Technical analysis - Page 86

January 22, 2025

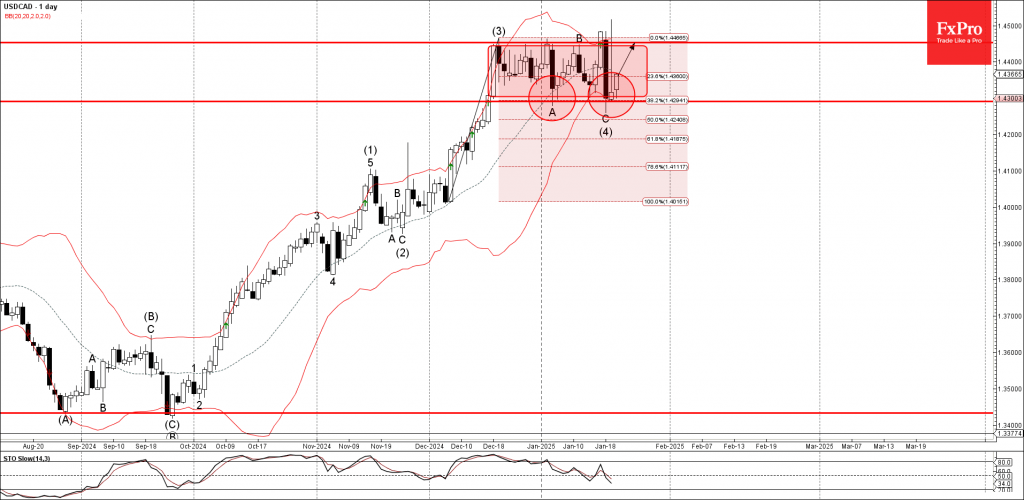

– USDCAD reversed from pivotal support level 1.4290 – Likely to rise to resistance level 1.4455 USDCAD currency pair recently reversed up from the pivotal support level 1.4290 (lower border of the sideways price range from December, which stopped previous.

January 22, 2025

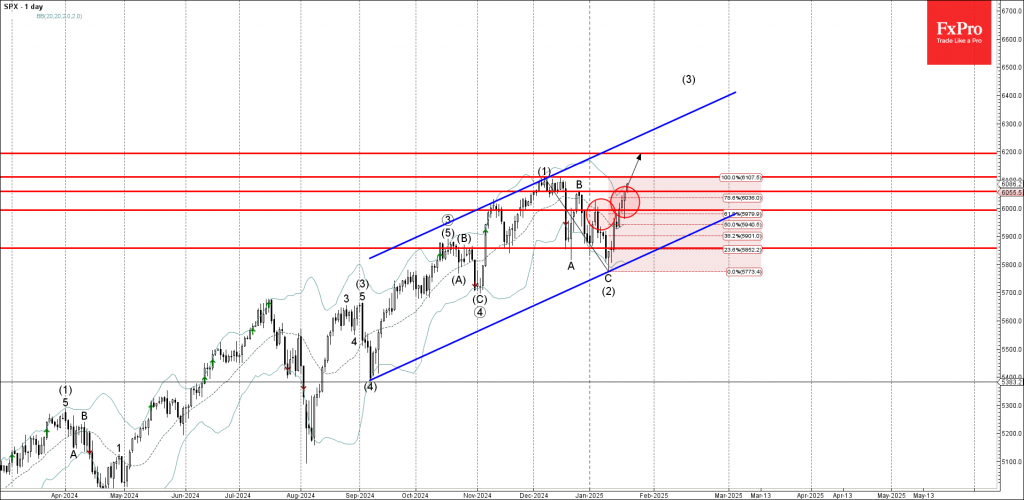

– S&P 500 index broke resistance levels 6000.00 and 6060.00 – Likely to rise to resistance level 6110.00 S&P 500 index recently broke the resistance levels 6000.00 (top of the previous minor correction) and 6060.00 (top of the previous wave.

January 22, 2025

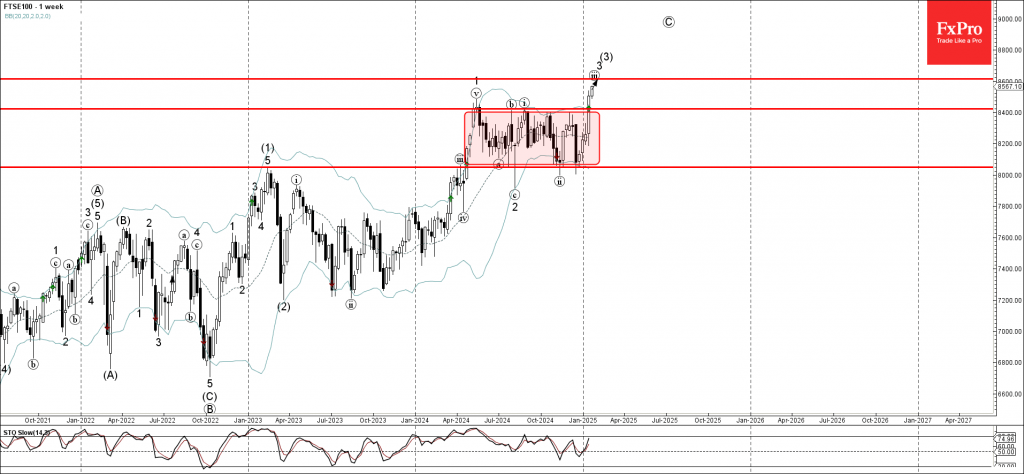

– FTSE 100 broke strong resistance level 8400.00 – Likely to rise to resistance level 8600.00 FTSE 100 index rising sharply after the price broke the strong resistance level 8400.00, which is the upper border of the sideways price range.

January 22, 2025

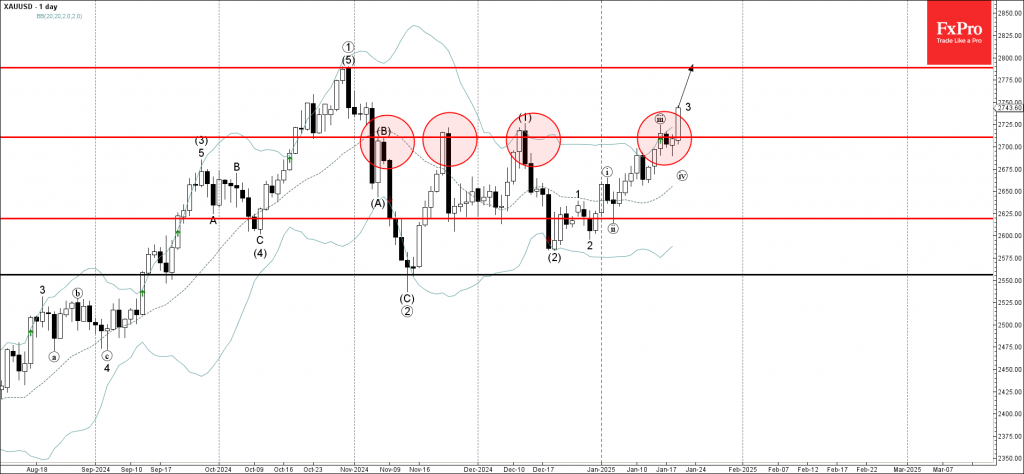

– Gold under bullish pressure – Likely to rise to resistance level 2785.00 Gold under the bullish pressure after the earlier breakout of the key resistance level 2710.00, which has been steadily reversing the price from November. The breakout of.

January 21, 2025

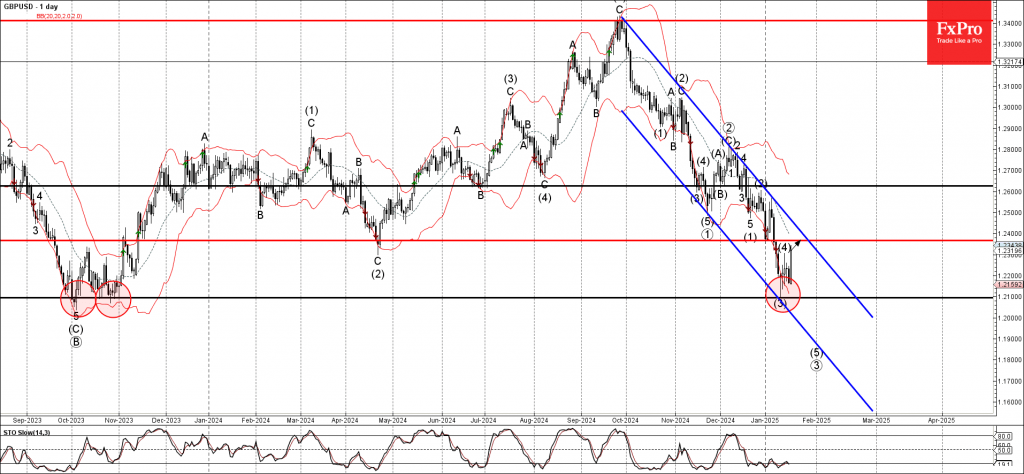

– GBPUSD reversed from support area – Likely to rise to resistance level 1.2365 GBPUSD currency pair recently reversed up with the daily Hammer from the support area located between the long-term support level 1.2095 (former Double Bottom from October),.

January 21, 2025

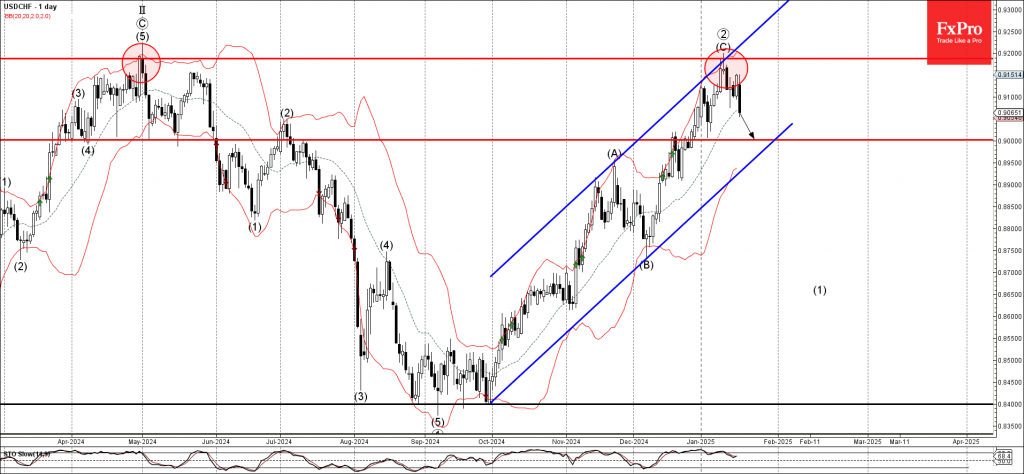

– USDCHF reversed from the resistance zone – Likely to fall to support level 0.9000 USDCHF currency pair recently reversed from the resistance zone located between the key multi-month resistance level 0.9185 (which stopped the daily uptrend last April), the.

January 17, 2025

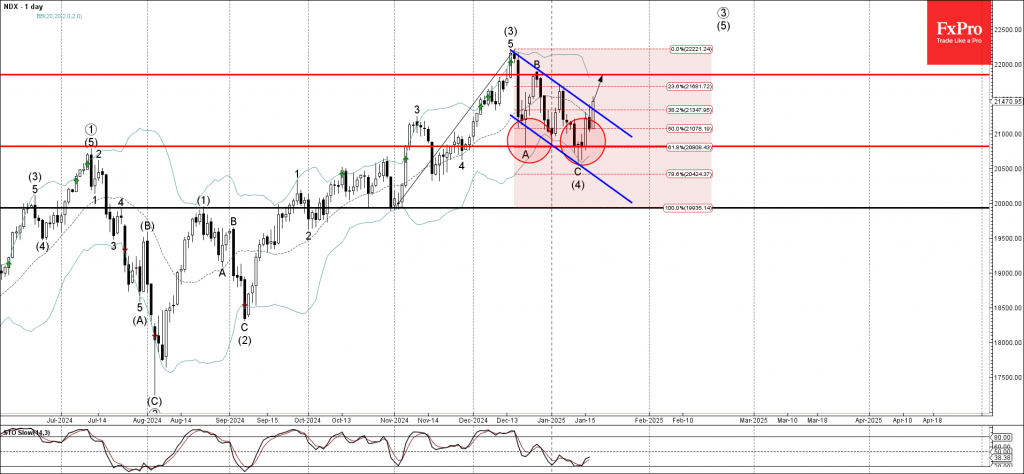

– Nasdaq-100 broke daily down channel – Likely to rise to resistance level 21850.00 Nasdaq-100 index rising inside the intermediate impulse wave (5), which started earlier from the support zone located between the key support level 20820.00 (former low of wave A.

January 17, 2025

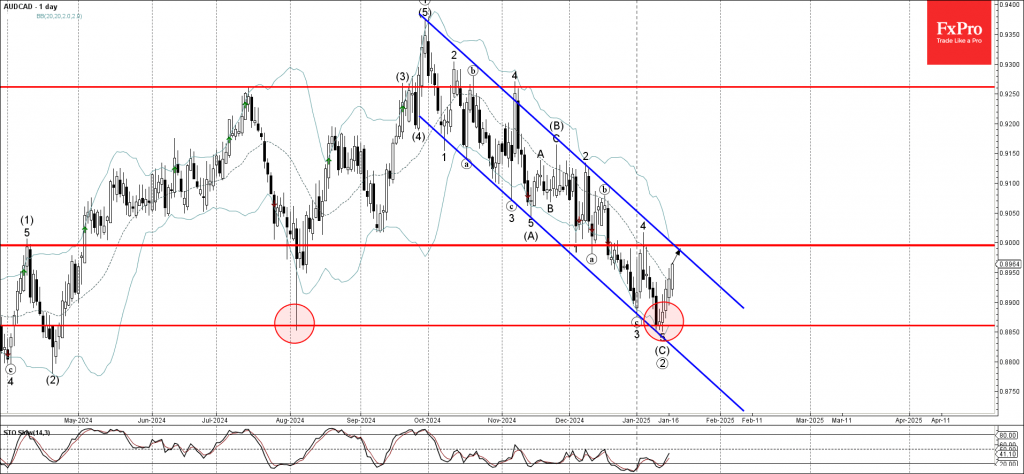

– AUDCAD reversed from support zone – Likely to rise to resistance level 0.9000 AUDCAD currency pair continues to rise inside the minor impulse wave 1, which started earlier from the support zone located between the key support level 0.8860.

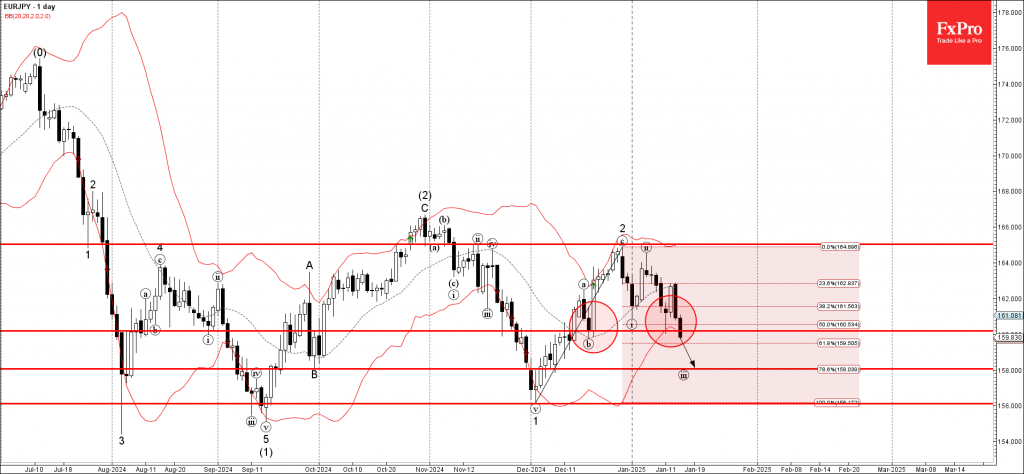

January 17, 2025

– EURJPY broke support zone – Likely to fall to support level 158.00 EURJPY currency pair recently broke the support zone located between the key support level 160.200, (which has been reversing the pair from December) and the 50% Fibonacci.

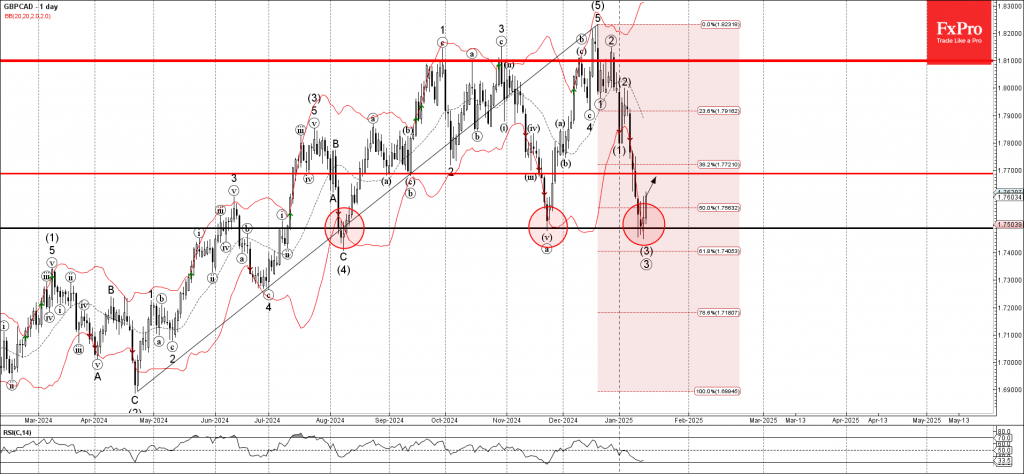

January 17, 2025

– GBPCAD reversed from strong support level 1.7490 – Likely to rise to resistance level 1.7700 GBPCAD currency pair recently reversed up with the daily Japanese candlesticks reversal pattern Hammer from the strong support level 1.7490, which has been steadily.

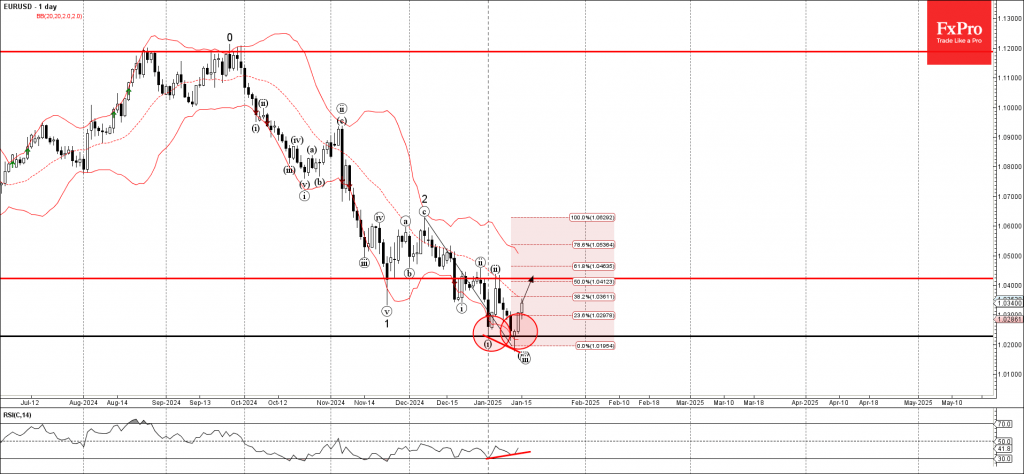

January 15, 2025

– EURUSD reversed from key support level 1.0225 – Likely to rise to resistance level 1.0425 EURUSD currency pair recently reversed up with the daily Japanese candlesticks reversal pattern Morning Star (with the daily Hammer in its middle) from the.