Technical analysis - Page 89

December 23, 2024

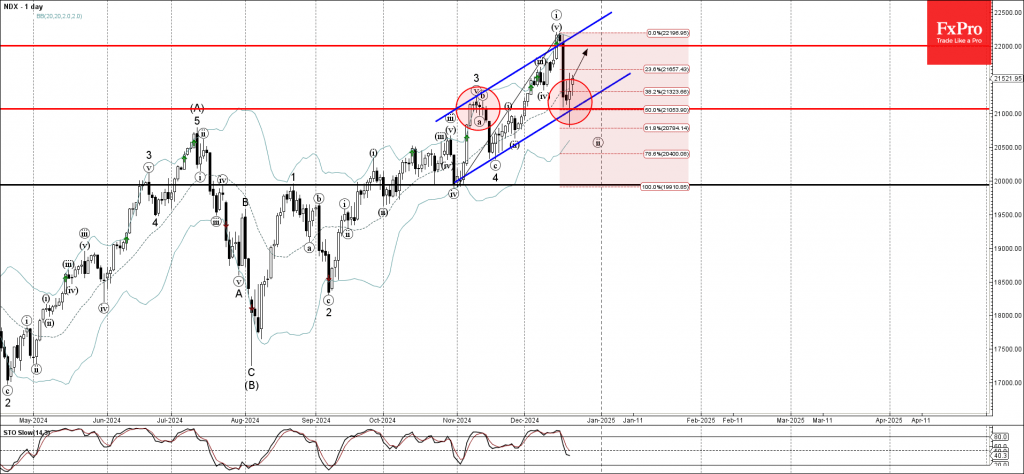

– Nasdaq 100 reversed from strong support level 21000.00 – Likely to rise to resistance level 22000.00 Nasdaq 100 index recently reversed up from the strong support level 21000.00 (former resistance from the start of November), intersecting with the support.

December 23, 2024

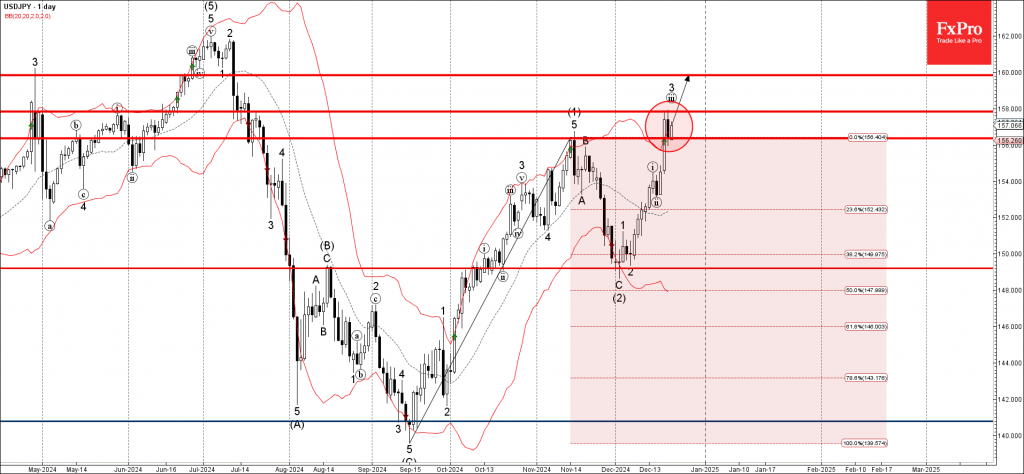

– USDJPY reversed from key support level 156.35 – Likely to rise to resistance level 158.00 USDJPY currency pair recently reversed up from the key support level 156.35 (former resistance from November, acting as she support after it was broken.

December 20, 2024

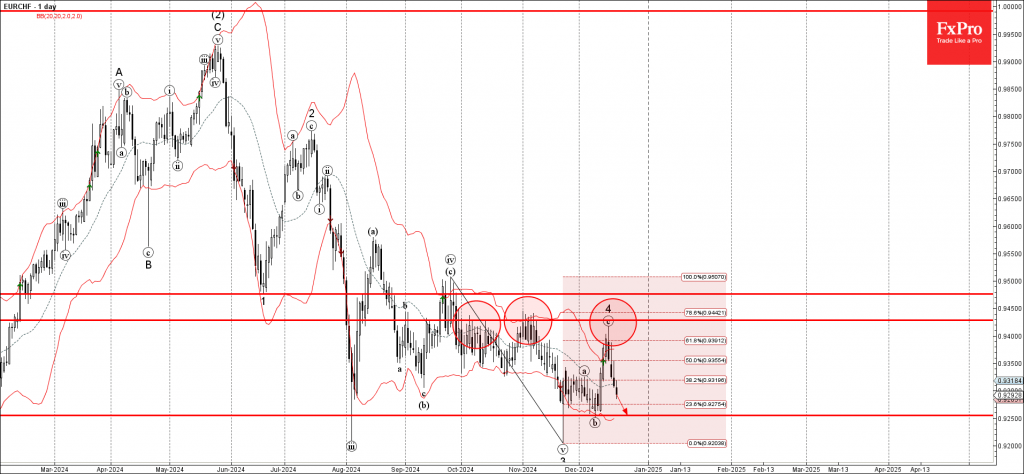

– EURCHF falling inside minor impulse wave 5 – Likely to fall to support level 0.9250 EURCHF currency pair continues to fall inside the minor impulse wave 5, which started earlier from the pivotal resistance level 0.9430 (standing well above.

December 20, 2024

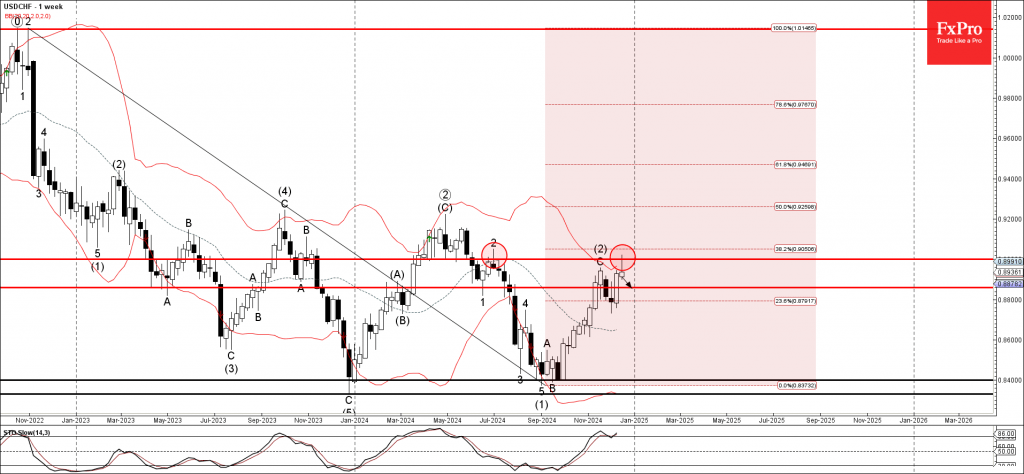

– USDCHF reversed from resistance zone – Likely to fall to support level 0.8860 USDCHF currency pair recently reversed down from the strong resistance zone located between the round resistance level 0.90000 (which has been reversing the pair from the.

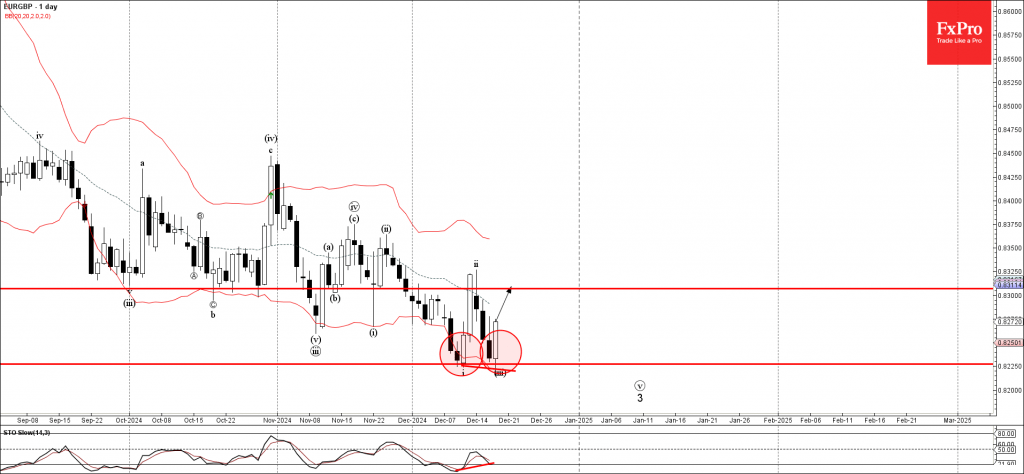

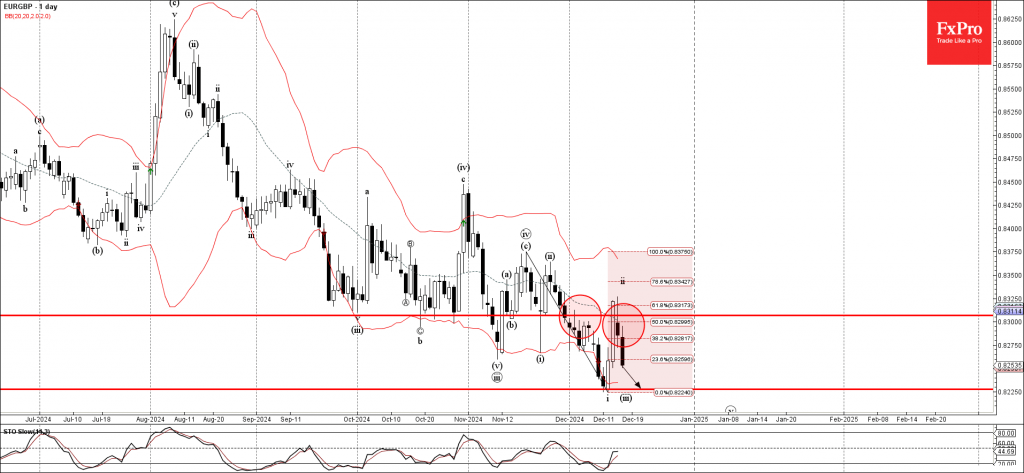

December 19, 2024

– EURGBP reversed from support zone – Likely to rise to resistance level 0.8300 EURGBP currency pair recently reversed up from the support zone located between the key support level 0.8225 (which stopped the previous minor impulse wave i) and.

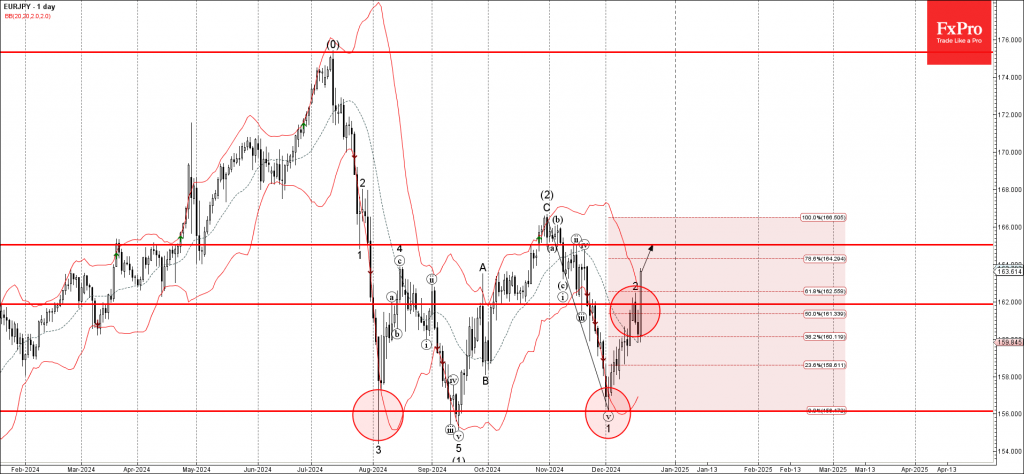

December 19, 2024

– EURJPY broke resistance zone – Likely to rise to resistance level 165.00 EURJPY currency pair recently broke the resistance zone located between the key resistance level 162.00 (which stopped the previous minor wave 2) and the 50% Fibonacci correction.

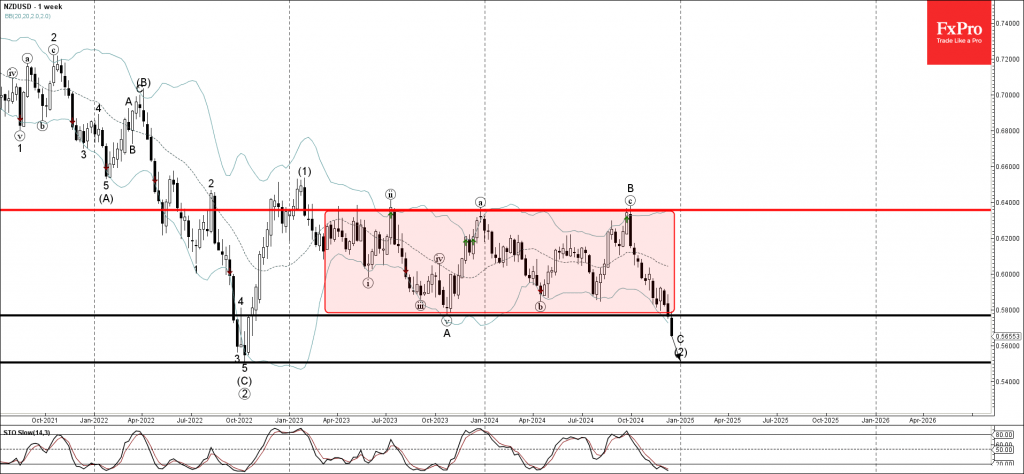

December 19, 2024

– NZDUSD broke long-term support level 0.5770 – Likely to fall to support level 0.5500 NZDUSD currency pair earlier broke below the long-term support level 0.5770 (which acted as the lower border of the weekly sideways price range inside which.

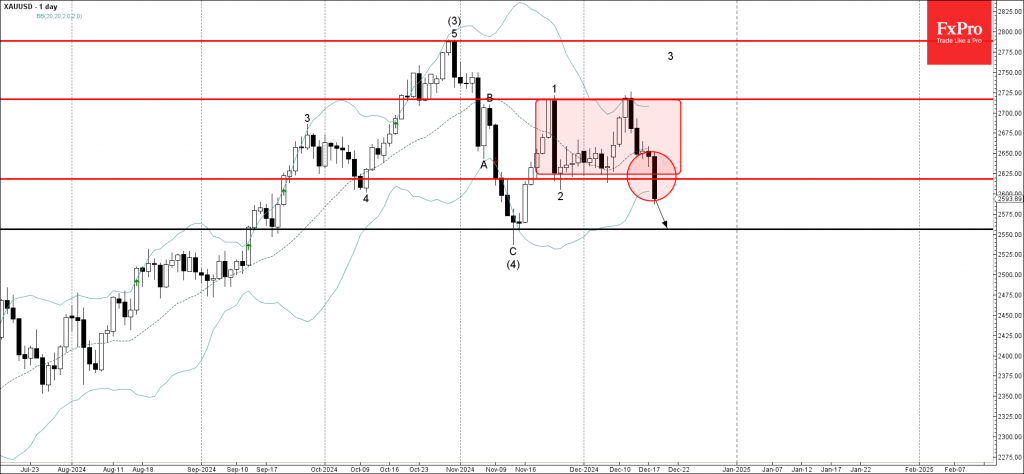

December 19, 2024

– Gold under bearish pressure – Likely to fall to support level 2555.00 Gold under the bearish pressure after the earlier breakout of the key support level 2617,00 (which is the lower border of the sideways price range inside which.

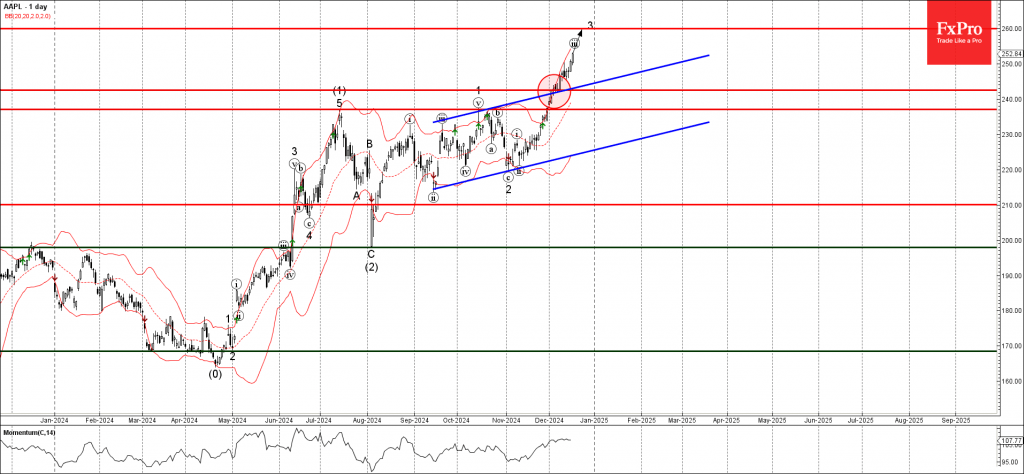

December 17, 2024

– Apple rising inside impulse wave 3 – Likely to reach resistance level 260.00 Apple continues to rise inside the accelerated impulse wave 3, which previously broke the resistance zone located between the resistance level 242.00 and the resistance trendline.

December 17, 2024

– EURGBP reversed from resistance level 0.8300 – Likely to fall to support level 0.8225 EURGBP currency pair recently reversed down from the key resistance level 0.8300 (former strong support from October) intersecting with the 61.8% Fibonacci correction of the.

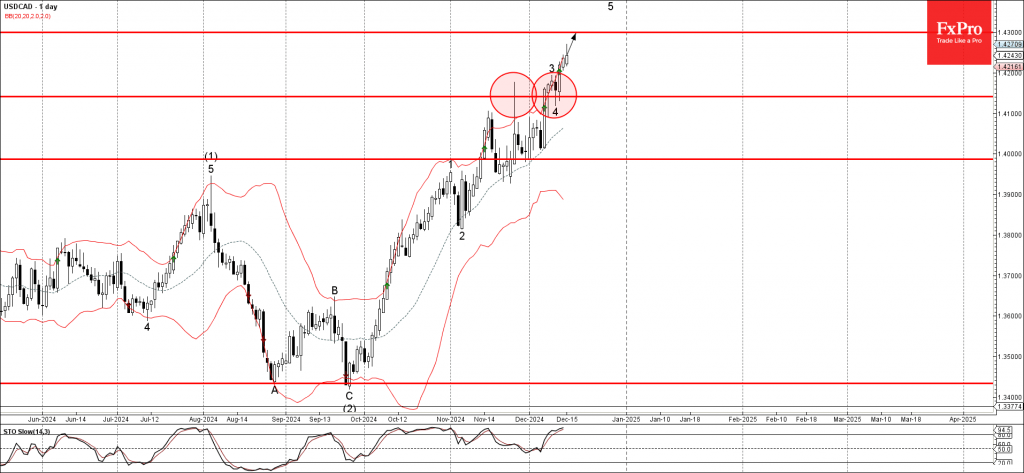

December 17, 2024

– USDCAD reversed from support zone – Likely to rise to resistance level 1.4300. USDCAD currency pair recently reversed up pivotal support level 1.4140, former resistance level which reversed the price sharply at the end of November. The upward reversal.