke key resistance level 5670.00 – Likely to rise to resistance level 5800.00 S&P 500 index today broke above the key resistance level 5670.00 (which stopped the previous impulse waves (5) and (1), as can be seen.