Technical analysis - Page 84

February 18, 2025

The crypto market’s facing a tough time with a 3% drop in market cap and no signs of a bullish reversal. Bitcoin is nearing $95K, trading below its 50-day moving average, while Solana drops 40% in the last month. Institutional.

February 18, 2025

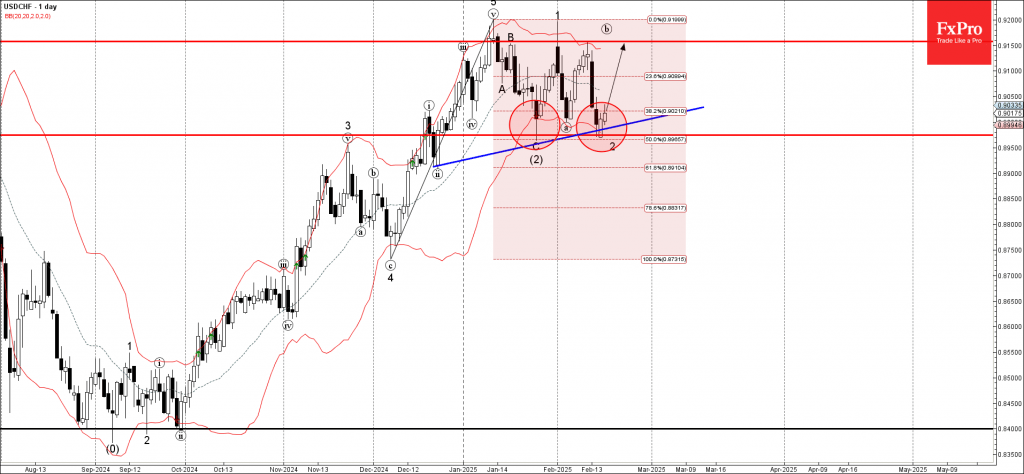

– USDCHF reversed from the support zone – Likely to rise to resistance level 0.9150 USDCHF currency pair recently reversed up from the support zone located between the support level 0.8975 (which stopped wave (2) in January), support trendline from.

February 18, 2025

– EURUSD reversed from the resistance zone – Likely to fall to support level 1.0400 EURUSD currency pair recently reversed down from the resistance zone located between the resistance level 1.0500 (which has been reversing the price from December), upper.

February 18, 2025

– Alibaba broke daily up channel – Likely to rise to the resistance level 130.00 Alibaba Group recently broke the resistance trendline of the narrow up channel from January – which accelerated the active impulse wave 5. The breakout of.

February 18, 2025

– AXP reversed from the support zone – Likely to rise to the resistance level 315.40. AXP recently reversed up with the daily Doji from the support zone between the pivotal support level 302.72 (former strong resistance from December and.

February 18, 2025

– Brent Crude Oil reversed from support zone – Likely to rise to resistance level 76.75 Brent Crude Oil recently reversed up from the support zone between the key support level 74.00 (former strong resistance from December), lower daily Bollinger.

February 18, 2025

– AUDUSD broke the resistance zone – Likely to rise to resistance level 0.6400 AUDUSD currency pair recently broke the resistance zone between the key resistance level 0.6320 (which stopped the previous minor correction iv) and the 50% Fibonacci correction.

February 15, 2025

– Gold reversed from resistance zone – Likely to fall to support level 2860.00 Gold today reversed down the resistance zone between the key resistance level 2940.00 (which formed daily Doji earlier this month), the resistance trendline of the daily.

February 15, 2025

– NZDUSD broke the resistance zone – Likely to rise to resistance level 0.5800 NZDUSD currency pair recently broke the resistance zone between the key resistance level 0.5700 (which stopped the earlier waves iv, 2 and ii), the resistance trendline.

February 14, 2025

– GBPUSD broke resistance zone – Likely to rise to resistance level 1.2720 GBPUSD currency pair recently broke the resistance zone between the key resistance level 1.2530 (which has been reversing the price from the start of January) and the.

February 14, 2025

– EURNZD reversed from long-term resistance level 1.8495 – Likely to fall to support level 1.8200 EURNZD currency pair recently reversed down from the major long-term resistance level 1.8495, which has been reversing the price from the middle of 2023,.