Technical analysis - Page 83

February 21, 2025

– CADJPY broke support zone – Likely to fall to support level 104.00 CADJPY currency pair recently broke the support zone between the key support level 105.40 (which has been reversing the price from September) and the 61.8% Fibonacci correction.

February 21, 2025

– GBPCHF reversed from resistance zone – Likely to fall to support level 1.1300 GBPCHF currency pair recently reversed down from the resistance zone between the multi-month resistance level 1.1385 (which has been reversing the price from July) and the.

February 21, 2025

– FTSE 100 broke support zone – Likely to fall to support level 8600.00 FTSE 100 Index previously broke the support zone between the support level 8700.00 (which created daily Bullish Engulfing earlier this month) and the 38.2% Fibonacci correction.

February 21, 2025

– Boeing reversed from the resistance zone – Likely to fall to support level 177.10 Boeing recently reversed down from the resistance zone between the multi-month resistance level 187.45 (which has been reversing the price from last July) and the upper daily.

February 20, 2025

– Solana reversed from the support zone – Likely to rise to the resistance level 186.60 Solana cryptocurrency recently reversed up from the support zone between the support level 165.65 (the previous monthly low from January) and the lower daily.

February 20, 2025

– USDJPY broke support zone – Likely to fall to support level 148.70 USDJPY currency pair recently broke the support zone between the support level 151.00 (which formed the daily Morning Star at the start of February) and the 50%.

February 20, 2025

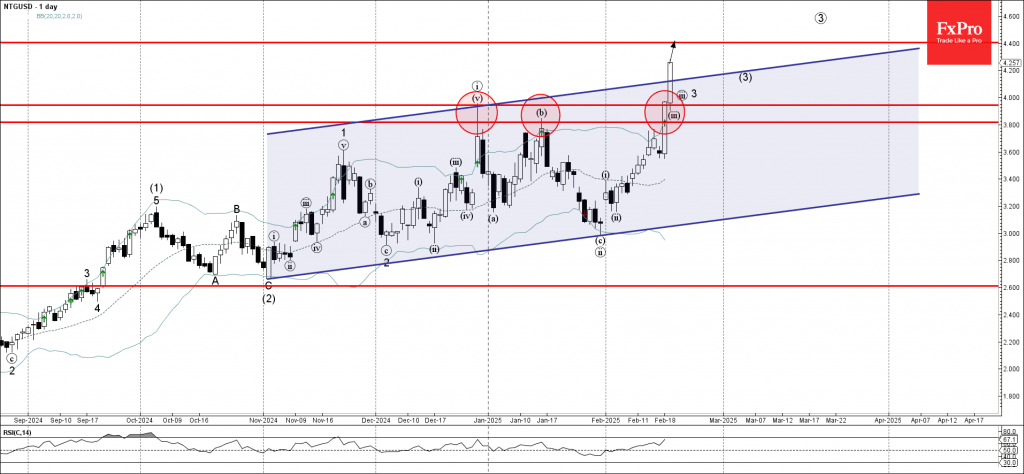

– Natural gas broke resistance zone – Likely to rise to resistance level 4.400 Natural gas recently broke through the resistance zone at the intersection of the resistance trendline of the daily up channel from November and the resistance levels.

February 20, 2025

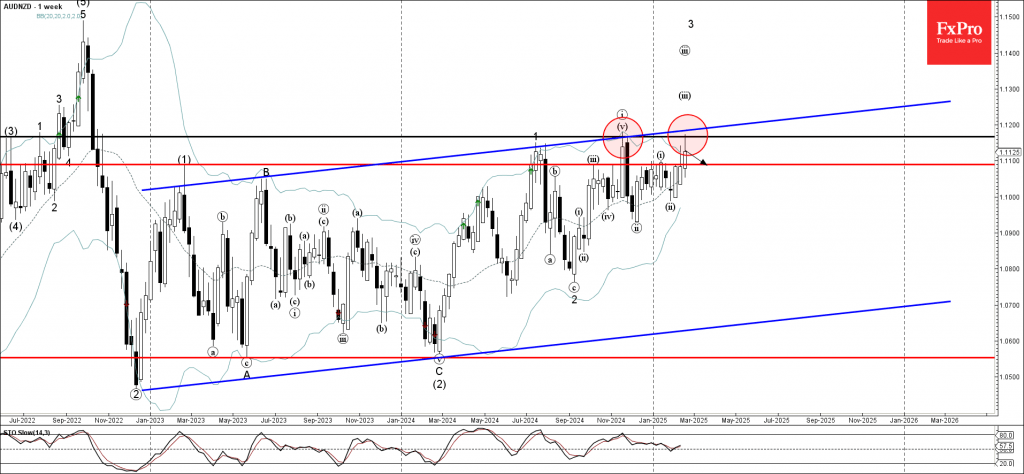

– AUDNZD reversed from the resistance zone – Likely to fall to support level 1.1100 AUDNZD currency pair recently reversed from the resistance zone between the key resistance level 1.1165 (former monthly high from last November) and the resistance trendline.

February 20, 2025

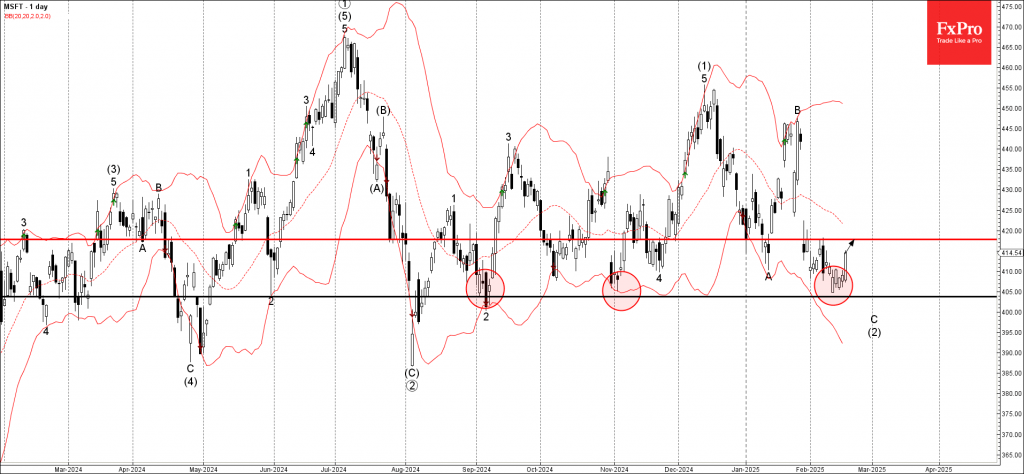

– Microsoft reversed from strong support level 405.00 – Likely to rise to resistance level 417.80 Microsoft recently reversed up from the support zone between the multi-month support level 405.00 (which has been reversing the price from September) and the.

February 20, 2025

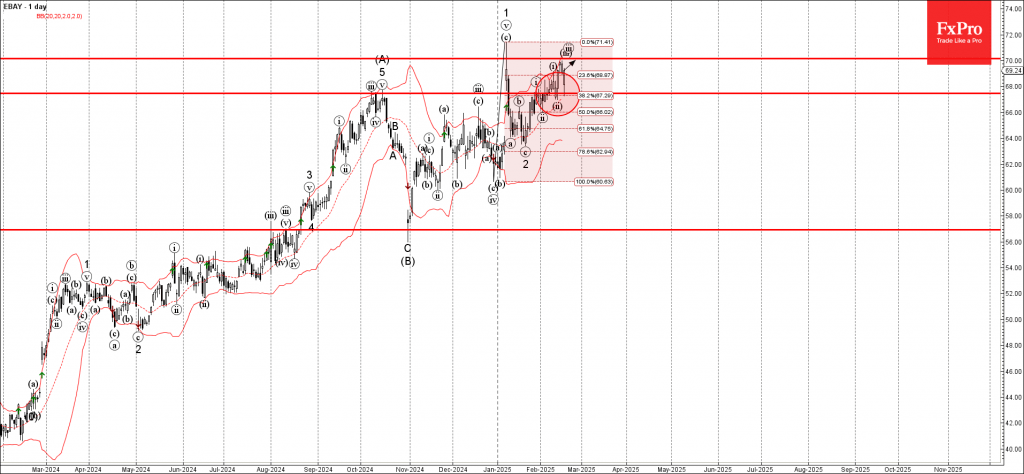

– Ebay reversed from the support area – Likely to rise to resistance level 70.00 Ebay recently reversed up from the support area between the key support level 67.45 (which has been reversing the price from January), lower daily Bollinger.

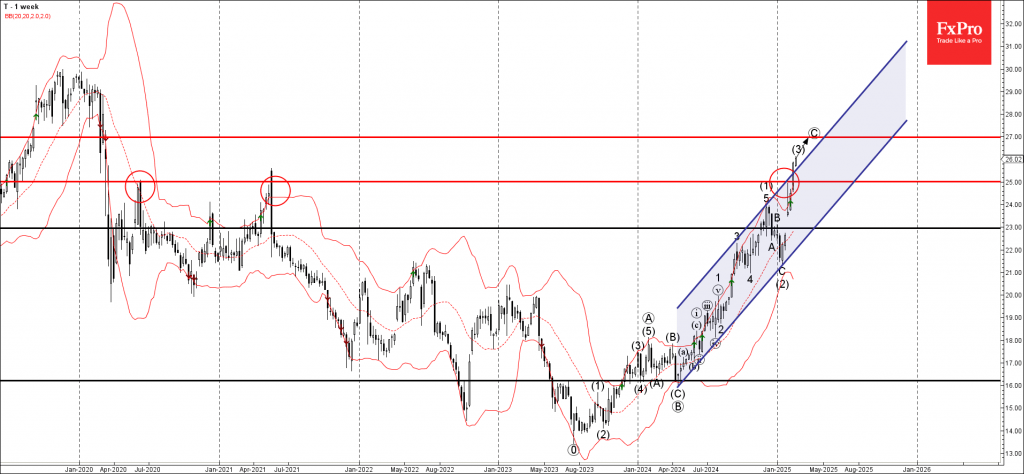

February 19, 2025

– AT&T broke the resistance zone – Likely to rise to resistance level 27.00 AT&T recently broke through the resistance zone at the intersection of the long-term resistance level 25.00 (which has been reversing the price from 2020) and the.