Technical analysis - Page 98

October 4, 2024

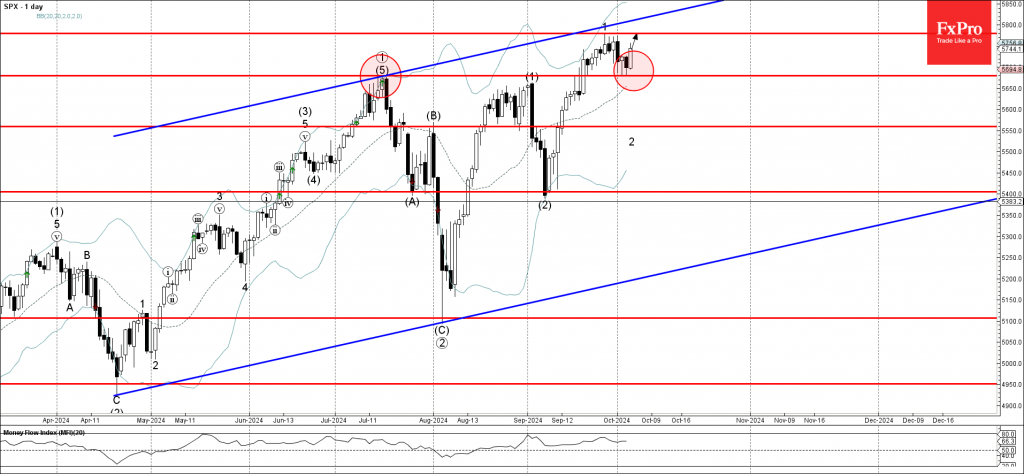

– S&P 500 reversed from support level 5680.00 – Likely to rise to resistance level 5780.00 S&P 500 index recently reversed up from the pivotal support level 5680.00 (a former multi-month high from July, acting as the support after it.

October 3, 2024

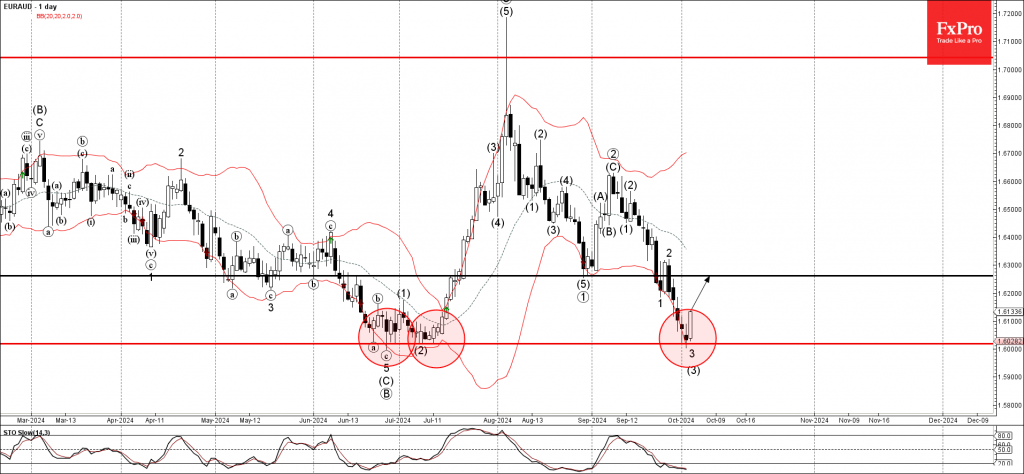

EURAUD currency pair recently reversed up from the strong support level 1.6020 (which stopped the multi-month downtrend in June) intersecting with the lower daily Bollinger Band. The upward reversal from the support level 1.6020 will likely form the daily Japanese.

October 3, 2024

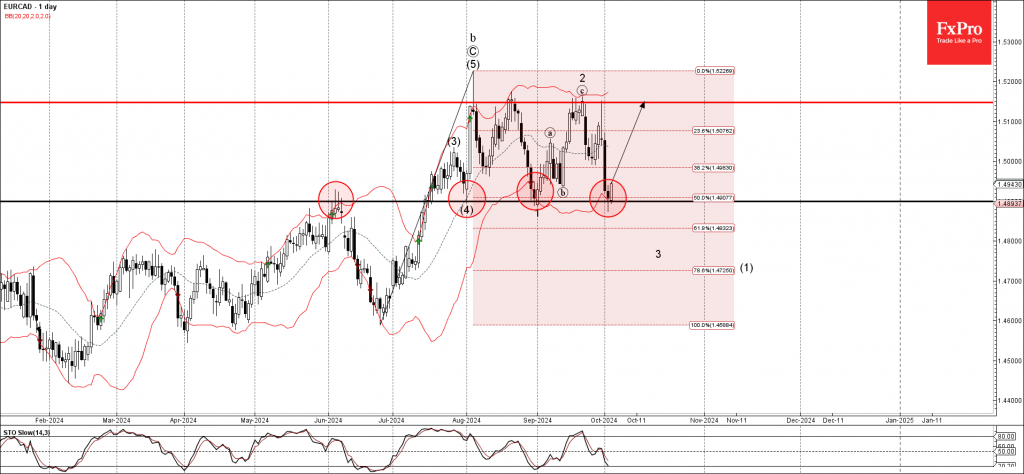

– EURCAD reversed from key support level 1.4900 – Likely to rise to resistance level 1.5150 EURCAD currency pair recently reversed up from the key support level 1.4900 (former resistance from June, which stopped the previous waves (4) and 1).

October 2, 2024

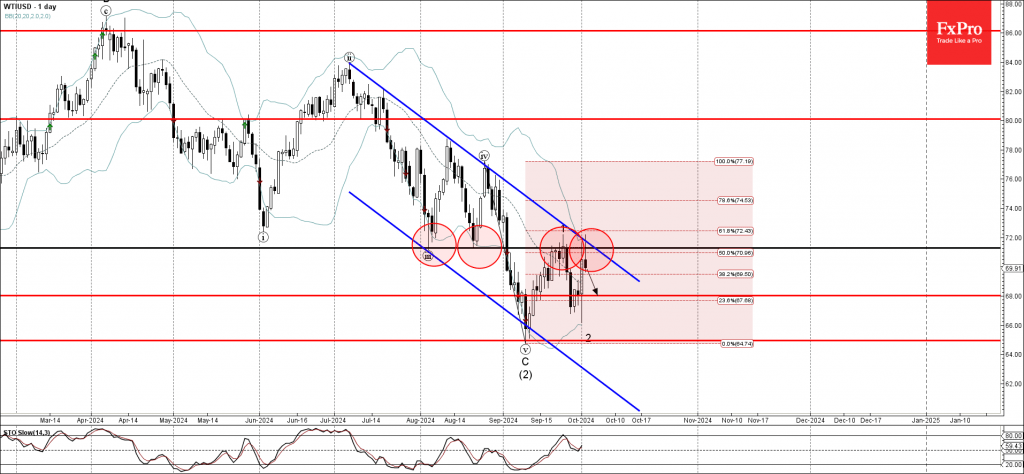

– WTI reversed from pivotal resistance level 71.30 – Likely to fall to support level 68.00 WTI crude oil recently reversed down from the pivotal resistance level 71.30 (former double bottom from August) intersecting with the upper daily Bollinger Band.

October 2, 2024

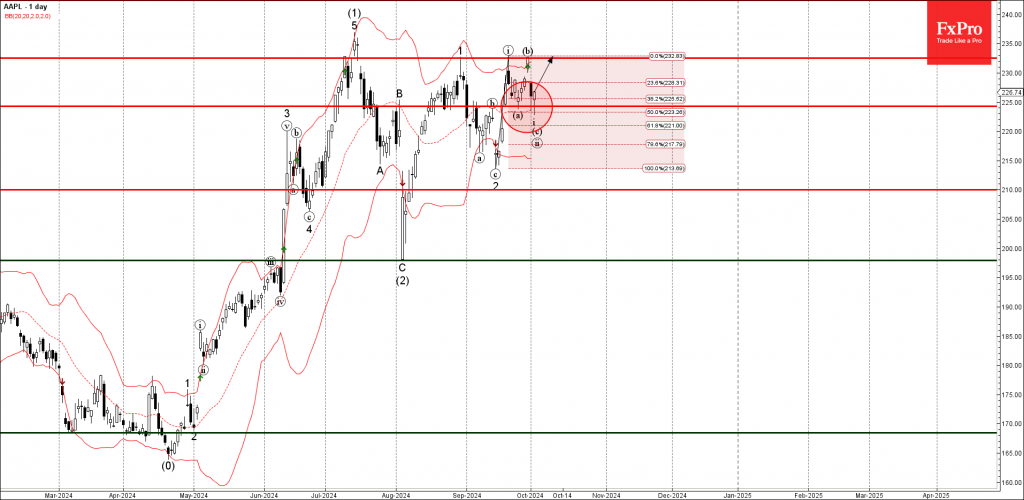

– Apple reversed from support level 225.00 – Likely to rise to resistance level 232.50 Apple recently reversed up from the key support level 225.00 (low of the previous wave (a)) intersecting with the 20-day moving average and the 50%.

October 1, 2024

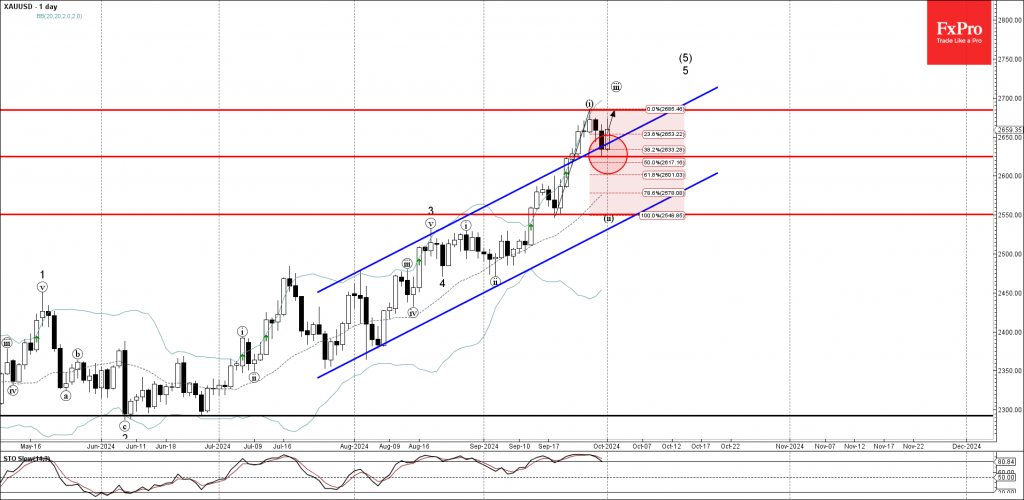

– Gold reversed from support level 2625.00 – Likely to rise to resistance level 2685.00 Gold recently reversed up from the support level 2625.00 intersecting with the upper trendline of the daily up channel from July (acting as the support.

October 1, 2024

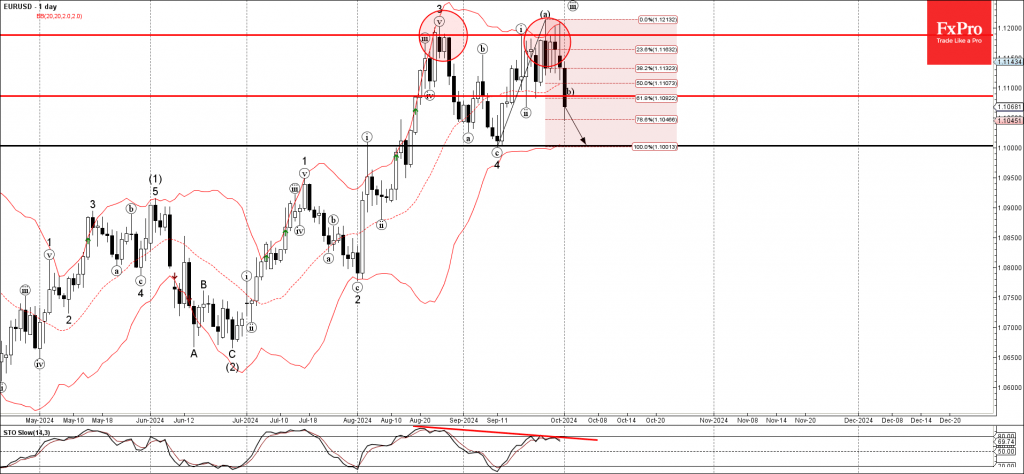

– EURUSD broke key support level 1.1085 – Likely to fall to support level 1.1000 EURUSD currency pair recently broke the key support level 1.1085 (which stopped the previous correction ii) coinciding with the 61.8% Fibonacci correction of the upward.

September 30, 2024

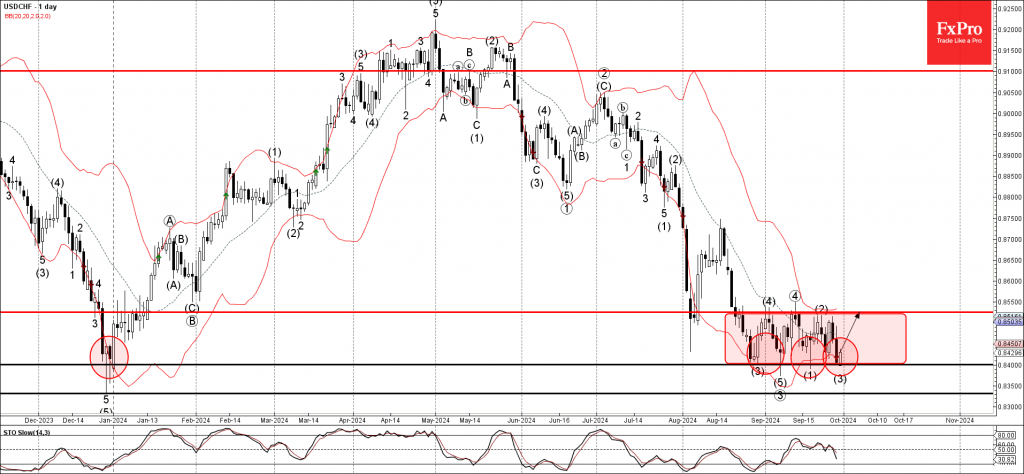

– USDCHF reversed from strong support level 0.8400 – Likely to rise to resistance level 0.8525 USDCHF currency pair recently reversed up from the strong support level 0.8400, which is the lower boundary of the sideways price range inside which.

September 30, 2024

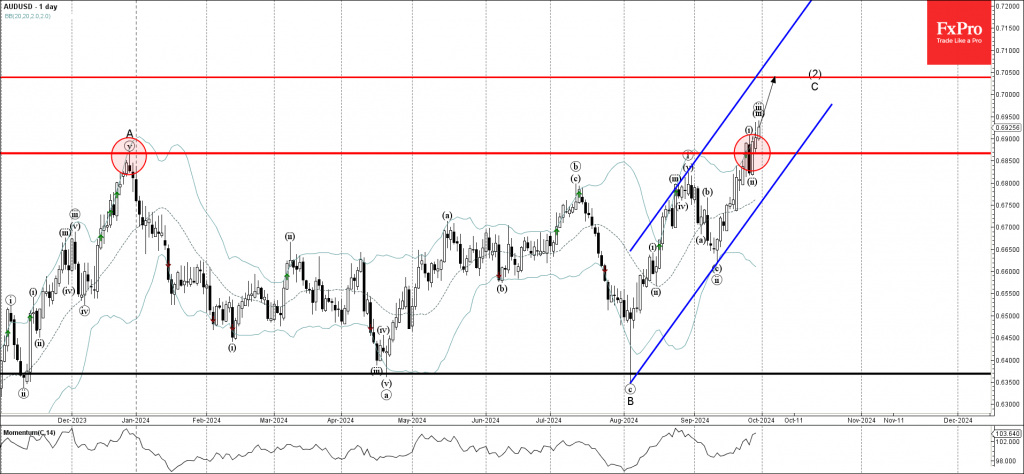

– AUDUSD broke multi-month resistance level 0.6860 – Likely to rise to resistance level 0.7050 AUDUSD currency pair recently broke above the strong multi-month resistance level 0.6860, which stopped the sharp wave A at the end of last year. The.

September 28, 2024

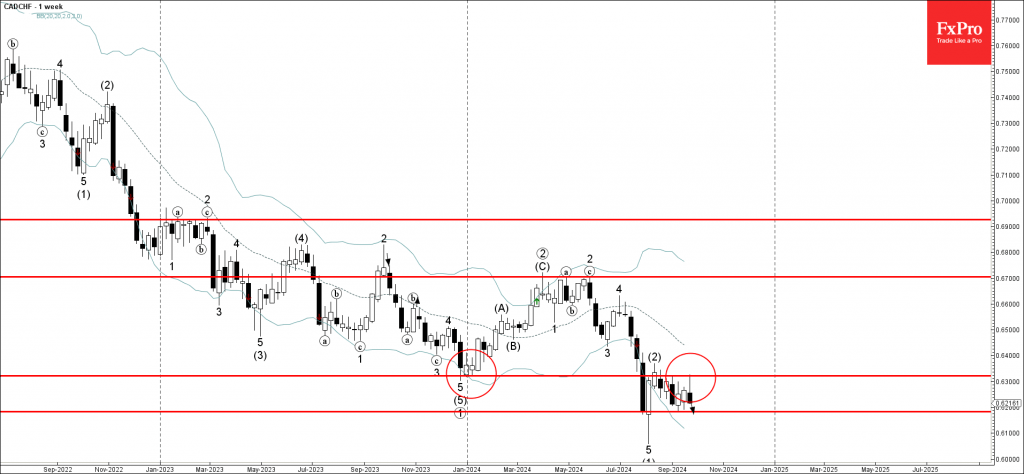

CADCHF currency pair recently reversed down from the resistance level 0.6320 (former strong support which stopped the weekly downtrend at the end of 2023). The downward reversal from the resistance level 0.6320 continues the active weekly downward impulse wave (3).

September 28, 2024

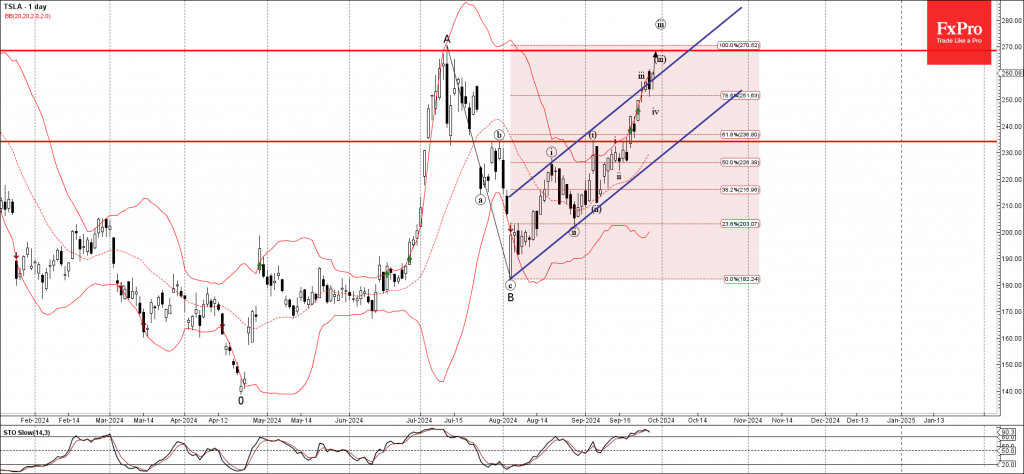

– Tesla broke daily up channel – Likely to rise to resistance level 268.50 Tesla continues to rise inside the sharp impulse wave iii, which recently broke the resistance trendline of the narrow daily up channel from the start of.