Technical analysis - Page 92

January 3, 2025

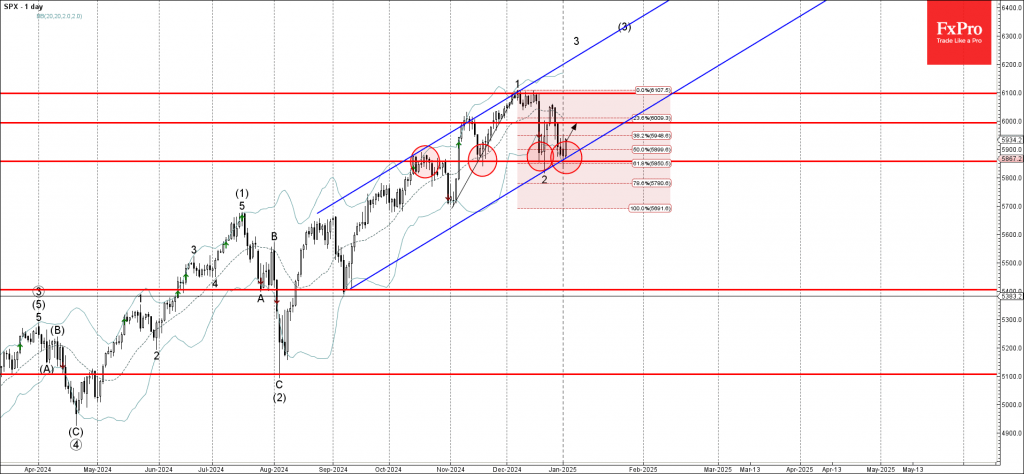

– S&P 500 reversed from support area – Likely to rise to resistance level 6000.00 S&P 500 index today reversed up from the support area located between key support level 5855.00 (former resistance from October, which has been reversing the.

December 31, 2024

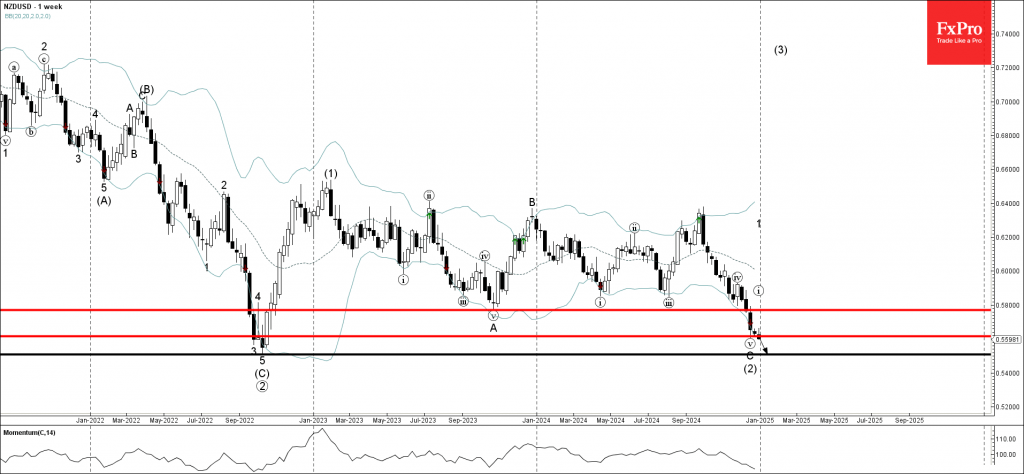

– NZDUSD broke key support 0.5600 – Likely to fall to support level 0.5500 NZDUSD currency pair under the bearish pressure after breaking the key support 0.5600, which stopped the previous long-term ABC correction (2) earlier this month. The breakout.

December 31, 2024

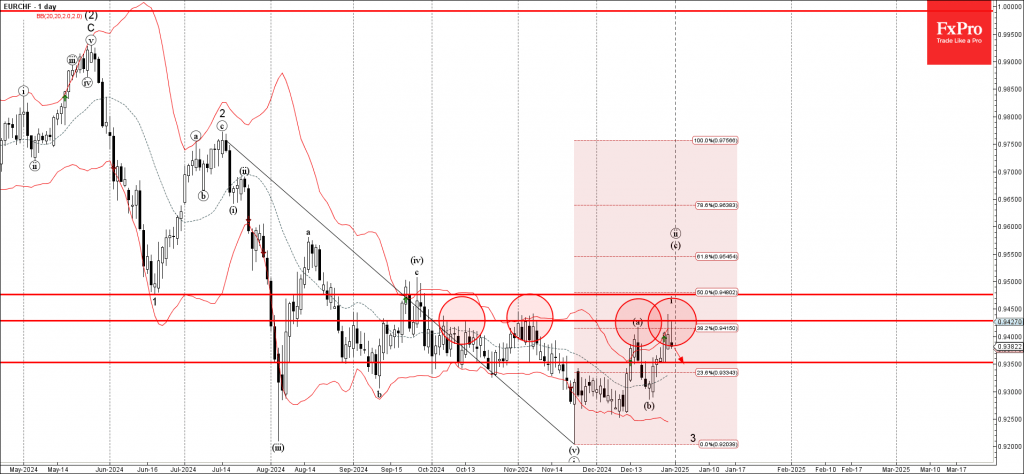

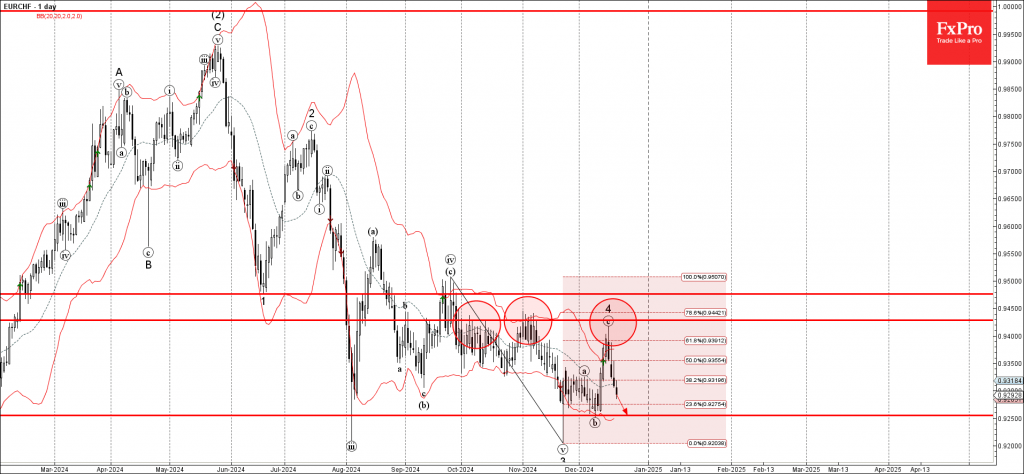

– EURCHF reversed from resistance zone – Likely to fall to support level 0.9350 EURCHF currency pair today reversed down from the resistance area located between pivotal resistance level 0.9430 (which has been steadily reversing the price from the start.

December 31, 2024

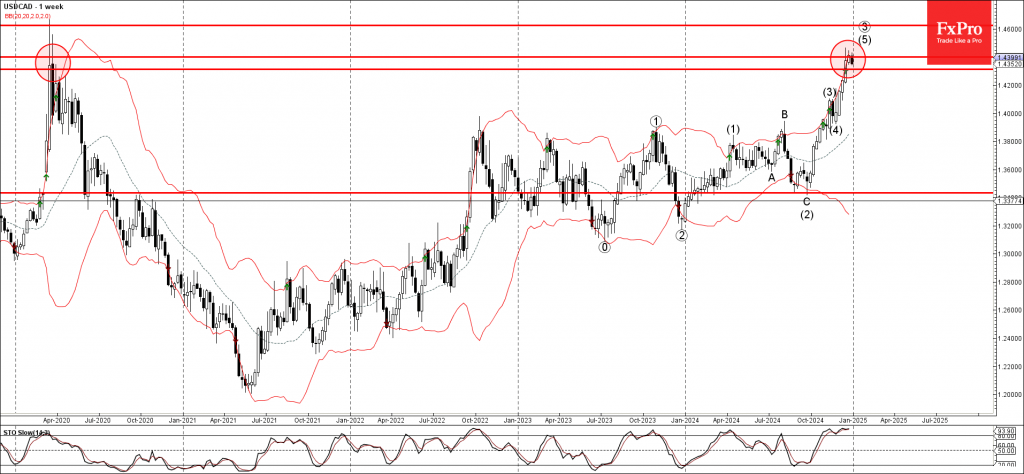

– USDCAD reversed from resistance zone – Likely to fall to support level 1.4400 USDCAD currency pair recently reversed down from the resistance zone surrounding the major long-term resistance level 1.4400 (which stopped the sharp uptrend at the start of.

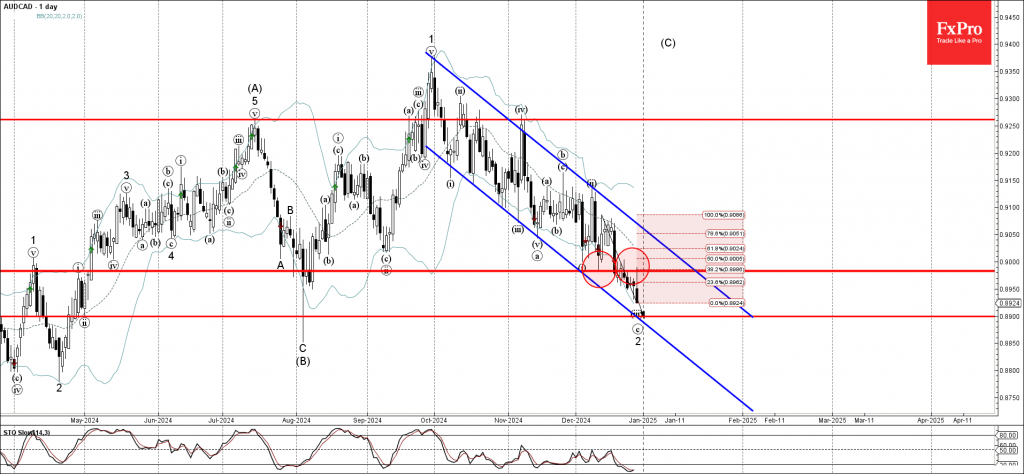

December 31, 2024

– AUDCAD reversed from resistance level 0.8980 – Likely to fall to support level 0.8900 AUDCAD currency pair recently reversed down from the key resistance level 0.8980 (former support from the start of December) intersecting with the 38.2% Fibonacci correction.

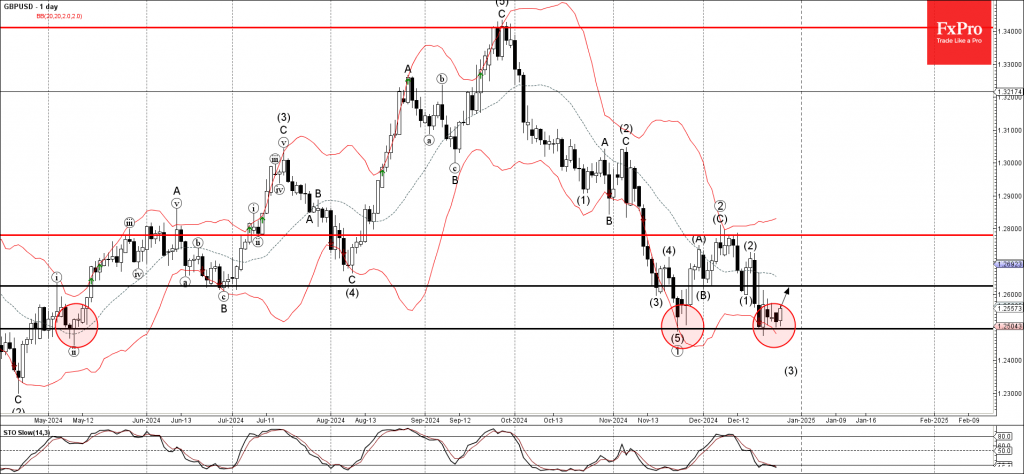

December 27, 2024

– GBPUSD reversed from support level 1.2495 – Likely to rise to resistance level 1.2625 GBPUSD currency pair recently reversed up from the pivotal support level 1.2495 (which has been steadily reversing the pair from May) intersecting with the lower.

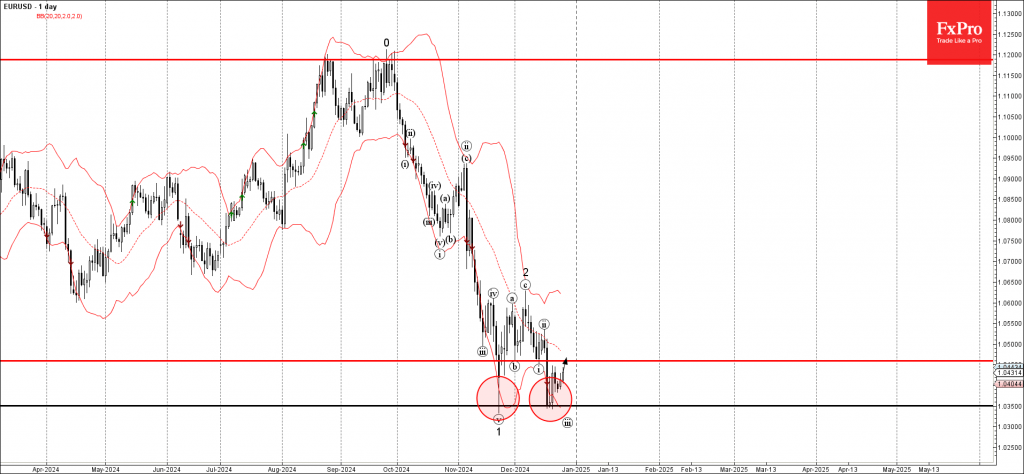

December 27, 2024

– EURUSD reversed from powerful support level 1.0350 – Likely to rise to resistance level 1.0460 EURUSD currency pair recently reversed up with the daily Morning Star from the powerful support level 1.0350 (which stopped the previous sharp downward impulse.

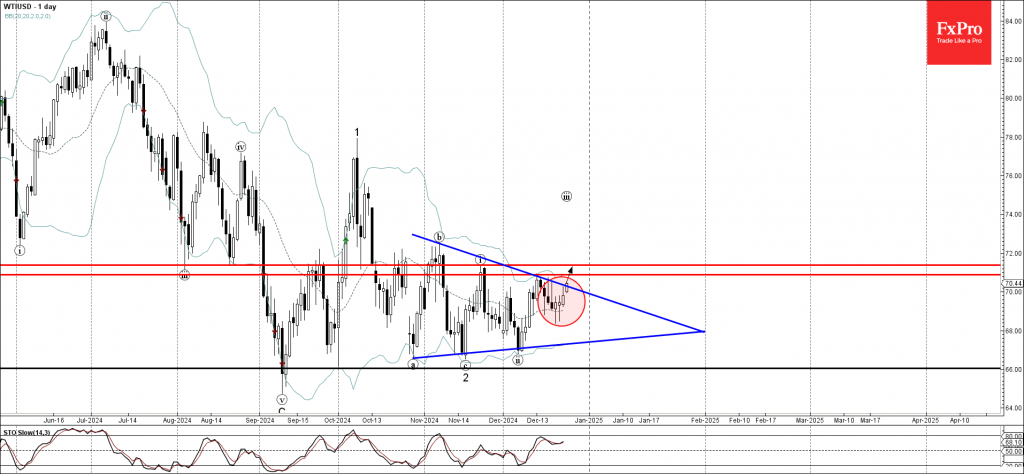

December 26, 2024

– WTI broke daily Triangle – Likely to rise to resistance level 70.90 WTI crude oil today broke the resistance trendline of the daily Triangle from the end of October, inside which the price has been moving from October. The.

December 26, 2024

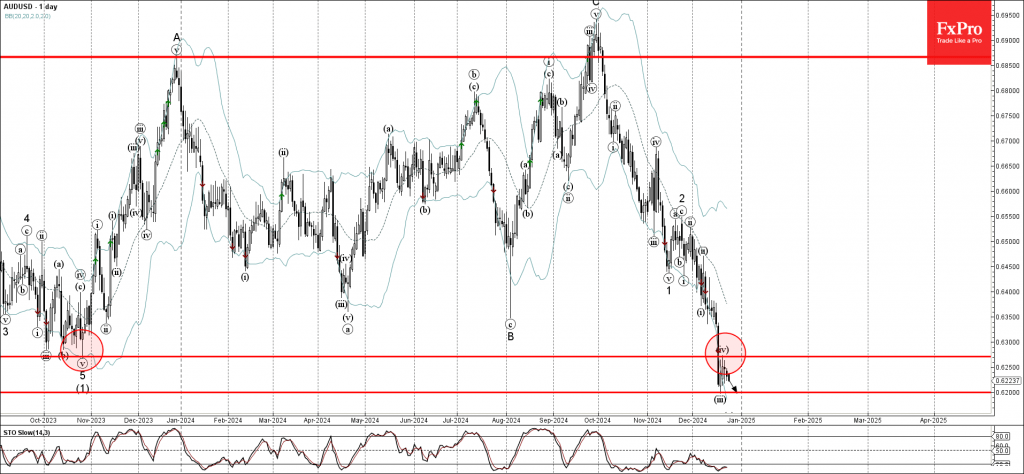

– AUDUSD reversed from resistance level 0.6270 – Likely to fall to support level 0.6200 AUDUSD currency pair recently reversed down from the resistance level 0.6270 (former multi-month support from the start October of 2023, acting as the resistance after.

December 23, 2024

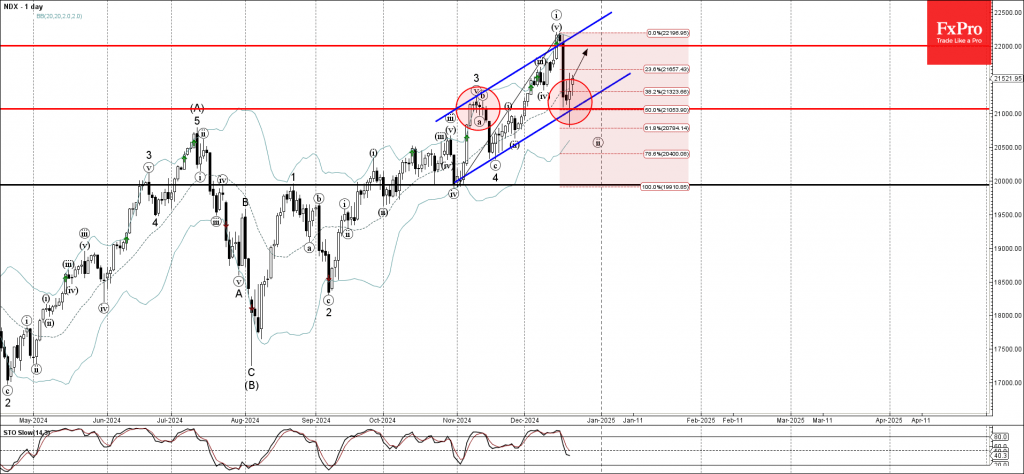

– Nasdaq 100 reversed from strong support level 21000.00 – Likely to rise to resistance level 22000.00 Nasdaq 100 index recently reversed up from the strong support level 21000.00 (former resistance from the start of November), intersecting with the support.

December 23, 2024

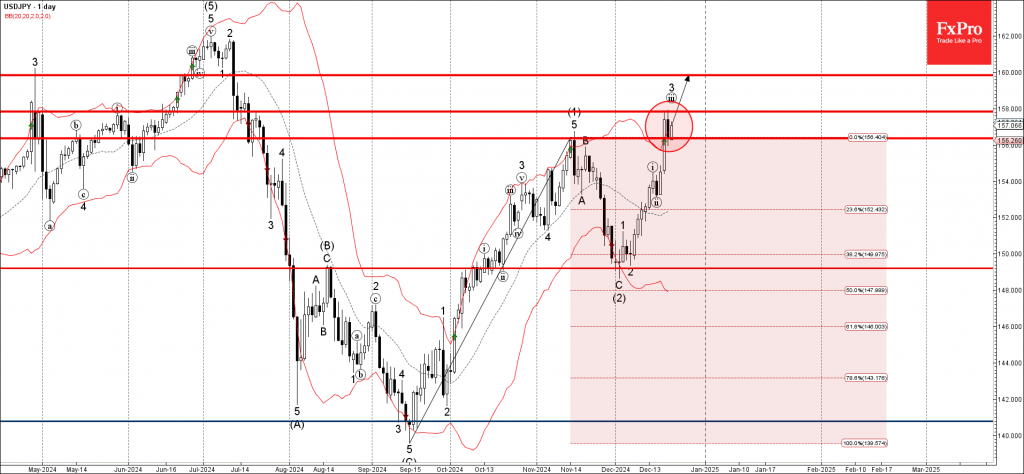

– USDJPY reversed from key support level 156.35 – Likely to rise to resistance level 158.00 USDJPY currency pair recently reversed up from the key support level 156.35 (former resistance from November, acting as she support after it was broken.