Technical analysis - Page 95

December 5, 2024

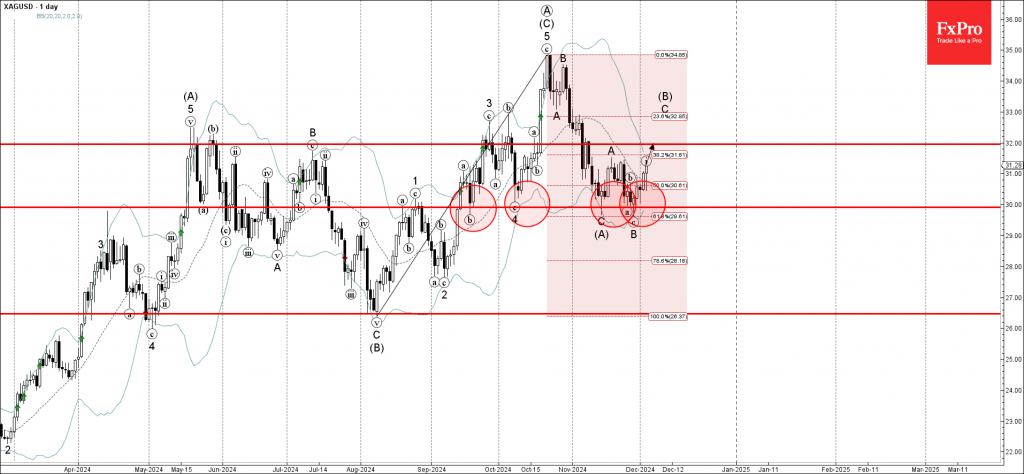

– Silver reversed from round support level 30.00 – Likely to rise to resistance level 32.00 Silver recently reversed up from the round support level 30.00, which has stopped all previous downward corrections from September. The support level 30.00 was.

December 3, 2024

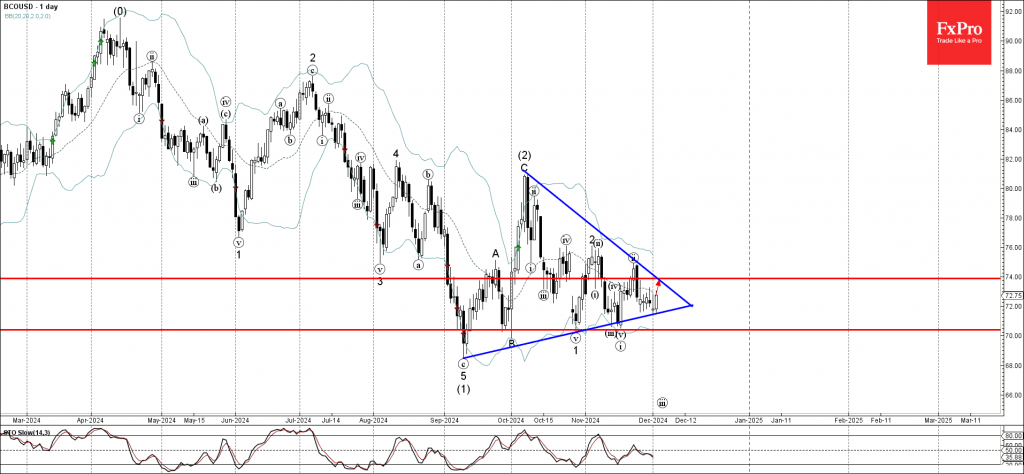

– Brent crude oil rising inside daily Triangle – Likely to rise to resistance level 74.00 Brent crude oil recently reversed up from the support trendline of the daily Triangle inside which the price has been moving since September. The.

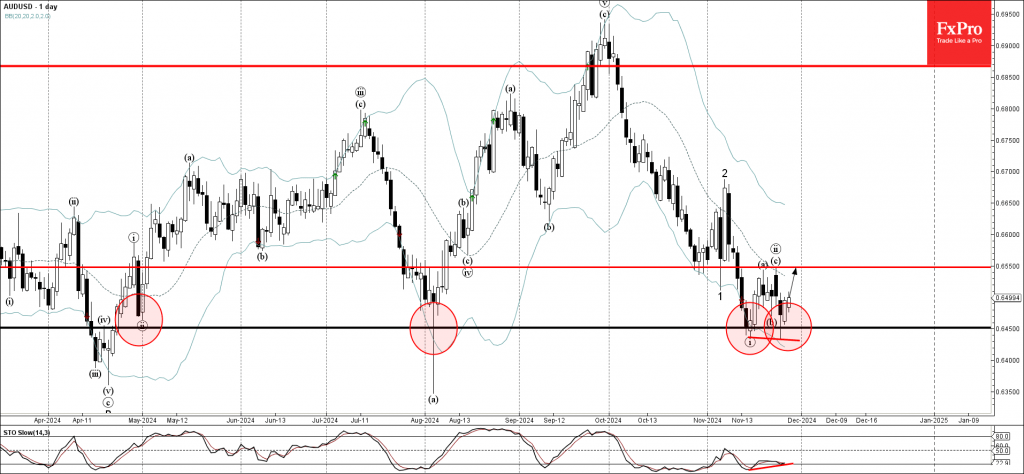

December 3, 2024

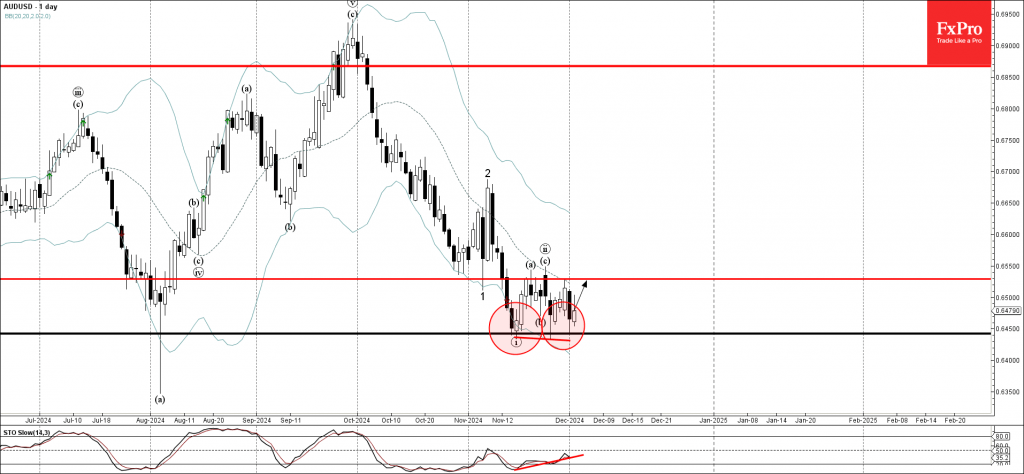

– AUDUSD reversed from strong support level 0.6450 – Likely to rise to resistance level 0.6530 AUDUSD currency pair recently reversed up from the strong support level 0.6450, which has been reversing the price from the start of August, as.

December 3, 2024

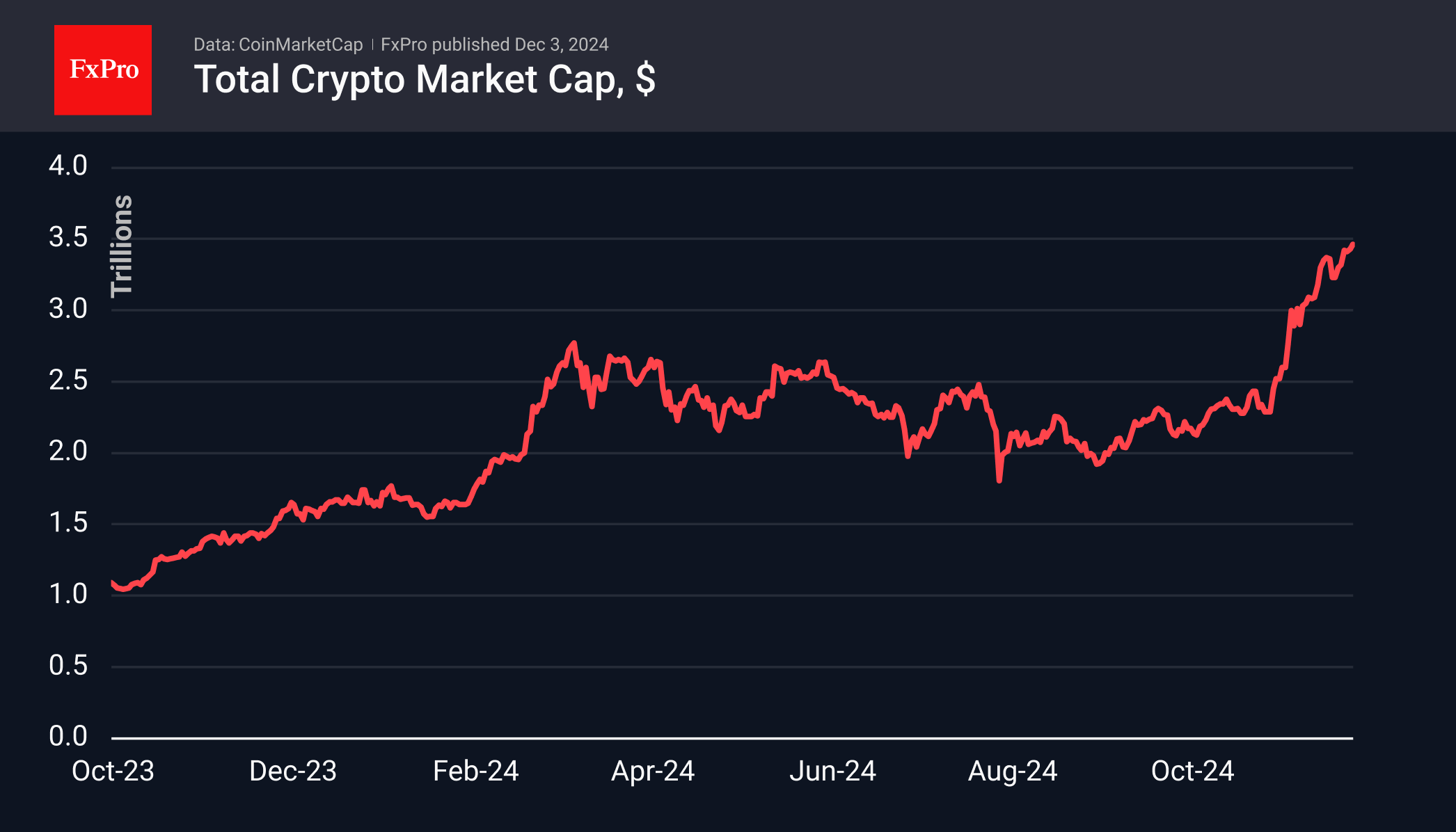

Bitcoin is unable to break $100K, but altcoins are thriving. XRP's price quadrupled, and global investment in crypto funds rose by $370 million. MicroStrategy bought more BTC.

December 2, 2024

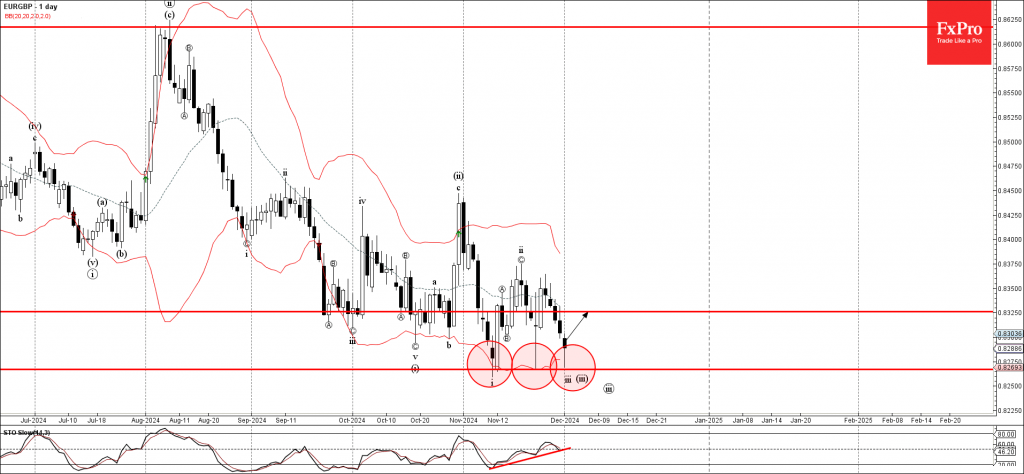

– EURGBP reversed from support zone – Likely to rise to resistance level 0.8325 EURGBP currency pair today reversed up from the support zone located between the strong support level 0.8265 (which has been revering the pair from the start.

December 2, 2024

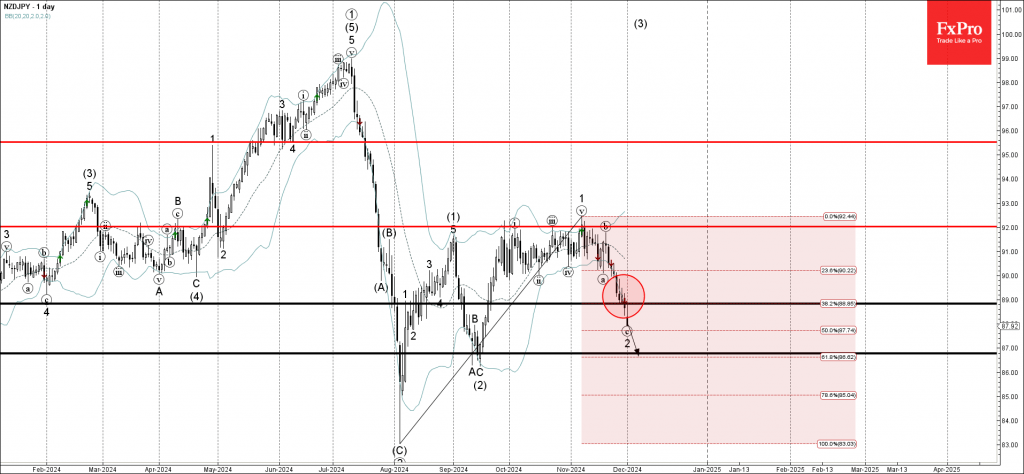

– NZDJPY broke support zone – Likely to fall to support level 86.75 NZDJPY currency pair recently broke the support zone located between the support level 89.00 and the 38.2% Fibonacci correction of the upward price move from the start.

November 29, 2024

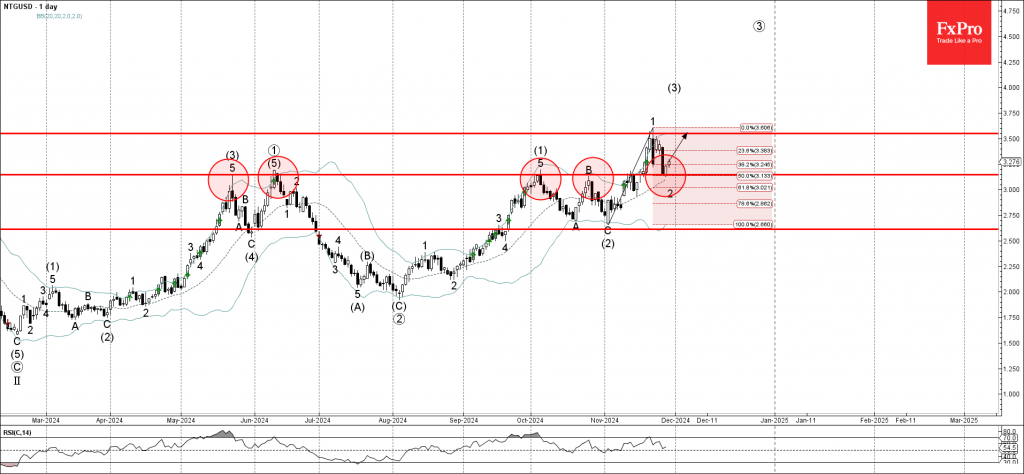

– Natural gas reversed from support zone – Likely to rise to resistance level 3.550 Natural gas recently reversed up from the support zone located between the support level 3.150 (former multi-month high from May, June and October), 20-day moving.

November 29, 2024

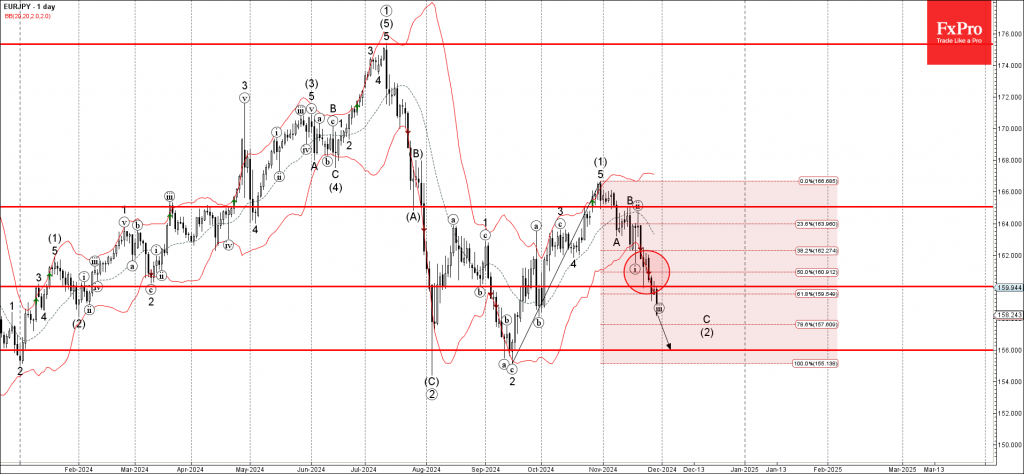

– EURJPY broke support zone – Likely to fall to support level 156.00 EURJPY currency pair recently broke the support zone located between the support level 160.00 and the 61.8% Fibonacci correction of the upward impulse from September. The breakout.

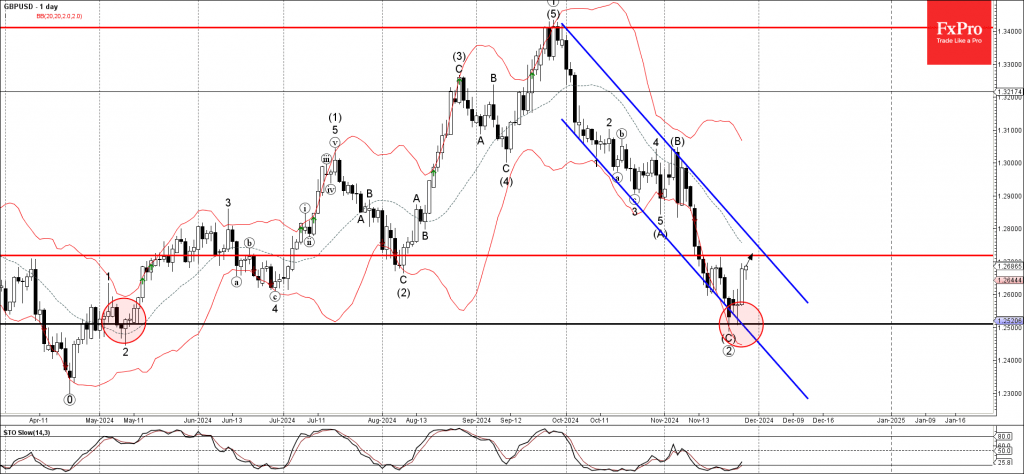

November 28, 2024

– GBPUSD reversed from support level 1.2500 – Likely to rise to resistance level 1.2720 GBPUSD currency pair continues to rise after the earlier upward reversal from the support level 1.2500 (which also reversed the pair in May) coinciding with.

November 28, 2024

– AUDUSD reversed from pivotal support level 0.6450 – Likely to rise to resistance level 0.6550 AUDUSD currency pair recently reversed up from the pivotal support level 0.6450 (which has been reversing the price from April) standing near the lower.

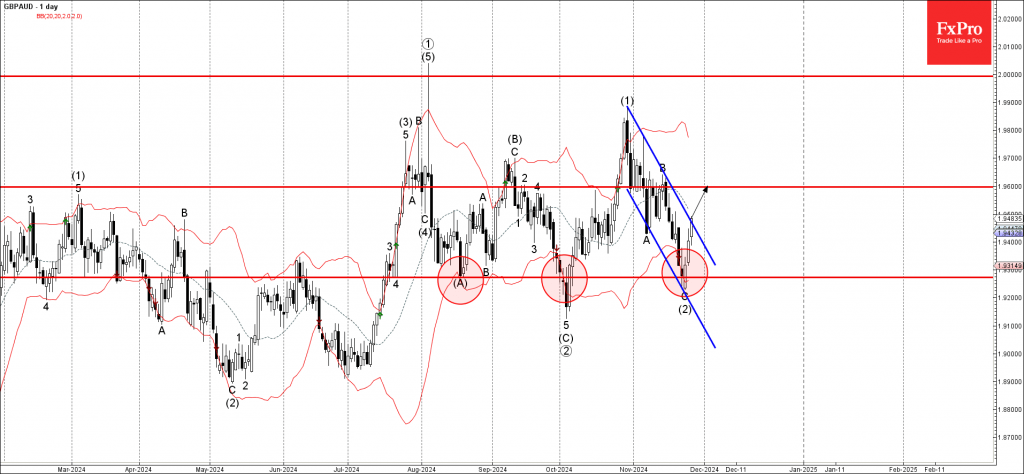

November 27, 2024

– GBPAUD broke daily down channel – Likely to rise to resistance level 1.9600 GBPAUD currency pair today broke the resistance trendline of the daily down channel from the end of October (which encloses the earlier downward ABC correction (2).