Technical analysis - Page 84

February 1, 2025

– AT&T reversed from long-term resistance level 25.00 – Likely to fall to support level 23.00. AT&T is under the bearish pressure after the price failed to break above the long-term resistance level 25.00 (which has been reversing the price.

February 1, 2025

– Dow Jones reversed from strong resistance level 45000.00 – Likely to fall to support level 44235.00 Dow Jones index today reversed down from the resistance area located between the strong resistance level 45000.00 (which stopped the previous multi-month uptrend.

January 31, 2025

– Gold broke resistance area – Likely to rise to resistance level 2789.00 Gold recently broke the resistance area located between the key resistance level 2789.00 (which stopped the previous sharp impulse wave (3) in October) and the resistance trendline.

January 31, 2025

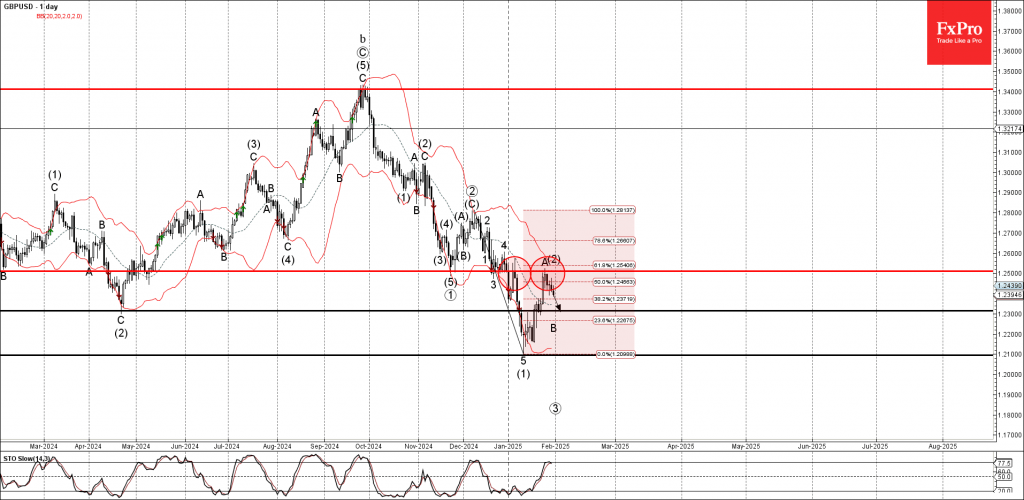

– GBPUSD reversed from the key resistance level 1.2500 – Likely to fall to support level at 1.2300 The GBPUSD currency pair recently reversed down from the key resistance level 1.2500 (the former monthly low from November, which is acting.

January 31, 2025

– IBM opened with a sharp upward gap – Likely to rise to the resistance level 260.00 IBM today opened with the sharp upward gap which broke the resistance zone between the resistance level 239.00 (top of wave 3 from.

January 31, 2025

Morgan Stanley continues to rise inside the minor impulse wave iv, which started earlier from the key support level of 135.00 (the former monthly high from November), acting as support after it was broken earlier. The active impulse wave iv.

January 30, 2025

– FTSE 100 Index broke resistance level 8450.00 – Likely to rise to resistance level 8800.00 FTSE 100 Index rising strongly after the earlier breakout of the resistance level 8450.00, which is the upper border of the weekly sideways price.

January 30, 2025

– Ethereum reversed from support zone – Likely to rise to resistance level 3340.00 Ethereum cryptocurrency recently reversed up strong from the support zone located between the round support level 3000.00 (which has been reversing the price from November), lower daily.

January 30, 2025

– Dogecoin reversed from strong support level 0.3040 – Likely to rise to resistance level 0.3565 Dogecoin cryptocurrency recently reversed up from the strong support level 0.3040 (which has been repeatedly reversing the price from December) intersecting with the lower daily.

January 30, 2025

– DAX broke the key resistance level 21500.00 – Likely to rise to resistance level 22000.00 DAX index recently broke the key resistance level 21500.00 – which stopped the previous minor impulse wave i earlier this month. The price earlier reversed.

January 29, 2025

– GBPAUD rising inside impulse wave 3 – Likely to rise to resistance level 2.0100 GBPAUD currency pair continues to rise inside the minor impulse wave 3, which started earlier from the key support level 1.9600 – which reversed the price.