Technical analysis - Page 87

January 14, 2025

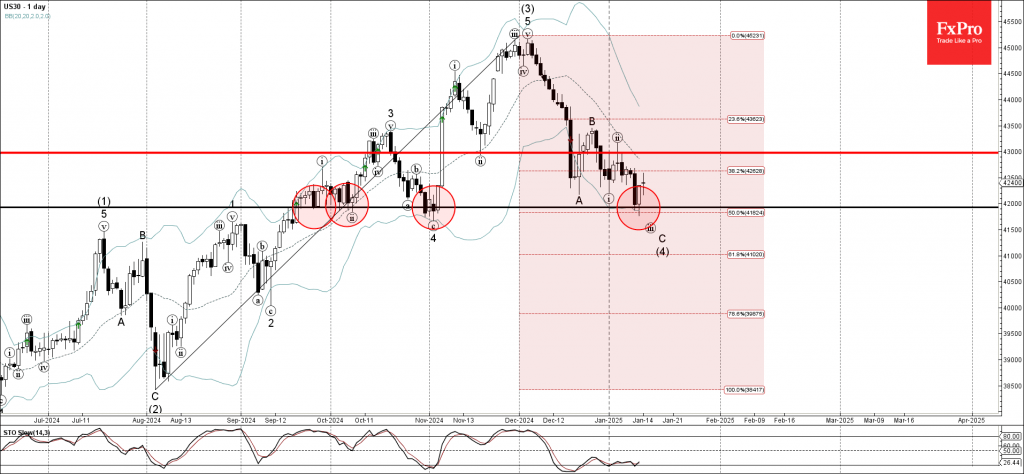

– Dow Jones reversed from support level 42000.00 – Likely to rise to resistance level 43000.00 Dow Jones index recently reversed up with the daily Piercing Line reversal pattern from the pivotal support level 42000.00, which has been reversing the.

January 14, 2025

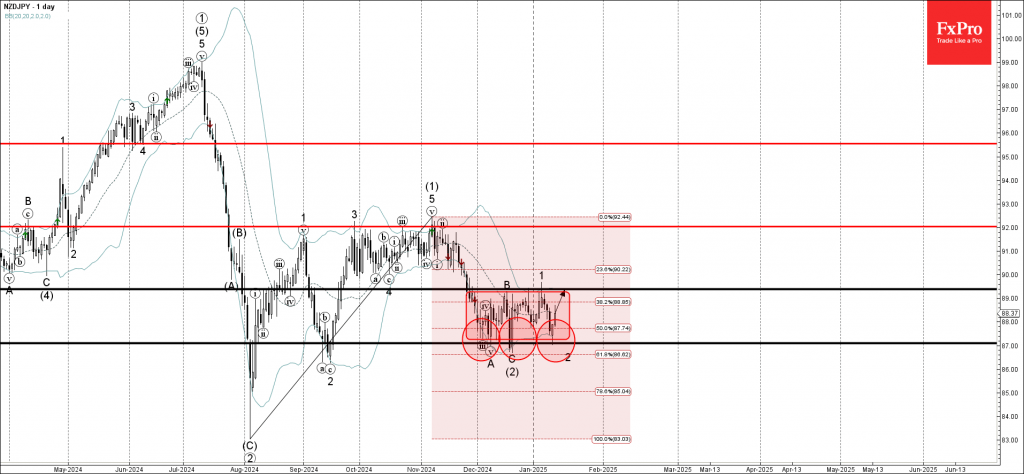

– NZDJPY reversed from key support level 87.00 – Likely to rise to resistance level 89.40 NZDJPY currency pair recently reversed up from the key support level 87.00, which is the lower border of the sideways price range inside which.

January 14, 2025

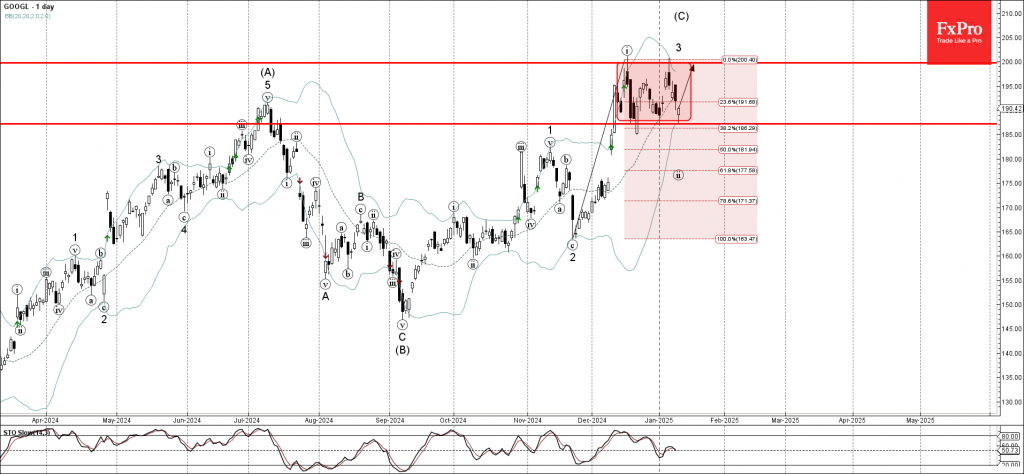

– Google reversed from pivotal support level 187.30 – Likely to rise to resistance level 200.00 Google recently reversed up from the pivotal support level 187.30, which is the lower border of the sideways price range inside which the price.

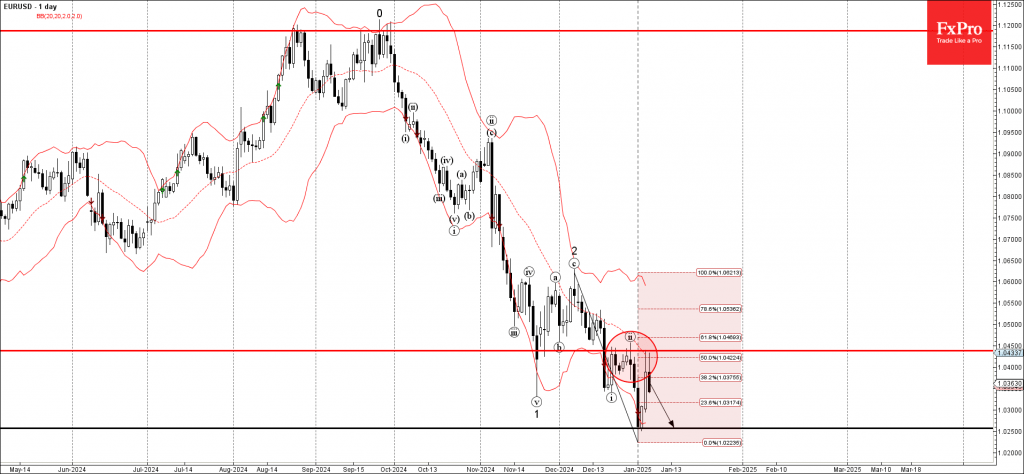

January 14, 2025

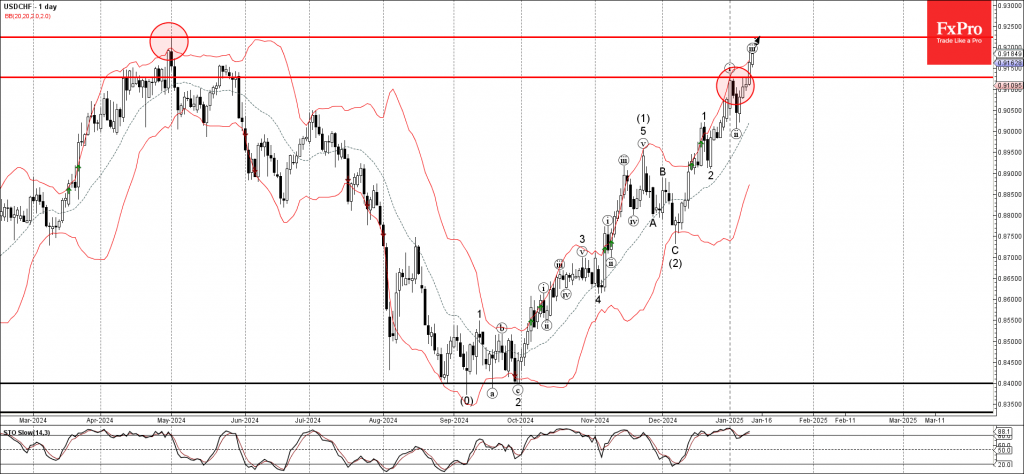

– USDCHF broke resistance level 0.9130 – Likely to rise to resistance level 0.9225 USDCHF currency pair recently broke the resistance level 0.9130, which stopped the previous impulse wave i at the start of January, as can be seen below..

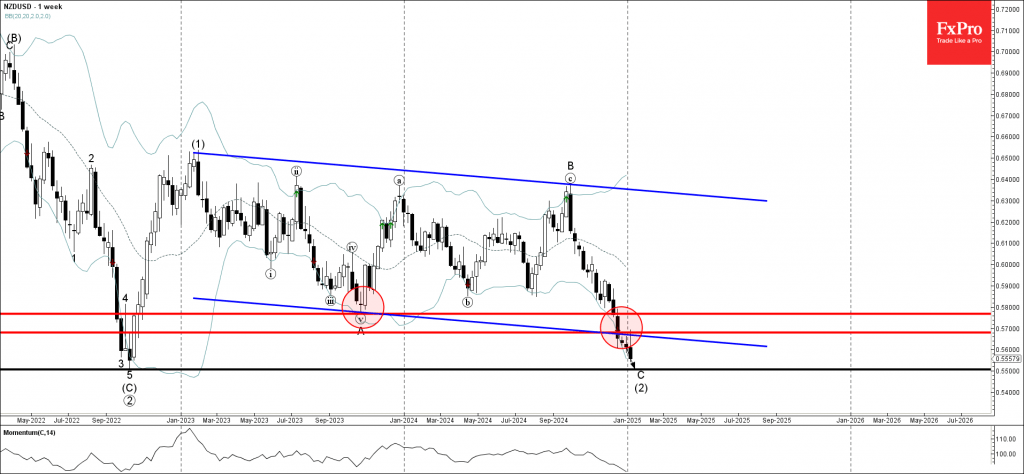

January 10, 2025

– NZDUSD falling inside weekly impulse wave C – Likely to fall to support level 0.5500 NZDUSD currency pair recently reversed down from the lower trendline of the wide weekly down channel from the start of 2023 (which is acting.

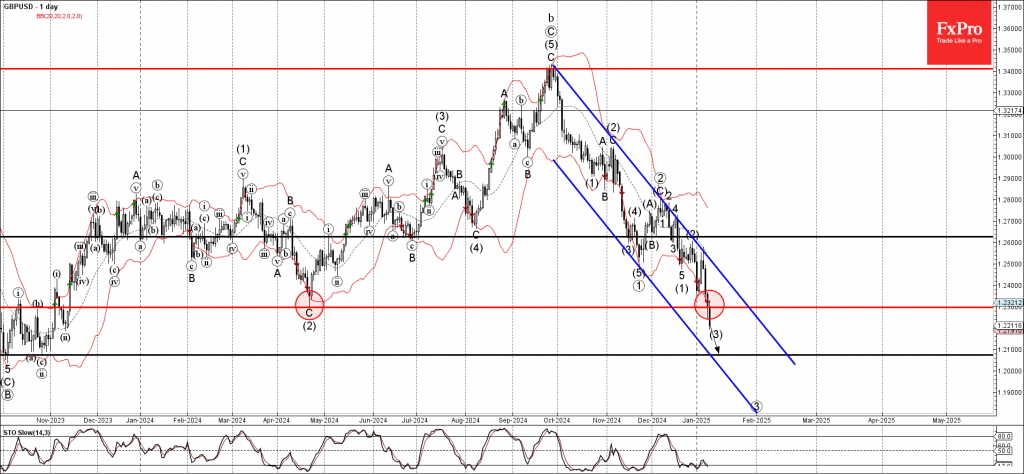

January 10, 2025

– GBPUSD broke key support level 1.2300 – Likely to fall to support level 1.2100 GBPUSD currency pair recently broke the key support level 1.2300 (former multi-month low from April of 2024, as can be seen below from the daily.

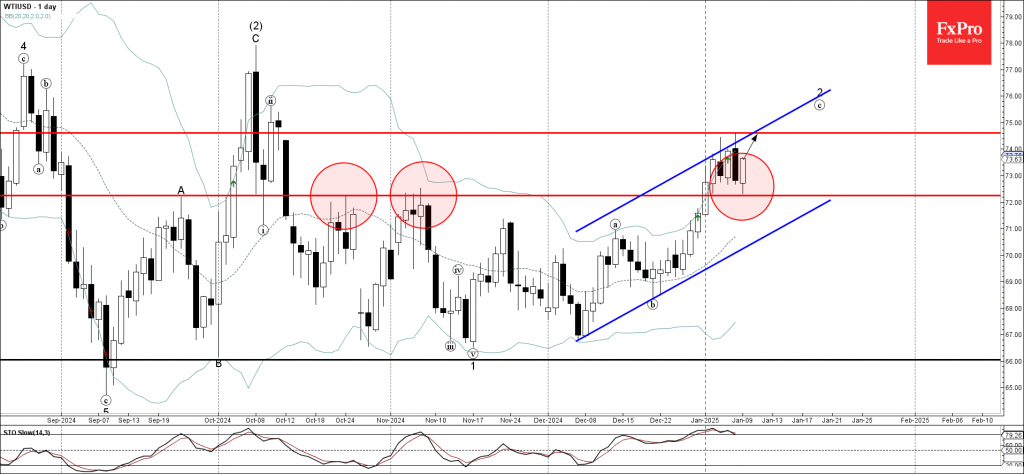

January 10, 2025

– WTI crude oil reversed from support level 72.25 – Likely to rise to resistance level 74.60 WTI crude oil recently reversed up from the key support level 72.25 (former resistance from October and November, as can be seen below)..

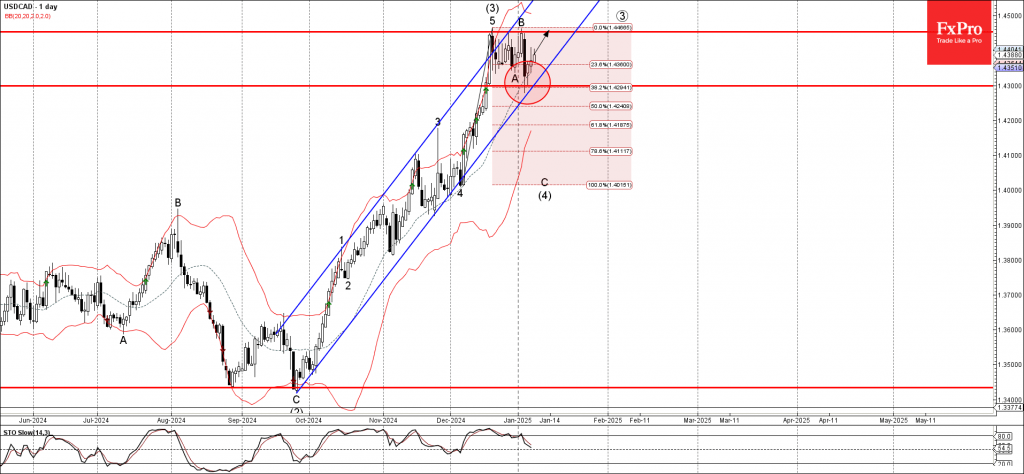

January 10, 2025

– USDCAD reversed from support zone – Likely to rise to resistance level 1.4450 USDCAD currency pair recently reversed up from the support zone located between the support level 1.43000, 20-day moving average and the support trendline of the sharp.

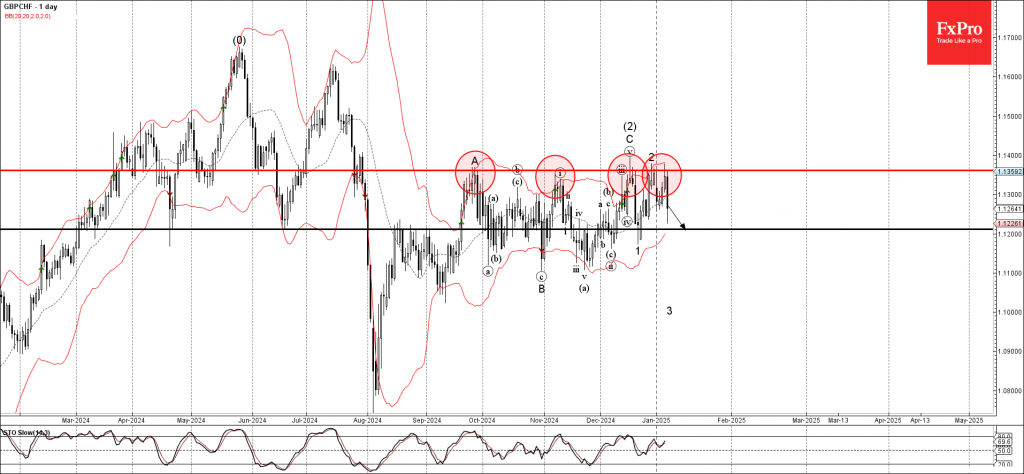

January 9, 2025

– GBPCHF reversed from resistance zone – Likely to fall to support level 1.1200 GBPCHF currency pair recently reversed down from the resistance zone located between the strong multi-month resistance level 1.1360 (which has been reversing the price from September).

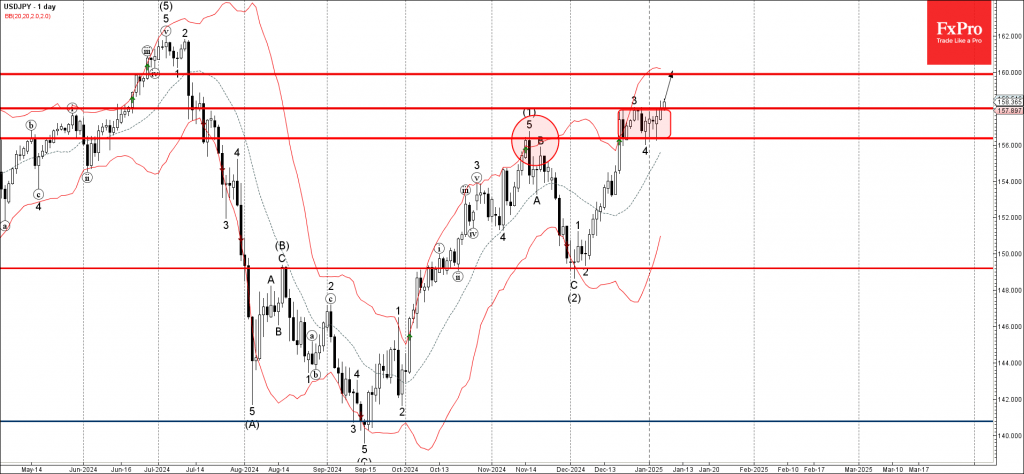

January 9, 2025

– USDJPY broke resistance level 158.00 – Likely to rise to resistance level 160.00 USDJPY currency pair recently broke the resistance level 158.00, which is the upper border of the narrow sideways price range inside which the pair has been.

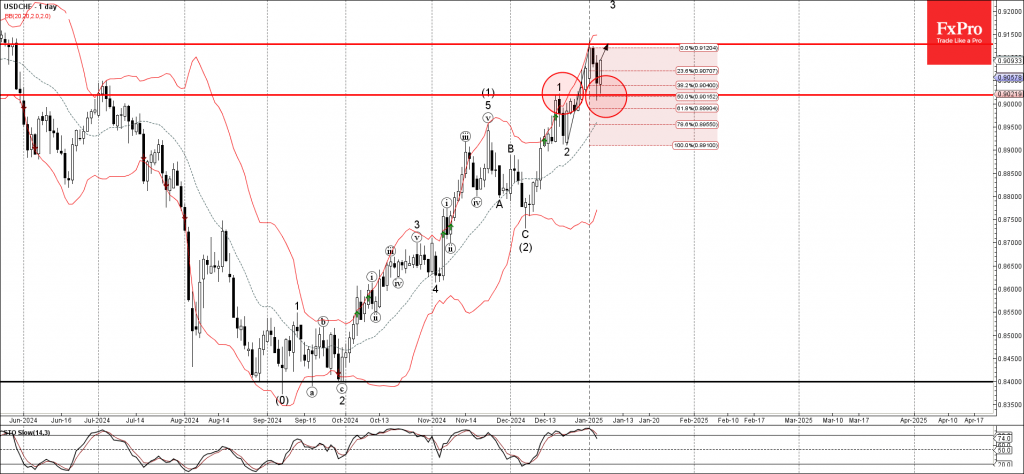

January 8, 2025

– USDCHF reversed from support zone – Likely to rise to support level 0.9130 USDCHF currency pair recently reversed up from the support zone located between the support level 0.9020 (former top of the impulse wave 1 from December) and.