Technical analysis - Page 90

December 13, 2024

– EURGBP reversed from support zone – Likely to rise to resistance level 0.8350 EURGBP currency pair recently reversed up from the support area set between the long-term support level 0.8210 (former support from the start of 2022) and the.

December 13, 2024

– USDJPY reversed from support zone – Likely to rise to resistance level 156.35 USDJPY currency pair recently reversed up from the support zone located between the key support level 149.20 (former low of wave ii from the middle of.

December 12, 2024

– GBPUSD reversed from resistance level 1.2780 – Likely to fall to support level 1.2635 GBPUSD currency pair recently reversed down sharply from the resistance level 1.2780 (which reversed the price for the last 5 consecutive trading sessions) standing close.

December 12, 2024

– GBPAUD reversed from resistance zone – Likely to fall to support level 1.9800 GBPAUD currency pair recently reversed down sharply from the resistance area between the upper daily Bollinger Band, key resistance level 2.0045 (former multi-month high from April).

December 11, 2024

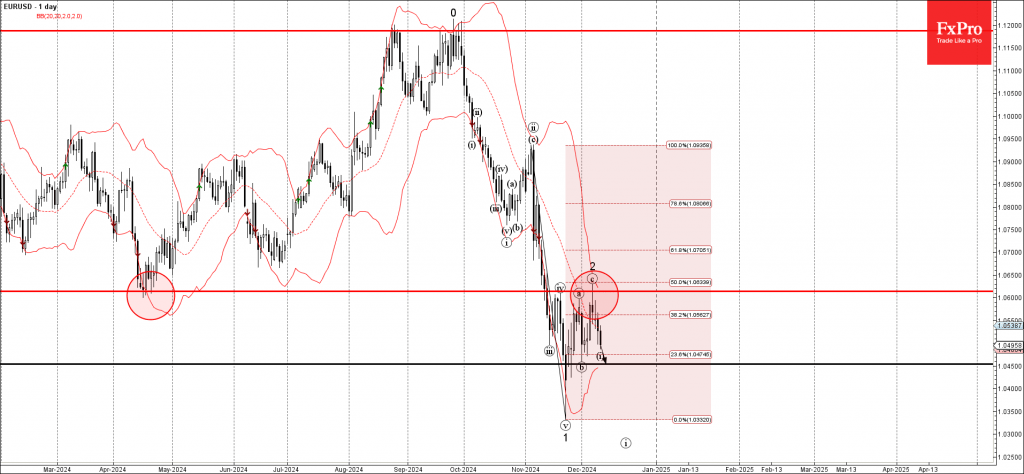

– EURUSD reversed from resistance zone – Likely to fall to support level 1.0450 EURUSD currency pair recently reversed down with the long-legged Doji from the resistance area between the upper daily Bollinger Band, pivotal resistance level 1.0610 (former multi-month.

December 11, 2024

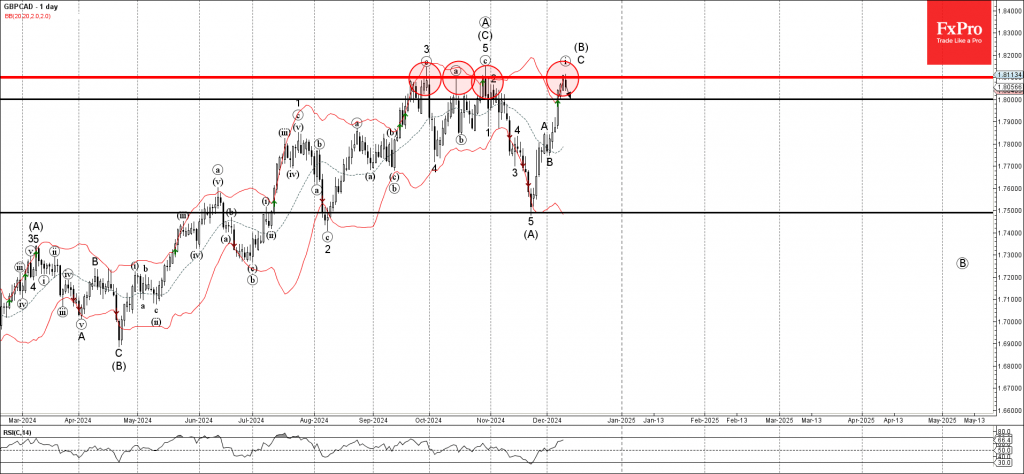

– GBPCAD reversed from strong resistance zone – Likely to fall to support level 1.8000 GBPCAD currency pair recently reversed down from the strong resistance zone located at the intersection of the upper daily Bollinger Band and the key resistance.

December 10, 2024

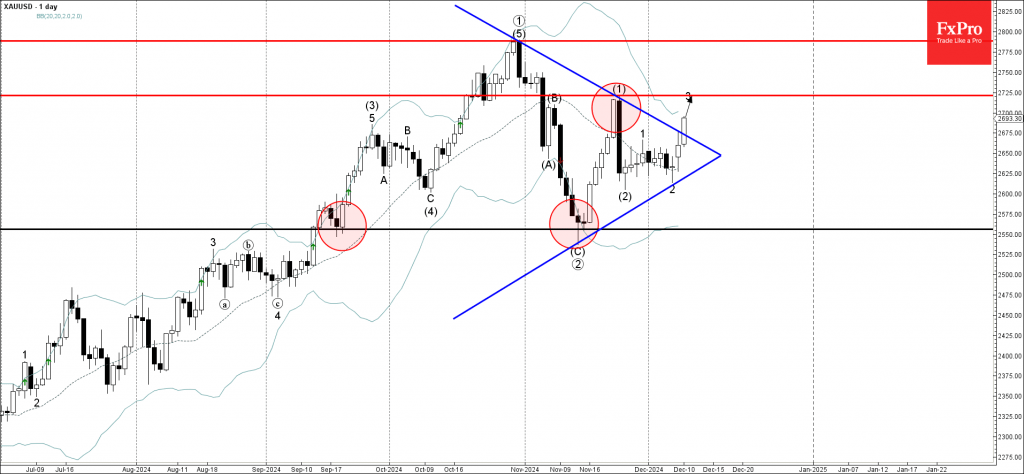

– Gold broke daily Triangle – Likely to rise to resistance level 2750.00 Gold recently broke the resistance trendline of the daily Triangle, inside which it has been moving from the middle of October, as can be seen from the.

December 10, 2024

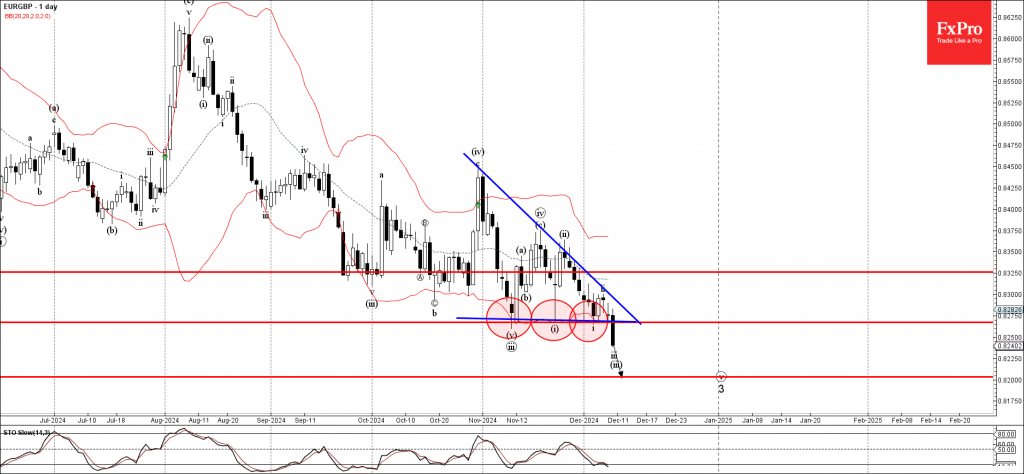

– EURGBP under bearish pressure – Likely to fall to support level 0.8200 EURGBP currency pair under bearish pressure after breaking the support zone between the key support level 0.8265 (which stopped previous waves iii, (i) and i) and the.

December 10, 2024

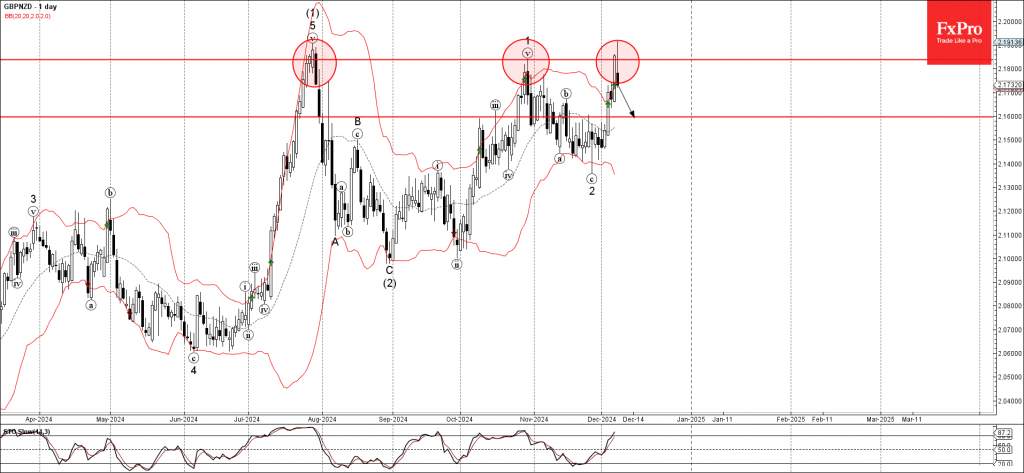

– GBPNZD reversed from key resistance level 2.1840 – Likely to fall to support level 2.1600 GBPNZD currency pair recently reversed down from the resistance zone between the key resistance level 2.1840 (which has been reversing the pair from July).

December 10, 2024

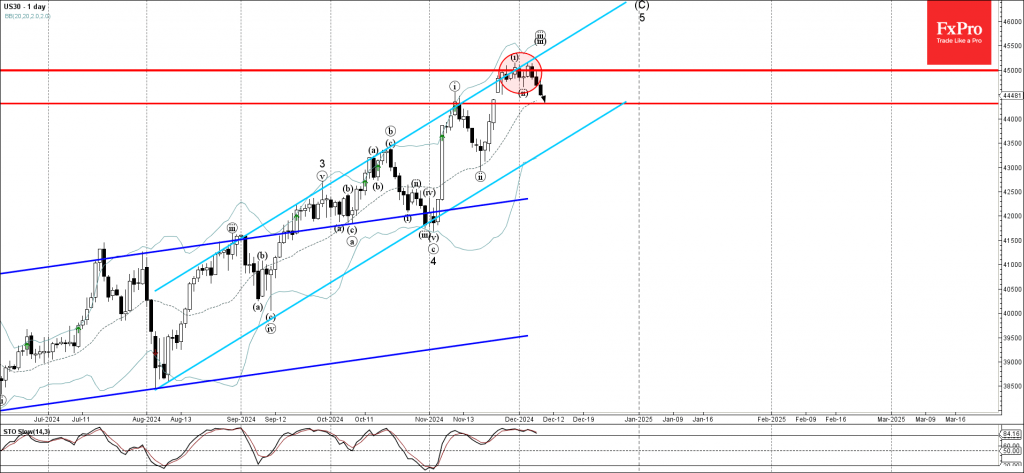

– Dow Jones reversed from resistance area – Likely to fall to support level 44300.00 Dow Jones index previously reversed down from the resistance area between the resistance level 45000.00 (which has been reversing the index from the end of.

December 6, 2024

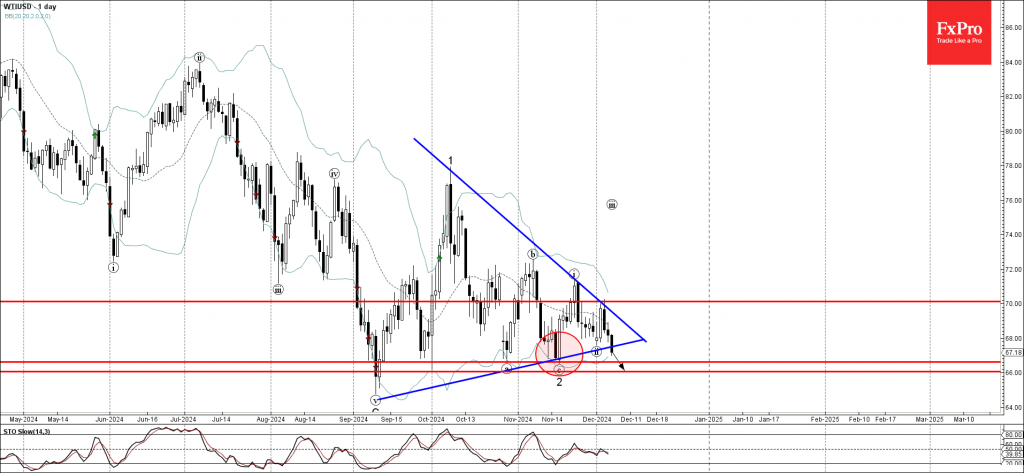

– WTI crude oil broke support zone – Likely to fall to support levels 66.6 and 66.00 WTI crude oil today broke the support zone lying at the intersection of the support level 67.60 and the support trendline of the.